For Q2 2021, MoneyGram has continued its strong run of results with an 18% year-on-year increase in overall revenue – 8% up on the pre-pandemic Q2 2019 – driven by record digital customer numbers. In our latest report download, I caught up with CEO Alex Holmes to dig deeper into MoneyGram’s resurgence.

MoneyGram continued its strong run of results with an 18% year-on-year increase in overall revenue – 8% up on the pre-pandemic Q2 2019 – driven by record digital customer numbers. This included a 92% year-on-year increase in cross-border transactions through the MoneyGram Online app.

Overall, the company’s cross-border volume climbed 41%, assisted by signs of improvement in its retail business, particularly in Europe and the Middle East, although this remains muted in areas still badly hit by the pandemic.

MoneyGram also announced that it has exited its Deferred Prosecution Agreement (DPA), which has allowed it to undertake extensive debt restructuring. As a result, MoneyGram is anticipating increased liquidity for Q3 and Q4 of this year.

With two major challenges now resolved, how is MoneyGram planning to capitalise on its new financial stability? How will it build on these digital wins? And how will it achieve synergy between its retail and digital businesses?

FXC Intelligence CEO Daniel Webber had a detailed discussion with MoneyGram CEO Alex Holmes to find out more.

Topics covered:

- The economics and challenges of moving retail customers to digital customers

- The five big initiatives MoneyGram is focusing on to drive digital to a 50% share of the business

- Does MoneyGram really have a legacy tech issue or is the market unfairly comparing a retail/digital business to digital only players?

- The “tremendous opportunity to partner” with MoneyGram in response to the acquisition rumors circulating in the press

Drivers of a Record-Breaking Quarter

Daniel Webber: Let’s start with the top line. If we’ve done our maths right, at a 2.9% take rate and a revenue of over $300m puts you above $10bn of flow. For probably the first time ever, since you declared it as a record-breaking quarter. What’s driving that?

Alex Holmes:

It definitely was a record for a lot of things. Generally speaking across the board, we’re definitely seeing record volumes through digital record transactions and total. That’s translating, generally speaking, into some records for revenue on the digital side. The momentum’s all there.

What’s interesting is that it’s hard to see forward progress when there’s a lot of churn. We’ve talked about online pricing, digital pricing is about a third lower than what you see in the traditional walk-in space. If you’re growing 33% and flat in walk-in, then you’re just replacing revenue, but with more transactions, more volume, more customers. I think the health of the business is probably as good as it’s ever been, but you’re displacing old, higher RPT, less customers, less transactions, but higher-revenue business.

What’s interesting about it is you’re getting a stronger business – more volume, more customers, more transactions – but it’s at a lower revenue. There’s the displacement curve going on because Covid continues to impact the walk-in business in such a material way.

So it says a couple of different things. I think about what’s happening in the market, but what’s quite fascinating is really just generally for the industry is the amount of volume that is actually flowing through the system right now.

It indicates the health of the business moving forward. But we are in this transitional phase. So, if you’re a pure-play digital player, you’re probably seeing huge growth rates right now and huge following surges and you’re probably very happy. For us, I’m equally happy but it’s a smaller piece of a bigger business, and the bigger business is treading water as Covid continues to move about.

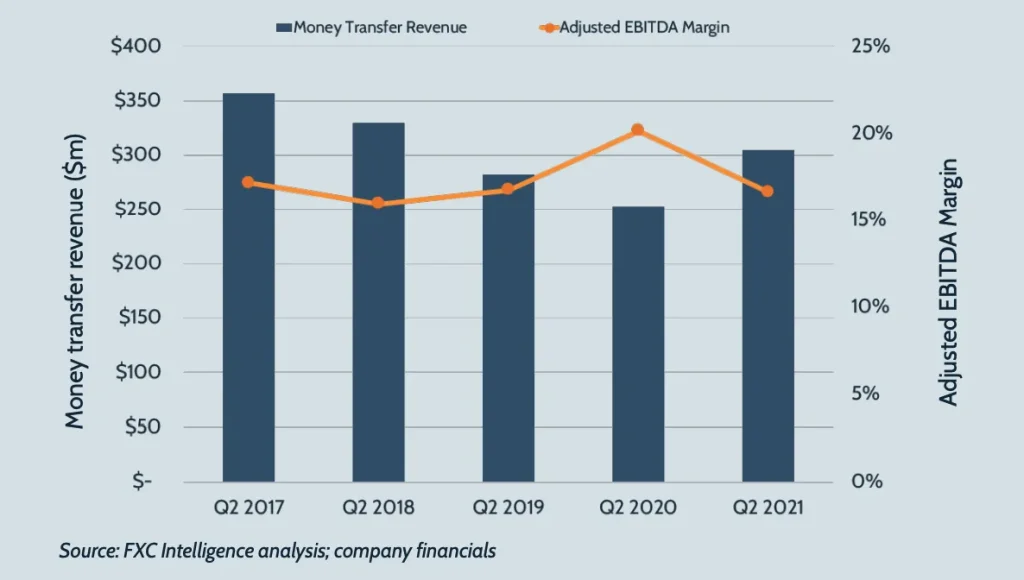

Figure 1

Money Transfer Revenue and Adjusted EBITDA Margin

Moving Customers to Digital

Daniel Webber: This quarter you had 85% brand new to digital, and you’re aiming for 50% digital by 2024. Given that only 15% are coming over from retail, I’m sure you’re looking at it, but why aren’t you focusing more on moving retail customers over?

Alex Holmes:

There’s a couple of different ways to look at it. Broadly speaking, trying to change consumer behavior is difficult. You can influence consumer behavior, but changing consumer behavior is a little bit like punching water. It’s hard to take someone in a walk-in space, take them out of that walk-in space and get them to do digital, unless they’re I think on their own inclined to do it.

The lockdowns, the closures, the displacement in the retail space from Covid across the board is really forcing a lot of customers to try new things. Something like 70% of people over the age of 65 tried an online application for the first time during the coronavirus because they didn’t have an alternative. 35% of people are shifting to digital, the type of sources generally speaking that they haven’t used before, during the virus. So, I think that it’s been a bit of a natural experiment because when left to other devices that tends to be where people go.

Back on the 85%, it was an interesting kind of shift. The walk-in business, we haven’t broken out our numbers, which I know annoys people quite a bit and we’ll get to it eventually. But if you just do simple math, let’s just say that the proportion of digital customers is equal to the number of transactions, and it’s going to be a little smaller, but let’s just say it’s 25%. Then you’re going to get, as 85% are new to the brand coming in, the 15% overlap. The 15% is a much bigger number that you’re pulling from. Today about 40% of all monthly active users were former walk-in customers.

The number is increasing just because of the sheer size of the walk-in business. On the flip side, even though that 15% is a small percentage number, it’s on such a large base that it’s actually beginning to fill the monthly active user pot quite substantially.

When you think about how you acquire customers in today’s day and age, we used to do sponsorships, traditional advertising and grassroots things. Given limitations on budget and global world challenges, we’ve really switched a lot of it to just social media, digital type search, app store type things.

Consumers by and large, at least in most markets, are consuming most of their media through and online applications anyway. And it saves a lot of time, energy and money over trying to put together large-scale advertising campaigns, by just doing targeted approaches on social media.

There’s a natural inflection in there where more consumers are consuming media online, you’re advertising more online. The general inclination eventually is just going to continue to be, “I’ll just stay on my phone, stay online and do the transfer and do the transaction there.” Now, it assumes of course that you are comfortable with financial banking in the online world, which a lot of people aren’t. Some people don’t have access to banking.

It also says that you’re comfortable with money going into a bank account and if there’s a delay getting the money on the receive-side, or vice versa, that you’re willing to wait for your account deposit to come in to send money or whatever the case may be.

There’s a little bit of a learning curve in there, and that’s also why the online customers are such a younger demographic, because their comfort with banking, their comfort with alternative financial services, their comfort with mobile applications is much more integrated in their thinking than it is for older generations who probably still have a propensity to maybe not trust as much in the online banking world.

Then obviously so much of the world’s economy still runs on a cash basis. People are paid in cash; they walk around with cash; they trade in cash. There is still that cash society that continues to dominate so many markets, and I just don’t know that it’s going to go away overnight. It’s going to be this slow trickle and it’ll fade. But that’s fine, because our network exists, it’s easy to maintain, and so much of the world is send and receive now anyway that it’s this hybrid blend that as long as people are picking up cash you may as well have sends enabled as well. That’s all really good.

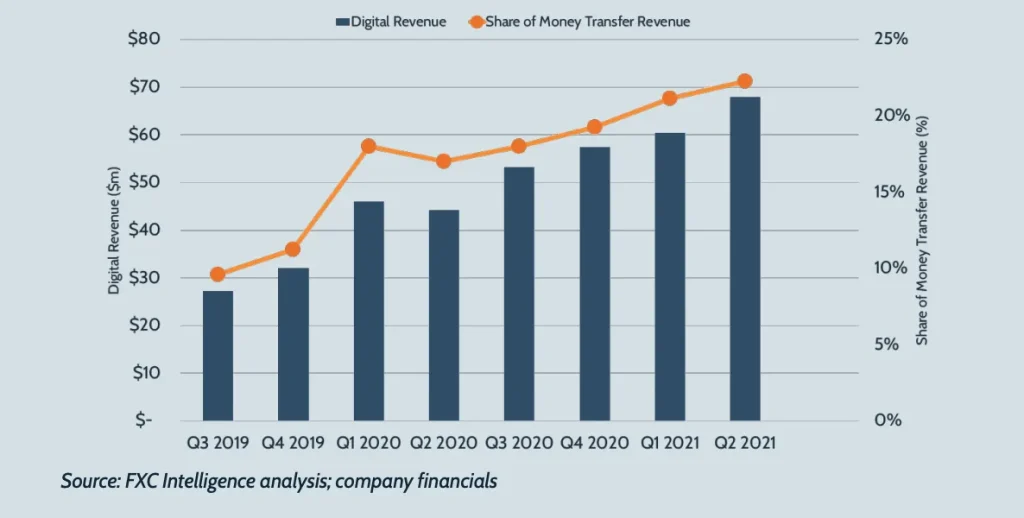

Figure 2

Overview of MoneyGram’s digital business by revenue

MoneyGram’s Brand Awareness

Daniel Webber: When we did some work on brand awareness in the sector a few years ago, MoneyGram was one of the most well-known brands for unprompted awareness. I’m not sure you get enough credit for it. Do you have any thoughts on the company’s brand awareness and perception today?

Alex Holmes:

We used to spend a lot of time on brand awareness, and we used to spend a lot of time promoting that stat. In any given market we have 80%-plus brand awareness. In Spain at one point in time, the unprompted was something close to 99%. It was pretty remarkable. I agree with you, I don’t think we get enough credit for it.

Back to the stock valuation, who MoneyGram is, there’s a lot of reality to the challenges that we’ve had as an organization more corporately than I think business-wise over the last five to 10 years. I do think that because of that churn and that displacement it has been hard to stand up and tout a lot of things. When there’s lack of financial performance, any new business is really overshadowed by challenges; people tend to fade away and give up on you a little bit, at least in the broad media financial circles. The stock trades down and it’s a little bit of a self-fulfilling prophecy.

We have a little bit of an uphill battle in terms of finding our feet again in a lot of that big-name area. I’m trying to do much more around the business in terms of media. We’re going to get back on the circuits on the equity market side. One of the things that we’re going to do as we continue to ramp back up our investment in the business is try to be more vocal, try to be more present and remind people of who we really are. We touch so many parts of the world, so many people are aware of us.

Once you leave the United States, once you leave mainland Western Europe, every country knows who we are; they welcome you. Remittances are a big deal. They get dismissed big time in the United States and thought of as an old-fashioned service.

That’s also probably why this idea of digital gets so much excitement in the press and in the news, because that’s what Americans think about and focus on. It’s hard because you get dubbed as a legacy player. And then back to the consumer, if they can associate you with a walk-in business you have to really make sure that they’re aware that you’re also in the digital space as well.

People put you into a box and then you have to get your way out of it. We’re getting there, and I think we’ve come a tremendously long way. It’s pretty remarkable to me the numbers we’ve put up in the quarter and then you kind of get that, “Yeah okay, fine. What have you done for me lately?”

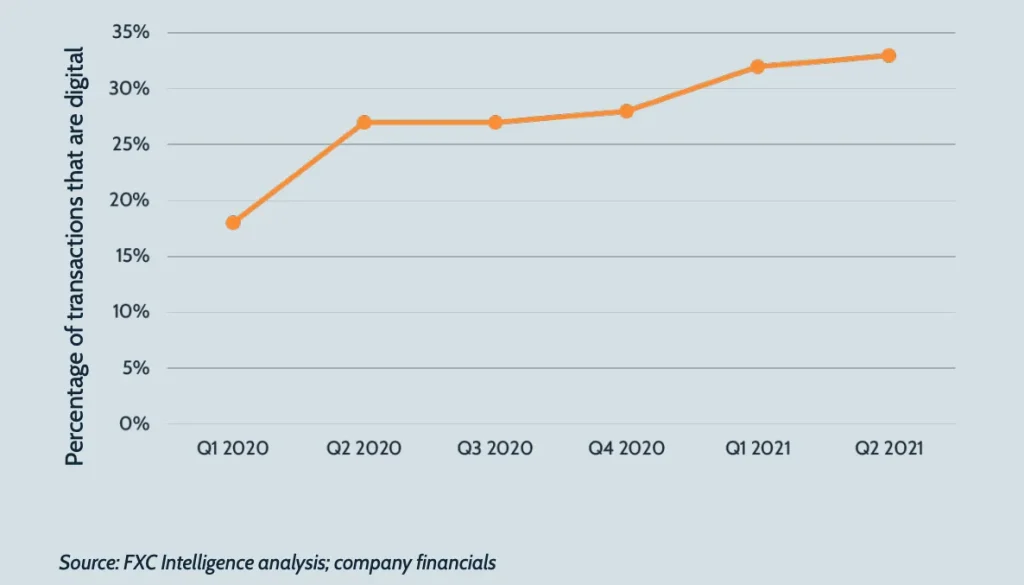

Figure 3

MoneyGram’s digital growth (by transaction share)

The Road to 50% Digital

Daniel Webber: You’ve had some good wins from digital, and the pandemic obviously gave a bit of a boost. What’s next? What do you have to do to get to 50% digital?

Alex Holmes:

It’s a really good question, because there’s a lot of thought going into that as part of our long-term planning. On the core of it, generally speaking, there’s one headwind to it big time, which is we want to get the walk-in business, retail business growing again in as many markets as possible. That’s going to continue to be delayed by Covid and the challenges around the latest on the Delta variant, vaccinations and everything else. So that’s going to take some time. Eventually, though, I do expect that that business will return to growth. And even if it only grows 2 or 3%, it’s a big business, right?

So that is something that is a natural offset to that transition. That means you have to continue to push and grow the digital business as quickly as possible. With respect to markets that we’re currently in, our market sphere is still incredibly low. There’s a lot that we need to do. There’s quite a few changes and enhancements to the app that we’re interested in pushing.

There’s quite a few opportunities to continue to improve. The investment on the marketing side, we talked about that a little bit, but one of the things we’ve been doing quite a bit is really figuring out where the marginal returns are on investment. We’ve been trying to optimize and get more targeted on the online, because you can spend millions and get nothing back for it. So we’ve been really trying to tighten that up and get targeting. That’s really lowered our cost of acquiring individual customers.

But at some point you’re losing too many customers to save money to be targeted, but then if you ramp it up you can also waste money not getting as many back. So, we’re trying to get that optimized as much as possible.

There’s an opportunity in a number of areas to try to get better returns on the customers. Because the market’s growing quickly, we’re doing really, really well, but I think we can continue to do better in many places. That’s priority one, with some of the enhancements to the customer experience and some of the user pieces.

We’re doing a lot on pricing as well, trying to make sure that that’s optimized. Continuing to promote low prices, but getting people to really see some of the account deposit services, getting people to really understand the registration and the bridging processes as well. That’s a big focal point.

Outside of where the markets are today, there’s a number of markets where you can’t go alone. We want to continue our receive-side account deposit wallet, and card deposit expansion, but on the send-side as well there’s places in the Middle East and in Africa and others where without a license you can’t be online unless you get a partner.

There’s a lot of partnership type things where we can go direct through a partner’s license, so there’s a lot of those initiatives under way. Then in markets where that’s not going to be feasible, we just continue to look for more and more pure-play digital partners where we can expand “the agent network”, but through a digitized partnership.

Then coming full circle back to where we have the app, there’s a lot more we can do, that we alluded to a little bit on the call. But right now, our target demographic is and continues to be the migrant worker, the $300 customer, etc. etc. As we do more with Visa Direct, there’s an opportunity to do more domestically. Venmo’s starting to rise prices, for example, in the US, so there’s a huge opportunity here.

There’s domestic transfers everywhere so that’s an important one. High-dollar senders we’ve talked about a little bit. Wise is doing an amazing job with that. We have an eye toward that. I don’t know necessarily that it’s going to exactly emulate Wise, but the idea behind that in terms of we tier fees and FX rates today, but could I just charge you $20 to send $5,000, as long as it’s account-to-account. There’s some credit learnings we need on that and others. But there’s a lot that I think we can do to evolve the front-end service to customers.

Then, more farther afield but interesting to us, are looking at what others have done in the crypto space; looking at what others have done in terms of bank accounts and debit cards and other ancillary services. I don’t know how many of those things will make sense for us, or in which markets customers will be attracted to that or not.

There’s a lot of competition out there. But there’s more value-add that we can put through to the app, to customers that we have today, and I think that it’ll be market-specific. That’s probably four or five big initiatives that we’re running in the background in terms of how to do more on the digital side, to ensure that we’re getting that throughput into growth. Some of those are just continuing what we do today but doing it better, then some of those are add-on value-add that we don’t do today which are exciting. So it’s a nice balance of both.

Responding to Legacy Tech Claims

Daniel Webber: People have said to me that MoneyGram’s stuck with a lot of legacy tech, but I know that you’ve invested significant money to replace it, so I’m sure there may be some legacy stuff left, but there must be a lot of new stuff. What are your thoughts?

Alex Holmes:

I’ve heard it a lot more recently. Here’s the evolution of my life in the last several years. First it was we have this DPA so we have terrible compliance so don’t sign with MoneyGram. Then we put in the ID stuff and then they said, “MoneyGram, their rules are too harsh, their restrictions are too hard. They’re going to go out of business.” Then the stock price dropped. Then we were going bankrupt.

Then Ria and Western Union started saying we have too much debt, and then, “You can’t sign with them.” Then they said we don’t have any cash, then they said we had too much debt. Then we were going out of business on compliance. Oh, then we were dubbed as we’re no good at retail. Then I was told we’re no good at digital.

Yet here I am and we’re still churning out what again was a record quarter for us. So, I would say that the stats say differently. We’ve been very open.

I’ve been very open about our five big challenges that we’ve had, and those were we had legacy compliance issues, which we checked off, we had balance sheet issues, which we’ve now checked off. We had the PE overhang, we had all that sort of stuff, that’s all gone. We had the legacy tech and really deficient digital. Digital, we’ve checked that box, and the deficient tech, that’s been an ongoing process to change and upgrade.

We have some of the leading APIs in the industry today. We’ve got a new set of APIs coming out in the next 120 days, which are going to basically change any perception of that. We have a new system that we’re rolling out globally called AgentWorks, for which there’s been some bumps and bruises along the way. Any time you roll out a new, full, front-end stack for agents it can be challenging. But when you compare what we call our AgentConnect system to what WU calls their Western Union Agent Gateway ours blows everybody away.

When you start talking about agent front-end technologies and you compare that to online digital, can you say that those are the same? No, you never can. I don’t know where the comparisons are coming from, but there is no possible way that anyone who thinks honestly that Euronet has technology that’s anywhere close to better than ours, that’s just a joke.

If Western Union is a hundred percent modern, so am I, and if they’re a hundred percent antiquated, so am I. There’s no way to distinguish the two.

Then our last big project that we’re currently in the middle of is full migration to cloud. Ria owns nine data centers around the world. Western Union still has a ton of data centers. We just have two and we’re looking to completely sunset those sometime in the next 18 months and be fully cloud-based.

Everything we do that’s digital, our entire MoneyGram Online stack, the entire piece is 100% digital, it’s in the cloud, it’s all digital mobile-first. And everything else is currently being rewritten to migrate to the cloud. But the migration to the cloud is more about growth, efficiencies and modernization going forward. We run our system 24/7. Like anybody else’s, it goes down from time to time. I mean, every third or fifth Sunday I try to get onto the Chase app and it won’t let me in. Everybody’s got to upgrade something sometime.

We’ve got a couple of areas that we’re not happy with and we’re going to continue to fix those issues. But I don’t know where that comes from or why people are starting to say that we have legacy tech and that’s somehow a deficiency for us. I think we spend probably about half as much as we used to on technology these days because of the efficiencies we’ve gained. The amount of space that we’ve taken for our own data centers, we’ve shrunk those materially.

I’ve said very openly, maybe this is what irritates people, we have the best data analytics group in the entire industry. I think we have the best analytics on our customer as anybody, we’ve the best database on our customer, the best customer information of anyone in the industry who has a physical presence of any kind. And we blow everybody away on that front end.

I would challenge anyone who says we have legacy technology, for them to prove that they don’t, unless it’s a pure-play digital person, in which case it’s not even the same sport, so I don’t know what the argument is.

Partnering Opportunities

Daniel Webber: In your earnings call you had to field 17 questions about the acquisition rumors and all the rest of it, so I’m not going to bother you with that. But your closing comment was, “Tremendous opportunity to partner.” What do you mean by that?

Alex Holmes:

At the end of the day, the world has changed quite materially. There are days where you’re in a world where you are competing; you go to do an RFP on a large business and there’s others making a bid on that RFP, and you’ve got to try to win that.

But I don’t think that the world really exists on its own anymore. It’s one thing for us to have the MoneyGram network, but it’s another thing to say that it’s really a 100% standalone network that doesn’t rely on or benefit from other people. So there’s a variety of ways to slice that answer. But I get questions all the time on Visa.

I don’t know what Visa’s agenda is, but right now I’m benefiting from the partnership that we have with Visa in a material way and pushing through transactions to Visa debit cards that others aren’t really doing today, and we’re having an amazing time doing it. It’s creating a value-add service for our partners and for our customers, so I’m going to continue to do that from a partnership perspective.

There are blockchains out there, Ripple was a good example, that want to take over the world and put us out of business. I’m happy to partner with them and run transactions through their rails, if there’s mutual benefit in doing that. So, there’s a lot of misplaced views of what networks are, how you can rely on others. And I think so many people have this mindset of, “I’m going to do it myself and 100% myself.” This reminds me of the old days with telcos when they started to get into money transfers. Orange and Africa – it wasn’t enough that they were going to do one country. It was basically, “Go away, I’m taking over the world.” And yet here we are 10 years later and it’s like where did MPesa go after Kenya and Tanzania? They didn’t go anywhere.

It’s the same thing that everybody runs into. Doing things in your domestic market is so easy. Doing things cross-border; doing things in multiple countries; doing things far afield in the financial world is really complicated. I don’t know how many times we’ve gone around the horn with Facebook only to have them say, “Oh it’s fine, we’re going to do it ourselves.” It’s like, “No, you’re not. So, eventually you’re going to call me back and we’re going to have this conversation again because you’re not going to do it yourself.”

What we’ve tried to do as MoneyGram is just be different. I want to be different; I want to be innovative. I’m not concerned about competition in the partnership sense. I’m always going to compete head-to-head with Ria, I’m always going to compete head-to-head with Western Union. But there are so many places that we sit in the same locations, there are so many places that we sit with the same partnerships. It’s sort of silly to always be thinking in this negative light that there isn’t room for everybody to win.

Daniel Webber: Great Alex, thank you for your time.

Alex Holmes:

Thanks.

The information provided in this report is for informational purposes only, and does not constitute an offer or solicitation to sell shares or securities. None of the information presented is intended to form the basis for any investment decision, and no specific recommendations are intended. Accordingly, this work and its contents do not constitute investment advice or counsel or solicitation for investment in any security. This report and its contents should not form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. FXC Group Inc. and subsidiaries including FXC Intelligence Ltd expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in this report, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting there from. This report and the data included in this report may not be used for any commercial purpose, used for comparisons by any business in the money transfer or payments space or distributed or sold to any other third parties without the expressed written permission or license granted directly by FXC Intelligence Ltd.