In the latest in our Post-Earnings Call series, we speak to OFX CEO Skander Malcolm about the key drivers of the company’s record-breaking results for fiscal year 2022, as well as how the company will go about expanding its footprint in North America and wider segments.

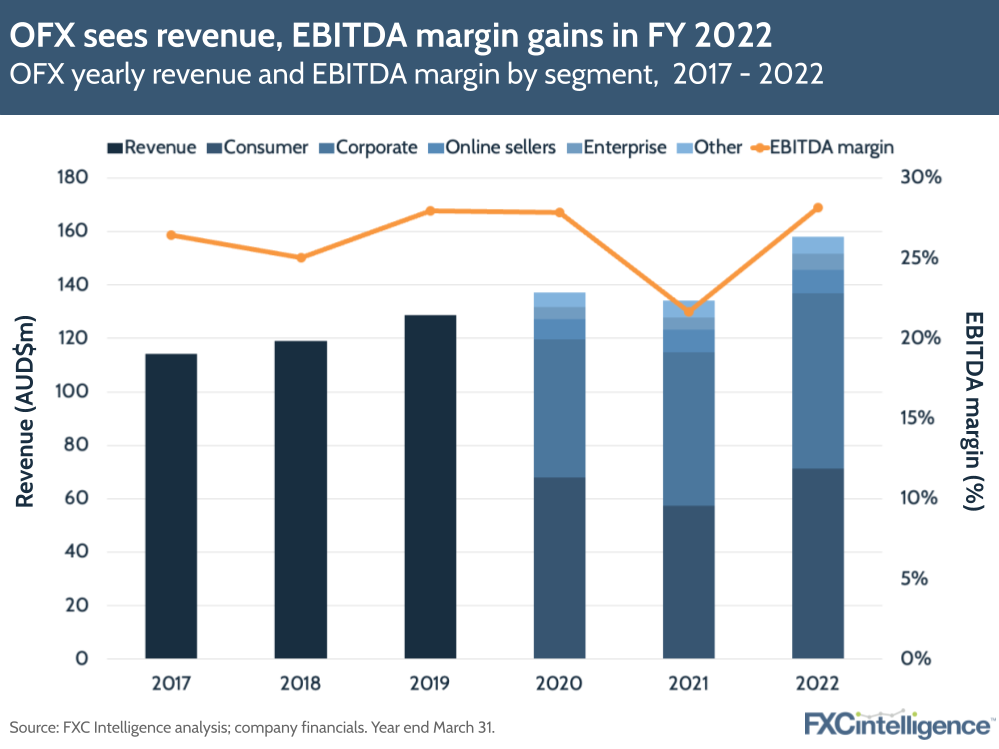

OFX Group saw its share price rise by 8% following the release of its results for fiscal year 2022. The Australian payments company marked a record AUD$147m in net operating income (a YoY growth of 24.7%) and a fee and trading income of $158m, up 17.7%.

OFX saw increases across all segments, with particularly strong revenue gains in enterprise (31.3%), high value consumer (24.5%) and corporate (14.5%) segments. Its online seller segment saw 2.7% growth, with declines in Asia and North America against a backdrop of Covid-19 activity in 2021.

After acquiring Canadian FX company Firma, OFX is looking to consolidate its gains in North America, launch a European expansion and bolster its growth across all segments. On the back of strong results, the company is projecting an operating income range of $200m-$212m and underlying EBITDA range of $55m-$60m.

I spoke to OFX CEO Skander Malcolm to flesh out key drivers behind the company’s impressive rise in FY 2022, and find out how it plans to grow its consumer and corporate markets worldwide.

OFX key growth drivers in FY 2022

Daniel Webber: What’s been driving the growth and profitability across your key segments?

Skander Malcolm:

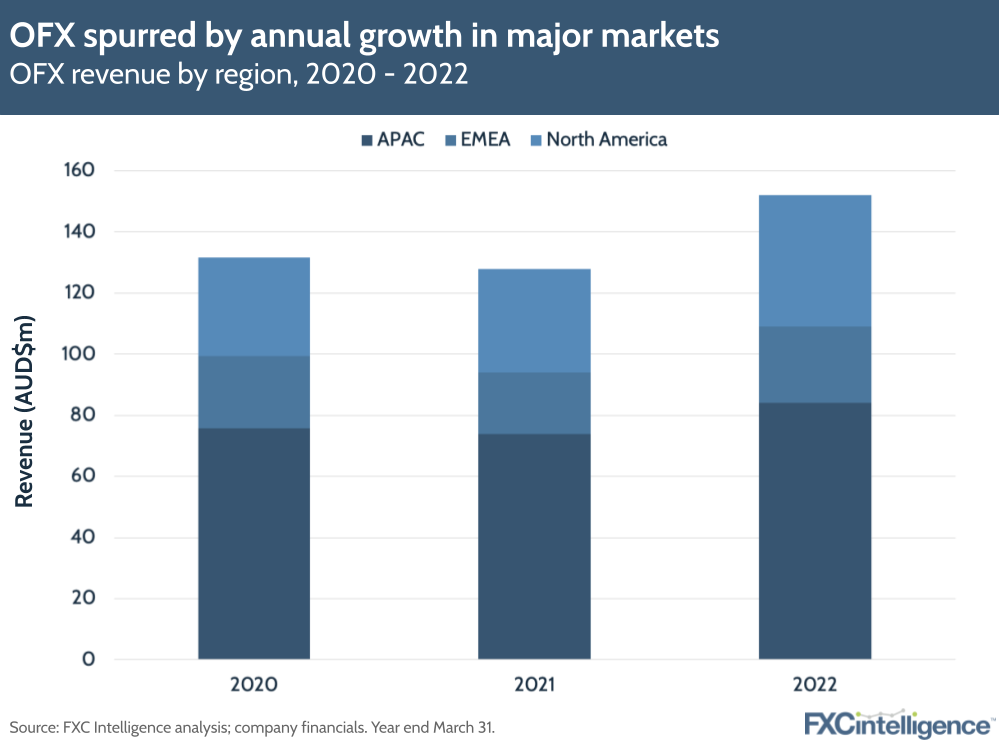

We were delighted that every region and segment grew over double digits – in many cases, 20% plus – and with operating leverage. Regionally, North America was a real standout, but bear in mind Europe also grew north of 20%. Admittedly, they dipped a bit more in fiscal year ’21 than North America, but it’s a very good growth story coming out of the UK and Europe.

Same with APAC, which grew about 13%. If you take out the very unusual offshore share purchases that we saw in fiscal year ’21, it was well north of 20%. There was growth in consumer and corporate. Our online sellers business ex Asia is growing nicely despite the ecommerce downturn, and even our enterprise segment grew over 30%. So we’re very pleased to see such quality across the board and such momentum.

It’s frankly nothing that we haven’t been talking about. It’s investing in a scalable platform, a much better client experience, strong risk management and strong people. Frankly, it’s investing in those areas where we think we can grow like North America, as well as partnerships and online sellers.

Figure 1

Factors driving OFX share price growth

Daniel Webber: What’s continuing to drive your share price up against the broader context of a market downturn in payments and fintech?

Skander Malcolm:

Generally speaking, with share prices, you get what you get. They’re a function of sentiment. The positive sentiment around OFX is, firstly, because you’ve got business momentum. In the past, OFX has been two steps forward, one step back. There would be a great half followed by a weak half, or a great deal followed by not enough revenue, and investors were impatient with the lack of momentum.

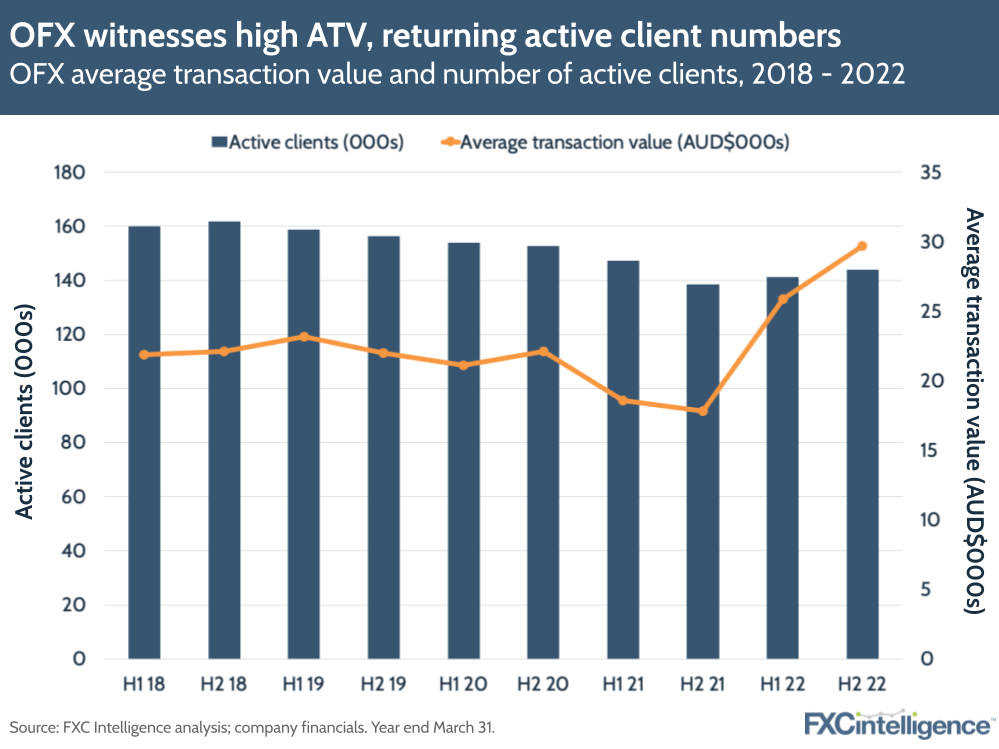

Now they’re seeing about six or seven quarters of consistent quarter-on-quarter growth since the first half of fiscal year ’21. Secondly, they’re seeing the benefits of prior intangible investments, such as transaction monitoring and fraud software. In fiscal year ’22, losses were a hundred thousand dollars on a $33bn turnover business, down from over $3m a couple of years ago. So investors are starting to see the benefits of a lot of investments and a momentum in the revenue.

Strategically, we’ve said for several years that our corporate segment has really been undervalued. It’s a high-recurring revenue business, and it’s hard to just go and win clients at scale.

OFX has a particularly distinctive value proposition that it executes well. Now you’re seeing very strong corporate revenue growth through the cycle, and investors like that because it addresses their concerns about two steps forward, one step back.

In terms of the share price, relative to some it’s still not that fully valued on a multiple basis. Bear in mind, it generates real EBITDA. Statutory NPAT grew by more than a hundred percent, and that’s not underlying EBITDA with an asterisk. It’s the real thing. That’s a very high-quality set of earnings with very strong cash flows. That’s what investors are starting to get more interest in as we move onto the next stage.

Figure 2

OFX’s pricing strategy

Daniel Webber: How do you think about pricing? How do you talk about it with investors?

Skander Malcolm:

For investors, we’ve guided stable net operating income margins across the five years I’ve been at OFX, and we deliver that. Pricing is a function of a segment that you’re targeting and the service that you deliver. If you believe that you cannot get any price for the service you deliver for that segment, I’m struggling to see the point of investors parking money with you.

The segments we target want a great digital platform that allows them to self-serve. We’ve talked about it very consistently and we’ve delivered it. In our case, over 90% of those transactions are digital. But they also want to talk to someone when they want to, and that’s the key to price.

Our NOI margins are in the 50 basis point range. That’s a very low price relative to the banks and competitive with a lot of the competition. When you add on service and trust, people are happy with that. That’s why we believe we can get stable net operating income margins.

There are value propositions where the price probably should be zero because there’s not a lot of value-add. People say for a $100, $200 or $500 transaction, it should be instantly free. However, typically our average transaction values for consumers are $18,000. In the last 12 months, they’ve been much higher than that because consumers have been selling and buying shares and property. Those are large transactions where the value-add is very real.

If competitors can’t serve those large-value transactions, they’re going to come back to OFX because they know that we’re here and we’re supported by strong banks, so we’ll get a price for that. Not excessive price by the way; we’ll still save customers a lot of money!

It’s exactly the same thing with the corporate space. SMEs are dealing with a lot of friction, such as supply chain and labour shortages. The last thing they need is their payment company to say, “Sorry, we can’t support transactions over a certain amount for an extended period of time.” Price reflects, if you like, the service that they feel is a reasonable service. That’s why we commit to stable net operating income margins.

Firma acquisition and future growth plans

Daniel Webber: OFX also recently released its three-year strategic plan. Tell us more about this.

Skander Malcolm:

The three-year plan is actually the same strategy that we’ve been talking about for some time. Obviously, the acquisition of Firma accelerated the financial outcomes and the financial envelope for investors, so now what they’re seeing is a far more corporate business. It went from being circa 40% or 45% of revenue to north of 60% of revenue. The US and Canada, or North America, is going to be a much more significant part. Around a third of our revenue going forward will be APAC, while two thirds will be global.

[The acquisition] took that three year outlook, which we were working toward organically, and just accelerated that to be more corporate, more North America. We now need to implement and activate those enterprise opportunities so that, from a revenue perspective, we would get a higher contribution from our enterprise segment (off a much bigger base).

We’ve got a strong pipeline there and it’s our job to go execute that. The three-year view is no different to the one year in terms of the main headings, it’s just substantially bigger. Firma’s really helped with that.

Figure 3

Expanding into global markets

Daniel Webber: It seems OFX has changed its Australia/New Zealand focus to be a more globally facing business. Is this a positive for investors?

Skander Malcolm:

Absolutely. We look at the TAMs and the SAMs in North America and Europe (and Asia for that matter) and they just dwarf Australia and New Zealand. We love Australia and New Zealand and we’re a very proud Australian company, but we’ve just got to grow, and grow sustainably.

Frankly, the headroom is only in North America and UK and Europe. So that’s really where a lot of the effort has gone in the last four or five years. I’d emphasise that they’ve done an amazing job in Australia and New Zealand turning around the core of the business, and that’s what funds everything else.

The importance of operating leverage for investment

Daniel Webber: Where are you gaining operating leverage from? And what are the benefits of that?

Skander Malcolm:

With the addition of Firma, we’ve got a lot more revenue, and that means we get more optionality for our investments. Clearly there are synergies, from a bank fee and technology perspective. That just frees up money for us to reinvest.

For example, in fiscal year ’22 we were performing very well, so we went to our regions and said, “If we could give you more money, what would you spend it on?” We ended up greenlighting a couple of things. One was our NHL sponsorship, another was an extra investment in our online sellers business. Those wouldn’t have happened without that headroom generated by good performance. Now we’ve put Firma in, we’re getting larger budgets that we can play with, and there’s a whole list of things that we’ve got lined up to invest in.

However, we’re not shooting for operating leverage in fiscal year ’23. This is a year to combine Firma with OFX, there’s going to be a lot of moving parts and we want to make sure that goes well. But generally speaking, it’s not a bad rule because it tends to give you pretty good insight as to what’s working and what’s not. At our stage as a company, in terms of our maturity, we ought to be able to generate operating leverage.

As a 30% EBITDA margin business, we can reinvest it intelligently. We could also make a whole bunch of dumb bets and we don’t want to do that. That’s not to say we won’t make a lot of bets (we do) but we should generate a return in a reasonable timeframe.

Employee growth in a challenging labour market

Daniel Webber: Anything else you want to add?

Skander Malcolm:

In my career, I have never seen such a challenging labour market for a number of different reasons. There’s not one CEO that I talked to that’s on plan for people.

The Firma acquisition gives us access to around 200 people, and we’ve now had the opportunity to spend time with them. They’re specialists in the industry and they’re passionate about growth, so that’s a good fit with OFX.

That’s something that a lot of investors didn’t really appreciate. For a smallish company like OFX with 400-something employees, to get 200 in one go who are specialists in the industry – we are very excited by where that could take us.

The information provided in this report is for informational purposes only, and does not constitute an offer or solicitation to sell shares or securities. None of the information presented is intended to form the basis for any investment decision, and no specific recommendations are intended. Accordingly, this work and its contents do not constitute investment advice or counsel or solicitation for investment in any security. This report and its contents should not form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. FXC Group Inc. and subsidiaries including FXC Intelligence Ltd expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in this report, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting there from. This report and the data included in this report may not be used for any commercial purpose, used for comparisons by any business in the money transfer or payments space or distributed or sold to any other third parties without the expressed written permission or license granted directly by FXC Intelligence Ltd.