Corpay’s Q1 2025 earnings were boosted by its Corporate Payments segment, with cross-border again helping to drive growth despite tariff headwinds. Corpay Cross-Border Solutions Group President Mark Frey discusses the latest earnings and ongoing strategy.

Corpay posted headline Q1 2025 numbers in-line with expectations, as it continues to deliver on plans to grow the business both organically and via strategic acquisitions.

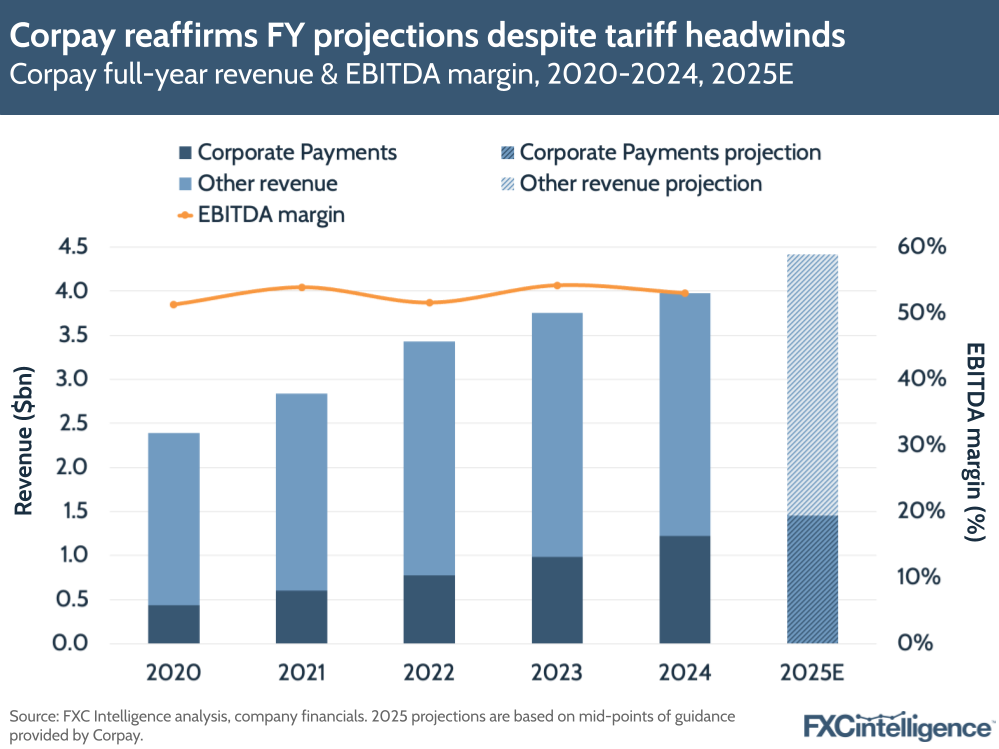

The company reported top-line growth of 8% YoY growth in both revenue and EBITDA, to $1bn and $519m respectively, producing an EBITDA margin of 51.6%.

However, its Corporate Payments division continues to be an outsized driver of this growth and Q1 saw a number of developments that are helping to bolster this, despite some limited, anticipated impact from the US tariffs. These developments include deals with Mastercard and AvidXchange, as well as its new multicurrency account product, alongside continued delivery on its growth strategy, with cross-border playing a key role.

We spoke to Mark Frey, Group President of Corpay Cross-Border Solutions, to find out more about what lies ahead.

Corpay’s Q1 2025 Corporate Payments growth

Daniel Webber:

It’s a busy, positive time for Corpay. Let’s zoom in on the Corporate Payments side and what the drivers are there.

Mark Frey:

The Corporate Payments business especially has continued to perform really, really well, not just in terms of existing customers and the continuation to build operational leverage and enhance EBITDA performance, but the sales of the business has performed particularly well.

We noted that the quarter sales for cross-border are up more than 50%, the domestic business is performing very well from a sales perspective as well, opening up a new segment in going live with an enterprise segment will be a very big win.

It continues to reinforce the overall strategy of Corpay Inc to continue to pivot towards Corporate Payments, turning our existing legacy businesses into more Corporate Payments-like enterprises and luring in more Corporate Payments capability into those businesses. We’re leaning into this as much as we possibly can and it’s reinforced by the performance of the business.

Corporate Payments leads Corpay’s Q1 2025 growth

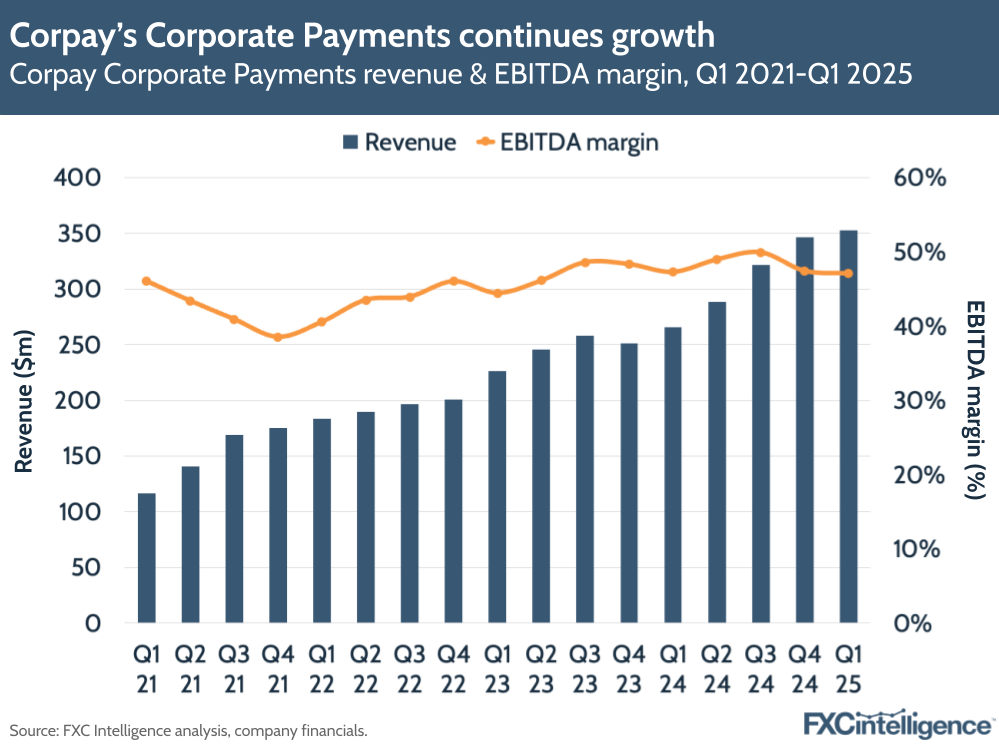

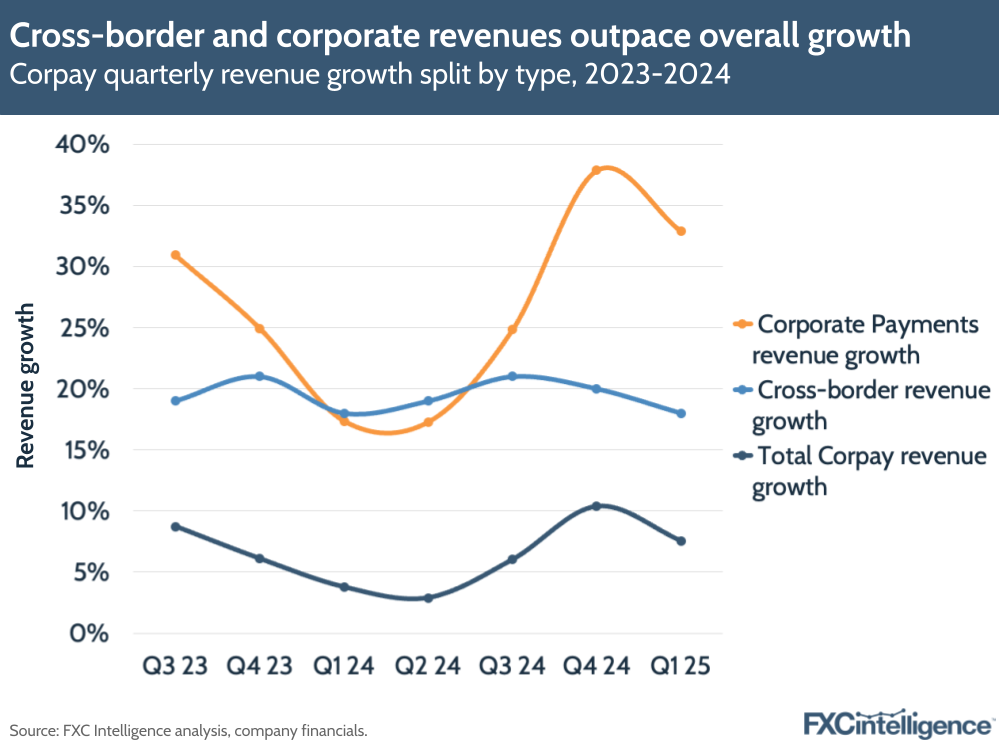

The Corporate Payments division was Corpay’s primary driver of growth in Q1 2025, with revenue increasing 33% YoY to $353m. EBITDA, meanwhile, grew 32% to $166m, for an EBITDA margin of 47.1%.

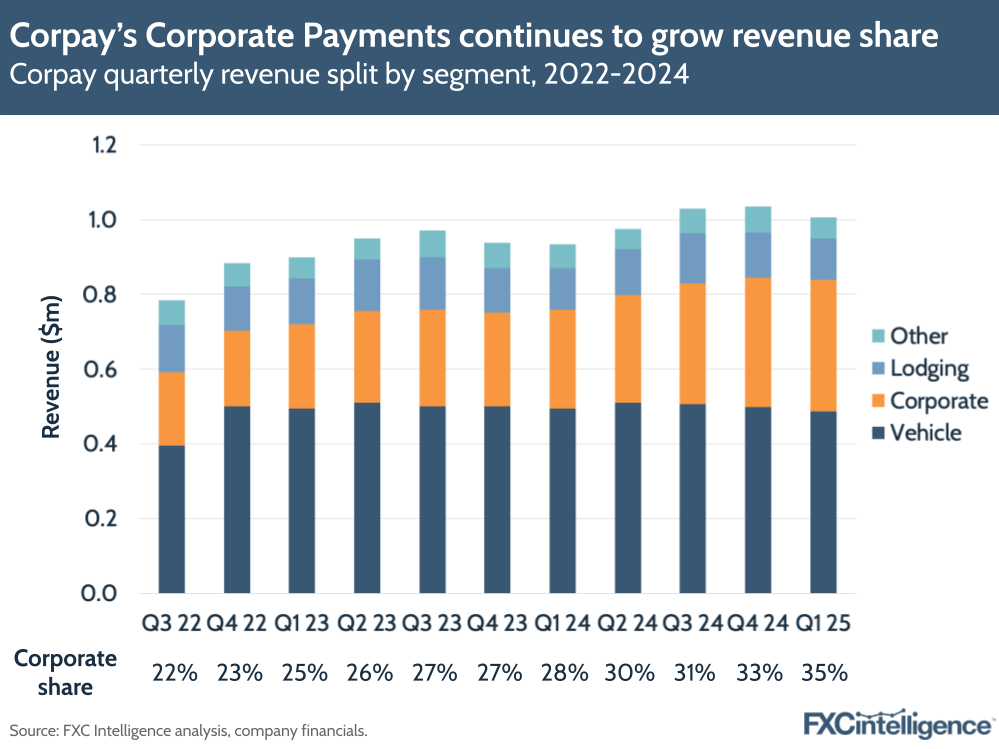

By contrast, all of Corpay’s other segments saw a contraction in revenue in this latest quarter, with Vehicle Payments and Lodging Payments both dropping by -1% and Other seeing a -13% contraction.

While Vehicle Payments remains Corpay’s largest segment, accounting for 48% of revenue in Q1 2025, Corporate Payments has consistently gained share and in this latest quarter accounted for more than a third of Corpay revenue for the first time at 35%.

During the earnings, Corpay CEO Ron Clarke said that the company was “looking a bit harder” at divesting three “non-core or less related businesses” that together could provide more than $2bn of incremental liquidity.

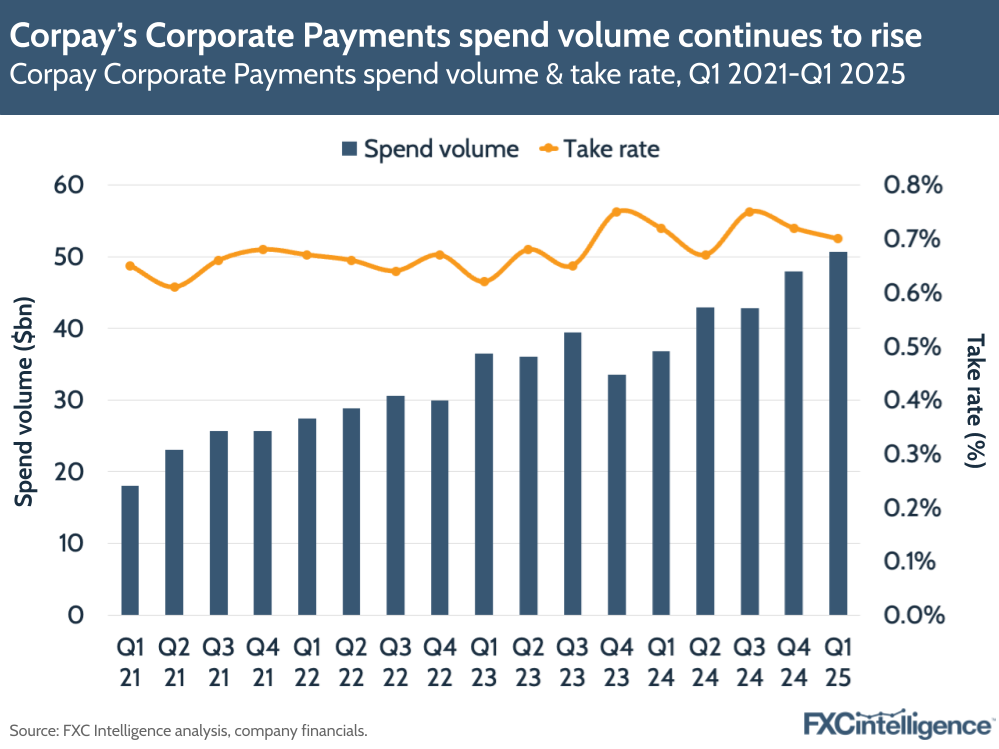

Rising spend volume was a key driver of Corporate Payments’ growth in this latest quarter, increasing 38% YoY to $50.7bn.

Payables also saw a 19% increase in revenue, aided by a 30% increase in direct sales as well as the signing of two new channel partners. In particular, Corpay has just gone live with a single “mega” client that is expected to have annual spend of over $30bn, and is also gearing up to launch its payables product in the UK this summer, where it anticipates higher rates of cross-border need, particularly in non-US corridors.

AvidXchange and Corpay’s ongoing M&A strategy

Daniel Webber:

Following Mastercard’s acquisition of a minority stake of the cross-border business, which we spoke about when it was announced, you’ve now announced the AvidXchange deal, where Corpay is buying a 33% share alongside TPG. Talk us through the strategy there.

Mark Frey:

It’s an interesting deal structure that we like a lot, which allows us to gain exposure to Avid – a leader in the space in particular customer segments that are different from our existing domestic payables business.

It’s an opportunity for us to have a long-term play and a view in that business with the call option as well where, if we can continue to see the improvement of that business, we can take a look at it again another day.

We really like the deal structure, we like the business and we think we can bring some acumen to improve that business over time. There’s a fantastic existing management team, which is great for how we think of the business and how we want to compete in the space.

There’s always cross-border opportunity in these deals. It’s mostly a domestic deal, but every one of these firms, especially the larger organisations, they’re going to have cross-border payment needs as well and we see that within the crossover between our domestic business.

It allows us to continue to grow these two portions of Corporate Payments in unison, the cross-border and the domestic payables business, continuing to look at deals. We will continue to grow organically nicely in the high teens, low twenties, but we’ll continue to look at deals.

There’s a long runway on both sides of the ledger, ultimately. We see an opportunity to continue to do accretive, attractive M&A in both cross-border and domestic payables and we’ll continue to execute on that strategy.

Mastercard and AvidXchange become Corpay’s latest M&A deals

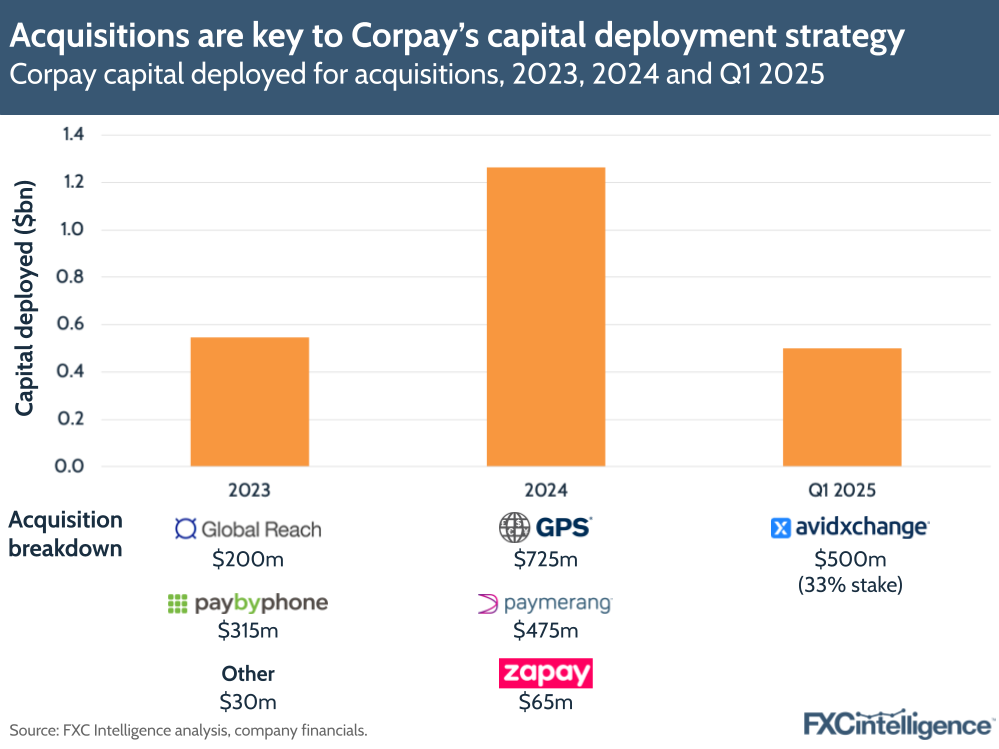

While it has taken considerable steps to grow organically, Corpay has also continued to bolster its reach through M&A deals, and this latest quarter saw two announcements that are set to be key for its Corporate Payments division.

The first is an unusual deal with Mastercard, announced in April, which sees the card issuer take a 3% stake in Corpay’s cross-border payments business. This values the unit, which makes up part of the Corporate Payments division, at $10.7bn – a 20x multiple of its expected FY 2025 EBITDA.

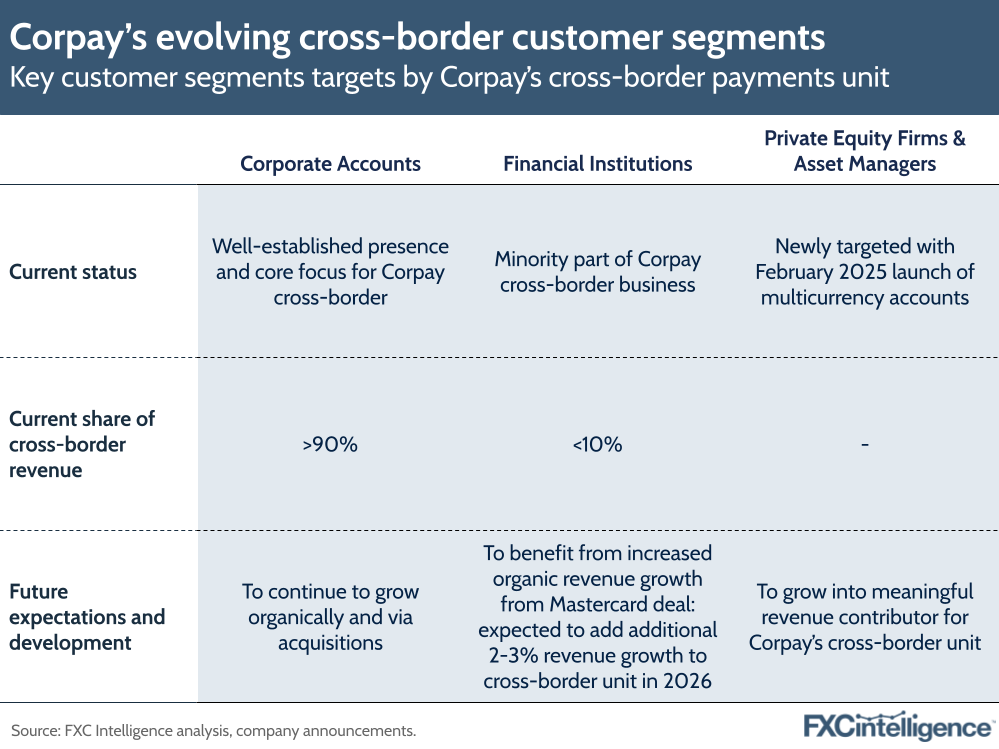

The deal sees Corpay become the exclusive provider of cross-border solutions, particularly those related to hedging and risk management, for Mastercard’s financial institution customers, and will initially focus on Tier 2-3 banks with limited FX capacity.

In its earnings, Corpay added that there were “hundreds of banks” in the total addressable market for this solution, and said that it expected to see an additional 2-3% revenue growth in its cross-border unit in 2026 from such financial institution clients.

Further to this, Corpay also announced a new M&A deal alongside its earnings, in the form of a partial acquisition of AvidXchange. This sees the AP automation player be taken private at a valuation of $2.2bn, in a deal led by private equity player TPG. Under the agreement, Corpay will invest around $500m for a 33% equity stake in AvidXchange, with the option to acquire the remaining equity of the company in the future.

During the earnings, Clarke said that both the Avid and Mastercard deals further the company’s previously stated goal of diversifying the business mix of Corporate Payments. He added that they “strengthen our position in the space and provide us the option to dramatically scale up our position over time”.

Growing Corpay’s multicurrency account product

Daniel Webber:

Your Multi-Currency Account, which you launched in February, is really starting to gain traction. What customer segments are resonating with you there?

Mark Frey:

We see strong adoption in our three key customer categories: corporates, the mid to large corporate category; financial institutions, our wholesale business that is somewhat of a correspondent solution that we offer to other licensed financial entities; and then our institutional customer base, which is small but growing very nicely.

It’s a segment that we’ve been focused on trying to accelerate growth in for the past couple of years and this value proposition resonates very nicely in that institutional category.

We see adoption amongst all three of those groups of customers. We see that this is a differentiator in terms of how we can compete and win in the space, and it continues to deliver float income to us as well, which is super attractive.

Corpay bolsters cross-border reach despite tariff headwinds

Corpay saw strong performance in its cross-border unit, with cross-border sales growing 51%, while cross-border revenue, which the company does not currently report a direct metric for, increased by 18% YoY.

While the Mastercard deal is expected to help grow the company’s reach among financial institution clients, which currently account for less than 10% of cross-border payments revenue, the Multi-Currency Accounts product is set to be particularly key to support growth among private equity firms and asset managers.

Launched in February with support for 12 currencies, this product allows clients to receive and pay out foreign currencies with an account with their business’ name, and has already seen significant adoption since launch.

Corpay reports that it has already signed over 2,000 clients, while aggregated account deposits have topped $800m.

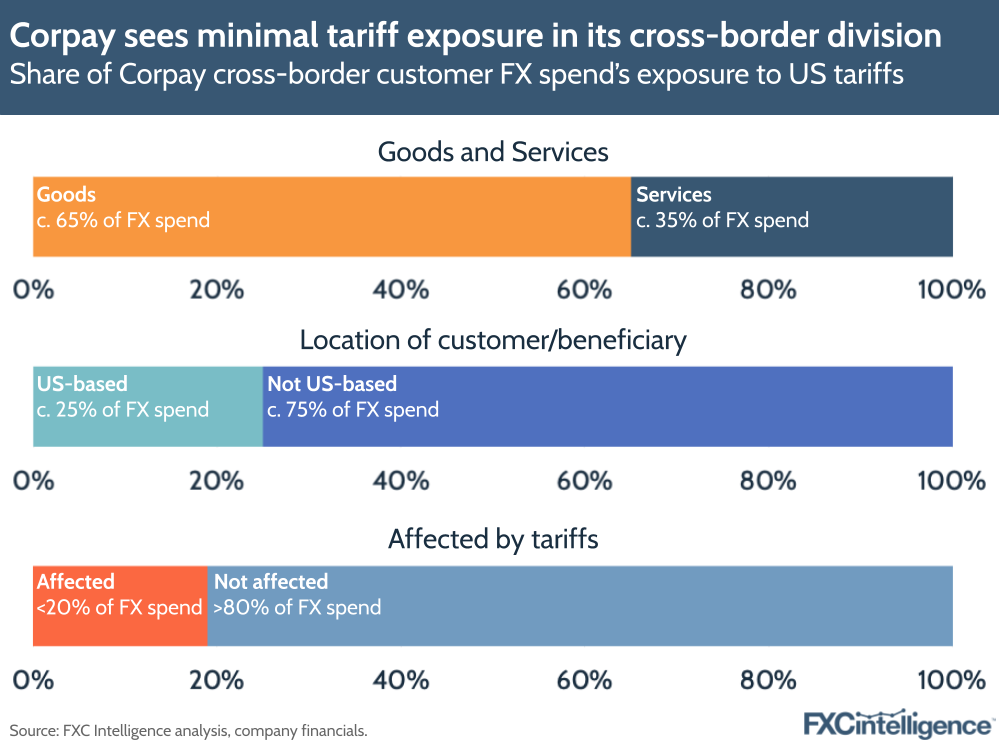

The company also provided an update on the impact of the US tariffs to its business, and in particular its cross-border unit. Here, it has seen some benefits from increased demand for risk management solutions, but also anticipates headwinds from flow reductions on corridors to and from the US.

While the company saw heightened cross-border activity throughout Q1 as a result of FX rate volatility, this early benefit turned in March as uncertainty around tariffs led to a softening in US goods-based volumes – something that has rebounded following the announced 90-day tariff pause.

Corpay also reported that it has already migrated most of the customers from its 2024 acquisition of GPS, allowing it to sell its risk management solution to these clients.

In terms of exposure, while around 65% of its flows are from goods, only around 25% of its FX spend is from customers or beneficiaries based in the US, and the company reports that less than 20% of its cross-border business is exposed to the tariffs. As a result, the company is projecting a $10m-15m drop in its cross-border revenue from the tariffs in FY 2025.

Despite this headwind, Corpay sees any anticipated impacts being balanced by other areas of growth in the company and so is maintaining its overall outlook, with a slight update to its FY projections to take its previous acquisition of Gringo into consideration. It is therefore projecting full-year revenue of between $4.4bn and $4.5bn for the whole company, while it is retaining its Corporate Payments projection of revenue growth in the high teens to 20%.

Future strategy and growth

Daniel Webber:

Is there anything else you want to highlight about how you are approaching the business?

Mark Frey:

We’re just going to continue to execute on the basics. We’re going to continue to do deals, yes, we will continue to synergise those deals and make them accretive to the business, but we’re very focused on building an organic grower as well.

When we talk about growing high teens, 20%, that’s on an organic basis, that’s not relying on synergies to get there. That’s relying on us continuing to sell very effectively, with a net sales expense that is industry leading and super attractive.

It makes it highly investable to put more investment into sales activities across the business, which is the lifeblood: it’s the future of the engine, ultimately.

We’re very focused on trying to continue to accelerate that organic growth engine, even as we scale this business. We don’t see us slowing down that organic growth rate at all.

We really believe we are just scratching the surface. We’re just getting started. There’s so much runway for us to build over the next generation in this business, and for us to continue this type of growth.

We’re super excited about the future, and think that exciting things that will come.

Daniel Webber:

Mark, thank you.

Mark Frey:

Thank you.

The information provided in this report is for informational purposes only, and does not constitute an offer or solicitation to sell shares or securities. None of the information presented is intended to form the basis for any investment decision, and no specific recommendations are intended. Accordingly, this work and its contents do not constitute investment advice or counsel or solicitation for investment in any security. This report and its contents should not form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. FXC Group Inc. and subsidiaries including FXC Intelligence Ltd expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in this report, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting there from. This report and the data included in this report may not be used for any commercial purpose, used for comparisons by any business in the money transfer or payments space or distributed or sold to any other third parties without the expressed written permission or license granted directly by FXC Intelligence Ltd.