In March 2023, a consortium of South African payment players and banks, including the country’s central bank, launched the PayShap real-time payments rail. Five months on, the system could prove transformative, but challenges remain to adoption.

About 80% of the adult population in South Africa have a bank account, yet it is estimated that 9 out of 10 transactions in the country are still made in cash and about a quarter of the population withdraws all the money sent to their bank accounts as soon as it arrives.

Many lower-income earners in South Africa rely on cash for their daily transactions, especially for payments to cash-based micro-small businesses, landlords and taxis. Though the South African payments industry is growing gradually, with developments in digital technologies, only a few South African bank customers have experienced instant transfers in electronic payments before 2023.

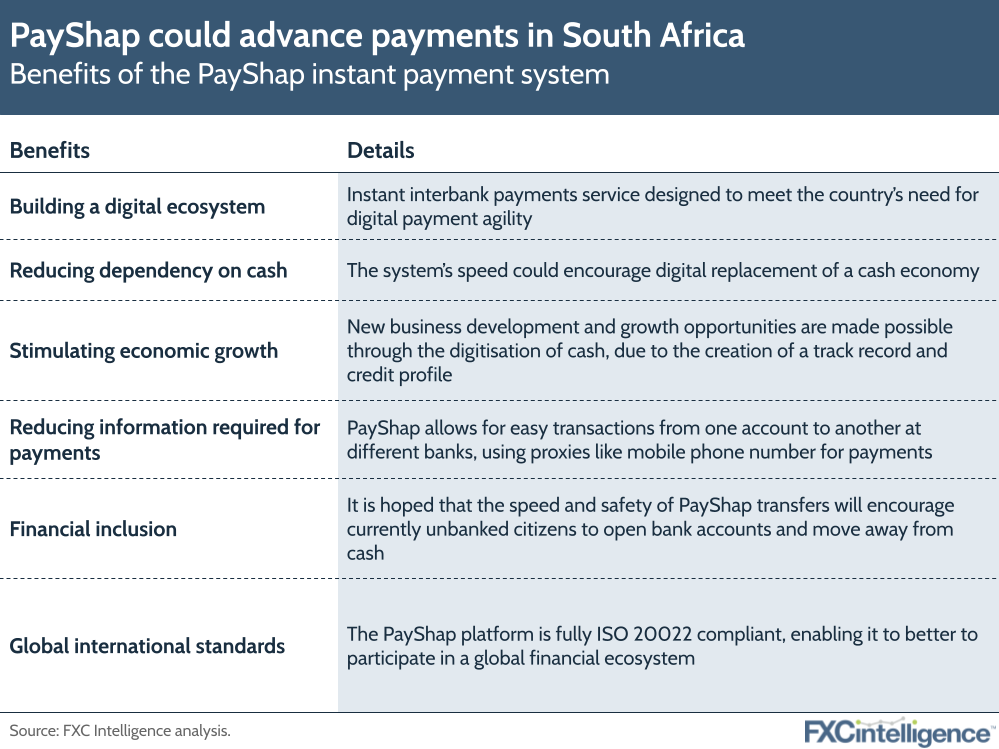

In March 2023, an instant interbank electronic payment scheme called PayShap was launched as part of a collaboration between BankservAfrica (the automated clearing house owned by South African commercial banks and the South African Reserve Bank, the country’s central bank), the Payments Association of South Africa and the South African banking community. The scheme is part of the South African Reserve Bank’s Vision 2025 strategy to reform and modernise the country’s national payment system framework to meet the increasing demands of businesses and consumers.

PayShap has three major product features: pay by account, request to pay and pay by proxies (payment identifiers) such as a phone number. According to some of the players involved, using a phone to pay via bank is entirely new to South Africa. For payment by proxy, users can send or receive payment directly into a bank account using a registered mobile number or business name – referred to as a ShapID and ShapName respectively – as well as a bank account number.

PayShap in the South Africa payment system

According to Mpho Sadiki, Chief Product Officer at BankservAfrica, PayShap was “created as a direct response to the South African Reserve Bank’s Vision 2025 strategy and to drive increased financial deepening by gaining trust and familiarity in electronic payments in the largely cash dominant market”.

The initial release of PayShap only supports real-time electronic funds transfers (EFTs), meaning users can’t make future-dated or batch payments. For the next phase, a request to pay service functionality and digital invoice to be sent between digital channels will be launched in the first half of 2024.

The government is also hoping that PayShap will boost financial inclusion by encouraging unbanked citizens to open bank accounts, thanks to the speed of transfer, and that those who already have bank accounts will use it for digitised payments rather than using cash.

PayShap’s adoption since the launch

Since its launch in March, PayShap now accounts for 0.4% of all real-time clearing (RTC) payments in South Africa. Sadiki says that more than 400,000 PayShap transactions have been registered since the launch.

According to Rothe Maedza, Head of Product at Standard Bank (one of the participating institutions), PayShap saw approximately 5,000 default proxies (a payment identifier) being registered daily after it went live in March 2023. However, three months on the adoption pace had slowed down. As of August 2023, about 1,500 default proxies were being registered daily, although over 300,000 ShapIDs have reportedly been registered.

A PayShap user can send up to ZAR 3,000 per single transaction or multiple payments that total ZAR 5,000 per day; by comparison, existing RTC allows for transactions of up to ZAR 5m. The current limits are in place to manage fraud and risk because once a PayShap transaction has been finalised, it can not be reversed. Rufaida Hamilton, the Head of Payment at Standard Bank, says that over time, as PayShap evolves from a low-value payment system to one that can accommodate B2B payments, the limit will increase.

PayShap’s implementation and costs

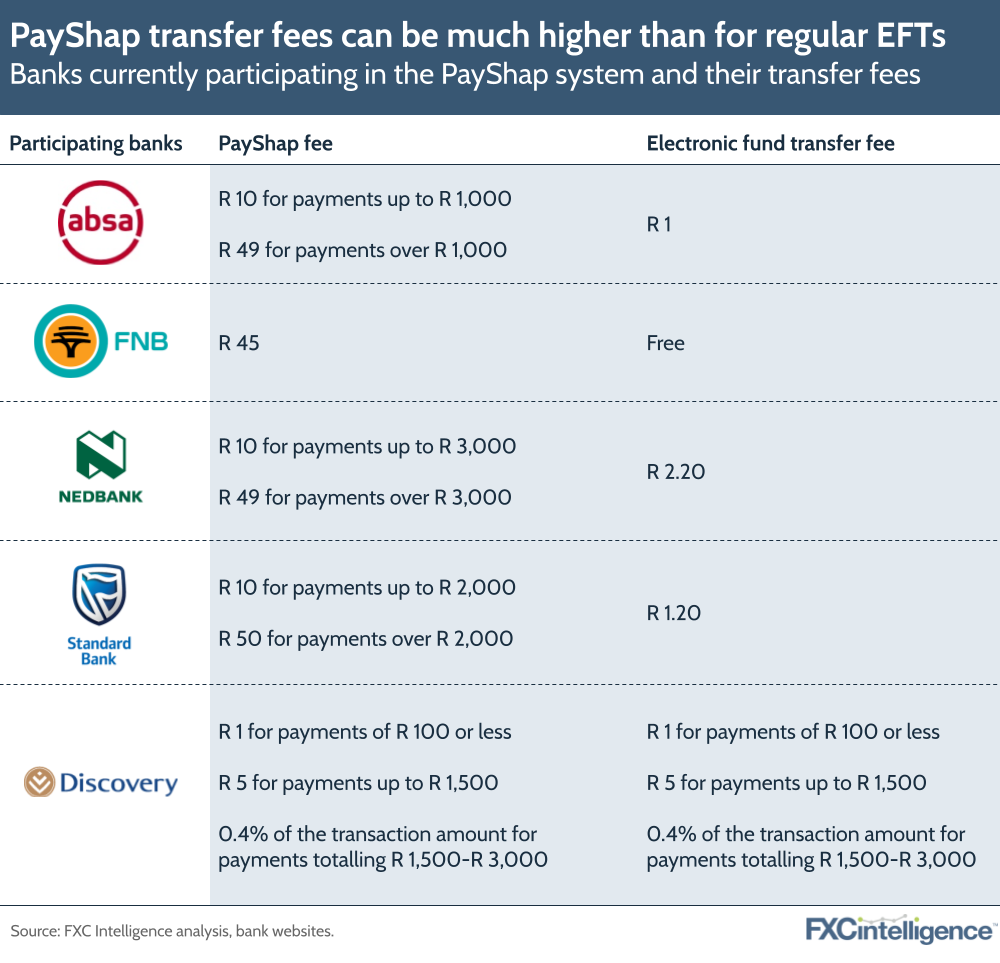

PayShap is not a standalone app and it is currently only available to account holders at participating South African banks (Absa, First National Bank, Nedbank, Standard Bank and Discovery Bank) via their banking channels, including mobile banking and internet banking. Later in the year, it will be rolled out to Capitec, Standard Chartered, TymeBank and Investec.

This market-first payment solution was designed to be a low-value digital payment rail and intended to be more cost-effective for banks than the existing RTC system, which should in turn result in lower fees for users. However, when comparing the PayShap transfer fees for the participating banks, existing EFTs seem to be cheaper for consumers than PayShap.

A PayShap payment costs ZAR 10-ZAR 49 per transaction, depending on the bank and the amount to be transferred. On the other hand, existing EFTs cost ZAR 1-ZAR 2.20 per transaction and for FIrst National Bank’s Easy PAYU account, it is free. This means that users may skip a PayShap transfer unless there is an urgent need for their payment to clear instantly.

Hamilton explains that the pricing model participating banks landed on was as a result of the cost of PayShap’s live implementation. Incorporating PayShap into their systems required the banks to invest in and commit to new, cloud-based infrastructure, a new ISO messaging standard and new software, among other things. However, it is expected that the pricing model will evolve as competition and other market forces shape the price in the months to come.

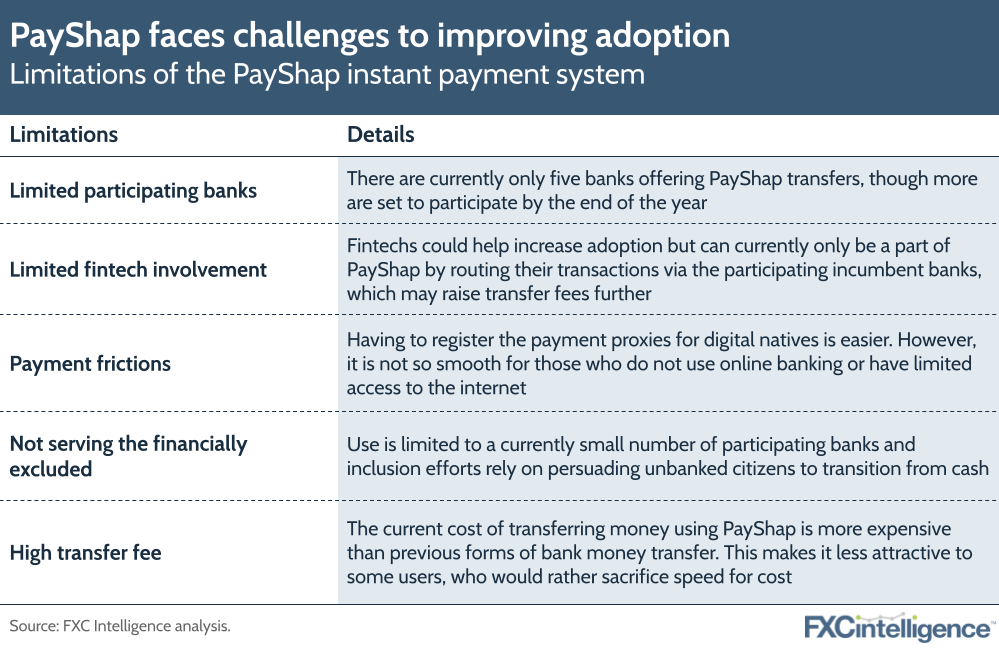

Limitations of PayShap in the South Africa payment system

There are several limitations that may hinder the expected shift towards and adoption of PayShap. Aside from the higher cost than RTC payments, PayShap is only available to those with an account with one of the five currently participating banks.

This means the roughly 15% of the population that is financially excluded, according to the World Bank, have little to no recourse towards using PayShap to send or receive money. This is not helped by the fact that data costs in South Africa can still be high and internet banking is required to register proxies for PayShap.

For most emerging economies, the fintech ecosystem has been instrumental in driving financial inclusion and boosting the economy, especially in Africa where they bring digital acceleration. However, fintechs are currently excluded from participating directly in PayShap and can only route PayShap transactions through the participating banks. This makes it difficult to leverage fintechs to drive adoption of PayShap.

How PayShap could shape payments in South Africa in the future

PayShap will continue to play a significant role in moving the informal sector from cash-based to digital payment. In the words of Hamilton, “PayShap is a great platform for innovation and will make a significant difference, especially in bringing more micro-merchant and small and medium enterprise into the formal economy. It will help to gradually migrate them from cash to digital payment.”

According to Sadiki, “PayShap will drive more collaborative partnerships between payments players (licensed banks) and non-bank participants including fintechs, telcos and other retailers through a sponsored model.”

For instance, there are ongoing discussions between some of the participating banks and telecommunication companies to explore PayShap payment via e-wallet. Though the clearing and other functions would be done by the participating banks, the e-wallet would be the platform for remittance. Part of the PayShap roadmap is to continue to modernise other forms of payment, including launching offline payment, batch payment and more.

Additionally, the Payshap platform will accommodate cross-border payment in the near future. Currently, Southern African Development Community (SADC) countries have deployed Transactions Cleared On An Immediate Basis (TCIB) – a cross-border payment scheme in the SADC for low-value transactions – and SADC-RTGS – a real-time gross settlement system – for high-value real-time cross-border payment. There is a future plan to merge PayShap and TCIB for wider cross-border payment capacity.

PayShap five months on from launch

It has now been five months since PayShap launched. Though it is still in its infancy, PayShap has the potential to change the face of South Africa’s digital payments system, provided its limitations are attended to.

Participation in the system will benefit from an expansion of participating banks, as with Nigeria’s NIP system, or if PayShap can move towards a mobile money-like system that does not rely on a bank account. Adoption could also be assisted by greater inclusion of fintechs, though this will rely on an update to the regulatory framework to accommodate and grant non-bank participants direct access to settlement.

Making PayShap more accessible at various touch points will help reduce reliance on cash, addressing a major pain point for both merchants and consumers, as well as foster more digital uptake and better customer experience. Increasing use may well rely on addressing the current perception of high fees, however, again following the path laid by mobile money systems in regions such as East Africa.

Finally, if PayShap achieves widespread adoption among South Africans, it will create more opportunities for South Africa to collaborate with other countries for cheaper cross-border payment, including leveraging PAPSS. BankservAfrica is set to release a special report on the system’s adoption later in the year, which will give a better sense of the progress made so far.