FXC Intelligence’s Daniel Webber spoke to Western Union CFORaj Agrawal about the company’s Q1 2021 earnings results and plans for the future.

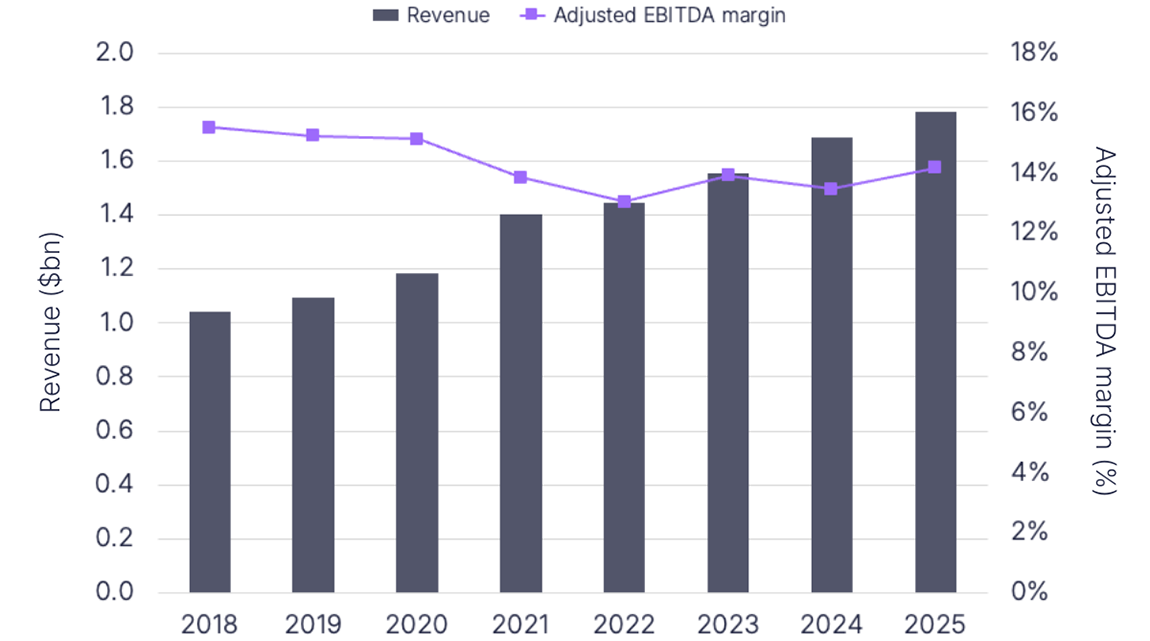

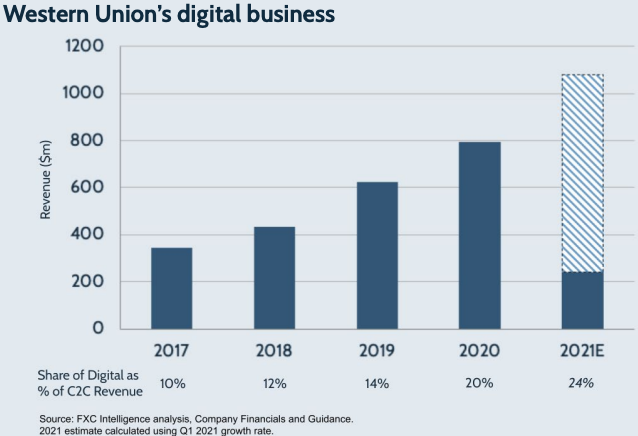

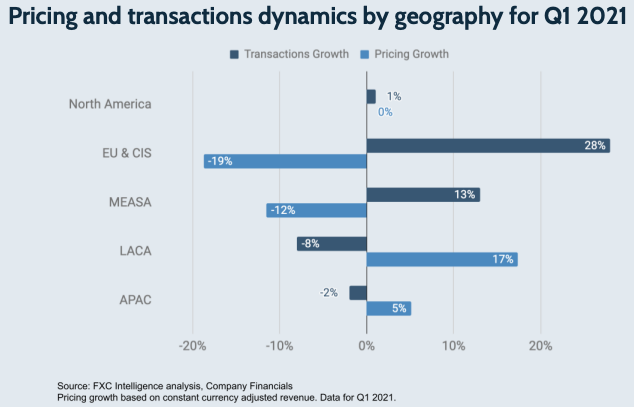

After a stronger-than-expected 2020, Western Union has continued its run into Q1 2021, with digital in particular driving overall growth – cross-border principal grew 28% and revenue grew 2%.

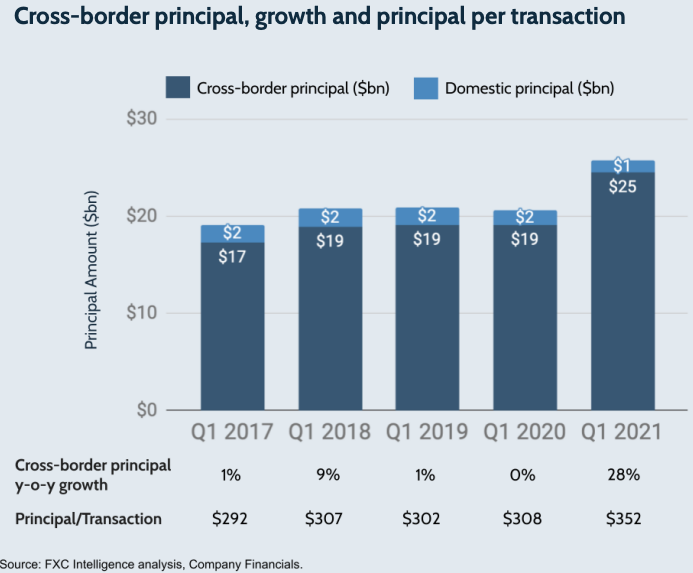

The headline is in digital money transfer revenues, which grew 45%, while WU.com grew for the fourth consecutive quarter.

As the prospect of the world reopening becomes increasingly real, how is the rise of digital changing the market for Western Union, and what can we expect for the rest of the year?

FXC Intelligence CEO Daniel Webber had a detailed discussion with Western Union CFO Raj Agrawal to find out more.

Topics covered:

- Drivers of cross-border principal growth

- The digital customer

- Speed and real-time transfers

- White labels and the WU platform

- New financial services offerings

Drivers of cross-border principal growth

Daniel Webber: Let’s start with the principal, which has jumped again. We talked last call about the underlying drivers of the increase but you must be learning more now as you’ve had a couple of quarters of really sustained principal jump. What do you attribute that to?

Raj Agrawal:

You’re absolutely right. What we’re seeing is that, thus far, consumers are continuing the behaviours that we saw last year, so that’s continuing into this year. Underlying the 28% cross-border principal growth was the fact that our principal per transaction was also up 15%.

It’s across our entire business, whether it’s retail or digital; no matter what channel you look at in our business, our principal per transaction levels are up. That tells us a few different things. It’s similar to what I may have said before, but people who are using our business today and for the last few quarters and the ones who have the ability to send more money around the world. And there’s a significant need to receive money around the world.

I see it in my own personal situation. I am sending higher principal amounts and I’m sending them a little bit more frequently than I was 18 months ago. It’s just because my relatives, they need it more. So there’s a need and there’s more ability to send, that’s part of it.

The second factor is that we’re continuing to get more account-oriented mix in our business. Whenever a transaction goes into an account or comes from an account, we see that the principal amount is materially higher than just being delivered in a retail location.

It’s very logical: when you move money to a retail location, if you need $100 or $200 to take care of some daily expenses, it’s not really about receiving it in an account, you want to get it in your hands, you want to spend the money. And a lot of transactions like that are still done in cash in many parts of the world. As money goes into an account, the principal per transaction, when it gets paid out to that it could be at least double what we normally see. So that’s a factor.

Then, this part I can’t really quantify, but it’s possible that we’re getting some benefit from people not really being able to travel as freely as they used to travel. And who knows when that’s going to normalise. It could be awhile before travel normalises in any way we used to see it before.

Maybe there’s a little bit of benefit from the stimulus here in the US, but that’s more hard to quantify now.

Figure 1

The digital customer

Daniel Webber: You stated that 80% of the digital customers are new customers to Western Union, and the use case you described makes sense of that. That person is a completely different use case to the typical retail customer. I know you often get the question, “isn’t digital just cannibalising the retail base?”, but it’s clear to us that they’re two very different customer types, so this is the wrong question. Could you add more colour on that?

Raj Agrawal:

I’m so happy to hear you repeat that back to me because very few people can articulate that difference just like you did. And it really is. Because when I, in my own case, when I send money to my brother-in-law’s bank account in India, I’m sending him minimum $1000 at a time, or $1,500, or now it’s maybe even more because I know they just have very little source of income in these difficult times in India, and they need more money.

When we used to send in the past, it’s also based on consumer behavior. My wife likes to use our business differently than I use it. I like to get on my mobile phone and just do it, or she might like to go to a retail store and send a couple of hundred dollars for different reasons. So people also like to use it differently, but when money goes into a retail location or is getting paid out at retail, you also don’t want your recipient to maybe walk out with $1000. That’s a lot of money in local currency, there’s a safety issue and most locations are not going to always have so much cash on hand.

The point is different consumers have different needs and they use our business differently. But that’s what we love. We like to provide them all different channels, both sending in omni-channel ways and receiving in omni-channel ways.

Daniel Webber: Are you getting more understanding of what the mix of that new [digital] customer is? I guess you’re doing a lot of work to understand that; there must be 10 million customers on your digital side now.

Raj Agrawal:

Yes. The new customers are coming from other parts of the remittance market, more so than our own business. They’re coming from other digital players, other banks, where they may have used banks before. And they may also be other retail customers of other retail organisations.

During the pandemic, especially, customers were just starving for ways of moving money online, and that really played into our customer acquisition strategy. They were looking for it, and we were ready to catch them in all of our outbound markets. 75 key sending markets, we were ready for them to find us. That’s really what happened last year, and that’s continuing a little bit in the first quarter.

Daniel Webber: In all these businesses the repeat customer is a critical component of the business. You acquire a customer, then you hold onto them. How’s the new vs. repeat mix different on the digital side to the retail side?

Raj Agrawal:

When I create an account, we then make it very simple for a customer to use their mobile device or whatever other means they have to go back into their account to move the money. So the retention levels are much higher in the digital business, in .com, than they are in retail.

Retail still thrives with one-time use cases, in many ways. We want to change that. We’re trying to create more of a relationship with our marketing programs, our My WU program. There are ways that we can try to engage more with the retail customer, but people will always have an emergency need to send money somewhere in cash, or at a retail location, and we want to keep providing that, and that’s just the nature of retail. The retention of the same customer is going to be different because these are people that are maybe transient in nature, they’re walking around, or they have transient needs that just have to be met at that time.

I’ll give you a quick example. When my older daughter was in college, she was just an hour away from us in Boulder, Colorado – we lived in the suburbs here around Denver – and she lost her wallet. So she lost her credit card, debit card, her cash that was in her wallet. She didn’t really have any immediate access to money, which she needed.

So I said, “Hey, I’m the CFO of Western Union, can I send you money?” Because I also didn’t want to make the three hour round trip of driving to her and giving her money. So I said, “Why don’t I send you money instead?”

I sent her, I think, $300. So she was able to go to a nearby location, then get $300 of cash by just giving them the money transfer control number. At a lower principal amount you’re typically only required to give them money transfer control number based on the compliance rules that we have. And so she was really happy and we were satisfied that she had the money; it was on a Sunday.

Now it turns out that she found her wallet behind her desk two days later, but that’s the kind of use case, that gives you an example of why people use our business. There are needs like that all the time.

Figure 2

Speed and real-time transfers

Daniel Webber: Let’s talk about speed, because it has been important and it’s becoming more important. 50% of your global account-to-account payout is in real time, so you have very good speed capabilities. What is bringing speed to the forefront, and what does success mean in terms of speed for Western Union?

Raj Agrawal:

We let the customer determine what we will provide to them: whatever the customer demands is how we will run our business. Customers want speed. Historically, our retail business has been all about speed, trust, reliability, convenience. We’re just taking those same characteristics and putting it into the digital world, because we know that there’s a lot of value in giving somebody immediate certainty that their money has been received. There’s no better certainty than that.

Money is such an important factor in everyone’s life that, if you sent whatever it is, $300, $500, and your recipient has received it in their account… We can do it at retail already, that’s not the question here, but it’s about not having to go through the correspondent banking system, which is what we’re trying to do.

When we say we’re doing real-time payout in more than 100 countries around the world, the way we’re able to do it is not by going through the correspondent banking system. We’re signing local deals with local banks, and maybe we have pre-funded accounts at times, or we have an arrangement in place with a local bank, so that when the customer is sending the money digitally, we can make it immediately available to the recipient and the money will move later. The money can get settled in the bank, and it’s invisible to the consumer. That’s what we’re trying to create with the real-time payment system.

There’s so much value in that. I take a lot of satisfaction knowing that when I’m sending $1000 to my brother-in-law, that he sends me a message within a few minutes, if we’re both still awake, because the time zones are so different. Within a few minutes, if he sends me a message, I feel very satisfied that he’s got the money. I don’t have to worry about it anymore, and I’m done. That certainty is really important from a customer standpoint.

Daniel Webber: The 50% number that you put out, there’s a very well-known fintech who measures speed and they’re not anywhere close to that number for real time. That’s a pretty high proportion that is real-time. What does it look like for the rest of the 50%?

Raj Agrawal:

The other companies, what they’ve been able to do is, if it’s a closed-loop system, they’re sending from a particular user of a digital company to the same company in another country. So if you’re the user of company X, a closed-loop system, and you have customer A in country A, and you have customer B in country B, they can move money immediately to themselves because they’re still holding the money in the wallet, in the closed-loop system.

The beauty of our business is that we’re sending money on a real-time basis. And we’re agnostic to how it gets paid out, where it’s going. We’re trying to create this ability for anyone, let’s say in the US, to send money to India on a real time basis and have it immediately available. And it doesn’t matter which bank you bank with. It doesn’t matter where you want to receive the money, whether it’s a retail or your local bank, we have the ability to get the money there.

And on the sending side, it’s a credit decision we’re making. So if somebody is funding the transaction from wu.com from their account here, we may not give them instance credit right away, because we don’t know who that customer is. We may want to wait a couple of days until it clears the settlement system here in the US, their local ACH system, until we actually give them that money. But when they do the second transaction or the third transaction, and we get to know them as a customer, we can take that two day risk or that risk and give them the instantaneous credit to be able to move money from the US to India on a real time basis. That’s the service I get because Western Union knows me.

White labels and the WU platform

Daniel Webber: Let’s talk about the platform and how you see it evolving, because you’ve got two different parts here. We’ve talked about account-to-account, which you have a very good offering from, but then you also have the ability to go to retail. How are you trying to position the WU platform to best differentiate in the market? Because I hear the word platform more than any other word right now, but I think you have uniquenesses and I’m interested to hear what you think they are.

Note, the day after this discussion, Western Union announced a deal to embed its offering into the Google Pay wallets (alongside fellow provider Wise).

Raj Agrawal:

Completely. It’s a very unique business that we have, and it’s unlike most other companies and businesses in this space. One of the best examples I can give you is, our platform is unique because companies like stc pay or SberBank want to use our platform because we give them access immediately, with sort of a turnkey solution, to them overnight, to the entire world to their consumer base. Their consumers can pay out into accounts or they can pay out at a retail location. That combination, the omni-channel payout, omni-channel funding, is not available with most other providers on a global scale like we provide it.

So it’s the ability to settle in 130 currencies. It’s the ability to settle on a multi-channel basis, digitally and retail-wise. It’s the compliance and regulatory capabilities that allow us to do what we do on a global scale. And it’s our ability to go to partners and offer our capabilities in both a branded and non-branded way. So that’s really the combination.

In the last year, I would say the last 18 months, as we’ve rolled out more of our platform on a white-label basis, it has really opened our eyes that there’s much more of a market that we can go after. 50% of the remittance market is managed by the banks. So most customers that have an account may want to go to their bank to move money around the world. It’s just a natural thought you get. We would like to be the white-label provider to the banking space. We’re not trying to replace the banks in any way for this service. We want to enable them.

SberBank is in Russia. SberBank, before we provided our service, was using the correspondent banking system like most of the banks in the world use. But we gave them now an ability to move money immediately into your accounts to many different parts of the world using our platform. And it’s a win-win situation for them because the customers like it, it’s a great customer acquisition and retention tool for them. And we win because we get paid a fee by Sber to move this money around for them.

It’s unique in nature. Very few other companies can go do this on a global scale. And the reason why we believe that we can be very successful with the banks is, we already do this for the banks at a retail level.

Two thirds of our network outside the United States are banks and post banks and financial institutions – in retail. So people are able to walk into a retail banking institution all over the world or into a post office and move money around using the Western Union system, it’s a retail sort of product. What we’re saying is, “Let us digitise that for you and provide that additional digital service to your customers.” So we don’t think it’s a big stretch for us to go do this.

Daniel Webber: You already have the relationship with the bank and can add the outbound piece on to what is already an inbound relationship, essentially.

Raj Agrawal:

Or it’s just an outbound relationship, but retail in nature only. And there are many banks that we don’t provide services to. They’re not necessarily all overlapping with each other. I’m just saying that because we do it already for banks and post banks, we can do it for them in a different way as well.

Daniel Webber: For direct money transfer companies, you are not looking to offer your platform out to those guys, right? You’d rather have it used by groups that are more complimentary to what you’re doing, because obviously there are other players in the market who do offer their platforms out to direct competitors.

Raj Agrawal:

Look, we would consider, and we have evaluated other, if you will, competitors that want access to our rails. But we have not done anything major there because it has to be a win-win situation for us. We’re not about to give out our great platform and our great payout capabilities for free to another provider, because we’re not in business to enable others that want to compete with us. Now, if we make money at it and it’s a differentiated service offering, and we can provide value we’ll certainly do it.

But many other players, many of our direct competitors, are providing these services to them. And it’s sort of giving away the capital that you’ve built over many, many years.

Figure 3

New financial services offerings

Daniel Webber: How are you thinking about the new financial services? Are you thinking about them on a standalone basis, or if they add more stickiness to the underlying customer on the money transfer side? Do they need to be incremental in revenue and contribution themselves?

Raj Agrawal:

First of all, it’s very early stages. We’ll be launching a pilot in the third quarter. And our goal is to have data on how customers like it by the end of the year.

We’re going after the core migrant customer who we know likes Western Union. We have almost nine million consumers on the wu.com business, that’s the customer segment we’re going after.

It might attract incremental customers, but it’s certainly going to allow us to think about going outside of the money transfer space. So this creates a new tab for the business to go after, beyond their cross-border remittance space. It could be loan. And maybe it’s loans, I don’t know, we’ll see what happens. But it certainly could be an account relationship, a bank account relationship, maybe we’ll offer a credit card or debit card.

We want to have the sender and receiver have accounts. So in my case, this pilot is in Europe, but eventually could we offer an account to both the sender and the receiver where they can start to engage with each other? Creating this consumer ecosystem where maybe I can send money on a regular basis to my recipient without having to always push a button to transact, make it more automated in nature. Or maybe my recipient can even receive the money whenever they want. Maybe I give them access to go draw down $500 from my account on a regular basis.

This consumer ecosystem is what we’re going to start to launch with financial service offerings, but it could also include a marketplace where we allow consumers to shop for other kinds of services. We’re not going to create that part of it on our own, but we can partner with other providers or many providers that have marketplace offerings, where consumers can go shop and maybe use their Western Union points in other ways.

We think it’s a great opportunity for us, but we don’t have the data to show you yet for that. And that’ll come by the end of this year. And we think it’s a possible next evolution of growth for westernunion.com.

Daniel Webber: I think it’s a no-brainer in my personal opinion: there’s a lot of capability and customers. Obviously lending is the most complex, and maybe you need a bit of time for a relationship with the customer, but if you hold their account, then after a while you can see what they do. And if you can become a deposit taker, because you are a bank, most cases studies of neobanks show it’s very hard to make money as a bank if you don’t lend, because you’re missing the major reason to pay deposits and interest in the first place.

Raj Agrawal:

What it’s going to do, Daniel, is that it’s going to create higher stickiness, higher retention levels. That’s what the goal ultimately is: to create a higher retention level of our customer base.

Give me a call by December 31st of this year and I’ll tell you how it’s going.

Daniel Webber: Raj, this has been great. Thank you for the time.

Raj Agrawal:

Thank you.

The information provided in this report is for informational purposes only, and does not constitute an offer or solicitation to sell shares or securities. None of the information presented is intended to form the basis for any investment decision, and no specific recommendations are intended. Accordingly, this work and its contents do not constitute investment advice or counsel or solicitation for investment in any security. This report and its contents should not form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. FXC Group Inc. and subsidiaries including FXC Intelligence Ltd expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in this report, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting there from. This report and the data included in this report may not be used for any commercial purpose, used for comparisons by any business in the money transfer or payments space or distributed or sold to any other third parties without the expressed written permission or license granted directly by FXC Intelligence Ltd.