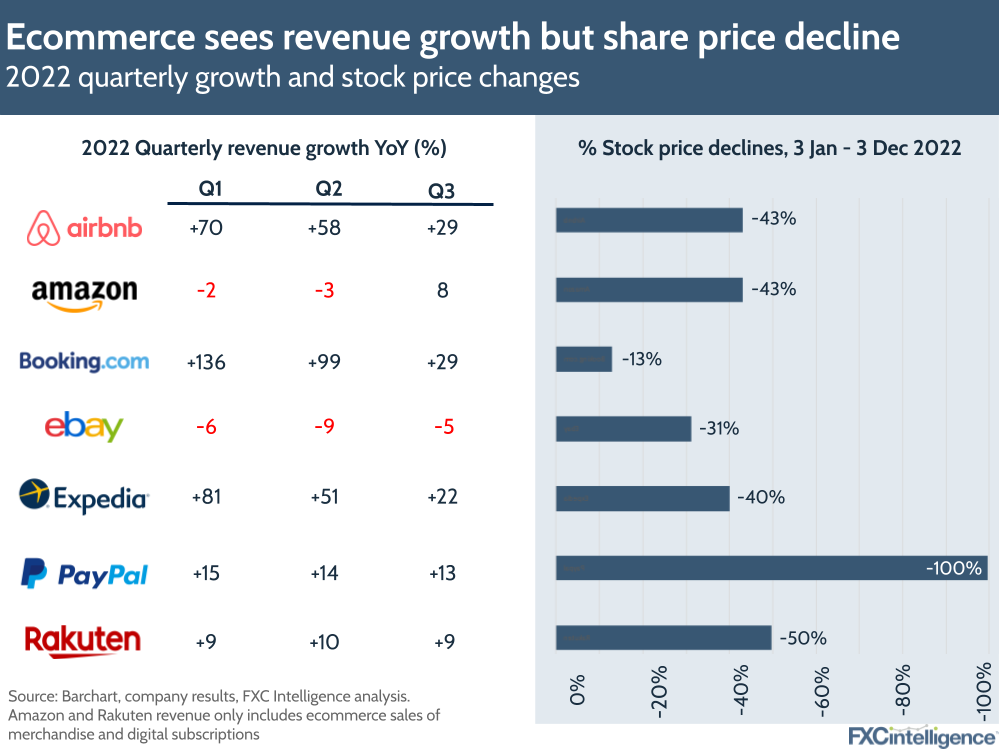

Ecommerce had a mixed year in 2022, marked by an economic downturn and continuing Covid restrictions in some countries. Despite ecommerce players’ best efforts to maintain a post-Covid boom, online sales have been affected as customers bear the brunt of the rising cost of living, while inflation is in some cases making operations more expensive.

Some of the biggest ecommerce players have seen revenue growth in 2022, backed by the ongoing Covid-19 recovery, but growth has declined through the quarters and been much lower than last year. This has been reflected in stock prices, with leading travel ecommerce companies Airbnb, Booking.com and Expedia all seeing a more than 40% decline in their stock price, while payments giant PayPal has seen its share price decrease by 100%.

A number of stories and trends have dominated the headlines in 2022, and these are covered in more detail below.

Buy now, pay later sees new entrants

New buy now, pay later (BNPL) challengers have emerged this year, while incumbent players have faced challenges as a result of the economic downturn. Nevertheless, rising living costs could give BNPL a boost moving forward.

Leading BNPL player Klarna saw its valuation decrease by 85% as a result of challenging market conditions, but the company has still been launching new products and entering new markets this year. Meanwhile, Apple announced Apple Pay Later, a BNPL offering that will be introduced first in the US but is likely to later go global. Given the extent of Apple’s network, its entry to the space could disrupt the sector and make it harder for new entrants to compete.

Over 150 providers worldwide are partnering with merchants to offer BNPL services at checkout. Some of these providers are facilitating cross-border payments, but this can involve a number of challenges, namely regulatory obstacles around risk and different payment methods.

Amazon versus Visa

One of the biggest stories this year was Amazon resolving its dispute with Visa over transaction fees, which had lasting implications for payments on the world’s biggest ecommerce site. Here’s what happened:

- In October 2021, Visa and Mastercard increased cross-border interchange fees on UK purchases from European businesses. Fees for debit cards increased from 0.2% to 1.15% for debit cards, while fees for credit cards increased from 0.3% to 1.5%.

- In November, Amazon told customers that it planned to stop accepting payments made with UK-issued Visa credit cards in January due to the high fees Visa was charging for processing credit card transactions.

- In January, just two days before Amazon threatened to stop accepting Visa card payments, Amazon told customers that it would postpone its ban on Visa credit cards in the UK as the companies were negotiating a solution.

- In February, the companies reached an agreement under which Visa would continue to be accepted at all stores and sites, but a number of changes would be made to fees. For example, Amazon customers previously had to pay a surcharge in Australia and Singapore, but this was removed.

Taking on Visa is a move that only an ecommerce player the size of Amazon could get away with, but the story brought attention to interchange fees, which are crucial to retailers’ bottom line but often poorly communicated or misunderstood (as discussed in this piece).

Crypto cards on the rise despite slump

The crypto market has seen a significant downturn this year, but there have still been some notable stories related to ecommerce. Crypto-backed credit and debit cards have been on the rise, with new contenders from Gemini and Nexo launching this year. Earlier in the year, Visa revealed that customers made $2.5bn in payments using its cryptocurrency-linked cards in Q1 22 (calendar Q4 2021).

Visa is also one of several payments companies to have filed trademark applications related to the metaverse, where cryptocurrencies are expected to be the primary payment method (if the metaverse can overcome numerous challenges, as we cover in this deep dive).

Ecommerce giants are entering the crypto space in different ways, even if not all of them actually accept payments for goods with the currency yet (see our ethereum report). For example, Argentina-based Mercado Libre announced it had created a new cryptocurrency called MercadoCoin, which customers in Brazil can earn as cashback when buying products via its platform.

Major ecommerce festivals display differing results

Major retail sales days – specifically Black Friday/Cyber Monday in the West and Singles Day in the East – are often an indicator of how ecommerce is performing globally. This year was a mixed bag.

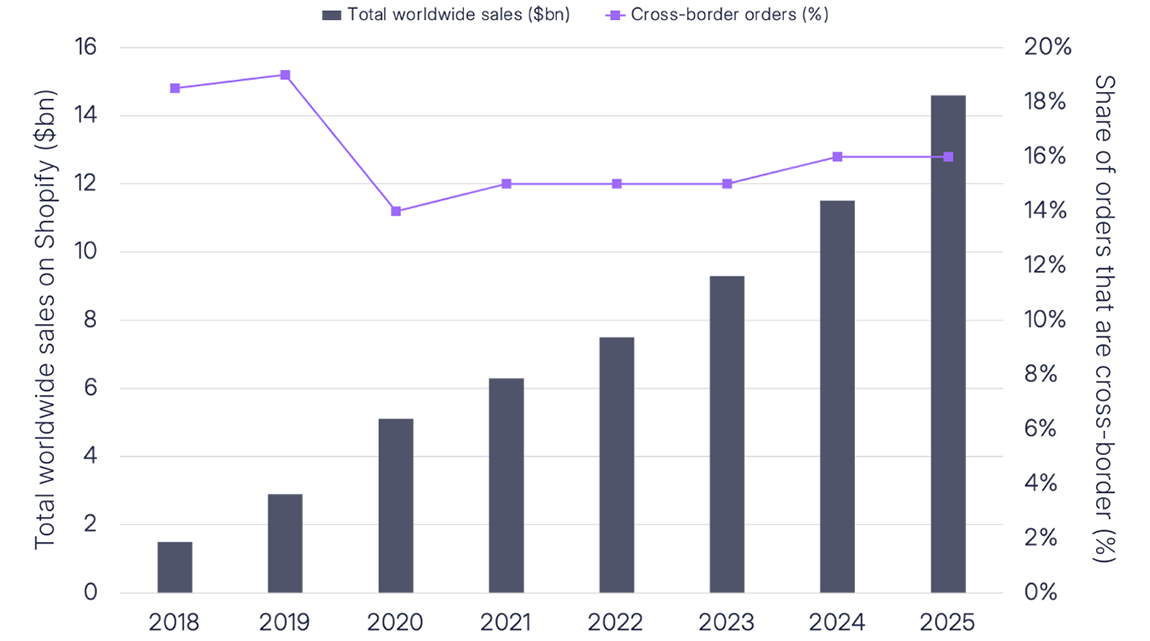

On the one hand, Adobe Analytics reported that record amounts were spent on Black Friday and Cyber Monday, with Shopify data showing that 52 million consumers worldwide used merchants powered by the company (an 18% increase from last year).

On the other hand, across China’s Single’s Day (which takes place on 11 November) ecommerce leader Alibaba saw 0% growth in gross merchandise volume compared to last year. This followed disappointing results from JD.com, another massive ecommerce player, which reported much lower growth during China’s 618 festival in June.

While not representative of every ecommerce provider, these figures reflect the impact that strict lockdowns and the economic downturn are having on China.

How does pricing compare between cross-border ecommerce players worldwide?