In the next instalment of our post-earnings call series, we speak to Remitly CEO Matt Oppenheimer about the company’s impressive YoY Q1 revenue growth and its plans to drive profitability moving forward.

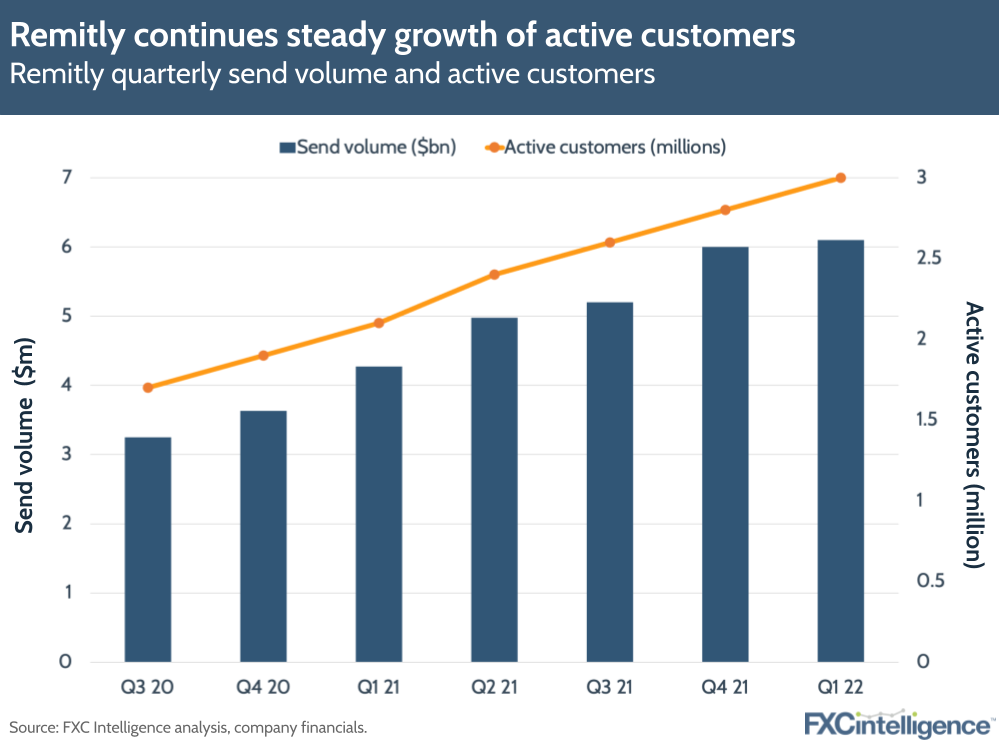

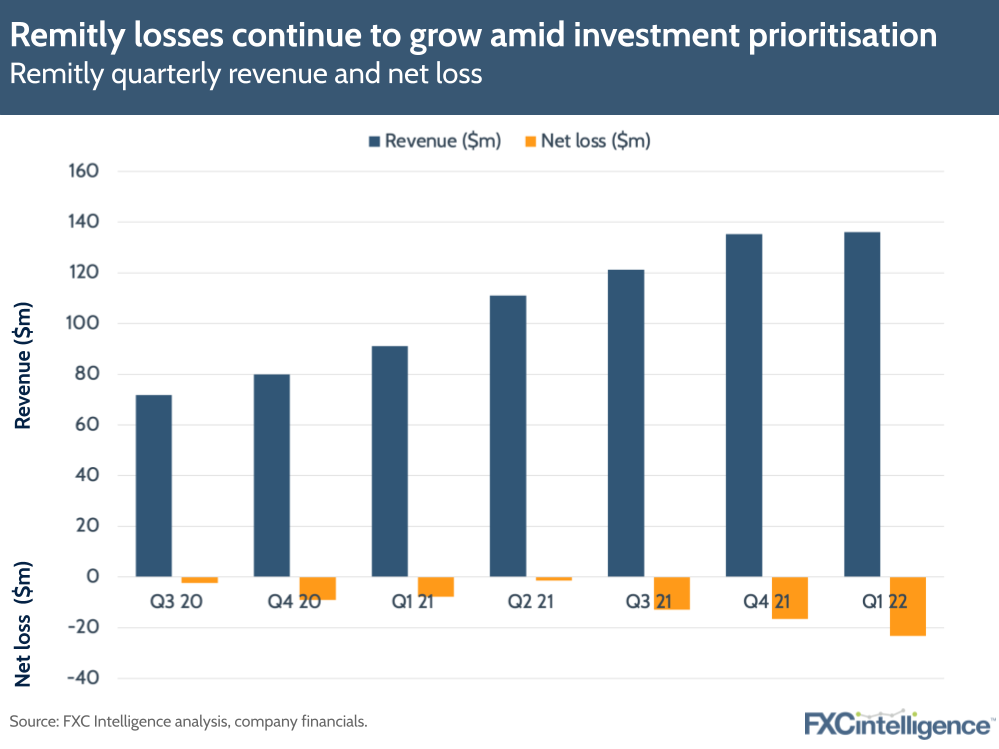

Remitly achieved a 49% year-on-year increase in its revenues to $136m in Q1, which the company has put down to exceptionally high levels of customer retention and new customer acquisition across the quarter.

A high marketing spend of $40m may have skewed the company’s EBITDA further downward (now at -$12.1m), but it seems to be bearing fruit. Remitly’s customer base increased by 42% to more than 3 million active customers in Q1, while send volume grew 43% (42.8%) YoY to approximately $6.1bn.

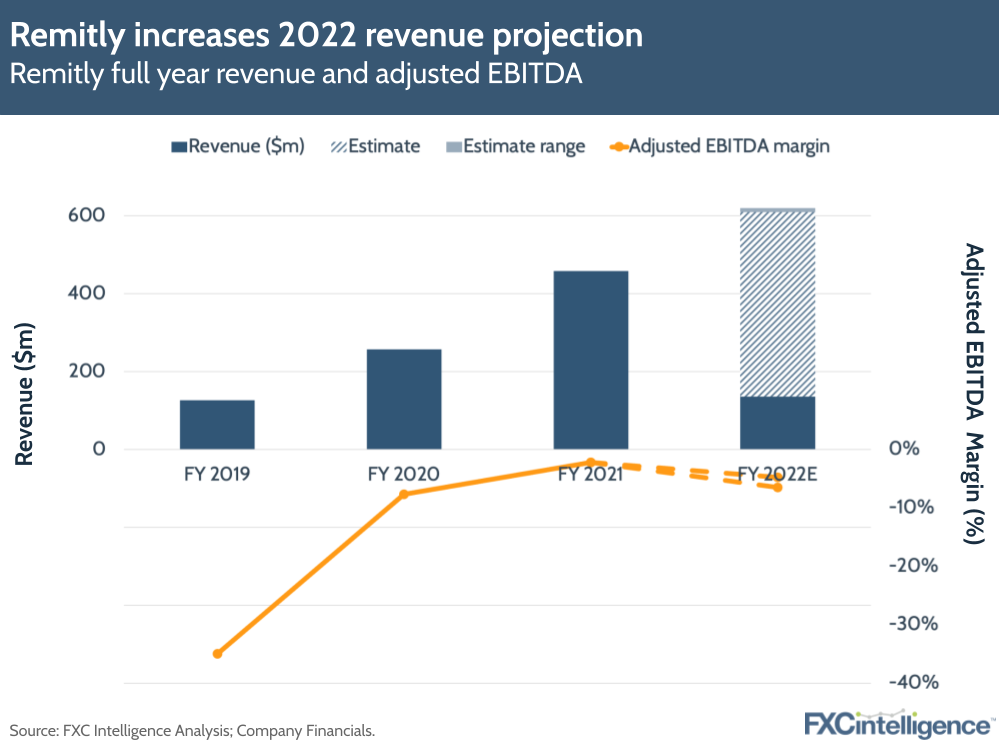

The company has also boosted its revenue projection range for FY 2022 to $610m-$620m (33-35% YoY). It says it will continue to invest in customer acquisition and expanding into new geographies, having increased its number of corridors by 200 to approximately 2,300.

I caught up with Remitly CEO Matt Oppenheimer to discuss company’s growth for Q1 and explore how its uniquely rigorous approach to unit economics has been a key revenue driver.

Remitly’s key growth drivers in Q1 22

Daniel Webber: Revenue and customers are up strongly year-over-year. Talk us through what’s driving that.

Matt Oppenheimer:

It’s driven by two things. Firstly, strong repeat usage of our existing customer base. 90%+ of our transactions and revenue come from our existing customers, who have a recurring need to send money back home and continue to come back to us.

Secondly, new customer acquisition at really favourable unit economics. That’s been the playbook for the last 10 years, but it’s gotten stronger as our business has grown.

Daniel Webber: What’s the mix of growth between your main historically large corridors and your new markets?

Matt Oppenheimer:

As you can guess, it is increasingly diversified when you look at the new customer mix, both in terms of send origin (we now send from 22 countries) as well as receive. Our three largest markets are the Philippines, India and Mexico, but keep in mind that’s now coming from 22 countries as opposed to just the US or North America. Secondly, we now send to 135 countries.

The strong repeat usage of our business means there’s still a large amount of volume going to those big three, but we’re also adding an increasingly diversified mix of new customers geographically, and that’s the leading indicator of future transaction and revenue diversification, which we’re excited about.

Figure 1

Meeting omnichannel customer needs

Daniel Webber: You are fully omnichannel on the receive side. Would you ever go fully omnichannel on the send side?

Matt Oppenheimer:

The question is: what percentage of remittances are originated digitally? That number has been growing and it’ll continue to grow at an industry level. Because of that, we’re investing where the puck is headed (to use a hockey analogy) in terms of digital origination.

On the receive side, it really varies depending on the country. We send money to 135 countries, and one of the things we say a lot is that remittances are global, while customers are local. We have some countries where receive is predominantly bank deposits, some that are predominantly cash pickup and some that are predominantly mobile wallets.

We have a few countries that are predominantly door-to-door delivery, where the most common way to receive money is a courier coming to the recipient’s door and delivering those funds. We’ve proven that we’re good at getting money into the recipient’s hands the way that they want to receive it. And that’s where we’ll continue to invest.

Daniel Webber: In the earnings presentation you spoke about serving underbanked customers. Do you have a strategy for serving the full range of customers, from non-banked through to fully banked?

Matt Oppenheimer:

In that underbanked segment, we include customers who may have a bank account with their local credit union, but that local credit union does not offer international remittances. That means they physically go to their local remittance centre and use cash to send money back home. That is underbanked in the sense that it’s suboptimal and more expensive. We believe with our remittance product, we can move that customer more into the fully banked segment.

We also have products like Passbook. Localised in Spanish, it’s targeting a customer base that might skew more underbanked or unbanked. In that instance, of course, customers can send money into that bank account in a digital fashion, but they can also go via partnerships to deposit cash into their Passbook account (we’re not setting up our own physical cash location).

In that sense, we are helping a wide range of people get from unbanked to underbanked, or from underbanked into more fully banked areas.

Figure 2

How Remitly’s unit economics drives growth

Daniel Webber: Can you talk us through the recent unit economics gains?

Matt Oppenheimer:

We have a uniquely rigorous approach to unit economics, both on the customer acquisition side and on the lifetime value side. On customer acquisition, we look at it not on an aggregate level, but at a marginal or incremental cost level. We look at it not at a global level, but at a regional or channel-specific level, and optimise very intently [based on that].

Then on the lifetime value side, we continue to see strong repeat rates of customers that have been with us for one, two, five or even 10 years. That gives us the confidence we need to continue to invest, especially in this market, in the right unit economics.

From an output perspective, that means 200% IRR, it means 6x LTV:CAC ratios (which we’ve shared in the past) and unit economics that are very favourable. That continues to motivate us to be able to continue to fulfil our vision and grow the business.

Daniel Webber: You’re investing across a range of areas at the moment. In the long term, how will you turn those unit economics into a positive EBITDA?

Matt Oppenheimer:

We spent roughly $40m in marketing in Q1 and you can see that our adjusted EBITDA was negative $12.1m. With that context, you can get a sense of how inherently profitable the business is. But when you’re seeing the unit economics that we’re seeing, the reason we invested that much in Q1 is because we think it’s a very high-return investment.

That being said, we can dial those levers up or down to impact profitability just in that first bucket that I mentioned, which gives me as a CEO a lot of confidence, especially in this environment.

Figure 3

Why remittances is a resilient industry

Daniel Webber: Anything else you want to cover?

Matt Oppenheimer:

If you look at the World Bank data, remittances is less impacted than other industries in a recession. The reason is that our customers are sending money home to their loved ones, and it’s not discretionary to send money back to your family for rent, groceries or emergency medical expenses.

It’s important to note the historic resilience of remittances during recessions, given the criticality of it and given the perseverance and heroics, quite frankly, that our customers have gone through and will continue to go through during tough times

Daniel Webber: Matt, thank you.

Matt Oppenheimer:

Thank you.

The information provided in this report is for informational purposes only, and does not constitute an offer or solicitation to sell shares or securities. None of the information presented is intended to form the basis for any investment decision, and no specific recommendations are intended. Accordingly, this work and its contents do not constitute investment advice or counsel or solicitation for investment in any security. This report and its contents should not form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. FXC Group Inc. and subsidiaries including FXC Intelligence Ltd expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in this report, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting there from. This report and the data included in this report may not be used for any commercial purpose, used for comparisons by any business in the money transfer or payments space or distributed or sold to any other third parties without the expressed written permission or license granted directly by FXC Intelligence Ltd.