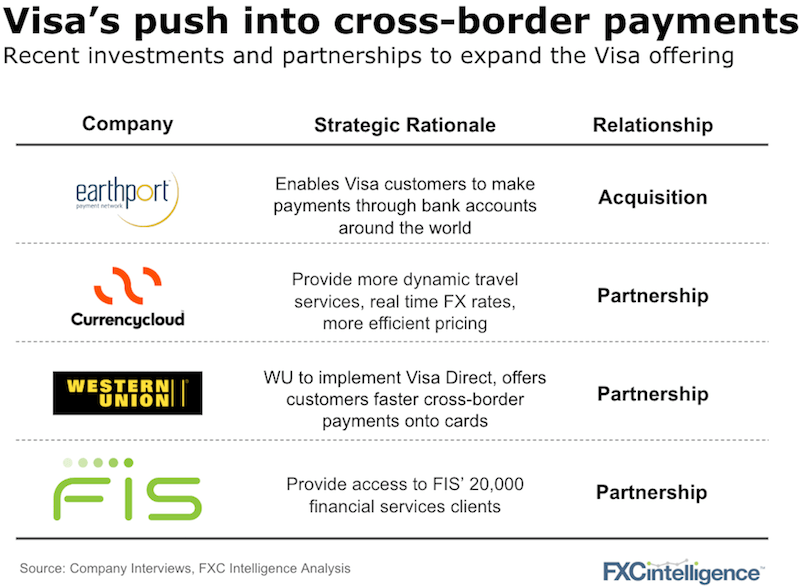

Visa has had an exciting six months making waves in the cross-border space. We spent time over the last week talking with Visa as well as partner companies such as Currencycloud and Earthport to dig into the strategy.

As to Visa’s strategy on cross-border (reminder Visa makes over $6bn a year in revenue from FX), Mark Pettit, Executive Director of Innovation & Strategy and Programs, Visa, said: “Visa should be the pipes and plumbing. We provide the core capabilities, at scale and consistently, and then let clients build on top of us.”

Each of the plays above adds another string to Visa’s bow. We covered the Earthport deal here so take Currencycloud for example:

- The current working of the card rails locks the FX rate at a different time to when the transaction actually occurs. This can cause lots of issues from a lack of customer transparency to reduced capabilities for the card issuer.

- The Currencycloud partnership allows the FX rate to be set real time removing this time delay. What Visa’s customers then do with this capability is up to them.

As our table above shows, the deals above are adding speed, transparency and new capabilities. This is building the plumbing and Visa’s Mark, who led the Currencycloud deal, said to me, there is a lot to come from Visa in the cross-border space so stay tuned.

[fxci_space class=”tailor-6332fbc65dd48″][/fxci_space]