In the latest in our post-earnings call series, Wise CFO Matt Briers discusses the company’s strong FY 23 results, as well as its strategy for Wise Platform, with assistance from Product Director Till Wirth.

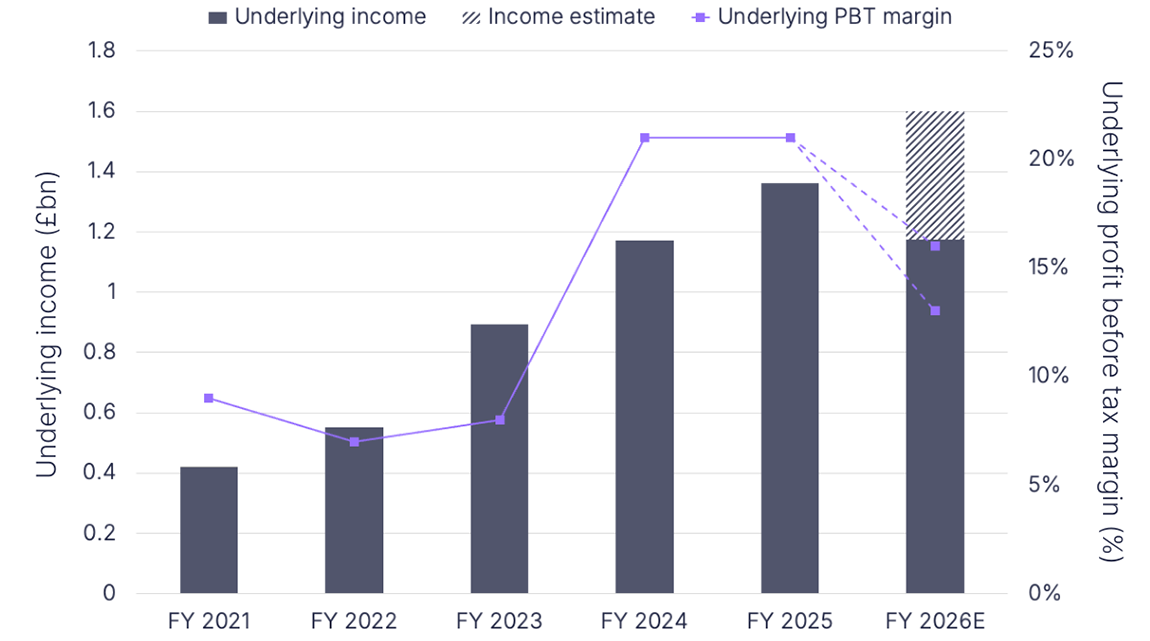

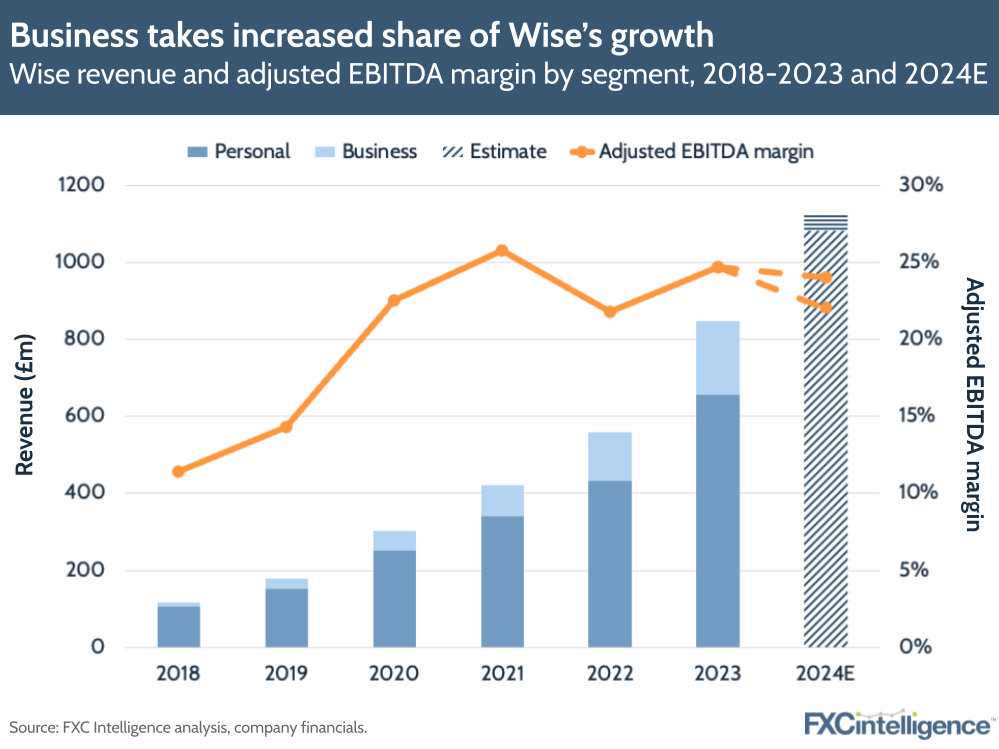

Wise’s FY 23 earnings, which cover calendar Q2 22 to Q1 23, show a company continuing to see significant growth. Revenue climbed 51% YoY to £846.1m, while higher consumer balances and interest rates drove a 73% increase in income.

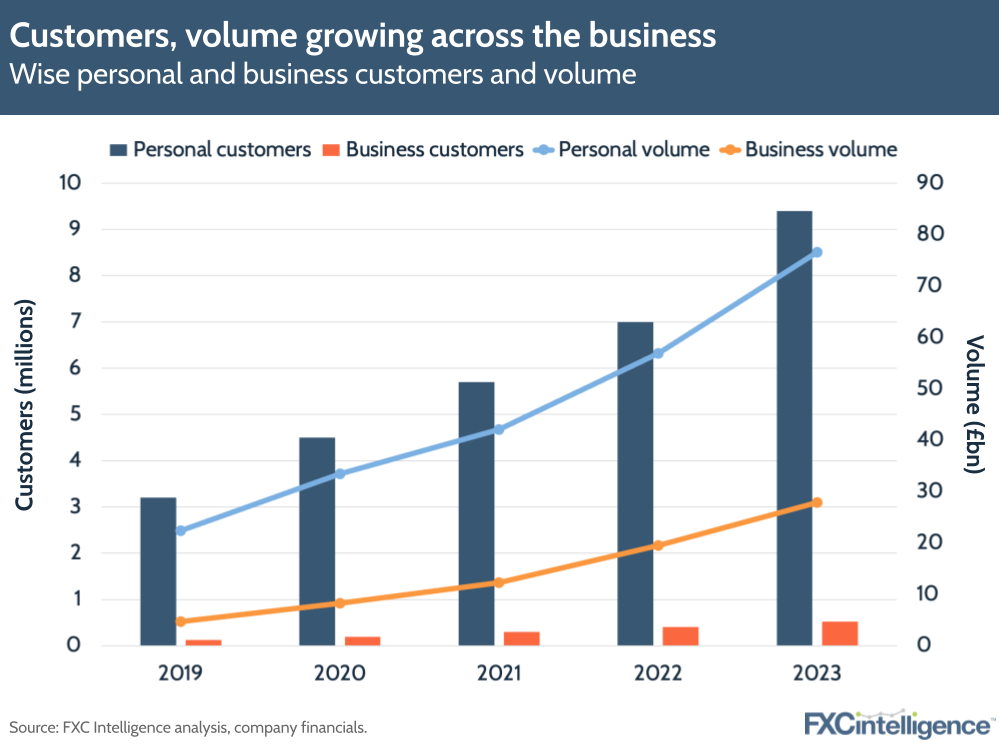

The company also saw active customers increase by 34% to around 10 million. On the cross-border side, cross-border transaction revenue increased 42% to £679.5m, while cross-border volume saw an almost 4x increase.

Significantly, Wise is also broadening how its customers are using the company’s services, with Wise Account now used in some form by 36% of personal users and 55% of businesses.

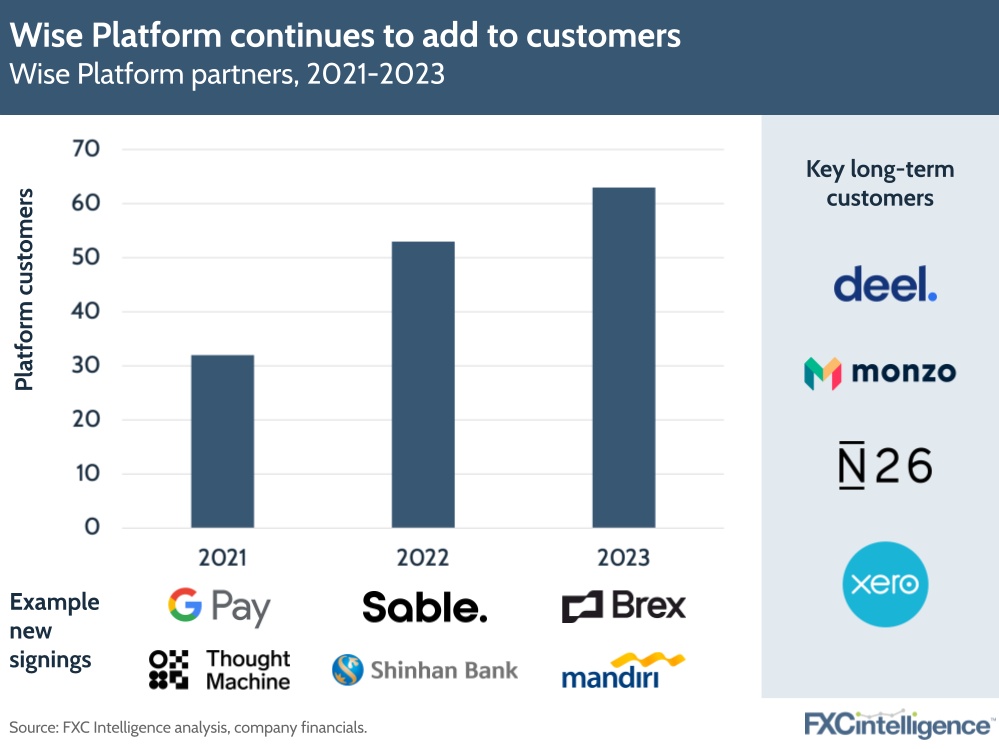

Meanwhile, Wise Platform coverage passed 60 partners for the first time, with 18 added this year, meaning that it now reaches 25 million customers and businesses in addition to Wise’s own direct customers.

Originally founded after Wise saw an influx of business coming from a Hungarian bank that had begun referring customers due to the better cross-border service, Wise Platform now works with partners across 18 countries in six continents. Customers include Google Pay, Xero and Shinhan Bank, with additions in FY 23 including US players Brex and AvidXchange as well as Indonesian bank Bank Mandiri.

FY 23 also saw Wise Platform launch its International Receive feature, which both enables banks not on the SWIFT network to more easily connect to it, as well as enabling SWIFT-connected financial institutions to switch to Wise’s service.

Given the growing presence of the service, we caught up with Wise CFO Matt Briers and Wise Platform Product Director Till Wirth to discuss the company’s results and how Wise Platform is set to form a key part of its future strategy.

Drivers of Wise’s FY 23 and future growth

Daniel Webber:

Let’s start with your FY 23 results, which are some of the best we’ve seen in the cross-border payment space for some time. What’s been driving that?

Matt Briers:

There’s two levels to think about this. I’ll talk about how the mechanics of growth is translating, but at a more abstract level, what is it we do that fundamentally makes us a generational company? Not just a great version of an international money mover, but what differentiates us?

There are a couple of things. One is this ability to make our customers evangelical. Word of mouth growth is something that has really played out over the last 5, 10 years: you can see the number of customers growing. Whenever we speak to the street we tend to talk quarterly, but if you zoom out annually and then maybe over a three to five year period you can see this. That comes about through building products customers love, seeing this incredible word of mouth growth.

Four and a half million customers joined in the last year alone. But we’ve also had this cohort retention such that customers that come along stick around. As you know, this gives you an amazing platform off of which to grow. If customers aren’t falling out the bottom, everyone you add on the top just helps you grow. That’s because we’re doing that with very little marketing.

That’s pretty special; we all believe companies should always do that, that’s what a great product does. But it’s actually quite rare to see that high NPS really translate into that type of growth. And to do that profitably is quite amazing.

The second thing is, and this makes Till’s life a lot easier, we’re doing that by building our own infrastructure and going deep. In the short run, I think you can repackage products that customers love, but in the long run to really build those profitably, sustainably and just keep that progression over time, financial services companies really need to be building the infrastructure as well.

Our mindset there is not just let’s build our own infrastructure, but let’s build this infrastructure that enables these products, over the next 10 years, to continue to delight not just our own customers but that of maybe the largest banks in the world in the future.

If you came to our Wise Connect conference, you’ve seen us talk about how this Wise Account is really the first thing that’s got built on this platform and hopefully in the future more and more institutions will build accounts that their own customers can use on this network for the world’s money.

Those two things really set us apart as to why we’ve been continuing to succeed and make great progress. It also gives us confidence as to why, if we keep sticking to these two things, that’s going to give us success in the future.

When you bring that back into a set of results for this year, you can see this turning up in the financials; you can see active customer growth north of 30%. That’s nearly 10 million customers using us now. They’re moving more money – the volume per customer increased marginally over this time – but really it’s the number of active customers that’s driven up the volume.

We’ve had an exceptional year, but two types of exceptional. One is that growing this fast is quite amazing but we suddenly saw interest rates come through this year, and interest rates are not going to have the same compounding impact every year. We’ve made a one-time shift, and some of that interest might be transient, but we’ve seen income grow 73% year-over-year as a function of the relationship, the account and the balances that we have with our customers now.

Then we have this amazing focus on customers that’s growing. We’ve invested a significant chunk of the cash flows into our products, which is continuously growing, and that’s super lean. Then finally, this Wise Account that we’re building has got this strengthening impact on the business. It’s supporting the growth of the number of customers but also this interest from the Wise Account, we’re actually reinvesting a significant chunk of that back into our products over time, through returning interest or other incentives that actually make the proposition even stronger.

That should mean more and more customers join and stay, but also, structurally, it makes us more profitable as well. There’s lots of things in here that, yes you can just look at the results on face value, which look awesome, but when you actually dig into some of the mechanics you can see a pretty strong business underneath and a strong business model that should give us confidence. We’re just going to get, hopefully, more competitive over time.

Beyond marketing: Wise’s competitive position

Daniel Webber:

In the early stage of your business you spent a lot of marketing to build the brand, and in theory that is going down. What is the best way to think about Wise’s marketing from a metric perspective?

Matt Briers:

I wouldn’t pay too much attention to it. Candidly, it’s a distraction. The rate at which we’re growing without marketing is what’s more interesting.

Only a third of our customers come through marketing. Clearly the fact that only a third of our customers come through marketing, and those customers are incredibly good payback, is a really awesome thing. But the main thing to focus on is the fact that two thirds of the customers don’t require any marketing.

The quality of the product you’re building should decide the rate at which you can grow without marketing.

Daniel Webber:

In the remittance space there is a lot of competition, but Wise has won most of its customers from banks and there are few other companies that also offer an account product. How do you think about competition in the market?

Matt Briers:

There’s definite competition on price, especially for first payments. We’re very transparent about this on our price comparison.

Customers are always going to care about price. They’re always going to care about speed. But increasingly, for international management of their money and moving it, it’s also convenience as well.

These convenience features: offering an account, offering cards and making your money work around the world, it’s really hard to do. This is partly why customers love us: because of the account. They also love us because of speed. More than half the payments are instant now, which is actually really hard to do at a low cost.

But then the account features – being able to receive money as well as send money and being able to hold money and earn an interest on that money and all these things – also really make the addressable market for customers that could theoretically move from their bank to us, because it’s convenient enough, much larger.

So it’s not that we’re not competing on price, but there’s so many features that customers can come to Wise for that when we were just Transferwise they couldn’t join us, which is why we’ve seen huge growth in the number of customers that join us every year.

The development and future of Wise Platform

Daniel Webber:

Wise Platform has really jumped ahead over the past few years, passing 60 partners. What has changed to drive this take-up, and what’s next?

Till Wirth:

Any new product takes a while to be built and get off the ground. Sales cycle and enterprise sales, particularly with large traditional institutions, are long and they take some time to convince them. We had to find out our way, how we explain what we do properly to them so that they see this as an opportunity, rather than a threat or something they just don’t understand.

We had our first successes with obvious targets: Monzo and N26. Monzo and Wise work together, it’s probably a fairly big shared user base, etc.

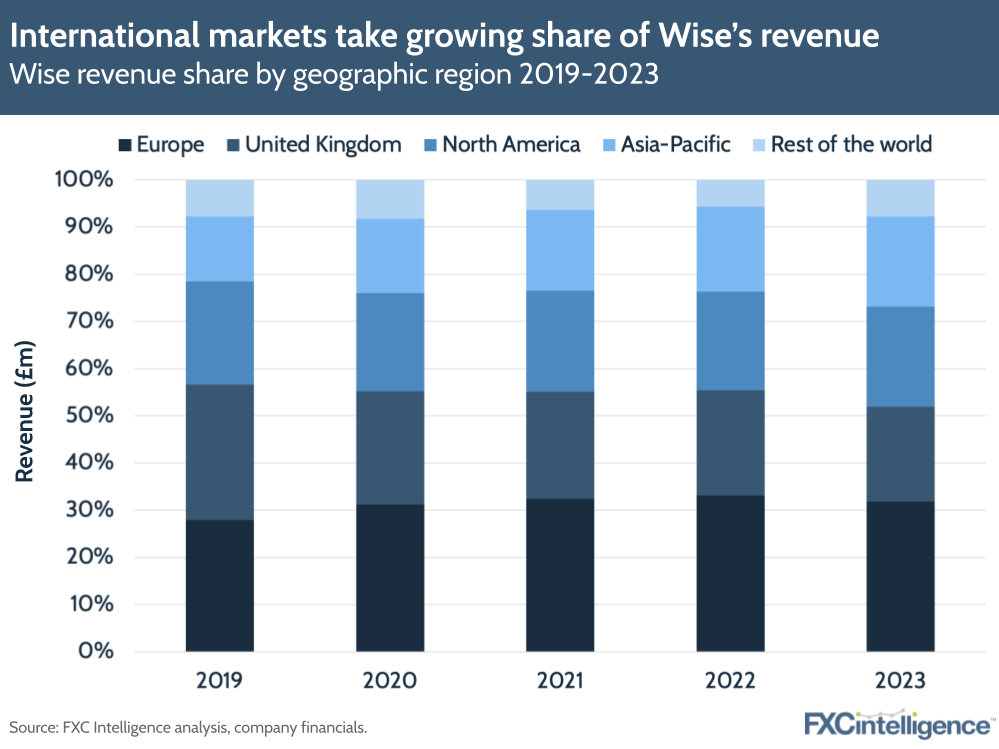

But now the next wave that we see is traditional banks. Mandiri, one of Indonesia’s largest banks, is a traditional bank that has existed for a long time and now suddenly they’re working with us to bring the same things that we offer our customers on the Wise app to their customers. Faster pay, faster international cross-border payments, more convenience and transparency. I think we’ll see that more and more.

That’s one part of where we’re going, the other part where we’ve been really successful is the bill pay fintechs. Companies like Brex, Ramp, Mercury, that really look for a partner that’s nimble, where you can build an integration in a few weeks and go live. Something that they just simply couldn’t build in that time or in 10 times that time.

Wise Platform’s bank proposition

Daniel Webber:

The traditional banks were traditionally much higher priced than where Wise typically is. How do you think that through when you partner with them?

Till Wirth:

First of all, we’re an infrastructure provider. We don’t manage the pricing sheets of banks, but one thing that we really care about is transparency. We think doing Wise Platform is one way to bring a fair price to more customers than we can with just Wise.

We provide the infrastructure, we care a lot about the transparency, but the pricing really is their job to do.

When we started this, Wise was relatively visible, not necessarily because we wanted that for strategic purposes but because that was the easiest way to get started. What we’ve realised particularly with banks is that they really want a pure infrastructure provider: they want 100% white label.

We have gone very quickly into that direction and can facilitate that now. There are some partners who actually quite like the Wise brand in the user journey and that’s also fine. But for the banks, the vast majority prefer a pure infrastructure play with full white label.

Wise Platform’s reach potential

Daniel Webber:

Is there any other colour on Wise Platform that you’d like to provide?

Till Wirth:

Just to share my overall excitement about the opportunity. You’ve talked about the amazing growth we had with the Wise app and Wise.com, but even at this growth it will take a very long time to make cross-border payments faster, more convenient and cheaper for people around the world, and in some cases you will never get people there. There are people who move money across borders once a year. Will they really open a Wise app? Maybe, maybe not.

But actually it’s much more convenient if they can do that one transaction in the bank and the account that they access every day. This is still spot on with the mission and has such great potential to increase that reach.

Matt Briers:

The way to think about Wise Platform and the big picture is in the long run. Could you imagine a world where we don’t need the Wise account? The Wise account could be a reference product for how banks should be building on the Wise Platform; that could be the pure purpose it’s playing. I mean this as a thought experiment. It’s quite an interesting way to think about it.

The reality is that, as good as Till is at selling, we’re probably not going to get quite there in our lifetime. He physically can’t build this fast.

But we might get a way there, where actually the faster this goes, the less the world needs the Wise Account or the slower this goes, the more the world needs the Wise Account.

There’s going to be competitors to the Wise Account built on our platform that are better alternative substitutes for customers rather than competitors. That’s brilliant.

But the answer’s going to be somewhere in between and in different stages, in different markets, into further take-up. In the big picture, this says: we’re actually building for anyone who wants to move money around the world and if their banks are forward-thinking, they’ll use Wise Platform. If they’re not, their customers are going to come and use the Wise Account.

Daniel Webber:

Matt, Till, thank you for your time.

Matt Briers and Till Wirth:

Thank you.

The information provided in this report is for informational purposes only, and does not constitute an offer or solicitation to sell shares or securities. None of the information presented is intended to form the basis for any investment decision, and no specific recommendations are intended. Accordingly, this work and its contents do not constitute investment advice or counsel or solicitation for investment in any security. This report and its contents should not form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. FXC Group Inc. and subsidiaries including FXC Intelligence Ltd expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in this report, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting there from. This report and the data included in this report may not be used for any commercial purpose, used for comparisons by any business in the money transfer or payments space or distributed or sold to any other third parties without the expressed written permission or license granted directly by FXC Intelligence Ltd.