We publish an industry first via our Forbes column, bringing together the CEOs of Western Union, MoneyGram, Ria, Remitly, WorldRemit and TransferWise to understand how these companies have been adapting through the pandemic.

Cash has been the enabler of digital growth

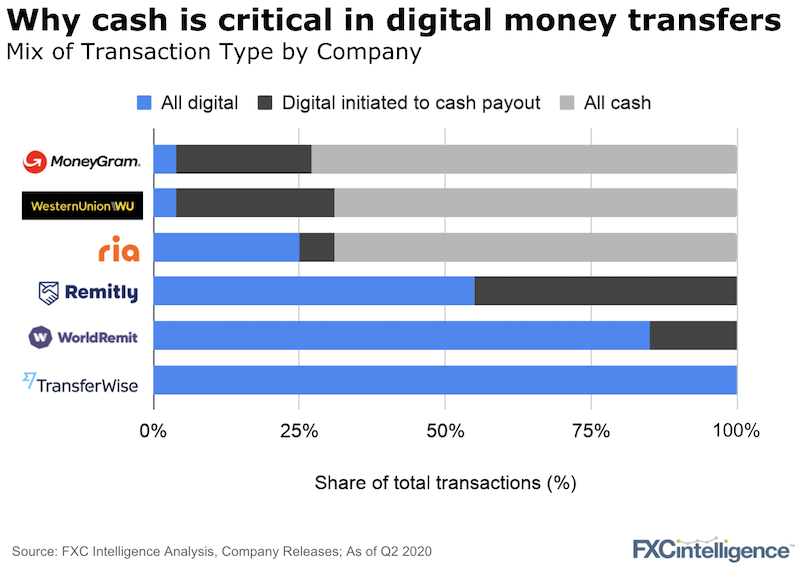

Digital growth has stolen all the recent headlines but even before the pandemic, counter-intuitively, cash has been the critical component enabling digital growth. We’ve published some new data on transactions mixes across the six leading players to show why.

What digital means within each of these companies is important to understand. We cover this in detail in our Forbes column but, at a high level, a transaction that is initiated digitally counts as digital. Put another way, a transaction that starts digitally but ends in cash counts as a digital transaction (the dark grey bars in the chart above). The whole transaction does not need to be digital to meet the definitions used across the industry.

The chart then speaks for itself and shows how across the first five companies, cash accounts for over 80% of total transactions (weighted by company size), as well as being a high proportion of digital transactions.

This means that when we assess the digital growth of the sector, it becomes clear from the data above that only a subset of all digital transactions are fully digital on both ends and, importantly, a cash payout solution is critical to enable digital in the first place.

We spoke with all six CEOs – Western Union’s Hikmet Ersek, MoneyGram’s Alex Holmes, Ria’s Shawn Fielder, TransferWise’s Kristo Käärmann, Remitly’s Matt Oppenheimer and WorldRemit’s Breon Corcoran – to understand their views on cash, digital and growth through the pandemic.

We include insights and data on:

- Sizes and key metrics for digital such as revenue and customer counts

- The differences in how digital is catergorised for each company

- The value of cash payout networks

Is pricing all going to zero? No.

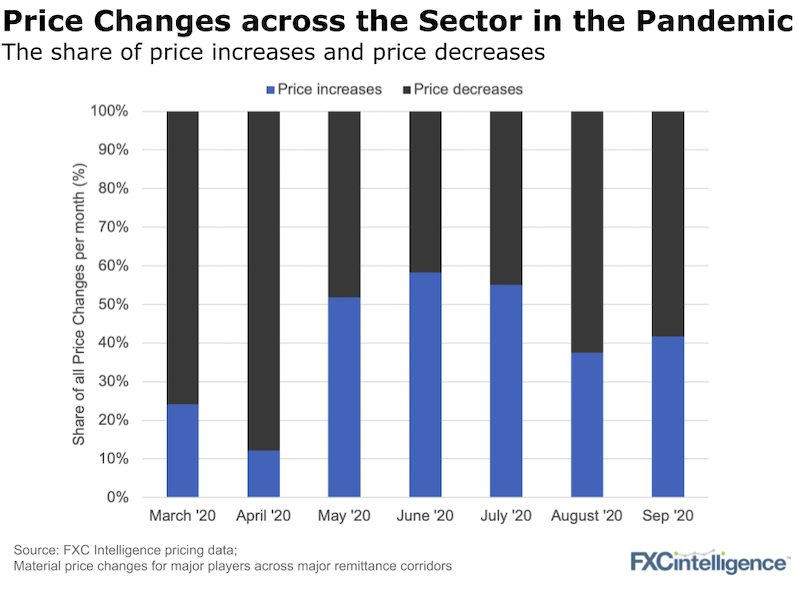

There is a long held theory in the sector that pricing will ultimately go to zero, thereby destroying the economics of the market. Fortunately, that data (and we have it), tells a very different story.

In the chart below, we look at the mix of significant price changes across the sector throughout the pandemic:

Some clear patterns emerge:

- Pricing is not going to zero. If it were, we would only, and consistently see price decreases across the board

- Pricing was typically lowered early on in the pandemic in March and April but then normal pricing strategies (i.e. increases and decreases) returned and have continued since

- The shares of increases and decreases differ by each pay-in and pay-out method (reach out to us for the more granular data) but the up and downs remain

And what about TransferWise’s stated “Mission Zero” – a goal to eventually make moving money free? Well, even Kristo, TransferWise’s CEO is more realistic on this goal, as he shared with us in our recent conversation: “It gets very close to zero. I don’t know if it’s going to get to zero. Probably not really, unless it’s subsidised by something else, but it can get very close to zero. And the closer it gets to zero, if someone wants to subsidise it, then that’s also going to be a better experience.”

For more insights from the six companies and their CEOs, read our Forbes article. For more of the data, speak to us.