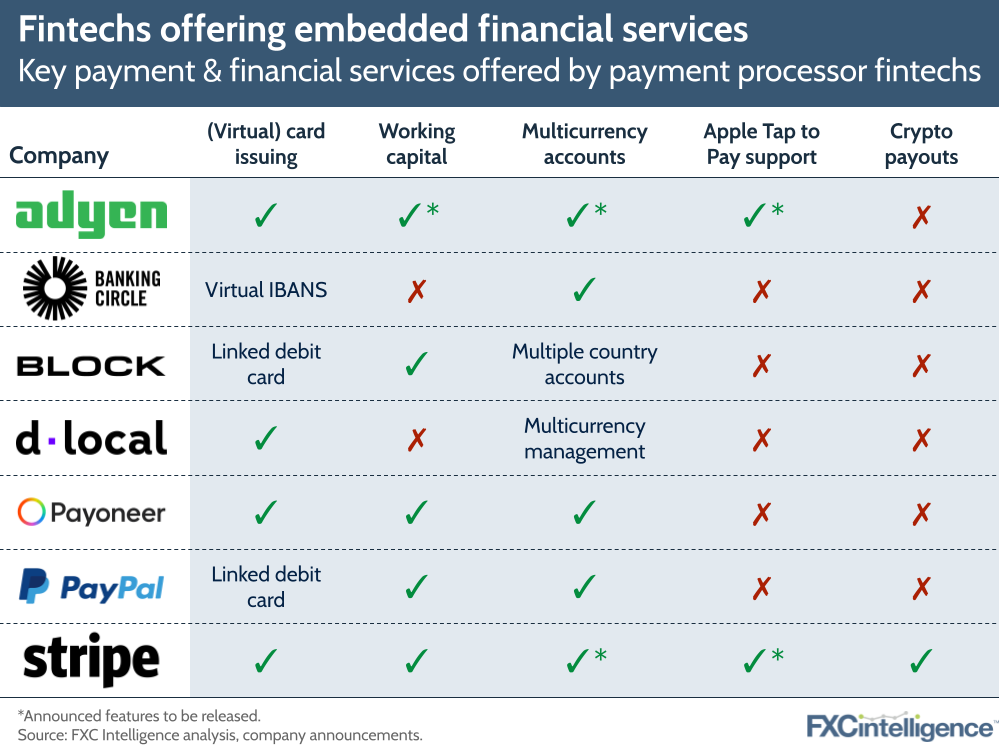

Payment processing competition continues to rise and many of the fintechs in the space are rolling out new products to grow share and drive margins. Adyen announced the expansion of its financial services offering as part of a wider push into marketplaces, while Stripe has added the ability to pay out in cryptocurrencies.

As part of its range of services targeted at marketplace customers, Adyen will now offer issuing capabilities that will enable marketplaces to issue cards to their sellers, as well as multicurrency accounts for merchants to receive payments, initiate payouts and store money in different currencies. The product range, which is enabled by Adyen’s 2021-acquired US banking licence and 2017-acquired European licence, will also include capital and FX services, although details of the latter remain limited. However, the company has said that it expects to see meaningful revenue contributions from both issuing and capital in the long term.

The move puts Adyen in more direct competition with other payment service providers such as Payoneer, which has established a strong base in the marketplace space, including through Amazon’s approved programme. However, Adyen already has Facebook, Uber, H&M, eBay and Microsoft among its customers, giving it strong foundations to challenge in the marketplace arena.

Meanwhile, in February Apple unveiled its new ‘Tap to Pay’ capability that allows US merchants to accept cards, contactless and digital wallet payments on an iPhone instead of a card reader device, using a partner iOS app. Stripe is to be the first payment processor to offer such functionalities this spring, followed by Adyen later this year. This is likely to be a particularly appealing feature for SME customers, an increasingly important space among payment processors.

Stripe is looking to further differentiate itself in payouts with the expansion of its product range to enable payout in cryptocurrencies, initially via Circle-issued stablecoin USDC. The company has partnered with Twitter for a pilot of the service, enabling a select group of creators to use cryptocurrency-based rails to receive their earnings from Twitter.

Given this week’s potential sale of Twitter to Elon Musk, we may see further crypto-led developments in this area, so stay tuned for more.

How are payment service providers competing on cross-border payments?