Payoneer’s Q2 2023 earnings have seen the company perform strongly, particularly on revenue and take rate, amid new management and an evolving strategy. CEO John Caplan and CFO Bea Ordonez discuss the company’s performance and how it is approaching growth.

Strong performance straight after the appointment of a new CEO isn’t always expected, but Payoneer has achieved that with its Q2 2023 earnings results. Having appointed John Caplan as CEO at the start of March this year, following a period as co-CEO with Scott Galit that began in May 2022, the company has pleased investors with its top-line results.

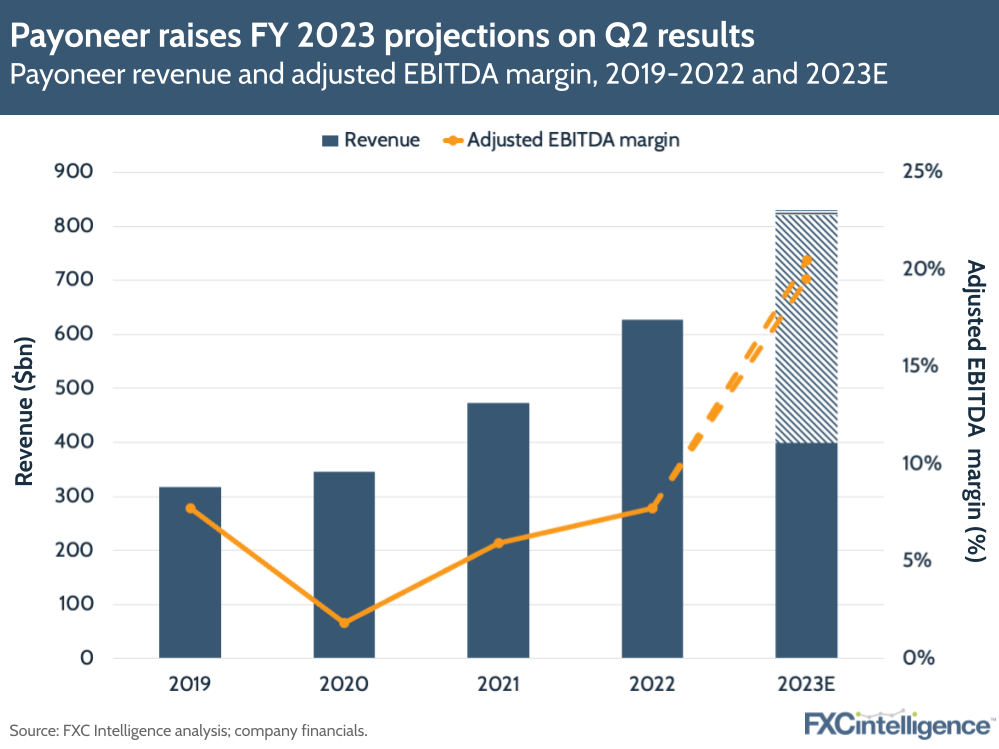

Payoneer reported a 40% YoY increase in revenue to $206.7m and a 280% increase in adjusted EBITDA to $56m in its latest earnings. Volume, meanwhile, grew 8% to $15.8bn, while the company saw a 30bps rise in take rate to 131bps.

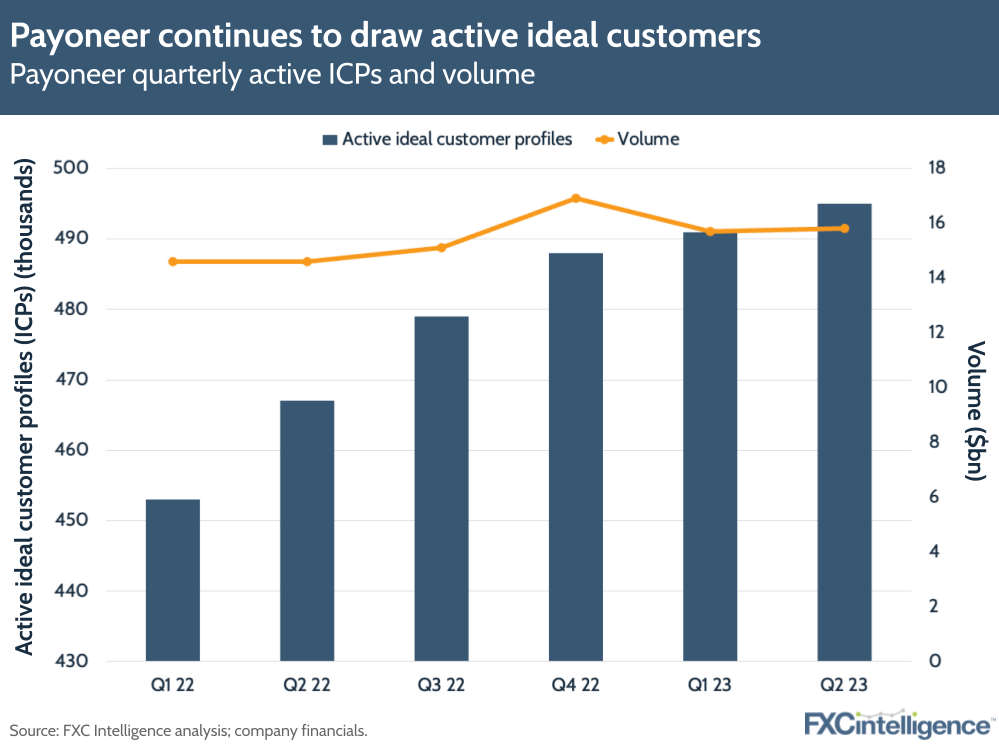

Critical to this approach has been an increased focus on active ideal customer profiles (ICPs), which increased 6% overall to 495,000, while larger ICPs with over $10,000 a month in volume grew 18%, buoyed by the ongoing addition of new features catering to their needs.

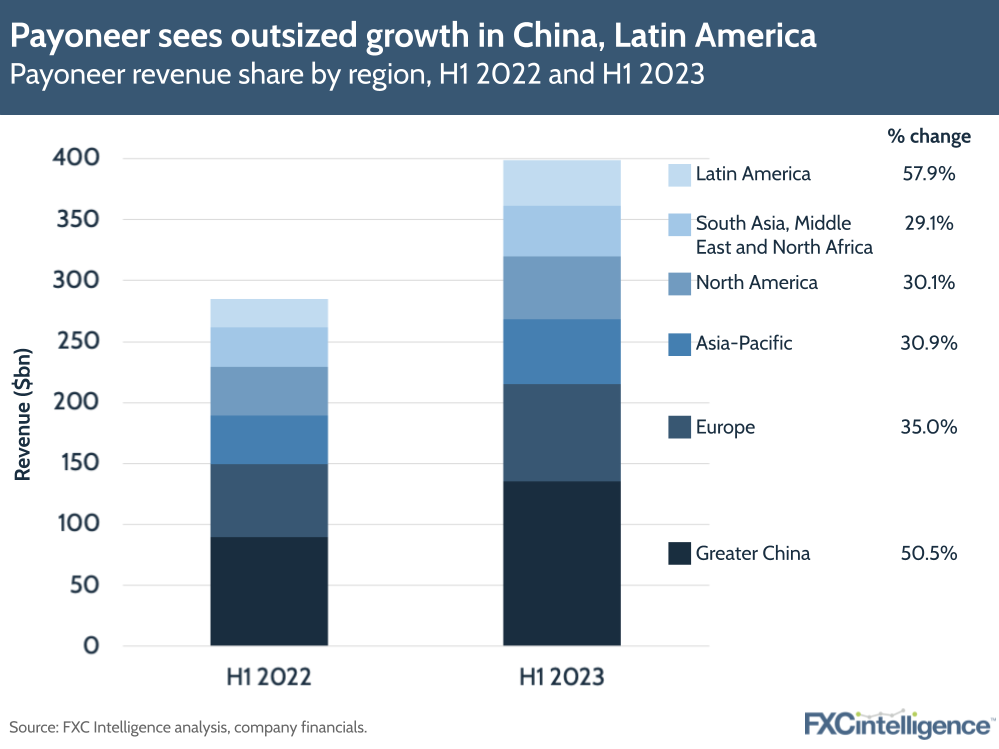

The company has also been increasingly growing beyond the US, with 45% growth in Latin America in Payoneer’s Q2 2023 earnings, 36% in Asia-Pacific, 34% in Europe and 29% in South Asia, Middle East and North Africa. North America, meanwhile, saw 27% growth in the quarter.

As part of this international focus, Payoneer announced a number of moves to bolster its focus on China, including the transition from operating as a foreign entity to becoming a local financial service provider. It is achieving this through the acquisition of an as-yet-unnamed, locally based payments services provider, as well as the appointment of Dandan Cheng, a Chinese cross-border ecommerce veteran to run the segment.

This is one of a number of appointments to Payoneer’s leadership team, which also saw CFO Bea Ordonez step up to the role in March. Amid these changing dynamics, how is the company approaching its markets and strategy? We spoke to John Caplan and Bea Ordonez to find out.

Key drivers of Payoneer’s strong Q2 2023 earnings

Daniel Webber:

Let’s start from the top: some very strong numbers and clearly some of the dynamics are now evolving because you’ve needed less flow to drive good revenue and profitability. What’s driving that?

Bea Ordonez:

We delivered 40% year-over-year revenue growth, record revenue in absolute terms and continued growth across our business lines. This was really driven by strong performance in the ecommerce sector; continued rebound in the travel sector; growing customer balances; driving increased float income. All of those factors contributed growth, including from a revenue perspective in our B2B business, all on the back of roughly 8% aggregate volume growth.

An expansion in the take rate, certainly when you include float income but even excluding float income, demonstrates the continued leverage we have from a profitability and margin expansion perspective to continue to grow in high take-rate regions and to continue to drive ARPU – in effect by cross-selling into our customer segments. As we’ve talked about before, we acquire those customers very efficiently by and large.

To the degree that we can continue to cross-sell with our card offering, with working capital and with other products, we anticipate that we will be able to continue to drive up that take rate. That’s really, from a top line and volume dynamics perspective, what informs those results.

Looking out through the rest of the year, we feel good; we expect to see more of the same. We’re seeing strong trends exiting the quarter in terms of ecommerce; we’re seeing nice trends continue with the travel sector. We continue to see strong performance in the freelance and gig work sector. Mid to high single digits is where we would put that volume growth as we look through the back half of the year, but with continued secular tailwinds driving that kind of commerce, which we think is definitely an interesting area for us.

From an operating leverage perspective, we have delivered significantly, expanding EBITDA profitability in Q2. That’s a factor, obviously, of growing that top line, as well as some of the expense discipline that we brought into the organisation coming into this year. We expect that there is continued leverage within the firm, both as we grow the top line but also as we find ways to use generative AI to automate aspects of our processes as we look to drive efficiencies with the organisation more broadly.

In common with many fintechs, we announced a reduction in our workforce back in July, which will be completed in Q3, of roughly 9% of headcount. Not something that we celebrate as such, but indicative of the overall discipline we are bringing to our organisation.

There’s significant leverage that we can bring to bear through the use of technology, through our platform transformation. We’re continuing to make meaningful investments in that infrastructure and in our go-to-market efforts to really align to this pivoting of the organisation to acquiring more customers that meet that ICP definition and that are going to drive that top-line growth.

Payoneer’s increased take rate and changing opportunity

Daniel Webber:

Take rate saw a significant jump. How much of that was driven by regional mix, product mix or customer mix changing?

Bea Ordonez:

On a gross level, obviously a portion of that is the float or interest income that is part of our core revenue. We provided significantly more colour around that revenue component than we have previously because we think it’s important to properly position that revenue stream for the investment community given that, from a macro perspective, we expect interest rates to remain elevated and thus this revenue stream is not transient. Every commentator at this point expects the US, where roughly three quarters of our balances are held, to remain in a relatively elevated interest rate environment for quite a few years to come. So, it’s not transient from a macro perspective.

It’s also not transient in the sense of it being earned on simply balances that flow through our network. We provided some really interesting colour on the customer behaviour behind those balances that we hold on our network and really the best way to encapsulate it is that over time, as we’ve added utility and as we’ve allowed customers to manage more of their businesses within our platform, we’ve seen that behaviour shift.

The way that it’s shifted is that customers are holding more balances, relative to their average usage, and holding them for longer. These are not transient flows of money that sit and then immediately exit. They stay for a prolonged period of time and what we have seen with customers is that they hold more of their balances on their platform today than they did two, three or even four years ago. That is a part of that take rate uplift. The other aspect is we are driving growth in our B2B business from a revenue perspective, even though volume performance continues to be somewhat constrained by terminations, and we saw a nice pickup in card adoption – and all of that is driving a higher take rate in our business overall.

Daniel Webber:

John, is there anything you want to add to that?

John Caplan:

The only thing I would say that’s really important to see is how broad and global we are.

In China, we had 50% year-over-year revenue growth in Q2.

In our B2B franchise, we generated 29% year-over-year volume growth in some of those key services markets, in APAC, SEMEA and Latin America where our high service-oriented economies are. We saw the volume of people and their need to have a digital solution that provides simple-to-use tools that make it easy for them to either invoice or get paid by their customers or make payments to their vendors.

Small business owners in high growth emerging markets expect to more than double their revenue from cross-border commerce and significantly increase the number of vendors they use that are abroad. When that happens, they live locally but they transact globally and so the Payoneer platform enables – whether you’re in Argentina or in Vietnam – you to do business globally.

We’re at the right moment in time for a business like ours and particularly in that B2B services space. People know of Payoneer for Amazon, Walmart and eBay and those big goods exporting opportunities. This next phase of our business is really around broadening the group of industries we serve and broadening the geographies. Those services economies in APAC, SEMEA, Latin America are really seeing significant growth and will continue to do so.

Taking the next step in China

Daniel Webber:

You’re seeing strong growth in China, where there’s been some interesting commentary around the challenges of doing business there. What’s driving that?

John Caplan:

The sellers in China who export goods rely on and trust Payoneer. We are the leader in those markets and are doubling down on the products and tools we need.

We just hired a woman named Dandan Cheng as our SVP of China. She’s running the China market and joined us in the last quarter to drive the growth of that market. She is exceptionally talented.

This quarter we also announced that we had reached an agreement to acquire a locally licensed payment provider in China. China is a large market for Payoneer and this transaction reinforces our long-term commitment to our customers in the country.

We made the strategic decision to transition from operating as a foreign entity in China to becoming a local financial service provider. The advantages we anticipate to operating as a local, licensed entity include expanding our service capabilities to provide outbound money flows and support RMB globalisation, as well as serving customers more locally via on-the-ground operations, technology, R&D capabilities, partnerships and integrations with more local tools. We also anticipate that it will improve our cost structure and FX margin, as well as enable us to more easily comply with potential forthcoming regulations.

The acquisition, once completed, will enable us to strengthen our regulatory infrastructure and enable us to better serve our existing customers, as well as new customer segments that we are not serving today.

This fits into our broader strategy to invest in our regulatory licensing framework and operate more locally around the world. We are now adding China to the other major jurisdictions, including the US, Europe, the UK, Australia, Japan and Hong Kong. Recently, we received our Major Payment Institution licence from the Monetary Authority of Singapore, and earlier this year we received our Electronic Money Institution licence in the UK.

Payoneer’s shifting strategy

Daniel Webber:

How does this play into your wider strategy?

John Caplan:

Bea and the team and I set out strategic priorities at the beginning of the year and we’re executing on them. We bought the Spott franchise and business in Israel that’s going to add AI capabilities to our underwriting in working capital. We’re excited about that.

We just talked about the transaction in China. We’re very excited about that.

Our B2B franchise is growing in those service-oriented economies and that’s delivering against the roadmap that we’ve put in place.

There’s also the ICP growth: we’ve articulated the priority of acquiring high-value customers and the team is executing well. With as much potential as we have to demonstrate our ability to consistently deliver, that is the moment we’re in as an organisation and it’s an exciting time for us.

Daniel Webber:

Is the platform piece still a priority for you? How are you thinking about offering your rails and services to other payment providers?

John Caplan:

It’s interesting because the inbound inquiries I receive for that are increasing: the number of people who are coming to us saying, “You are best-in-breed, can we work together more creatively?”.

The economics have to make sense for everybody. The important thing is the deal structure and economics in those relationships.

Spott acquisition and the role of credit

Daniel Webber:

Where are you seeing the credit piece fit into your overall strategy, particularly with the acquisition of Spott?

Bea Ordonez:

We talked a lot about ARPU in the call and in our prepared remarks. We’re looking to serve the needs of SMBs. They are underserved and not well-served across a range of financial services in emerging markets, they have to go to many financial institutions to deal with all of the various needs.

Global and cross-border commerce, particularly for SMBs, is growing, becoming more digital and becoming more borderless. SMBs in those emerging markets need a broad range of capabilities. We can fulfil many of them today and we can expand.

Lending capital and other capital-type services is only one leg of the stool. We see it as a tremendous opportunity and it’s an area we’re really exploring.

In terms of year-to-year performance, our originations are performing pretty well. We’re up about 12%. We see pretty decent growth in China. We launched some new offerings specific to Amazon sellers, so we think those are interesting and allow us to cement that strong position that John talked about with large ecommerce sellers in China. We’ve opened up new markets; we added six additional countries in LATAM and saw originations grow there by almost 30%.

We think the Spott acquisition is super interesting and really dovetails to what we’ve talked about in terms of M&A. It’s consistent with the approach we’ve outlined, which is that we are focused on interesting technologies that can accelerate our roadmap in areas that we think are core and strategic.

Spott’s a great example of that and really helps us refine our underwriting. It brings both proprietary and public data points into our ecosystem to help us better underwrite risk, capture more of that market, better target customers and be more nuanced in our pricing. As we integrate that technology, we think it’s super interesting.

SME use cases

Daniel Webber:

Is there anything else we should be thinking about in terms of SME use cases beyond your core focus of cross-border trading SMEs with a focus on emerging markets?

John Caplan:

On the accounts payable (AP) side, people generally don’t see how strong our AP capabilities are. What we see is the larger ICPs are excited about more and more of our accounts payable solutions and use more and more of them.

It’s clear the big ICPs get even more benefit from our commercial Mastercard products, from the role management we put in place so that they can manage cards across all their customers. It’s sort of Brex built inside of Payoneer for those emerging market entrepreneurs.

Another example would be our merchant services franchise. We launched Checkout and then we’ve got an early rollout of our merchant of record product, which enables our customers to get significant improvements in their acceptance rates when they’re selling from abroad into the US. This makes actually being a good seller to the US on your own storefront possible, because if the acceptance rates are low, you can’t advertise to grow your business well.

It’s high take rate business and more AR into the Payoneer accounts, which results in even more participation in all of our great AP products.

Daniel Webber:

Is there anything else you want to mention?

John Caplan:

This was a strong-execution quarter by a new management team that’s come together, that’s meeting the moment of intense need of emerging market small businesses. So it’s the combination of the needs of the customers, the capability of the platform and our focus that are in sync, and the results are executed against that.

Daniel Webber:

John, Bea, thank you.

John Caplan and Bea Ordonez:

Thank you.

The information provided in this report is for informational purposes only, and does not constitute an offer or solicitation to sell shares or securities. None of the information presented is intended to form the basis for any investment decision, and no specific recommendations are intended. Accordingly, this work and its contents do not constitute investment advice or counsel or solicitation for investment in any security. This report and its contents should not form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. FXC Group Inc. and subsidiaries including FXC Intelligence Ltd expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in this report, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting there from. This report and the data included in this report may not be used for any commercial purpose, used for comparisons by any business in the money transfer or payments space or distributed or sold to any other third parties without the expressed written permission or license granted directly by FXC Intelligence Ltd.