As the UAE continues to position itself as a hub for fintechs, a series of recent key regulatory approvals, infrastructure upgrades and partnerships have focused on how money is moving into and out of the region.

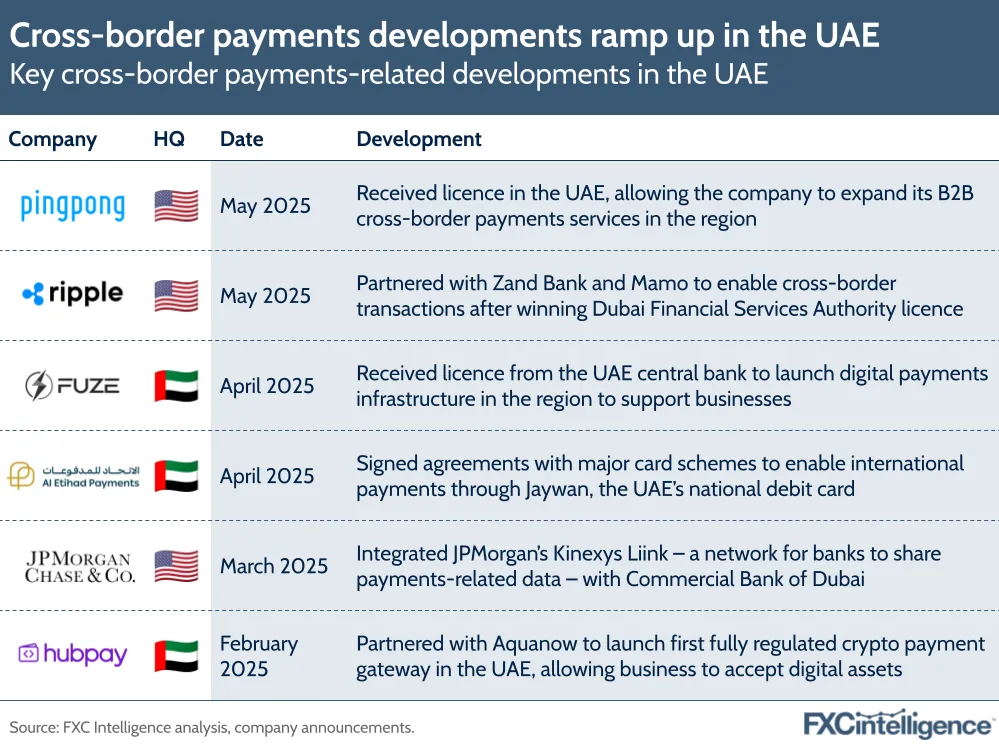

Global payments players are continuing to expand into the UAE, including B2B cross-border platform PingPong, which received a licence to enable international transaction services for clients in the country. Blockchain infrastructure payments provider Ripple, meanwhile, has partnered with UAE-based Zand Bank and digital B2B platform Mamo to facilitate cross-border blockchain transactions, while Canadian crypto provider Aquanow has partnered with Hubpay to introduce a crypto payments gateway to businesses.

A number of factors are driving demand for cross-border payments from the UAE. The country sits at the intersection of major global trade corridors connecting Asia, Europe and Africa, and is also home to over 8.7 million migrant workers – equivalent to more than 80% of the country’s resident population. This continues to drive demand for low-cost real-time transfers, while a growing SME segment also needs accessible international payments solutions to support trade and cross-border payroll.

The country has seen several schemes and organisations emerge to try and support the demand for more streamlined payments in the country. This includes Al Etihad Payments, a subsidiary of the UAE’s Central Bank, which launched a real-time P2P and P2B payments system, Aani, in 2023 and a domestic card payment scheme, Jaywan, in 2024. In March 2025, the company signed agreements with a number of global card schemes – including Discover, Mastercard, UnionPay and Visa – to take its Jaywan scheme global, allowing Jaywan cardholders to make payments in other countries globally.

Developments align with the UAE’s push towards digital, which includes its Digital Economy Strategy, aiming to double the contribution of the digital economy to the UAE’s non-oil GDP from 11.7% to 20% by 2031. Overall, the country is very much in the deployment stage, and with its economy projected to grow in 2025 and companies within it seeking to expand their reach globally, cross-border payments companies are capitalising on the opportunity.

Find out more about your cross-border opportunity with a custom insight report