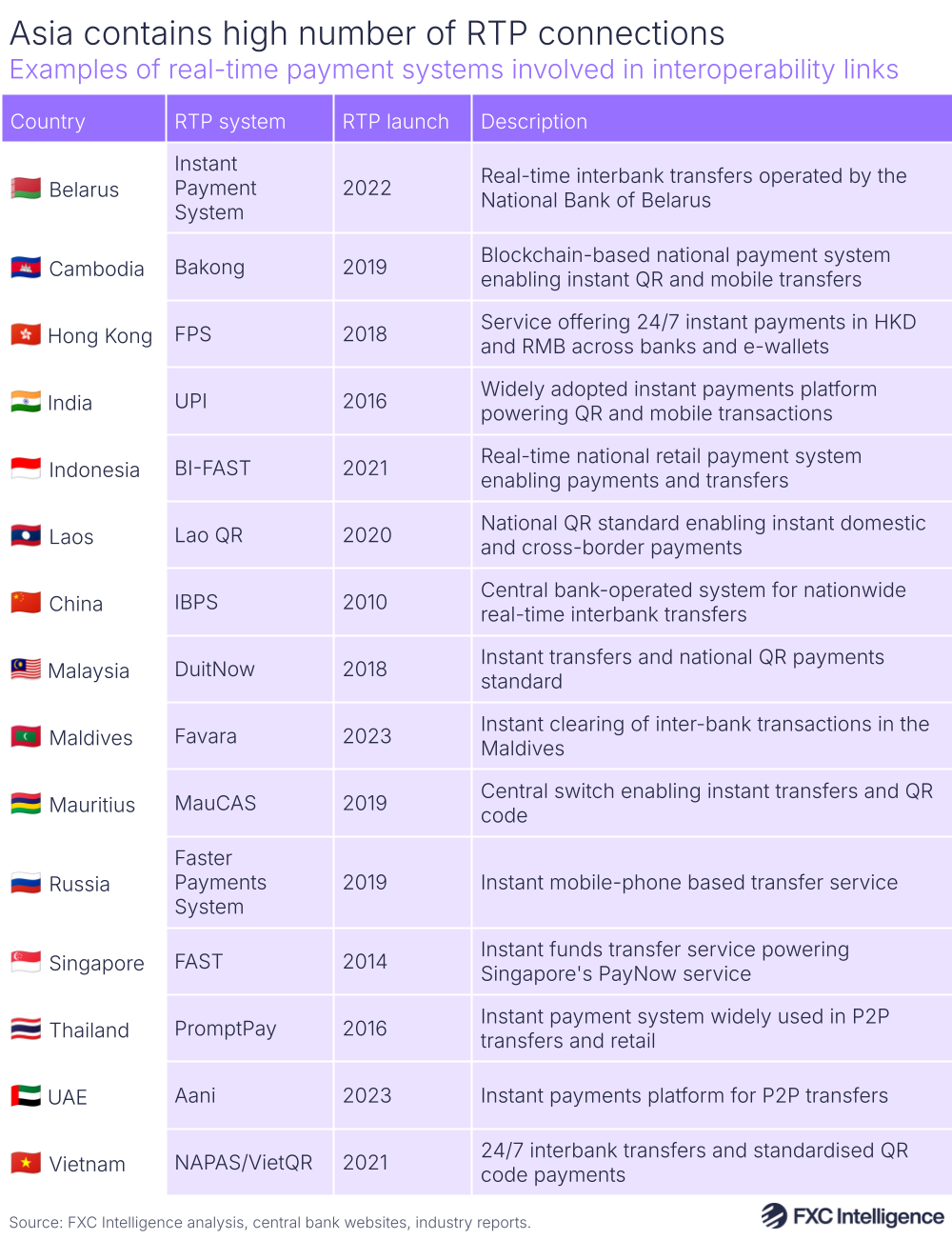

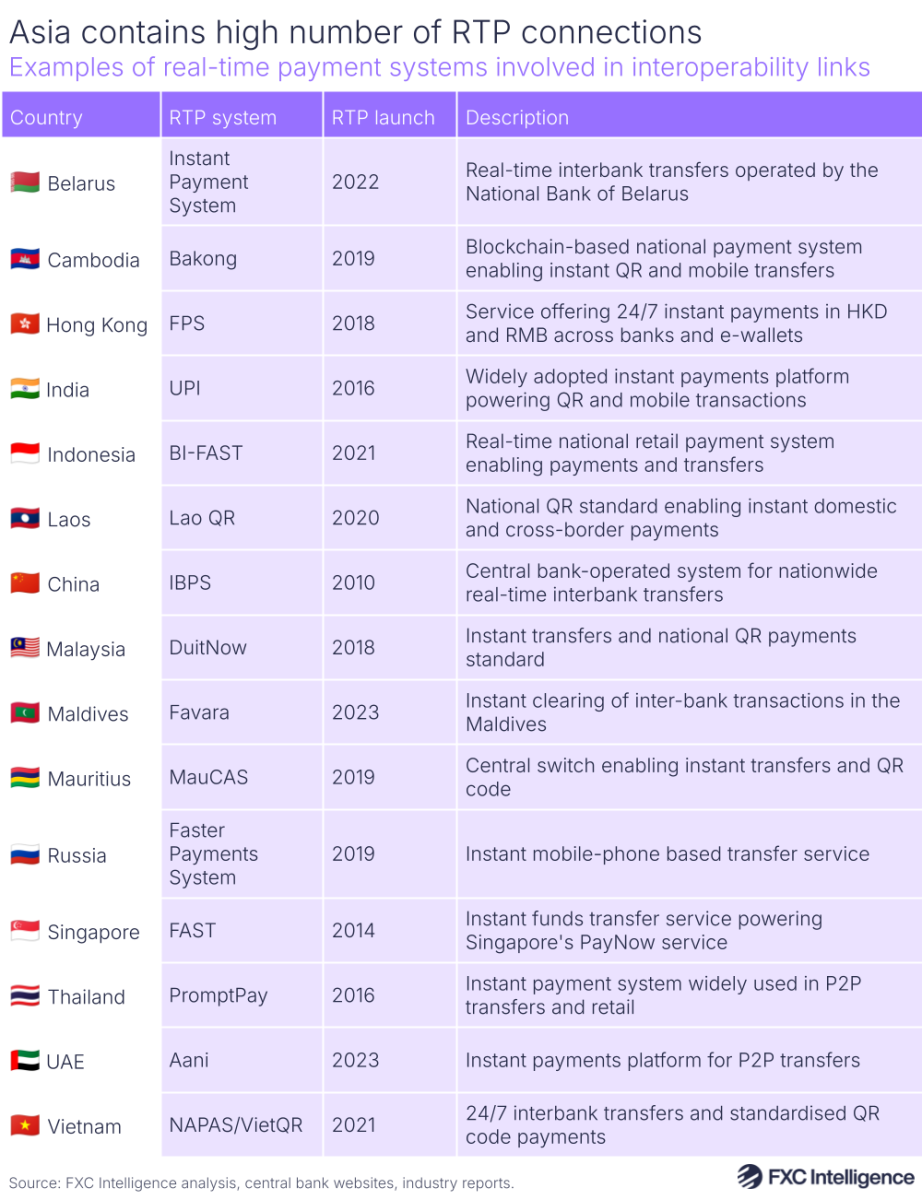

In the last few years, countries in Asia have seen a significant rise in the number of cross-border linkages between national real-time payment systems – digital payments infrastructures that enable instant transfers between bank accounts 24/7/365.

This complements wider regional moves to create payments systems that are gaining traction in Europe, Africa, South America and the Middle East as countries target faster, more seamless cross-border payments.

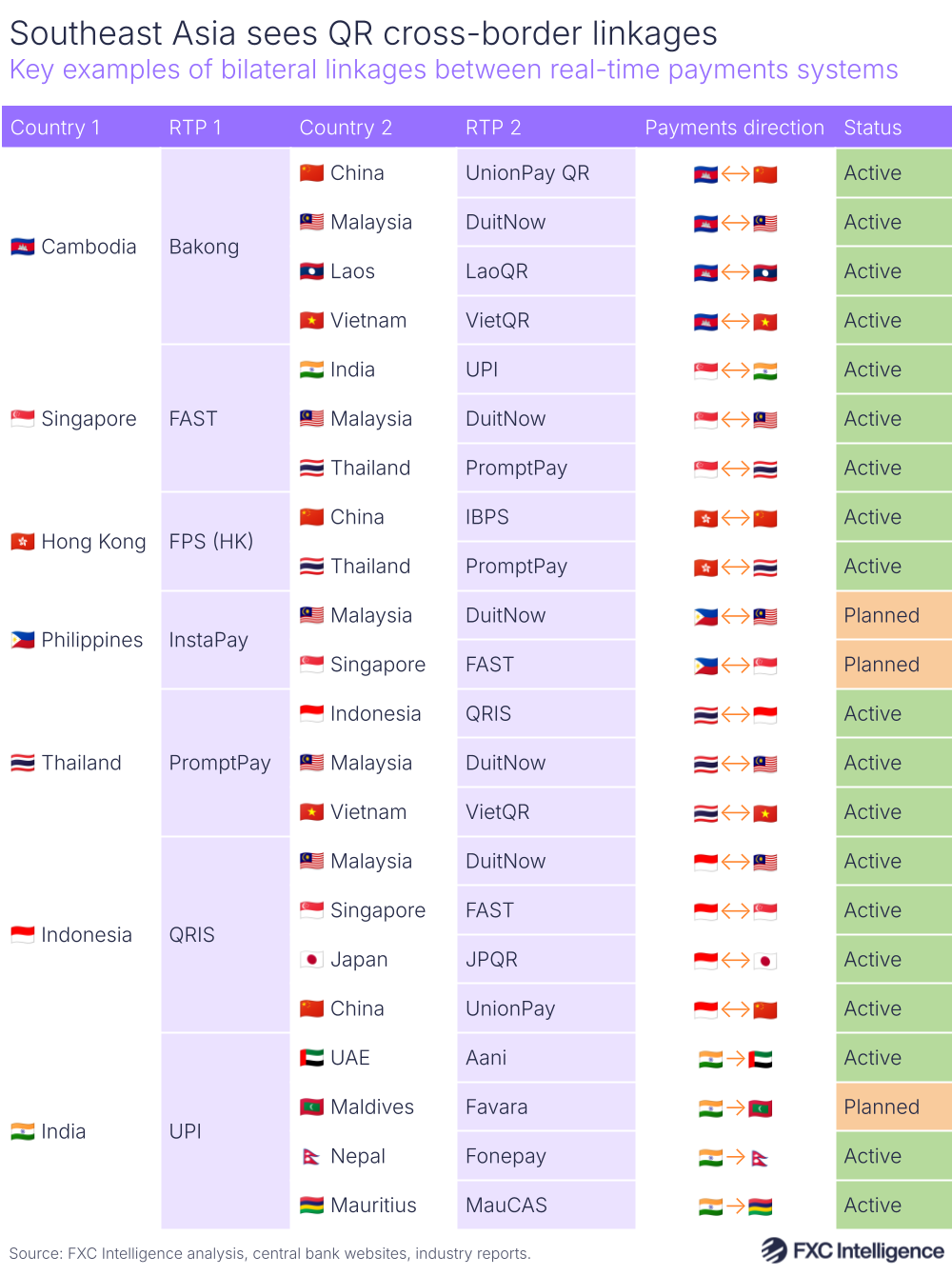

Southeast Asia sees high number of real-time payments connections

When looking specifically at real-time payment systems that are owned or operated by central banks (or companies in which the government or central bank owns a significant stake), the majority of reported bilateral links between countries are seen in Asia.

In Southeast Asia, countries are increasingly using QR interoperability to enable cross-border payments. The Association of Southeast Asian Nations (ASEAN) Nations has been working to link up the national real-time payment systems of its member countries, many of which already have well established fast payment systems, including Singapore (FAST), Thailand (PromptPay), Malaysia (DuitNow), Indonesia (QRIS) and the Philippines (InstaPay).

Bilateral agreements enable faster, more seamless payments for migrants and tourists from other countries. It is now possible to scan a QR code at a merchant in Thailand in order to pay directly from a Singaporean bank account for example. The other notable real-time payments system that has seen growing traction in Asia is UPI, the owner of which, NPCI, has partnered with several countries to enable Indian travellers to make payments using UPI-enabled apps while abroad.

In most cases, cross-border agreements are enabling payments in both of the countries involved in the scheme. In July 2025, India’s UPI significantly expanded its link with Singapore’s PayNow (its instant retail payment system built on top of FAST) to enable users to send and receive money across the two countries. Last week, Chinese state-owned financial services provider UnionPay International initiated a pilot for cross-border QR payments between China and Indonesia, following a recent launch of Indonesian QR code payment acceptance in Japan.

In addition, a number of industry projects are ongoing to connect instant payment systems. For example, Project Nexus – launched by the Bank for International Settlements (BIS) – aims to create a central hub that standardises connections between countries’ existing instant payments networks. The BIS says it is moving towards live implementation with its five central bank partners, including India, Malaysia, the Philippines, Singapore and Thailand.

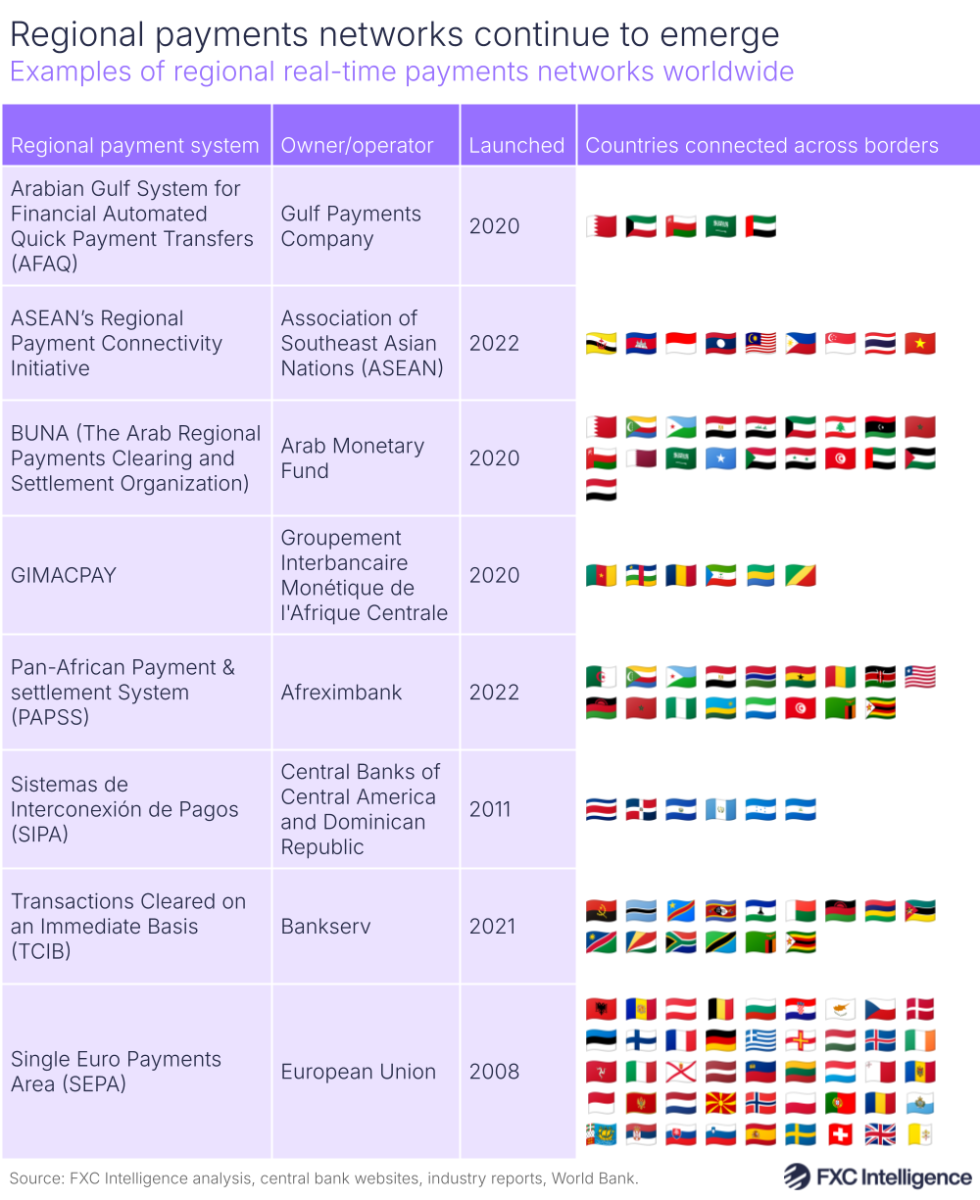

Regional payments networks continue to emerge

Across the world, regional initiatives have also arisen to enable cross-border payments across corridors. While some of these, such as Central America’s SIPS and Europe’s TARGET Instant Payment Settlement system, have been around for longer, others have emerged more recently, such as Africa’s Pan-African Payment and Settlement System (PAPSS), plus two cross-border payments systems in the Middle East: BUNA and AFAQ.

While the rise of bilateral links and regional payment systems marks an understanding of demand for faster and cheaper payments, the question remains about how efforts to link payments systems nationally and regionally could come together in a unified payments network, or if it could make it harder to standardise payments in the future.

In the meantime, competition continues to grow from private sector players that are continuing to grow traction and plugging into rails to enhance their own growing money transfer networks. Alongside real-time systems, new forms of digital money – from stablecoins to central bank digital currencies – continue to grow and depending on how they are adopted could spur movement away from these rails altogether.