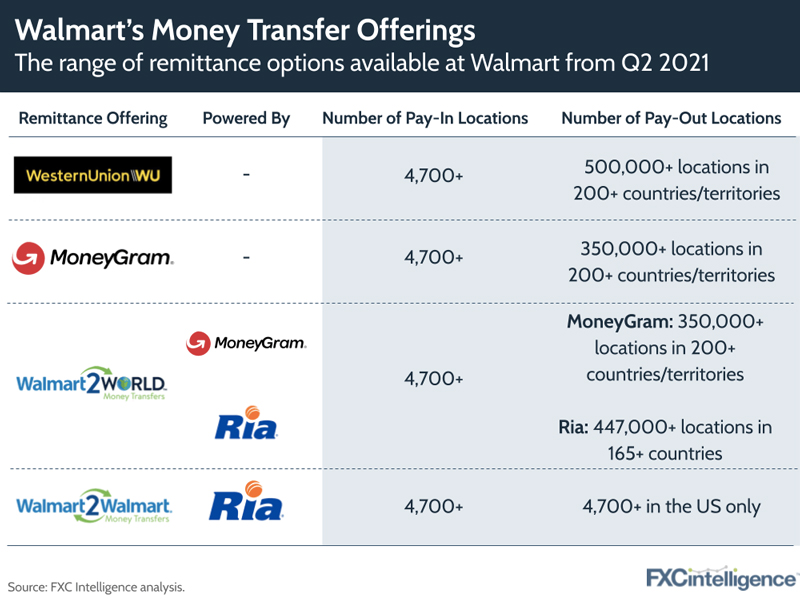

Last week Western Union grabbed attention with the announcement of a major partnership with Walmart, which will see it bring its money transfer services to Walmart’s 4,700+ US stores. We caught up with WU CEO Hikmet Ersek and Walmart’s Financial Services team to find out more.

Walmart became the first major US retailer to move to a marketplace model in 2018 by offering more than one brand to customers (US supermarket chain Kroger followed late last year). Western Union will be directly competing for Walmart customers’ business alongside current incumbents MoneyGram and Ria.

However, Hikmet confirmed that WU won’t be lowering prices to lure customers away from these rivals, arguing that they will pay a premium for the size, speed, safety and reliability of Western Union. He also added that this offering would likely be quicker that other non-Walmart WU locations in the vicinity (a benefit of Walmart), arguing that it “has to be fast” to match the customer experience expected in the stores.

Hikmet anticipates that the deal could be “really significant” for Western Union’s US market. MoneyGram’s shareholders agreed, wiping 10% off its market value on announcement of the news.

- Walmart accounted for around 16% of MoneyGram’s revenue in 2019 (c. $190m – $200m) and around 20% of Ria’s (over $200m), although Ria is part of larger parent Euronet. Although not fully reported yet, 2020 saw meaningful declines in these revenues due to retail reductions from the pandemic.

- These three players are now battling over a likely $300-400m total revenue pot for 2021, with much depending on Covid’s continued impact on in-store retail.

- If WU can win a third of this business overall, that would add several percentage points of growth to its top-line revenue (and make Hikmet happy!)

Whilst the wider narrative around money transfers has long been a digital future, this deal highlights the more nuanced reality. We’ve previously shown how important cash remains in remittances, and this deal reflects Western Union’s focus on ensuring its network provides options that best suit local customers. As the largest US retailer, this is Walmart’s continued push to put the customer first. Note, the new Walmart fintech recently announced will run separately to this offering and Walmart Financial Services.

Long-term, WU’s strategy continues to be focused on leveraging its platform. Whilst it’s unlikely Hikmet will open WU’s rails up to other money transfer players, partnerships such as this one, STC Pay and TD Bank are likely to continue. Four or five percent more top-line growth for Western Union would be significant and Walmart could be a big part of that.

Sign up to our newsletter to stay up to date on industry developments