In both 2021 and 2023, we reviewed the ratings of major remittance and money transfers companies across app stores and Trustpilot. But how much have these changed? We return in 2024 to find out.

Consumer money transfers and remittances is a highly competitive space, with price-sensitive consumers often hopping between multiple different players depending on who is offering the most appealing deal on a given day. However, price is by no means the only factor in a consumer’s choice of provider – customer experience and trust is also vital.

In the online space, customer ratings are critical determinants of this. Customers look to the experience of other users to gauge whether their own experience is likely to be acceptable, and negative reviews can be serious red flags for any consumer considering whether to trust a company with their money.

This is all the more vital in a landscape where digital is becoming ever more important to companies in the remittances space.

At the start of 2023, traditionally retail-led MoneyGram saw its share of transactions that were digital pass 50% for the first time, up from less than 20% just three years previously. Western Union, meanwhile, saw 23% of its consumer-to-consumer money transfers revenue come from digital in Q4 2023, while Ria owner Euronet reported elevated digital remittances growth. Other digital-only players are also seeing strong performances, with Remitly seeing 39% revenue growth in Q4 2023.

Online reviews are therefore not only critical to companies in the space, but a valuable indicator of the focus they are placing on the sector. Notable changes in ratings are therefore key, with increases suggesting increased investment while sharp drops raise concern.

In this report, we look at the money transfers players that have the strongest customer ratings in 2024, as well as comparing them to their past averages in 2023 and 2021. To achieve this, we combine the average customer ratings on both Apple’s App Store and Google’s Play Store across both the UK and the US, and map these against their ratings on popular review site Trustpilot. As this is the third year we have undertaken this research, having previously conducted similar assessments in 2023 and 2021, we are well-positioned to track changes in ratings across the past three years.

The best money transfer companies by customer ratings in 2024

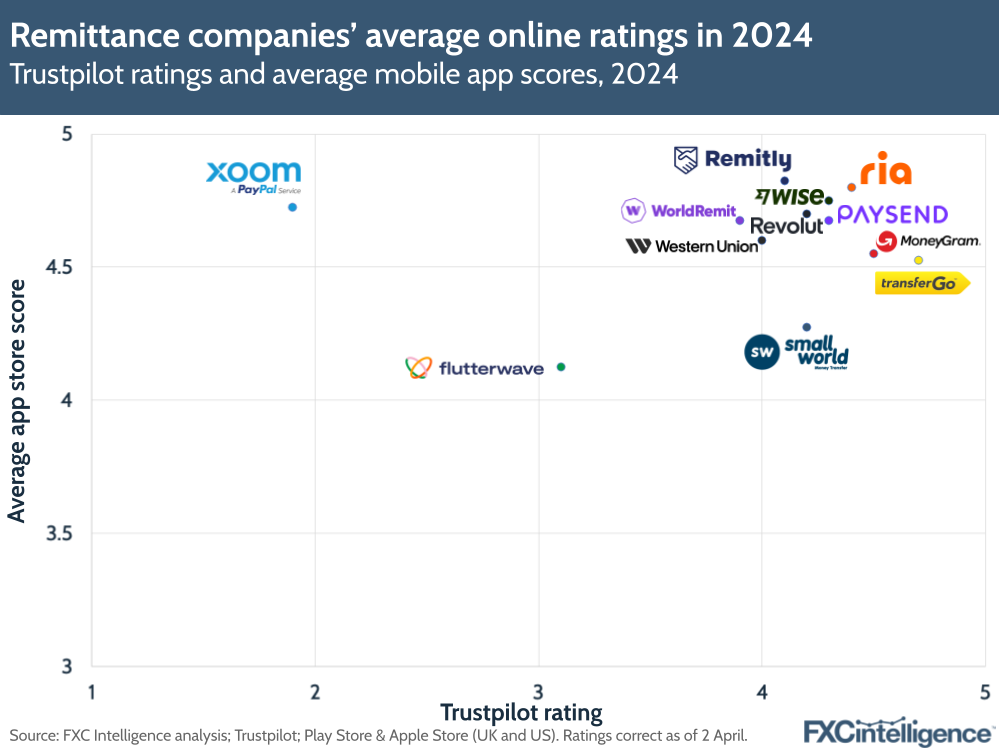

Of the 12 companies we assessed for this report, most had strong combined customer ratings in 2024.

Nine of the 12 had a Trustpilot rating of over 4 out of 5, with one of the remaining companies (World Remit) only narrowly missing this at 3.9. Average app store ratings were even stronger, with every company achieving a 4 or above.

However, there was some variation in country and operating system versions.

The average ratings for iOS across both the UK and US were higher than the equivalent for Android, with Google Play seeing an average of 4.5, compared to the App Store’s 4.7. While some player’s Google ratings were closer to their Apple ratings, not one had a higher average Play score, which may reflect the higher development priorities placed on iOS versus Android by many companies.

On a country-level basis, the average ratings were very close, with the UK scoring slightly higher at 4.63, compared to the US’s 4.58. However, this converged more when taking into account operating systems.

While companies had a slightly higher average score on Apple in the US versus the UK, at 4.73 versus 4.71, on Android the UK was ahead of the US, at 4.6 versus 4.4. This may reflect the fact that Apple has a higher market share in the US than in the UK.

Within this, while most companies followed broader trends, there were some outliers. Ria had identical scores on both its UK and US Apple apps, at 4.9, and different but equally similar ratings on its Google apps, at 4.7.

TransferGo and Wise both saw higher scores on their UK apps than their US versions, which is likely a reflection of the fact that both are UK companies. And Nigerian-founded but US-headquartered Flutterwave had notably higher ratings on its US apps, which is likely a reflection of the fact it has prioritised this market.

Comparing 2024 to 2023 and 2021

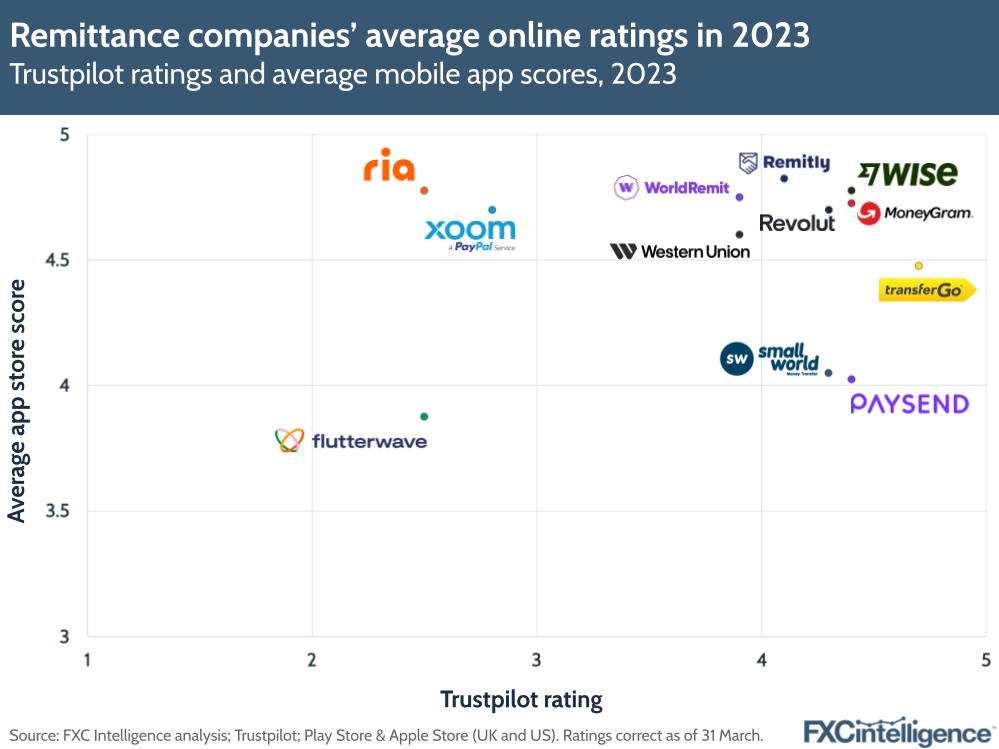

Compared to our research from a year ago, there has not been a significant transformation in ratings over the last twelve months.

At the top end there has been a slight increase in players since 2023. The notable exception is Ria, which has seen its Trustpilot change significantly over the period.

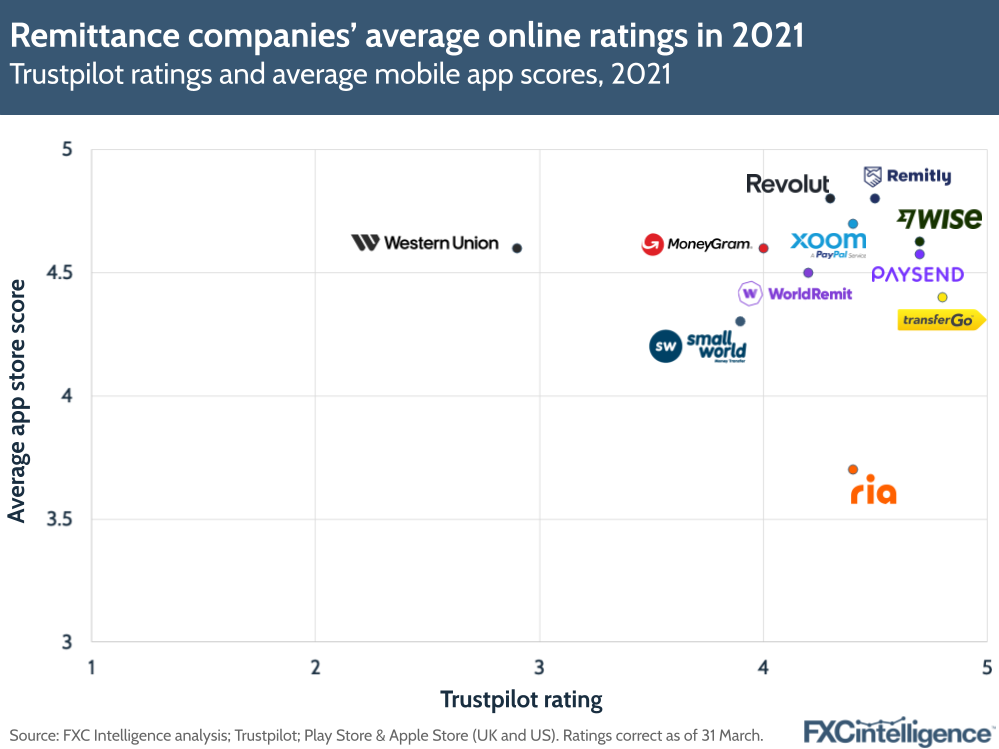

Interestingly, with the exception of a few outliers, the 2024 chart has a slightly closer resemblance to the 2021 chart, with greater clustering in the top rightmost quadrant in reflection of higher average customer ratings among the money transfer players. Here, Flutterwave was not included in the original version and so is not shown.

Which companies have seen the most change in ratings over time?

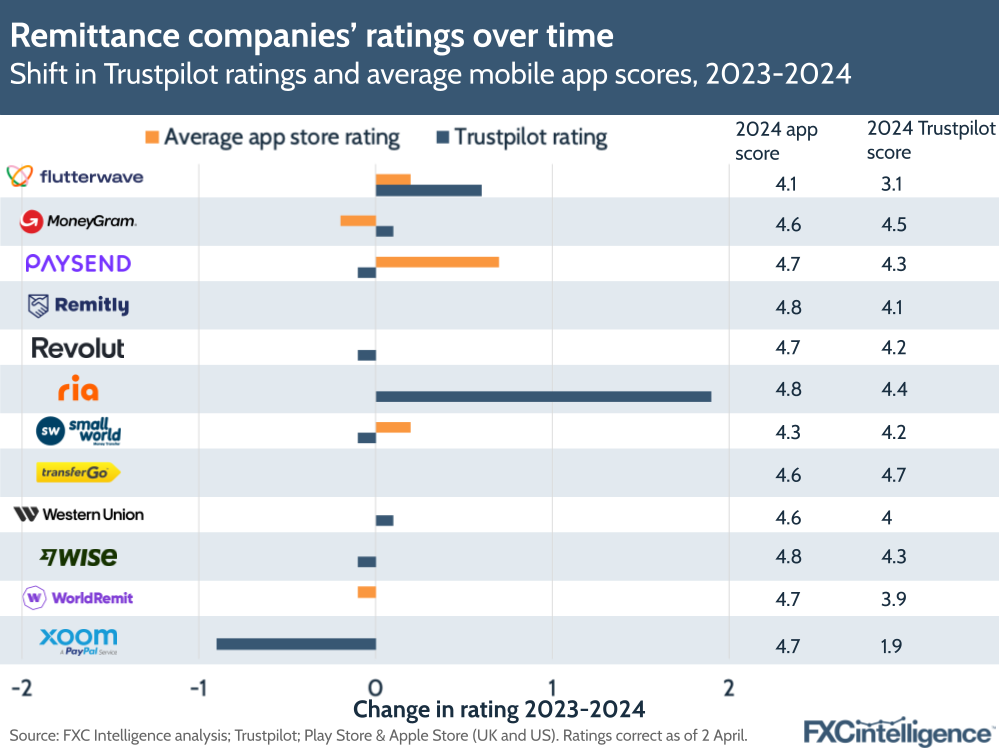

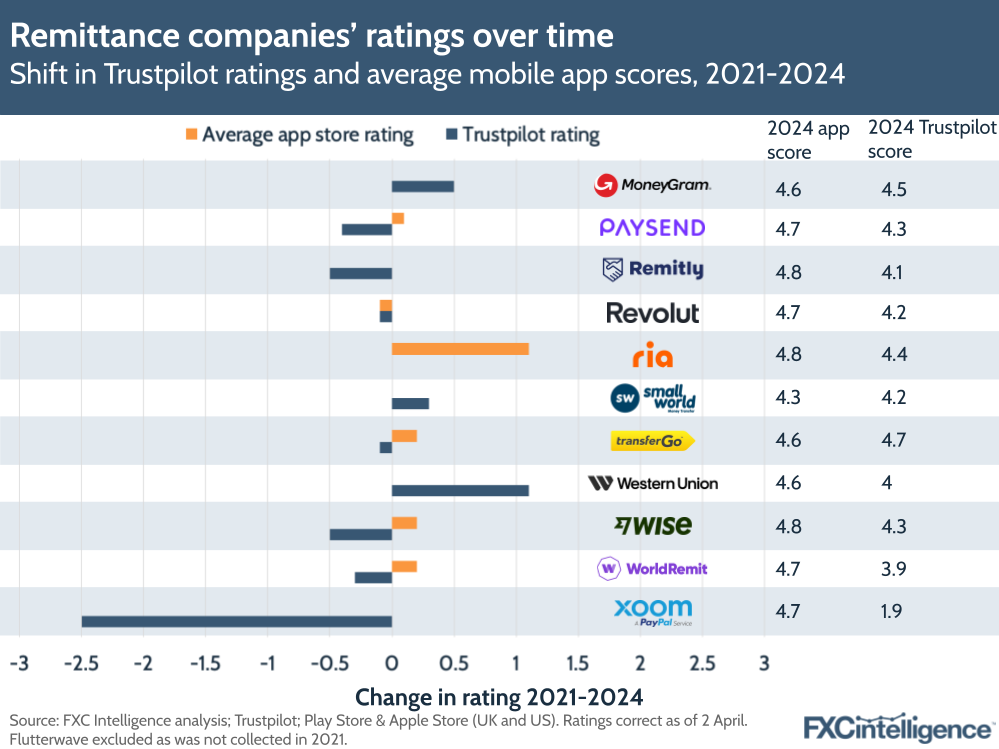

Looking at the changes between 2023 and 2024, most players have seen only minimal movement in both Trustpilot and app store ratings. Both Trustpilot and app store ratings have trended slightly up across most players, with an average increase of 0.12 and 0.07 respectively.

However, there are some exceptions to this. PayPal’s remittance brand Xoom has seen a 0.9 decline in its Trustpilot rating, which may be a reflection of the lack of priority the ecommerce giant has placed on the brand in the last few years.

By contrast, Ria has seen by far the biggest gain in its Trustpilot rating, which increased by 1.9 between 2023 and 2024, likely as a result of company efforts to improve this.

Meanwhile, Paysend saw the biggest increase in its average app rating, which increased by 0.7.

However, when we look at the movements between 2021 and 2024, we see some more interesting movements – or lack thereof. Average shifts were slightly larger over this period, although still trended in the same directions as between 2023 and 2024, with Trustpilot seeing an average drop of 0.23 and the app average seeing an increase of 0.14. This does not include Flutterwave, which was not included in the original 2021 collection.

The biggest change in movement during this three-year period was Xoom, which saw a bigger Trustpilot decline of 2.5. Meanwhile, Western Union saw the biggest increase in Trustpilot rating, at 1.1, while Ria saw the biggest app increase, also at 1.1. MoneyGram’s 0.5 increase in Trustpilot score is also likely an indication of its increased digital investment over the past few years.

Some of the players’ lack of movement over this period is also telling. Despite dropping in 2021, Ria’s Trustpilot score is now back to where it was in 2021. Meanwhile, the average app ratings of Western Union, Small World, MoneyGram, Remitly and Xoom have all remained the same.

As 2024 progresses, we are likely to see some of the ratings trends continue unless there are significant catalysts for change, although ongoing developments at some money transfer players may have an impact.

A shift to digital among traditional remittances players may prompt further investment in their apps, particularly for Western Union given its relatively recent CEO change. Xoom, meanwhile, appears to be gaining increased attention from PayPal, which may prompt an improvement in scores.

We’ll be monitoring developments in the space closely, and will update in 2025 with the latest scores.