The time of competition is over. It is now the time of the partnership.

On Tuesday, Euronet (the owner of Ria and XE) released its first quarter results. Both Ria and Remitly have made plenty of hay of their new partnership that doubles Remitly’s cash-payout network overnight by partnering with Ria. The days of doing it all on your own are over.

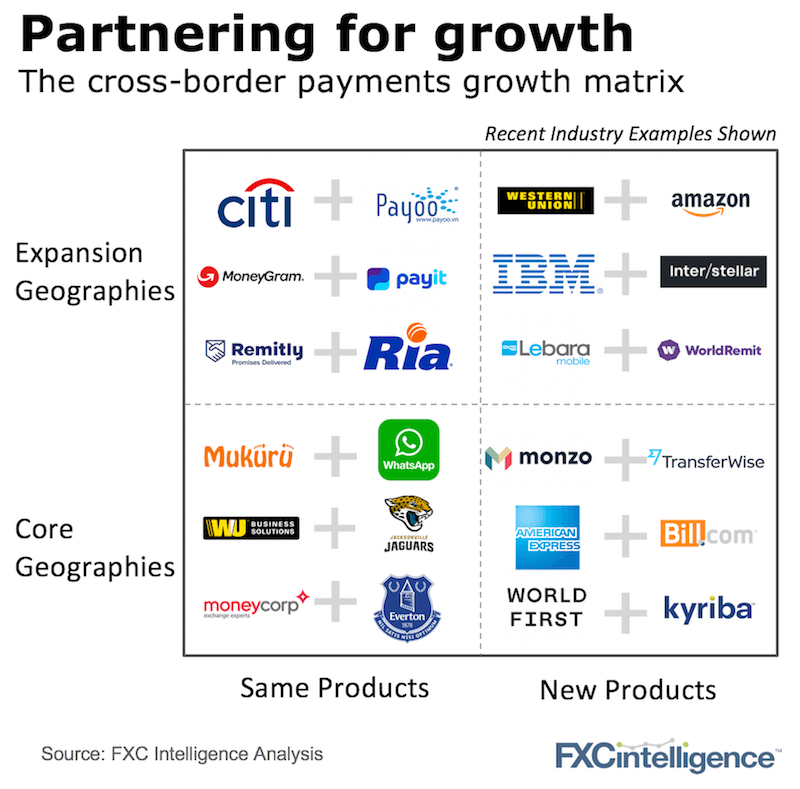

We think about growth driven by partnerships in four ways as our 2-by-2 matrix above shows. Partnerships are either targeting an existing or a new customer base and focus on core or expansion geographies. That grouping covers everything.

Some observations:

- Core market/same product partnerships are very common and are strategies to increase share in existing markets. Sports sponsorships are becoming increasingly popular here to drive increased brand awareness and connections among an existing base.

- Launching new products in core markets helps to broaden the offering to a customer whilst keeping them within your ecosystem. Revenue share deals can be common here (bottom right of the chart).

- Expanding geographic reach, especially to emerging markets can be very time consuming and costly (see the Ria & Remitly example). Partnering gives local market expertise and reduces risk.

- The most challenging box are partnerships that expand reach and products. These are two steps from the core offering as whilst we provided a few examples above, overall they are much rarer than the partnerships in any other box.

We continually track these partnerships that involve cross-border companies. It provides insight into where companies are going and how strategies are changing to achieve it.

Ria (and Euronet) keep chugging along

Euronet announced Q1 results on Tuesday. Their money transfer segment (anchored by Ria) continues to grow at above market rates. Q1 revenue was up 11% and EBITDA 18%.

Euronet listed five partnerships early in its earnings call including plugging into Ripple, and focused on how Euronet is leveraging its existing assets. As their CEO stated regarding the Remitly partnership: “Over half the remittances sent through Remitly are collected in cash at a physical location and our technology enables them to meet their customer demands through our expansive network that is so hard to build and develop.”

Which gives us some clear direction. The bigger companies across the sector, be it Euronet, Western Union or a TransferWise have a clear strategy to sell their infrastructure to others. This partnership approach convinces another potential competitor to cooperate instead.

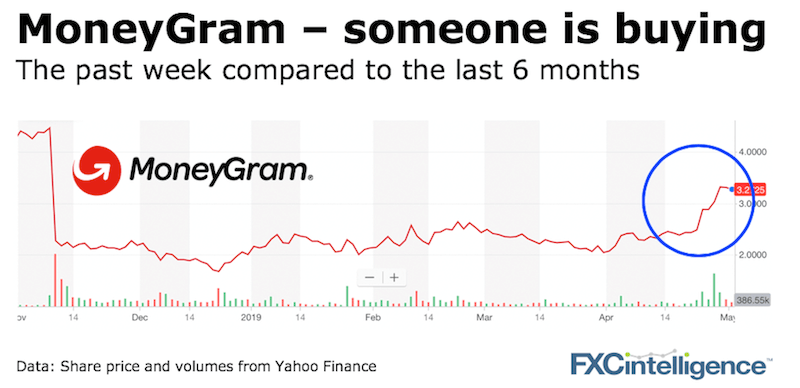

Something is happening at MoneyGram

MoneyGram’s stock price has jumped over 33% the past week, the first major movement since its crash six months ago. There have been no earnings releases and no major announcements. Someone is building a position:

We’ve called an early market movement before (see the Earthport acquisition back in early December 2018). And we all know what happened there.

For a much deeper conversation on MoneyGram, get in touch.

[fxci_space class=”tailor-6332e2eecbe25″][/fxci_space]