This past week, OFX reported its results for the first half of the 2020/2021 financial year. We spoke with CEO Skander Malcolm for more insight.

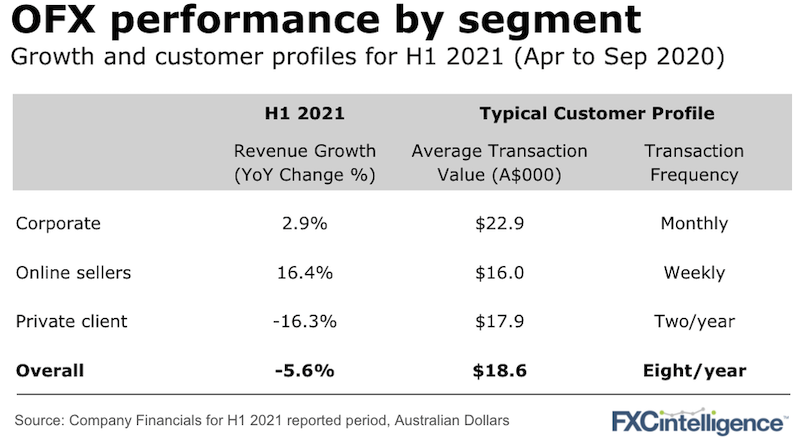

The company reported a 5.6% drop in revenue, while EBITDA was down by 34.5% as a result of the unstable economic environment. This was primarily driven by the decline in the private client business, especially in April to June. However, the segment has already started to pick back up.

OFX is one of few players in the space with a truly broad mix of revenue streams – private client and a range of B2B offerings – across corporate, online sellers and enterprise. Its performance across all these segments provides some useful benchmarks.

- Overall, the average transaction value declined 12% year-on-year as the Covid-19 crisis inhibited spending, especially in calendar Q2. Trading in the Corporate segment shifted towards offshore share purchases and disposals, which normally have a lower transaction value.

- Asia and Europe were the most impacted by the economic instability and revenue declined 30% and 8% respectively. North America continues to be a solid source of growth for the company, with 14.5% growth in calendar Q3. While others have exited the US, expect more from OFX in the market as it continues to find growth.

- Online Sellers’ revenue rose 16% and the segment was up 52% excluding Asia, as OFX moves away from what has become an incredibly low-price environment, cross-subsidising lending products. Corporate revenue from new clients was up 33% year-on-year, another positive sign as corporates tend to expand over time.

- Enterprise also had a second big win of the year with its WiseTech partnership, a global logistics platform, which is expected to generate AUS$5m of annual revenue by 2024. Skander told us not to expect OFX to chase digital bank partnerships but will focus on deals like this instead.

OFX had a difficult start to its financial year (which began in April 2020), but the company has already seen trade recovering across the verticals it serves and performed better than many of its peers, especially in the B2B space. More broadly (and similar to the journey of Moneycorp), OFX will focus on B2B as its growth engine going forward, especially in the US and Europe.