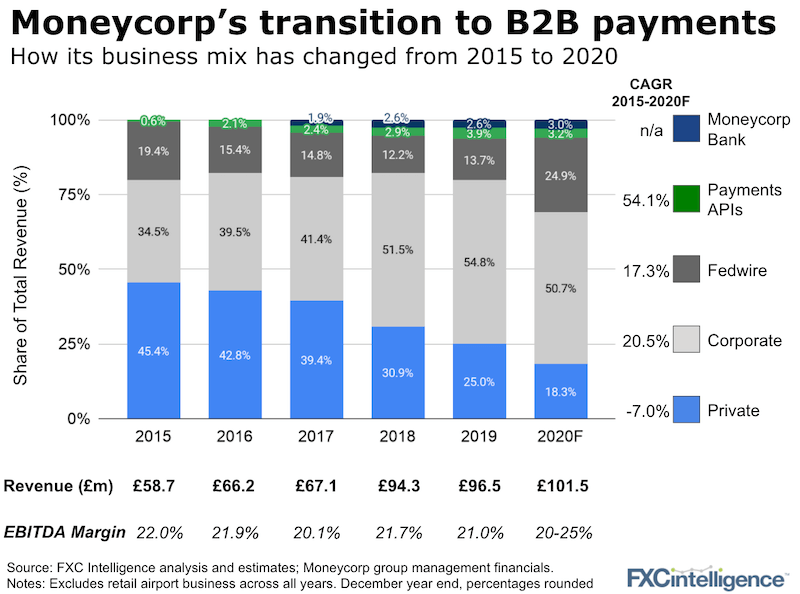

Many of our readers would associate Moneycorp, one of the UK’s most well known international payments brands, with travel money and a private client business. We could see why, especially if you just read the public filings. But you couldn’t be more wrong.

While this may have been the case back in late 2014 when the private equity firm Bridgepoint purchased the company, it is not what Moneycorp is today. Given the group’s private equity ownership structure, the consolidated numbers below have never been shared externally before and there was no requirement to do so.

Note: TTT Moneycorp, the main UK corporate entity, represents only 50% of group revenue – i.e. just half the true picture. We show the whole group below.

We spoke with Moneycorp CEO Mark Horgan to walk us through the transition of the group and its growth path. Our summary:

Sign up to the weekly FXC Intelligence to receive the most newsletter in cross-border payments

- Moneycorp is now a B2B cross-border payments company

As the numbers above show, less than 20% of its business comes from private clients and it will have fully exited the travel money space by the end of this year. The decision to make the strategic change came back in 2016 as it was clear its heavily UK consumer-led business was going to come under severe pressure from Brexit. - The focus now is on international growth, corporate and banking customers

Since 2016, Moneycorp has made acquisitions in Brazil and the US and launched organically in Europe. In addition, within the banking network, Moneycorp provides its Fedwire product, which gives direct access to dollars from the US Federal Reserve. In 2012, Moneycorp was a 100% UK exposed business. By the end of 2020, less than 50% of revenue is likely to come from the UK. - The Fedwire business is the key growth opportunity

Moneycorp’s direct relationship with the Federal Reserve is no small feat. This relationship helps provide a surety of supply of US dollars to a customer base of international banks. Few players have this type of relationship.This market is currently dominated by a large US-based bank and Mark sees an annual revenue opportunity of c.£250m per year of which Moneycorp still has just a small share. Plenty of room for growth and this division has just doubled year-on-year.

In 2021, expect more from Moneycorp from its payments API segment, international divisions and its Fedwire business. We’ll keep you updated.