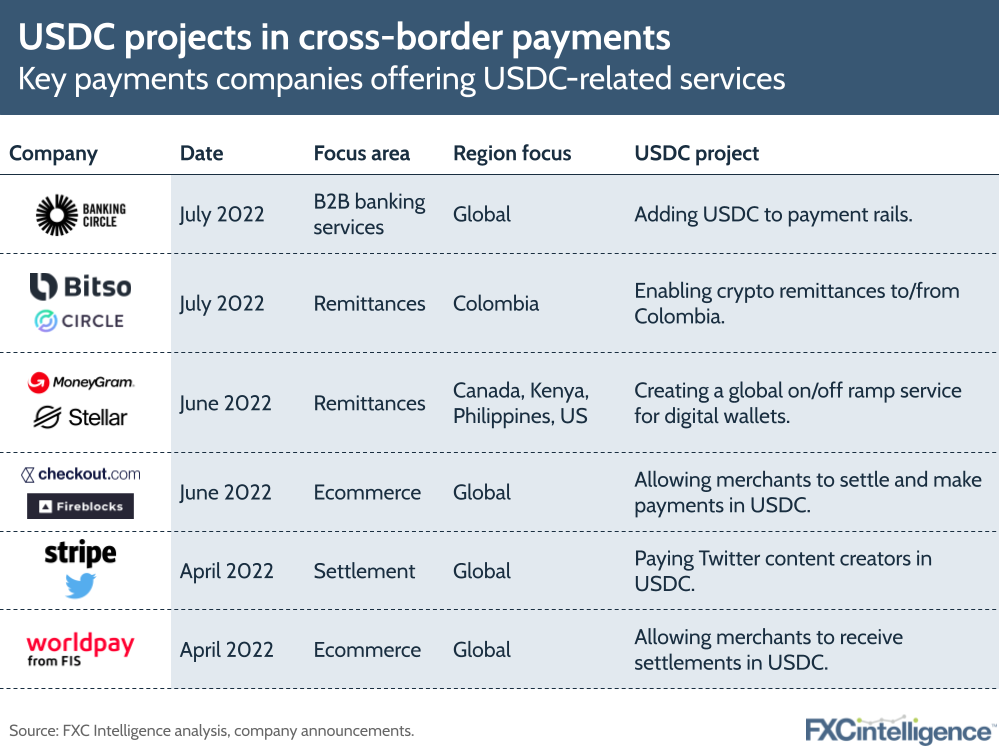

Banking Circle recently announced that it is adding USD Coins (USDC) to its payment rails, making it the latest in a line of cross-border payment companies to launch projects around the USD-backed stablecoin.

Issued by global fintech Circle, USDC is currently the second largest stablecoin in circulation, with a market cap of $55bn, behind Tether ($66bn). Like other USD stablecoins, its value is pegged to the US dollar, but its level of regulation, transparency and lower risk nature of its fiat-currency holdings have made it an increasingly appealing option for cross-border payments projects.

The companies harnessing USDC for cross-border payments

Cross-border payments companies are looking to tap into the benefits USDC offers, one of which is instant settlement. Through their USDC adoption, Checkout.com and Worldpay want to give merchants the ability to settle payments instantly on a 24/7 basis, as opposed to waiting for money to pass through legacy systems (often batched overnight or not available on weekends).

Meanwhile, Banking Circle will allow banking/financial institution clients the ability to convert fiat to USDC so that they can facilitate faster, cheaper payments for individuals and businesses.

Another common benefit is the ability to send and receive money across borders without needing a bank account. This is particularly true for Bitso, which enabled crypto-powered transfers between the US and Mexico last year and has now extended the service to Colombia. The service is expected to give people in these remittance-heavy countries a stable, easy way to transfer money while protecting its value from inflation.

Why USDC is being favoured over other stablecoins

Why the focus on USDC as opposed to other stablecoins backed by the US dollar? Trust and stability are likely factors. Stablecoins suffered a blow earlier this year when Terra’s UST stablecoin lost its peg to the US dollar, causing a large-scale sell-off and a loss of confidence in the space.

However, unlike TerraUST, which was backed by Luna and pegged to the US dollar via an algorithm, USDC is a fiat-backed stablecoin that is backed entirely by cash and highly liquid cash-equivalents such as US Treasury bonds. For established financial companies, this makes the stablecoin a safer bet than its rivals, as owner Circle says it holds enough cash in reserve to support 1:1 withdrawals of fiat currency.

USDC has seen rapid growth recently and is catching up on Tether. Circle said in February that growth was being driven by people seeing the coin as a ‘safe haven’ for conversions from weaker currencies, as well as benefits for cross-border payments, increased payment use cases and its availability across multiple blockchains.

As cross-border payments players continue to bet on USDC, we’ll see how the coin’s position in the digital payments landscape evolves moving forward. And longer term, we’ll be watching how USDC’s position evolves as Central Bank Digital Currencies (CBDCs) come online.

How are crypto players competing with fiat on cross-border payments?