Elon Musk’s acquisition of Twitter is creating a fresh need to find a path to greater and more consistent profitability for the social media network, and payments represent a vital piece of the puzzle.

Less than a week ago, Elon Musk took ownership of Twitter, after a fraught process that saw the Tesla and SpaceX CEO pay $44bn to purchase the social media platform and take it private.

Since then, Musk has already taken his first steps to overhaul the company’s finances, most notably with the announcement of plans to charge verified users for the privilege of keeping their blue tick status, although by how much seems subject to change. While the amount proposed was initially $20 a month, this was met with largely negative reactions and Musk has since indicated that he is revising this to $8, with some other markets charging less.

The move is an attempt to broaden Twitter’s revenue, which is currently highly reliant on advertising – much of which is currently uncertain after a number of agencies advised advertisers to pause further spending on the platform until Musk’s plans became clearer.

However, it is likely that this is not Musk’s endgame for the platform. While this overhaul of the company’s subscription offering is an attention-grabbing first step, in the long run the company is likely to be far more focused on payments. Not only has Musk, who was key to the early development of PayPal, indicated he plans to prioritise payments on Twitter, including in an investor deck that targeted $1.3bn revenue from payments by 2028, but he maintains close links with the company’s founder and former CEO Jack Dorsey, now CEO of Square parent Block.

But what is the potential of payments for Twitter, and what could Musk’s payments plans on the platform look like? This report explores how the social media platform’s revenues could be transformed by a multifaceted payments strategy – and where Musk may choose to focus his attention.

Twitter’s financials: Why the company needs to diversify

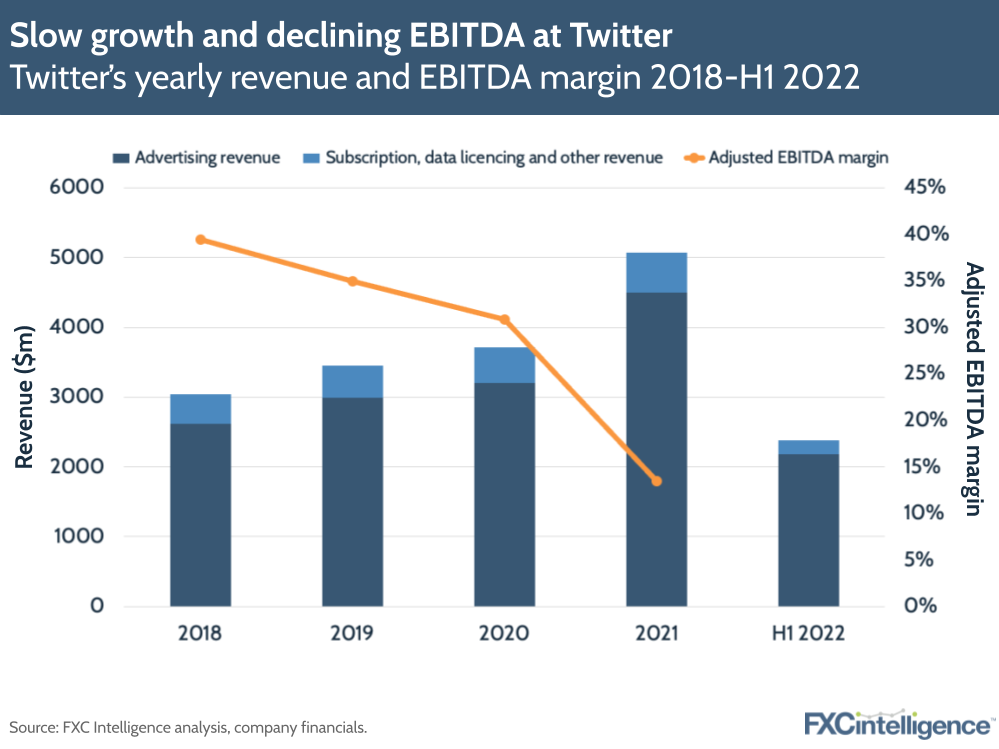

While Twitter has strong brand recognition, the company has arguably underperformed in terms of its financial performance over the past few years, creating key areas for the incoming owner to tackle.

The company is currently highly reliant on advertising

Many social media platforms have sought to diversify their revenue streams, however Twitter has consistently remained focused on advertising for much of the past few years.

2021 saw the largest percentage of non-advertising revenue, albeit at just 8%, and the company also saw its strongest overall revenue growth in several years, at 37%.

2021’s rise is largely the result of the initial launch of subscription service Twitter Blue, which has since been rolled out to a number of markets, namely the US, Canada, Australia and New Zealand.

Processed by Stripe, subscription payments have been a small but growing source of revenue for Twitter. However, the Twitter Blue service has been met with criticism, largely focused on the limited range of features, which mostly focus on custom user interface solutions and content curation.

Looking forward, a Musk-owned Twitter is likely to look to diversify revenue far further as a primary way to increase growth.

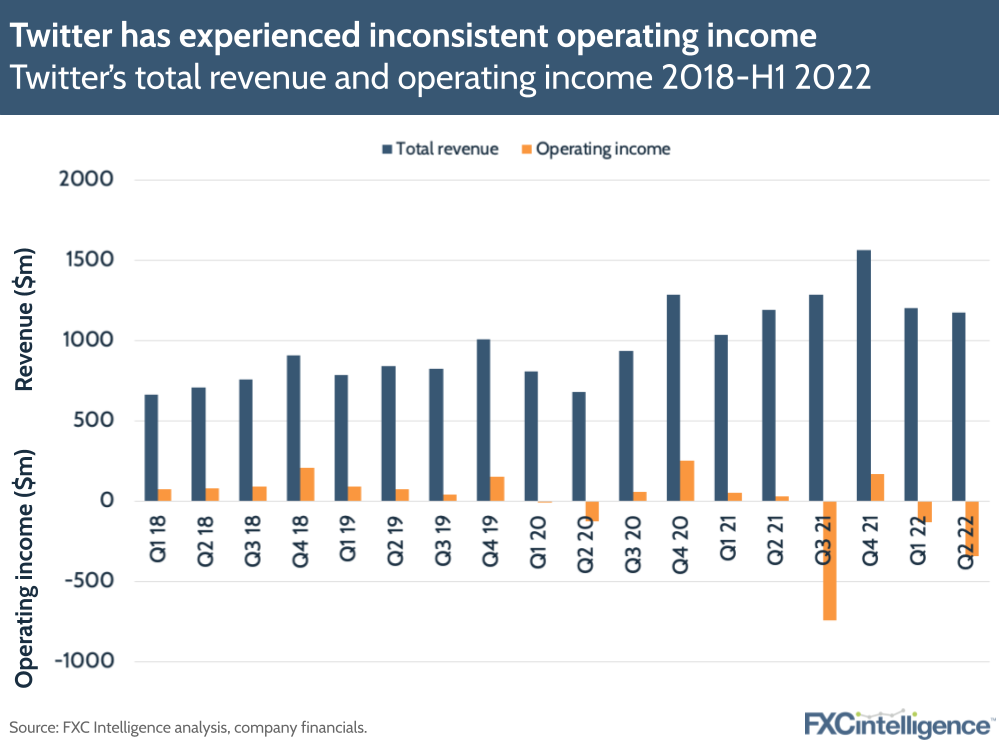

Twitter does not consistently make a profit

Twitter’s financials are not in as good shape as many similarly mature tech companies, with the company making an operating loss in five quarters since the start of 2020. Until recently this was manageable for Twitter, although at times was a source of contention for investors, but Musk’s acquisition of the company has complicated things.

Prior to the purchase, Twitter had debt in the region of $5.5bn, however Musk took on a further $13bn debt to complete the acquisition. This means that Twitter, which paid around $60m in interest payments over the last year, is expected to see such payments rise to $600m per year.

This will create a need to increase revenue relatively urgently, as Musk looks to keep the company in a sustainable financial position.

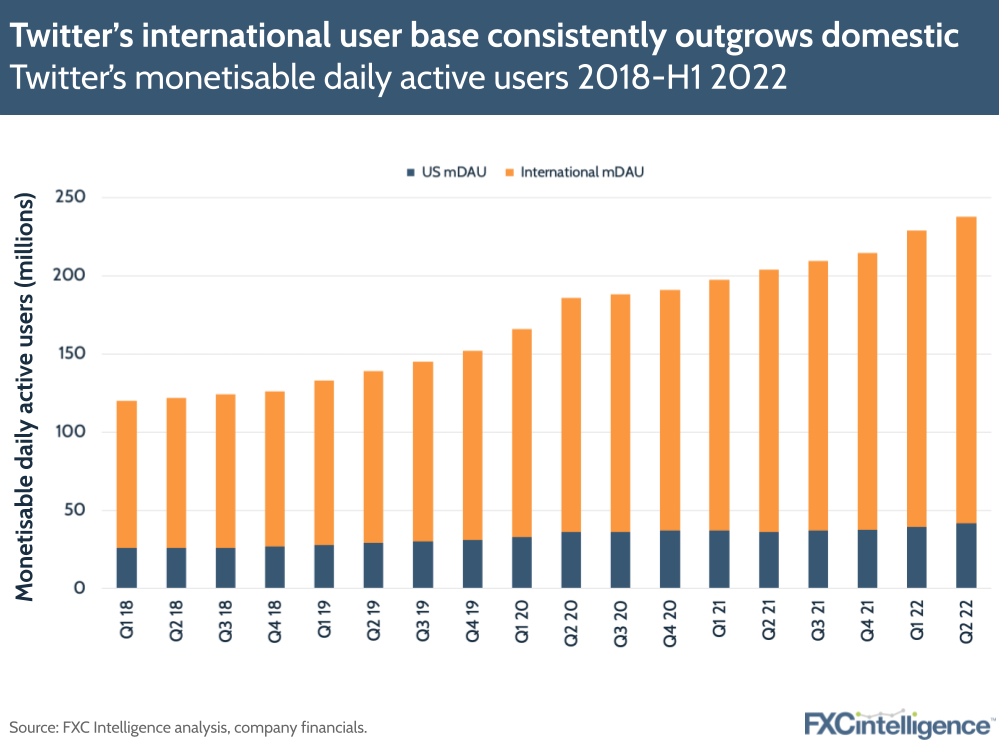

Twitter is under-utilising its international customer base

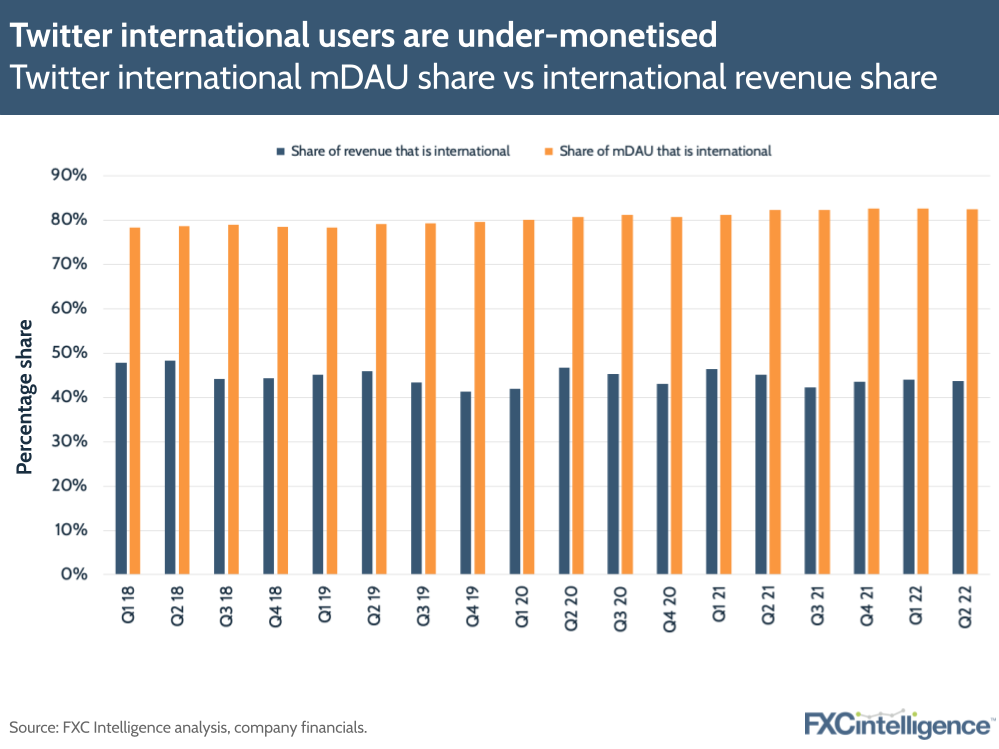

While diversified revenue streams are key, there is also a need for Twitter to better monetise its non-US userbase. The company’s monetisable daily active users (mDAU), the metric Twitter uses to measure users it can gain revenue from, have been relatively sluggish to grow, however its non-US userbase is rising at a faster rate than its US counterpart, and now accounts for 83% of all mDAU.

This is particularly key, because Twitter has consistently made a much smaller percentage of its revenue internationally than from the US, compared to the percentage of mDAU that is international. The percentage of international revenue even dropped in 2021 compared to 2020, while international mDAU rose.

In other words, Twitter is consistently making much less per international user than per US user, creating the potential for this to be a key source of future revenue growth.

Payments and Twitter: A vital potential revenue stream

With a less-than-ideal financial situation, Twitter under Musk needs to find new sources of revenue quickly – with a strong international focus – and payments provides a strong potential option.

The current payments landscape on Twitter

While for the most part Twitter does not handle payments itself, this does not mean that payments are not a vital part of the social media platform. Payments are extremely commonplace, with many users sharing links to payments either within tweets or on their profile, yet Twitter has no involvement in these and so takes no share of the processing fee.

Users make use of payments for a wide variety of purposes on Twitter, but some of the most commonplace purposes are as follows:

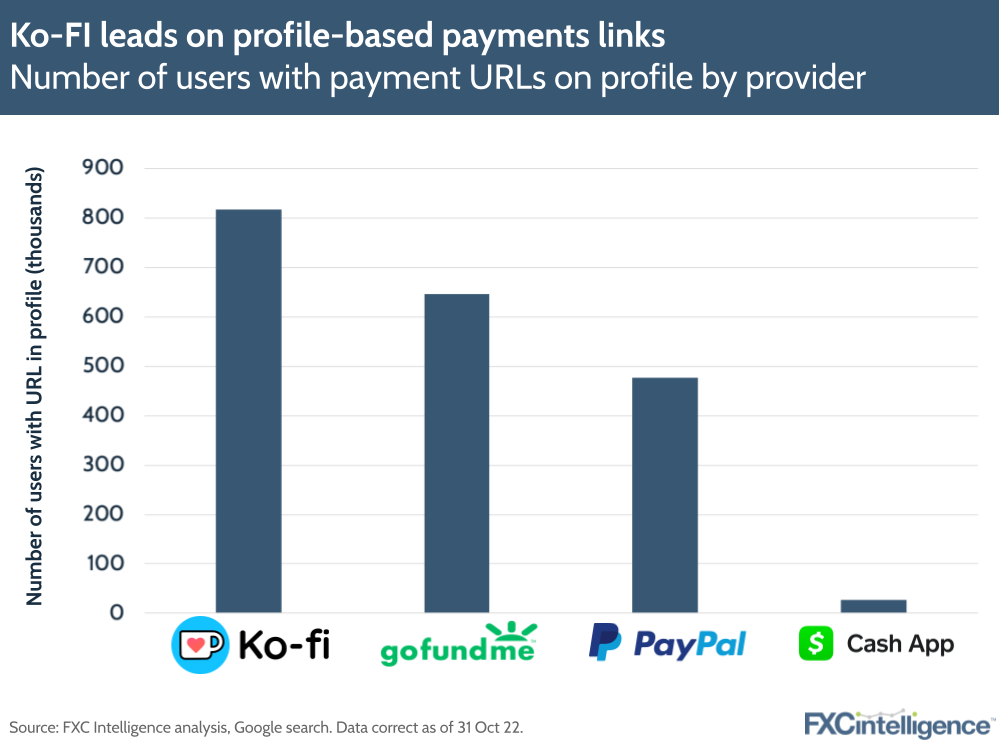

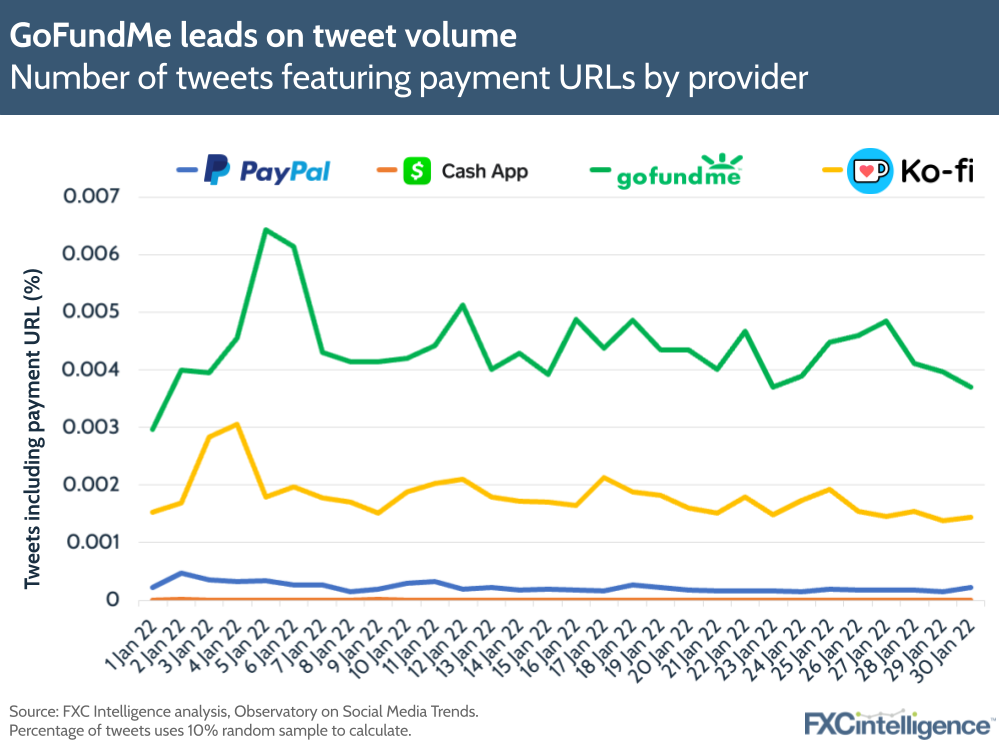

- Charitable donations. Largely P2P payments, these often see Twitter users ask for donations to meet personal needs, such as healthcare, housing or bills. GoFundMe is the most popular platform for this purpose

- Tips to creators and influencers. These are one-off P2P payments, typically of low values, that are often paid in response to well-received content. Ko-fi is the most common provider of this type of service, although PayPal and Block-owned Cash App also have a presence.

- Payments for goods or services to individuals or small businesses. Largely focused on the creative industries, this sees individuals purchase items, many of which are delivered digitally, from other Twitter users. PayPal and CashApp are popular for this purpose.

- Subscriptions to individual creators. These see users opt to make regular payments to a particular creator in exchange for access to content or other services. Ko-fi and Patreon are the most popular for this service.

Many of the most common providers in this space have a strong international presence, and make a consistent source of funds from users they capture via Twitter. GoFundMe, for example, takes a transaction fee from each donation and supports the receipt of payments in 19 countries. Funds are collected in the recipient’s currency, and it allows donations from far more countries.

Ko-fi, meanwhile, does not take a cut of its core tipping feature, giving donors the option of paying an additional fee to cover its costs, but does take a transaction fee for its other services. It allows creators to take payments in most currencies, although it has eight core currencies that it supports without conversion fees, and allows recipients to withdraw their money to PayPal or Stripe. While Ko-fi does not publish its volumes for Twitter specifically, it saw overall volumes of $6m in October 2022, with Twitter believed to be its primary source of payments.

PayPal offers some similar services to Ko-fi but takes a cut of transactions and is less popular for small-scale payments of the type that are currently commonplace on Twitter.

Mobile wallet and P2P payment platform Cash App, meanwhile, is limited to both send and receive users in the US and UK, and so has far lower volumes on Twitter than other key players.

Potential of remittances for Twitter

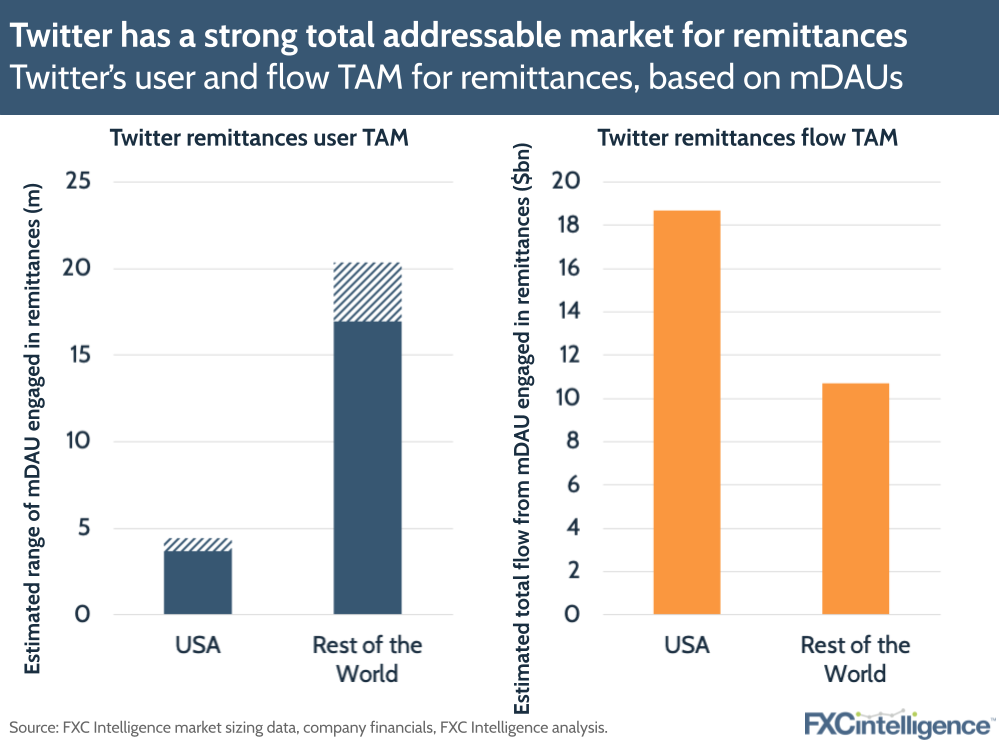

While small-scale P2P payments are already widespread on Twitter, there is also the potential for the platform to begin offering remittances and cross-border money transfers – something that it has a large potential total addressable market (TAM) for among its existing mDAUs.

With remittances increasingly becoming digitised, there is growing support for such services to be offered within digital environments, including via familiar brands. If Twitter were to partner with a white label remittance provider, it could integrate remittances into its platform with relative ease and in doing so offer a service that its existing users are already engaging with in large numbers.

In the US alone, Twitter users sent an estimated $19bn in remittances in 2021, while international users sent around $11bn, making this a market with a very strong TAM for the platform.

Twitter’s ecommerce potential

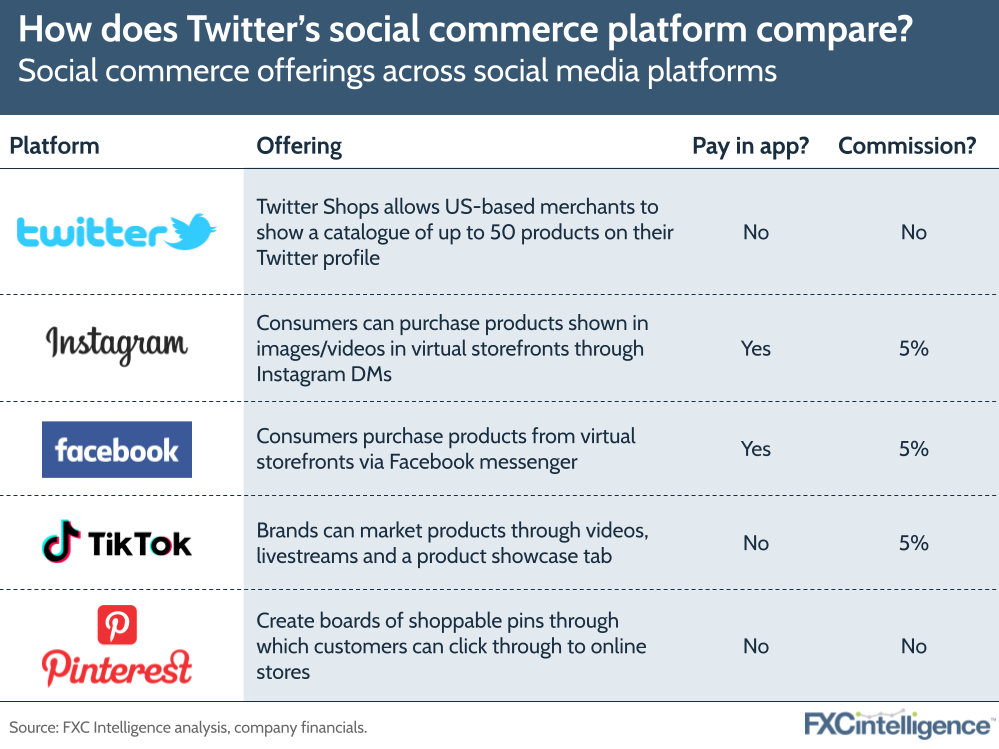

Brands have already recognised the potential of major social media platforms such as Facebook, Instagram and TikTok for selling their products. Social commerce – enabling brands to market and sell their products directly via the platform – has therefore been a major point of discussion as brands aim to target customers with relevant, authentic ads that target them where they are spending large amounts of their time and often enable them to complete purchases without leaving the ecosystem.

Twitter has been relatively slow on the social commerce uptake, but this has begun to change. First piloted in 2021, the company launched Twitter Shops for US merchants earlier this year, through which merchants are able to market up to 50 products via their Twitter profile page.

Clicking on products allows users to find out more information via a product page and then checkout via the company’s website – meaning Twitter misses out on the ability to take a fee for handling the payment itself. Prior to this, Twitter had also launched Shopping Module (now known as Shop Spotlight), which allows businesses to showcase five products directly on their profiles, as well as Live Shopping, which allows users to make purchases while watching a livestream. However, these have all remained confined to the US, and are currently a minimal part of the Twitter experience for users.

Expanding the Twitter Shops service internationally would help Twitter to reach more merchants worldwide, and could even be integrated with other payments areas the company may wish to pursue (in particular, P2P payments). However, it will be interesting to see how the commerce offering performs next to more visual-focused apps such as Instagram and TikTok.

Instagram and Facebook, for example, both allow businesses to set up their own customisable storefronts, where they can upload or create product catalogues; view products with different sizes and specifications; and see detailed prices, descriptions and information. On Instagram, customers can move directly from videos and images of a product to a page where they can browse and buy, without ever leaving the platform.

TikTok Shop has a similar feature, allowing merchants to market wares through in-feed videos, livestreams and product catalogues. As videos appear directly in users’ ‘For You’ feeds, content appears in front of them seamlessly and is always relevant to them. This blurring of the lines between regular content and advertising has made it much more attractive for brands.

Potential of crypto as a revenue stream

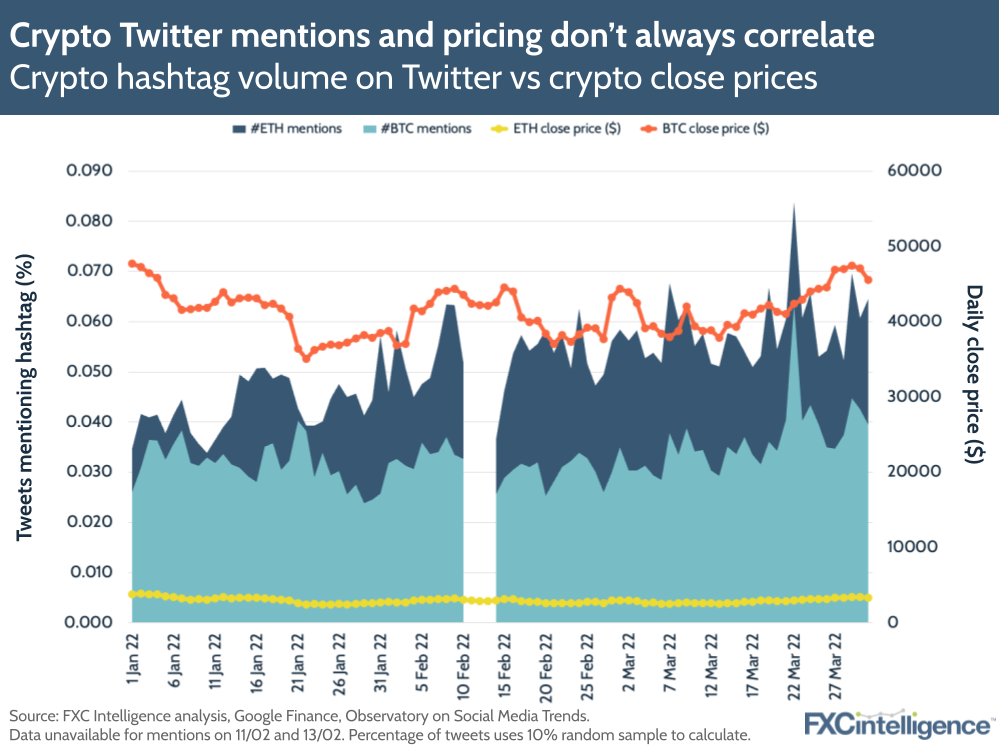

Beyond ecommerce, Twitter’s payments potential also doesn’t end at fiat currency. Crypto has long been a vital presence on the platform – for better and for worse. Twitter has been used to spread awareness of rising cryptocurrencies (including Musk’s beloved Dogecoin), share education about the technology and connect key players in the space. It has also been a significant source of misinformation, and has unwittingly hosted a wide variety of scams on crypto, including some involving Elon Musk himself.

While there isn’t always a direct correlation between tweet traffic levels and the price of major cryptocurrencies, we do see some related movement and here there is potential to more closely integrate crypto into a space that is already deeply connected to it.

Musk is a longtime advocate of crypto, as is founder Jack Dorsey, and it is likely that he will want to explore the potential of digital currencies on Twitter. This is echoed by the fact that the CEO brought in a number of crypto heavyweights to support the acquisition, including Binance CEO Changpeng Zhao, who was one of the equity investors.

However, the exact form remains to be seen. Musk may simply look to add a white-labelled crypto trading service to the platform in a manner similar to Revolut, or he may be looking for something more unified.

A digital currency that is native to the app may be a way to add support for P2P payments, social commerce, remittances and beyond without needing to handle multiple currencies and their respective FX fees, and so may well be an area Musk explores.

But such an approach is not without significant challenges. Any such project is likely to be met with intense regulatory pushback, which was a key reason for Facebook parent Meta abandoning its own plans to develop a platform-native digital currency, known as Libra and later Diem.

Elon Musk’s potential to add payments to Twitter

Despite now being better known for SpaceX and Tesla, Musk built his career on payments as co-founder of online bank X.com, a company that merged with Confinity in 2000 to become PayPal. As a result, it is no surprise that he sees payments as key to Twitter’s future.

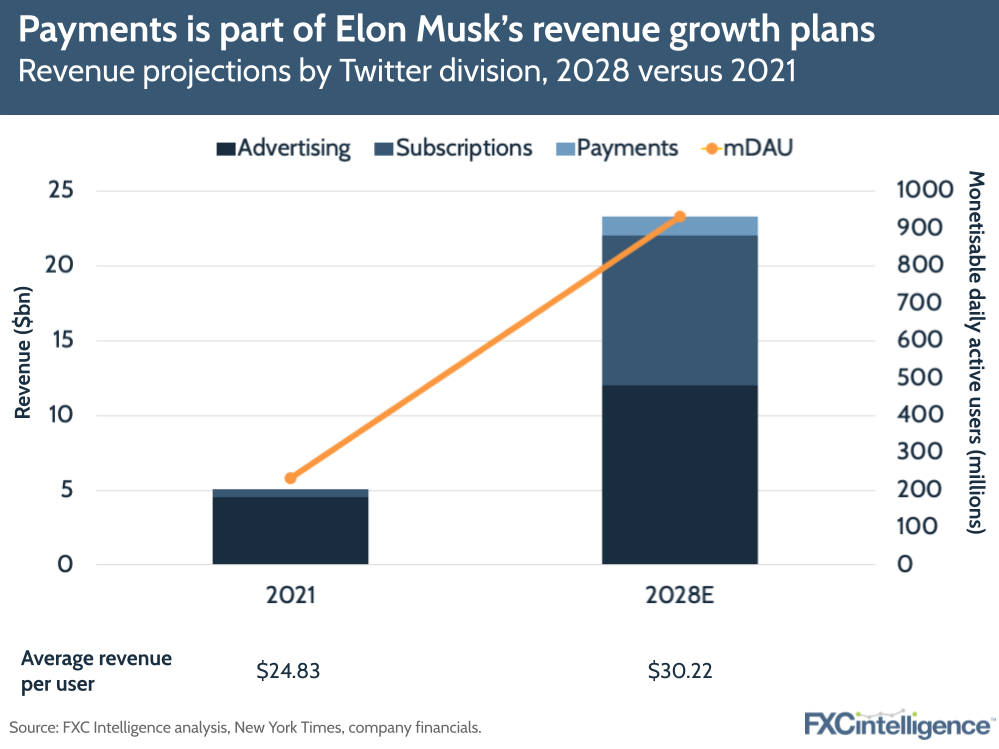

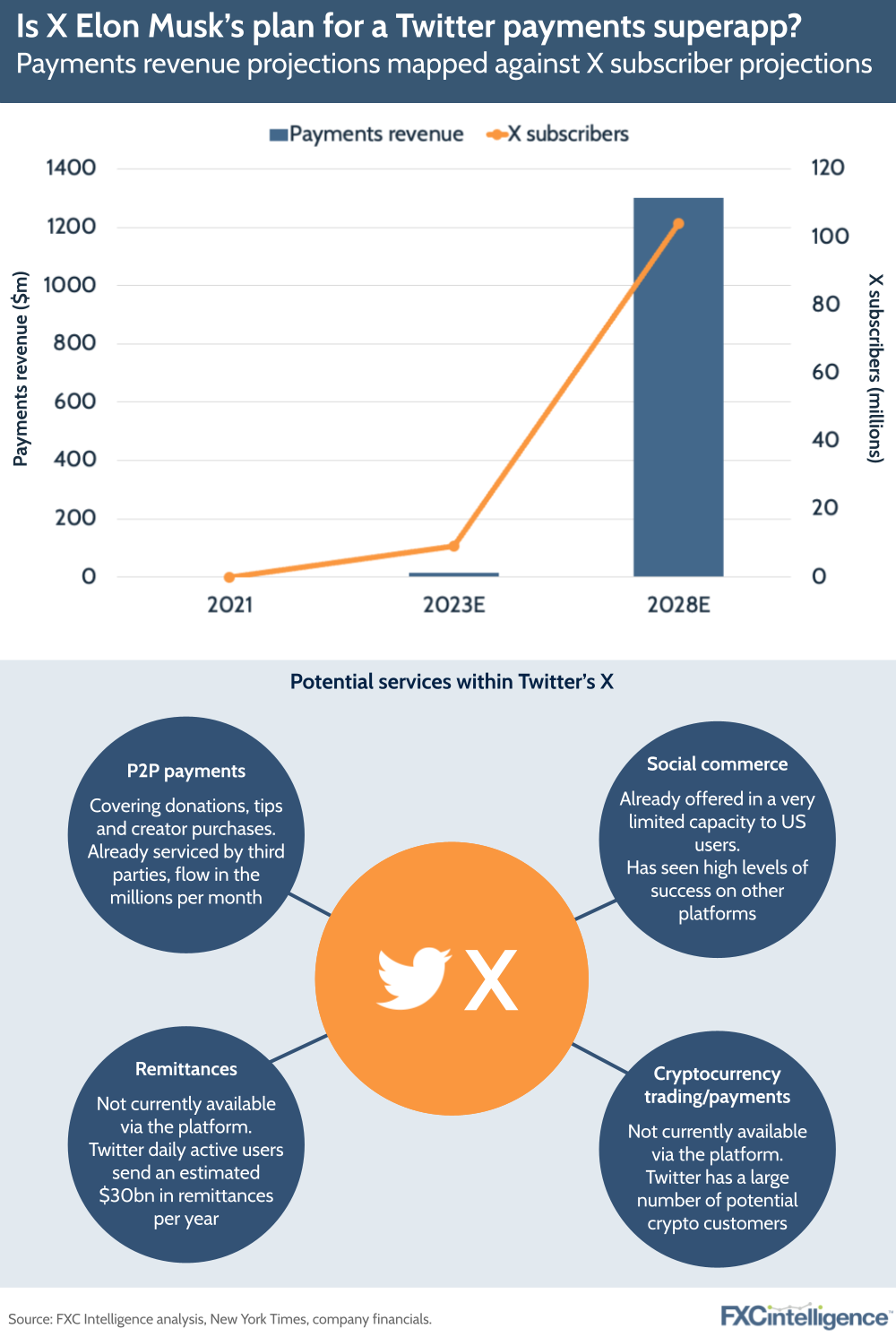

In May, Musk presented an ambitious investor deck that outlined his financial goals for the company, with the headline of quintupling overall revenue to $26.4bn by 2028. This included the growth of Twitter’s currently negligible payments business to $15m in 2023 and then $1.3bn in 2028.

This would see it account for 11% of Twitter’s revenue in 2028, while advertising would drop from an 89% share in 2021 to 46% in 2028. The remainder would be made up by the company’s subscription business, which Musk plans to grow from 11% in 2021 to 38% in 2028.

Musk has since continued to echo the importance of payments on the platform, including highlighting their potential for Twitter at a town hall meeting in June. His ongoing connections to Block CEO Jack Dorsey are also likely to provide additional benefits.

Any payments approach on Twitter is likely to bring together solutions that better capitalise on existing payments volume going through the site, in terms of current P2P and similar payments, as well as bringing other forms of payments more directly onto the platform, such as ecommerce and remittances.

Significantly, while the US presents strong payments potential on its own, Musk would be remiss if he ignored the international payments potential on the platform. With the ability to take a cut of currency conversions, cross-border payments provide a strong potential source of revenue for Twitter, and one that should be central to any payments plan.

Twitter as a superapp

With a broad range of payment options for the social media platform, Musk may look to the increasingly popular area of superapps to bring payments to Twitter.

The growing popularity of superapps

Superapps aim to tap into consumers’ desire for an all-in-one experience from a single app, from financial services to online messaging, food delivery, mobile top-up services, ride-hailing and much more.

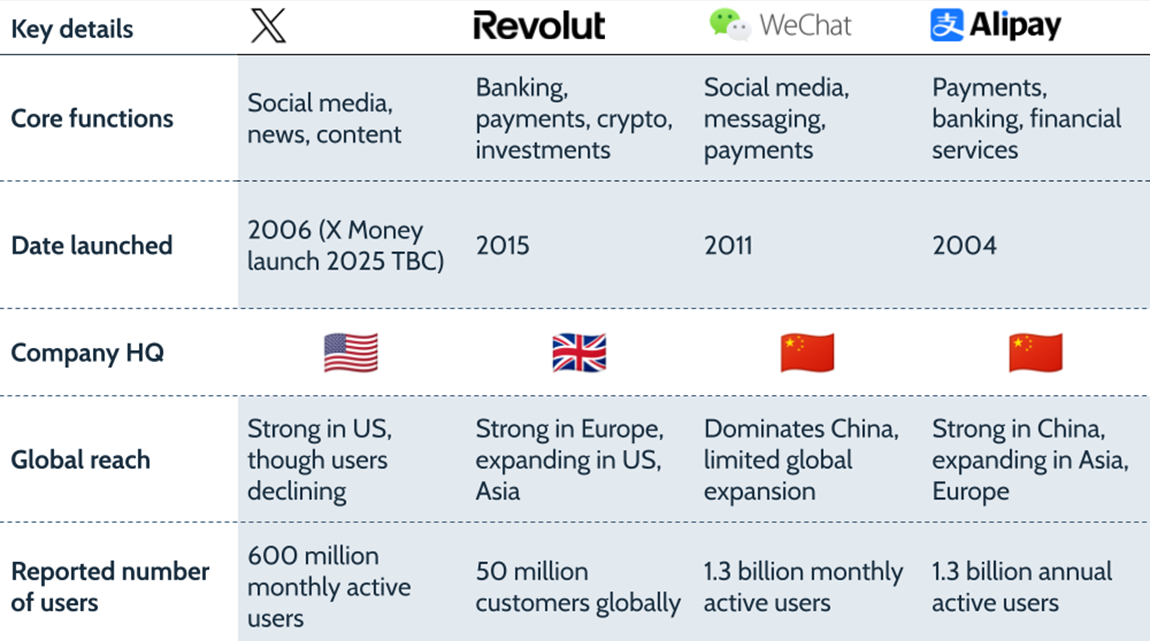

Apps such as WeChat and AliPay in China have already established themselves as one-stop-shops for all kinds of services, but superapps are emerging more slowly in the West. Things have moved faster in Asia due to a mobile-first culture driven by high unbanked populations, more government support for apps and a lack of regulation seen in Western countries.

Having said this, companies such as PayPal, Meta and Google have been trying to consolidate more services into their digital wallets and mobile payment services. PayPal, for example, launched its new app last year with a variety of new offerings, including QR code payments for in-store purchases, P2P money transfers and in-app messaging.

How Twitter could compete as a superapp

With the superapp market heating up, and a wide range of payments options open to Twitter, Musk has indicated that he may revive his X brand and make the social media platform a part of it.

Musk purchased the X.com domain back from PayPal in 2017, but has not done anything with the brand since. However, his investor deck included projected subscriber numbers – although no additional detail – about a new X product on Twitter that roughly matched the projected revenue growth of his payments division.

This led to speculation about its potential as a multifaceted payments product, and in October he backed up the theory of X as a payments superapp, tweeting that he planned to make it an “everything app”.

It appears that Musk plans to begin the new X as a product within Twitter, potentially providing a suite of services such as P2P payments, money transfers and crypto. However, in the long run he may build upon the “everything” concept to take its offering beyond payments, possibly incorporating products and services from his other companies, such as Tesla.

In the long run, Twitter may form one part of X, as a social hub for a host of services that are interconnected by payments.

Conclusion

Twitter is currently undergoing considerable change as Musk begins to make his mark and reshape the company to meet his vision. Undoubtedly there will be moves to improve the company’s financial situation as part of this – improvements were needed prior to the acquisition but are now absolutely necessary to the company’s future as a result of its current levels of debt.

Payments has the potential to be an essential part of this and Musk recognises that, although what form this will take remains to be seen. Twitter is already informally used for millions of dollars in payments every month, and its userbase engage in payments on other platforms, such as remittances and ecommerce, that are likely to create a strong potential market for the company in the future. There is also a strong untapped international userbase on the platform, which cross-border payments could play a key role in catering to.

At the core of Twitter’s payments offering is likely to be X, which Musk looks set to brand as the platform’s payments superapp, targeting highly ambitious growth over the next few years. We can expect far more details on X as Musk begins to flesh out his payments strategy for the platform over the next few months, but with strong potential it could serve as a key third revenue stream for the company.