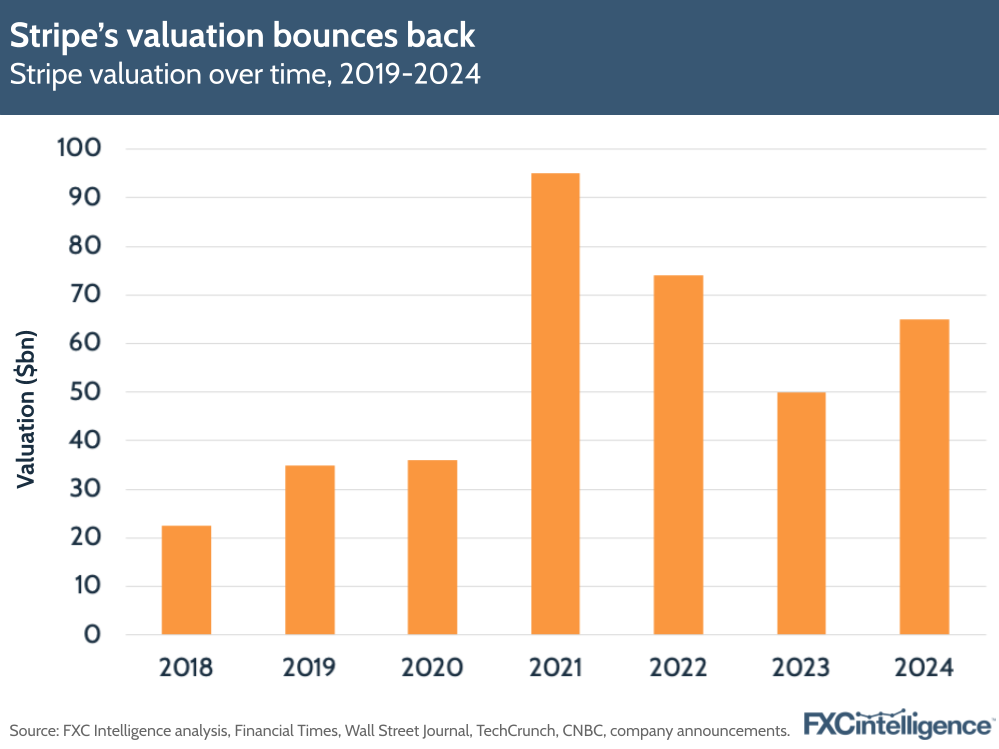

Last week saw payments processor Stripe increase its valuation to $65bn, signalling the start of a bounceback after it previously sharply cut its valuation from its 2021 peak.

The deal will allow employees to cash out stock totalling around $1bn and is being funded by groups including Sequoia Capital and Goldman Sachs, as well as Stripe itself. It sees a rise in valuation after Stripe grabbed business headlines for cutting its valuation to $50bn in 2023 – almost half its 2021 peak.

At its current valuation, Stripe is valued above payments processor rival Adyen, which has a current market capitalisation of €46bn ($50bn), and Block, owner of PoS-focused player Square, whose current market cap is $47bn.

The move does reflect signs of a more favourable market, with Stripe often regarded as an industry bellwether, despite reports of lower consumer spending in the holiday season across publicly traded players.

It also suggests that the long-awaited Stripe IPO is still some way off, and is unlikely to occur before 2025 at the earliest. This is also a reflection of the wider market, which has seen few public market debuts over the last year.

How can our cross-border card data give payment processors an edge?