$5.3bn is a big tech exit. The ability to connect financial products to customers’ bank accounts at scale and seamlessly is what Plaid has built. The acquisition fits very much along the lines of Visa’s strategy – adding to its capability to provide the pipes and plumbing of payments.

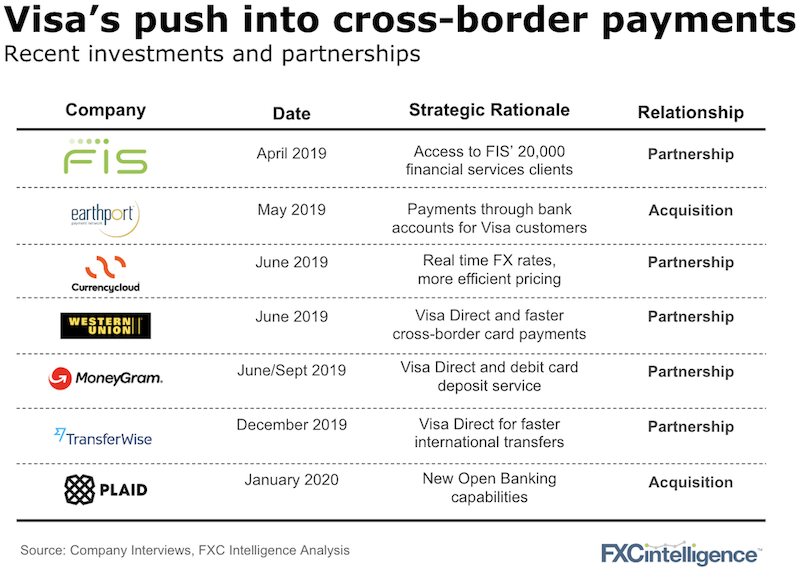

2019 was a remarkable year for Visa, as it considerably expanded its partnerships and acquired Earthport. 2020 doesn’t seem to be different. In fact, Visa invested in the data security company Very Good Security only some days after the deal with Plaid.

What do these deals have in common?

All of them are aimed at adding one of these characteristics to cross-border payments:

Speed

The acquisition of Earthport means that Visa now enables both individuals and businesses to send and receive money through their bank accounts. This makes cross-border transactions faster than if initiated using a credit card.

Transparency

The partnership with Currencycloud allows Visa to set real-time FX rates to process transactions in foreign currency.

New capabilities

The acquisition of Plaid will allow Visa to develop open banking products, which seem to be a big thing in the payments market at the moment.

As Visa said to us at last year’s Money2020 Europe: “We provide the core capabilities, at scale and consistently, and then let clients build on top of us.”

[fxci_space class=”tailor-63342398821cg”][/fxci_space]