In the latest instalment in our Post-Earnings Call series, Remitly CEO Matt Oppenheimer talks about what’s been driving revenues and customer acquisition in 2022 as the company moves closer to annual profitability.

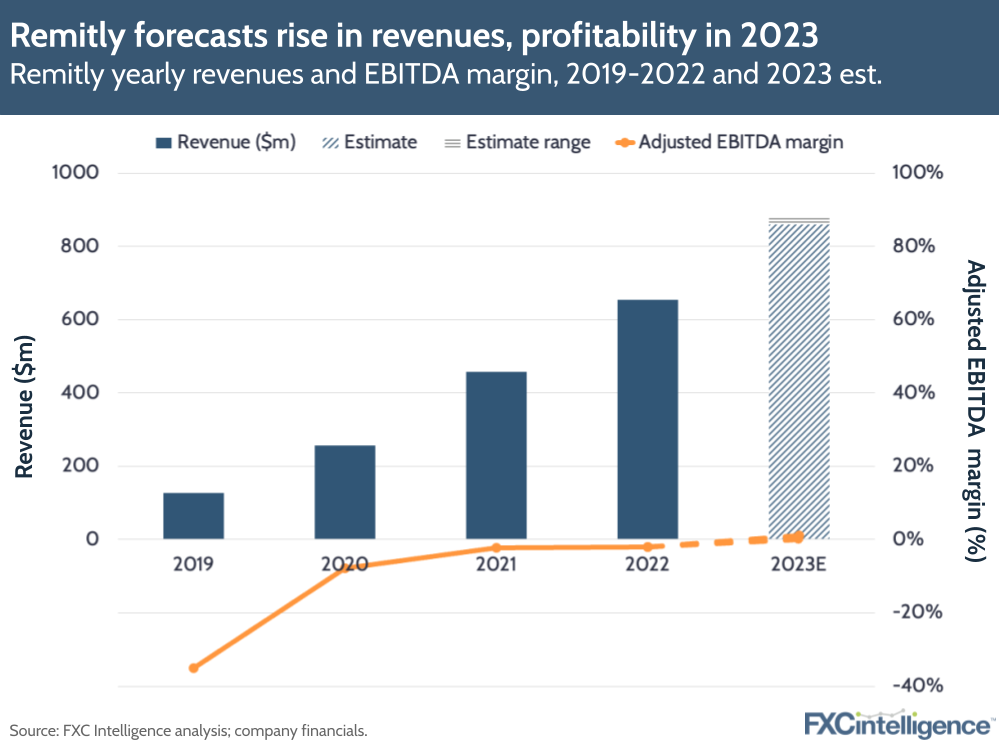

Remitly closed its 2022 with another solid quarter, in which it saw revenue rise 41% to $191m. This brought the digital remittance player’s full-year (FY) revenues to $653.6m (a 43% rise) while its adjusted EBITDA was -$13.6m.

The company’s annual adjusted EBITDA margin was still negative at -2.09%. However, Remitly executives forecast that new customer acquisition, marketing expansion and product enhancements will yield an EBITDA between breakeven and $10m in 2023, as well as 32-35% revenue growth.

Remitly said that certain macroeconomic factors had been positive for revenues in 2022, as they provided an incentive for customers to send remittances. The company is also scrapping Passbook, its digital banking platform designed for immigrants, so it can focus more on its remittance customers. Passbook’s last day of operation will be 1 May 2023.

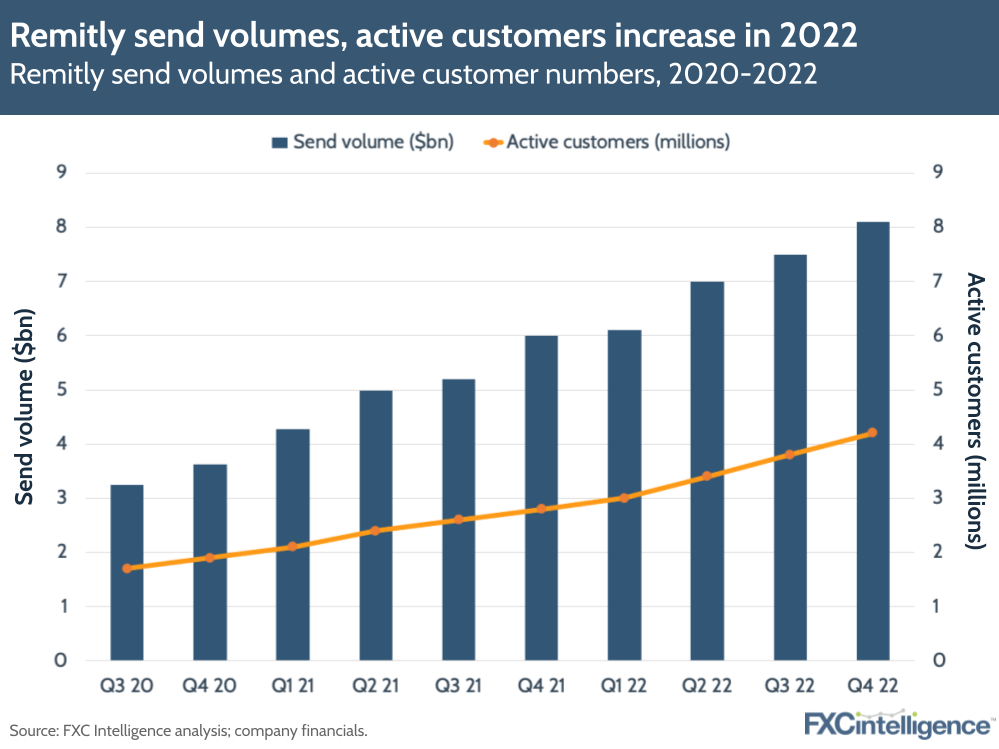

Much of Remitly’s revenue is still driven by repeat business, with around 90% of revenue being retained over the year. However, the company has also seen customer numbers rise 48% – to 4.2 million in Q4. It now serves 4,300 corridors across 170 countries, up from 2,100 corridors across 150 countries in Q4 2021.

Daniel Webber spoke to Remitly CEO Matt Oppenheimer about what’s been driving Remitly in 2022, as well as how its geographic expansion and product enhancement plans will help push the company closer towards profitability this year.

Key growth drivers for Remitly in 2022

Daniel Webber:

You’ve had sustained growth in Q4, but you are also moving closer towards profitability. What’s driving this?

Matt Oppenheimer:

It was a good quarter. Starting with volume, we saw $8.1bn in volume, up 35% year-on-year. We reached $191m in revenue, which was up 41% year-on-year for the quarter. And then we had our first adjusted EBITDA profitability quarter at $7.5m positive compared to -$7.1m the year before. And we’ve guided to adjusted EBITDA profitability between break even and $10m for 2023.

Across the board, the numbers were really exciting. We’re continuing to see what we’ve seen in the business for a long time: the repeat usage of our product; the resilience of our customer base and how it’s a non-discretionary expense, which is especially unique in today’s times; and the commitment our customers have to their families back home. There’s a lot to appreciate, and ultimately it’s in service of our long-term vision, which we’re more focused on than ever.

The positive impact of macroeconomic factors on remittances

Daniel Webber:

Which macro factors have had a positive impact on the company recently?

Matt Oppenheimer:

Firstly, there’s obviously a shift happening to digital and specifically digital origination. The industry continues to be at a tipping point, with more and more customers shifting to digital devices to send money back home. That’s the biggest macro shift.

The second, potentially, is the segment of customers that we serve. It might be different in developed-to-developed countries, where people aren’t sending money back for basic living expenses; they’re sending money to buy a house, for example. For our customer base, they’re sending money back for rent, groceries, education or emergency medical expenses. For that segment of customers, it’s critical that money gets back home. Our customers have a lot of grit, tenacity and perseverance, which is part of the immigrant journey and which creates a predictability and a resilience to our business that we’re really thankful for.

Shifting towards digitalisation

Daniel Webber:

In markets that are digitising quickly (such as India, through its Unified Payments Interface), have you seen a shift to digital on the receive side over the last few years?

Matt Oppenheimer:

It varies depending on the country and the corridor, but overall, that macro theme of shifting to digital is definitely occurring at an even more rapid pace. People forget that a huge percentage of remittances are originated via physical cash locations, and that is digitising first. On the receive side, it varies depending on the market and we’re happy to send funds the way that customers need to receive them. In some markets, it might be predominantly bank deposits. We have four billion bank accounts that we can disperse to, usually within minutes.

We also have 1.1 billion mobile wallets; that’s growing tremendously in some countries. For countries that are still pretty cash based, of which there are several, we have over 400,000 cash pickup locations. So it varies, but the overall trend of digitisation is certainly occurring globally.

Reducing costs and tackling fraud with machine learning

Daniel Webber:

If you look at the UN’s sustainable development goal of 3%, your take rate is below that overall as a business. Is digital the key piece that enables that?

Matt Oppenheimer:

There are some other benefits of digitisation too in terms of just automation. But you’re right; with fund acceptance and disbursement, digitising takes a bunch of costs out of the system.

The other thing we talked about in Q4 earnings is that our fraud loss rates were exceptionally good in Q4, which flowed down to the bottom line in terms of adjusted EBITDA profitability. We’re automating things like our machine learning models to drive down fraud loss rates and create a really frictionless, seamless customer experience. That also impacts the overall cost structure, because our fraud loss rates are lower.

Ultimately there’s a lot of infrastructure on the backend that’s being digitised and automated that also results in bringing down cost in the industry overall. More importantly, if you were to ask our customers, it increases the trust, the peace of mind and the reliability of our service, which is what they care about the most and what is often lacking with a lot of remittance companies out there.

Daniel Webber:

What drives the fraud loss rate in the first place? How are you able to get that down?

Matt Oppenheimer:

There’s a variety of different fraud attempts but, ultimately, the challenge is you want customers to have a seamless, frictionless experience. Then, you want to prevent any sort of stolen identity from being used on the platform, because if that transaction goes through a stolen identity, we are liable for that fraud loss.

When we talk about fraud loss rate, we need to delineate between fraudsters and good customers. To do that, you leverage data analytics and machine learning, which takes signals from a lot of different areas and feeds them into models that are learning and iterating based on the millions of transactions going through our system. We are a larger team now, including a machine learning team and an engineering team, and we have more data being fed into those models. This means the precision (i.e. the extent to which we can accurately delineate between fraudsters and good customers) gets better and better, which means fraud loss rates go down and more customers have a seamless experience while we’re preventing the bad actors on the back end.

Expanding into new remittance markets

Daniel Webber:

What’s the importance of geographic diversification in a business model like yours?

Matt Oppenheimer:

The benefit is in the compounding growth rate that we saw; we grew over 40% in 2022, and we’ve guided in the 30% growth rate range for 2023. The way we’ve compounded that is stable, consistent growth in our existing markets and then layering on new corridors and new geographies in a really intentional way.

Our corridor expansion playbook has been a great way for us to continue to serve customers well in the markets we’ve been in for a long time, and then methodologically add new corridors in a staged and thoughtful way. That’s a different approach to some other companies.

What’s exciting is we’re 2% of the overall global remittance market – the $1.6tn dollars that’s sent – and we still have a huge amount of room to grow in the markets we’re in. There’s a bunch of markets where we haven’t even launched yet (hence, we just launched in the UAE). We’re glad we’re not everywhere yet because we can do it again in a methodological way to have that compounding growth that we’ve seen over the last decade.

Daniel Webber:

Let’s talk about the UAE – what’s different about the market there?

Matt Oppenheimer:

There are eight million foreign workers in the UAE. It’s the second largest origination corridor after the US, and it’s at an exciting point where remittances are becoming more digitised, but they’re still earlier in that journey. As the shift happens, we can very much improve the lives of customers in the UAE who deserve a service like ours and continue to build a sizeable business as we serve customers there.

Acquiring new customers with data-driven marketing

Daniel Webber:

How are you thinking about new customer acquisition moving forward?

Matt Oppenheimer:

It was an exciting quarter on new customer acquisition. Our customer acquisition cost improved and we added another record number of new customers. How? Because we continue to improve and execute well on a really quantitative analytical, data-driven marketing strategy.

We’re continuing to add new channels. We’ve started doing a bit more advertising in places like the London Underground and various other non-digital channels, which is helping with our overall brand awareness, which in turn improves things like customer acquisition costs. And then the advertising environment has been less competitive and we’ve been able to benefit from that as well.

New products and ongoing customer resilience

Daniel Webber:

Remitly is focusing on its core remittance product, but then you are also looking at complementary products. Can you tell us more about that?

Matt Oppenheimer:

These are products that can enhance and benefit our core remittance customer. We haven’t announced specific products in that area yet, but we’re seeing a lot of pain points that our customers face outside of just remittances. We now have relationships with millions of customers, so the question is how can we solve those pain points. More to come on that, but we’re excited about the direction.

Daniel Webber:

Anything else?

Matt Oppenheimer:

I can’t emphasise enough how unique and amazing our customers are. When you understand our customers’ journey and how they had to make sacrifices to be away from their families, to build a better life for themselves and their families back home, you realise the grit and tenacity that was required to do that. When our customers hit tough economic times, as we saw during the Covid-19 pandemic, remittances were way more resilient than a lot of businesses. Why? Because of our customers.

There’s often a misunderstanding of our customers and how much they contribute to the world we live in, and how resilient our business is from that perspective. Especially in this market, it’s super inspiring and important to understand who our customers are, how exceptional they are and the impact that has not just on our business but the wider world.

Daniel Webber:

Matt, thank you.

Matt Oppenheimer:

Thanks very much.

The information provided in this report is for informational purposes only, and does not constitute an offer or solicitation to sell shares or securities. None of the information presented is intended to form the basis for any investment decision, and no specific recommendations are intended. Accordingly, this work and its contents do not constitute investment advice or counsel or solicitation for investment in any security. This report and its contents should not form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. FXC Group Inc. and subsidiaries including FXC Intelligence Ltd expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in this report, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting there from. This report and the data included in this report may not be used for any commercial purpose, used for comparisons by any business in the money transfer or payments space or distributed or sold to any other third parties without the expressed written permission or license granted directly by FXC Intelligence Ltd.