The world of cryptocurrency has been gaining steady interest among payments companies, and one of those leading the way is Visa. This week I spoke to Nikola Plecas, head of new payment flows at the card network, for my column in Forbes.

You can read the full piece on Forbes, but here are some key takeaways from my conversation with Nikola:

- Digital currency, not cryptocurrency. Visa sees the market as having two components: cryptocurrency, which includes the likes of Bitcoin and is purely an asset. And digital currencies, which are stablecoin cryptocurrencies that it believes have the most potential for payments.

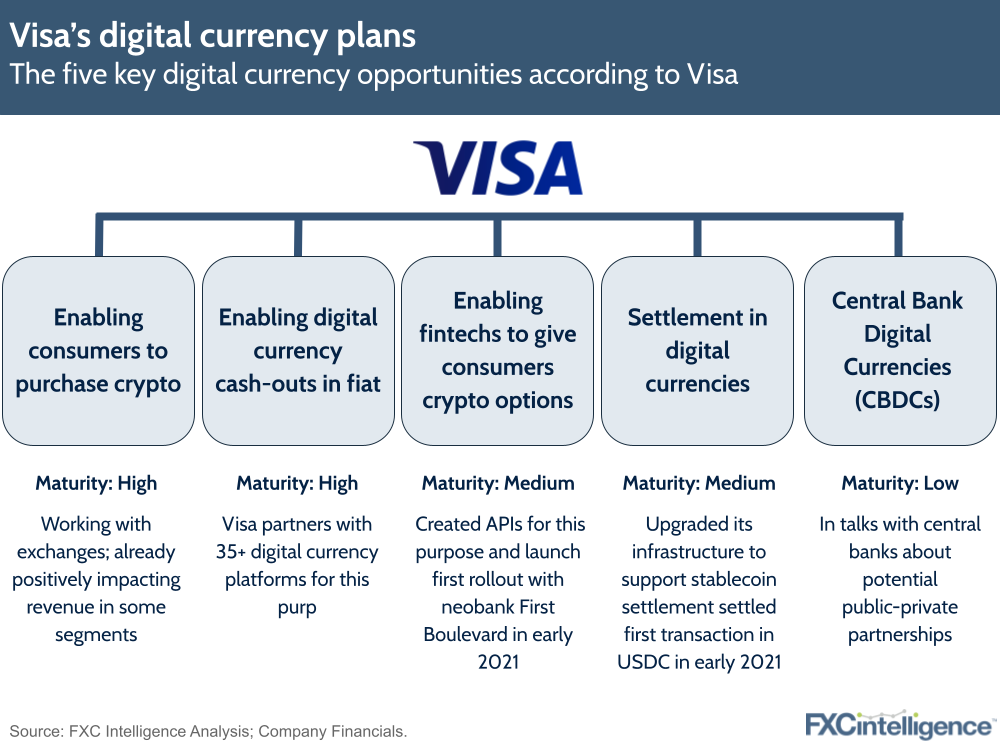

- The company has both long and short-term plans for digital currency, as outlined by its five pillars, shown above. Some of these, mainly focused on the buying and selling of asset cryptocurrencies, are already benefiting the company’s revenues, but it is beginning to incorporate stablecoin payments into its network.

On the horizon, meanwhile, is a desire to be involved with central bank digital currencies (the Bank of International Settlements has published a range of detailed papers on the topic). - B2B payments, a big growth area for Visa, has the potential for stablecoin usage, particularly in countries with limited infrastructure.

- Cross-border payments is also a strong opportunity, although it’s not a simple fix for the industry’s complexities. Here the biggest benefit Nikola sees is in marketplaces.