We’ve entered earnings season with a host of year-end reporting, some of which – most notably Western Union and Ria – we’ll be covering next week. This week, we start by focusing on Visa and Mastercard.

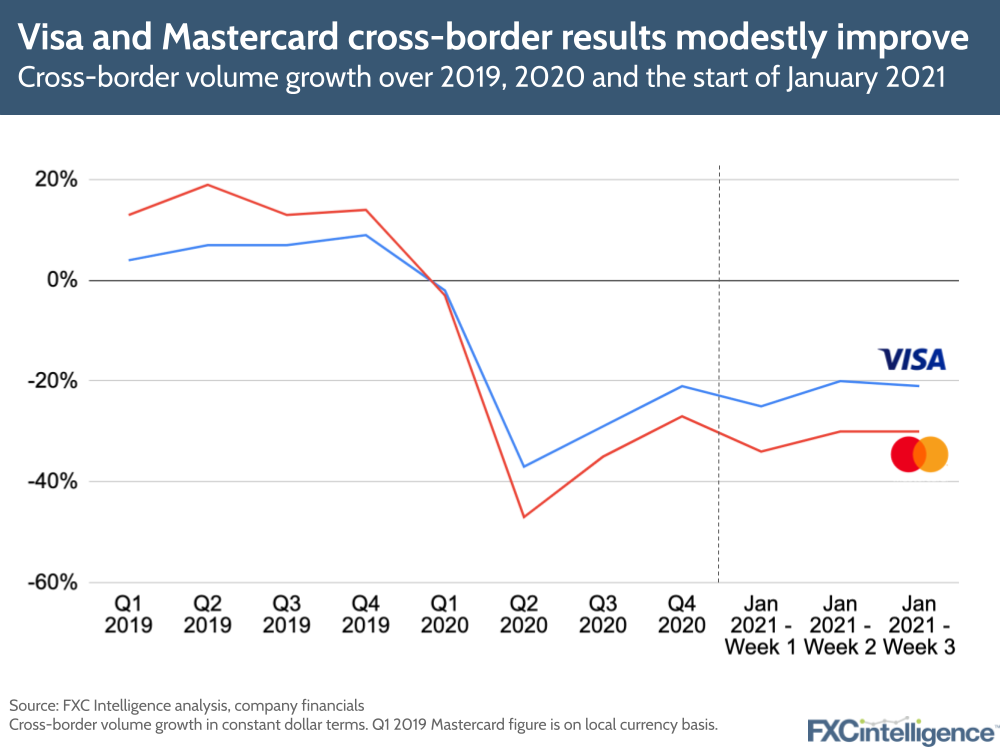

For both companies, the story is similar. Overall net revenue is down, primarily due to the reduction in cross-border business, although both Visa and Mastercard are showing signs of recovery compared to the previous two quarters. Cross-border ecommerce has also been strong for both.

Visa

- For Visa’s Q1 2021 (which is calendar Q4 2020), international transactions revenue accounted for 25% of Visa’s net revenue, compared to 33% a year ago.

- Visa highlighted cross-border P2P and remittances as a key area for future growth, with TransferWise, Western Union, Remitly and MoneyGram all onboarded in 2020.

- Other partnerships include African fintech Zeepay, which will use Visa Direct for its money transfer services, and Goldman Sachs, which is using Visa B2B Connect for its cross-border money movement.

- Visa also plans to enable customers to purchase and sell cryptocurrencies through partnerships with wallets and exchanges, with the company seeing this as a strong area of future growth.

Mastercard

- For Q4 2020, cross-border volume fees accounted for 21% of net revenue, compared to 33% a year ago.

- Digital payments, including cross-border ecommerce, is and will continue to be a strong focus for Mastercard.

- The company has seen a slowing in cross-border travel, particularly in Europe, due to the return of lockdowns in many countries, however it has positioned itself for the return of travel with “strong travel-related portfolios”, which it believes will be a key driver of growth once countries begin to ease lockdown restrictions.

- However, it is not yet giving a forward view on net revenues for 2021, as it considers the vaccine rollout to be too uncertain at present.