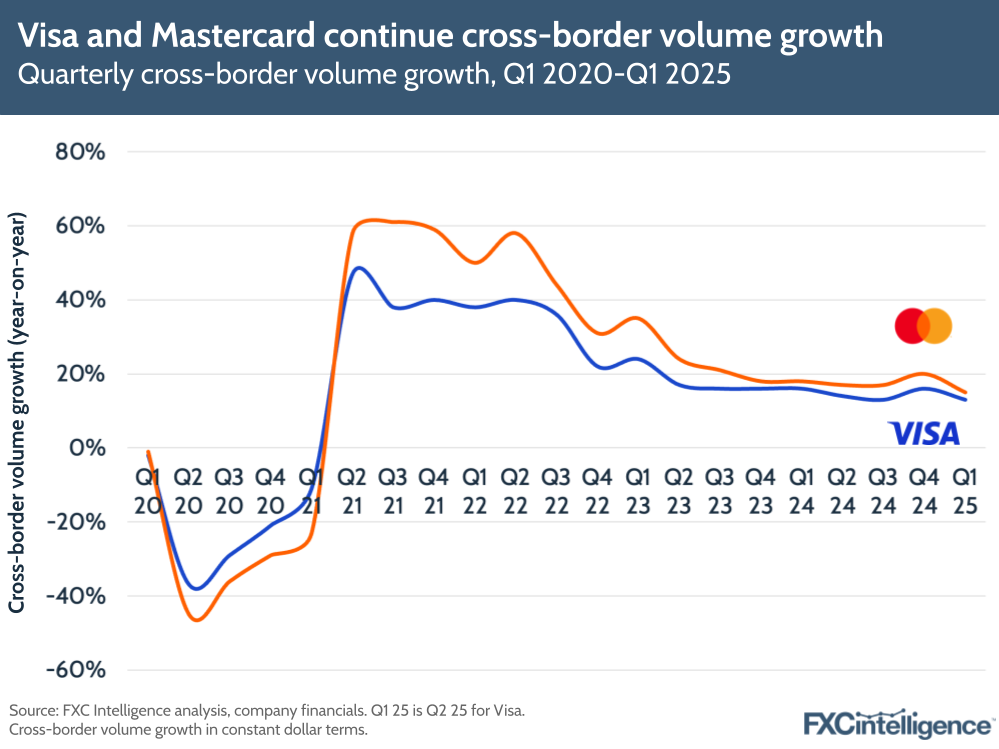

Mastercard and Visa have both announced their calendar Q1 2025 results, reported as financial Q2 2025 for Visa, and while current global market conditions present some potential future challenges, both reported strong cross-border metrics.

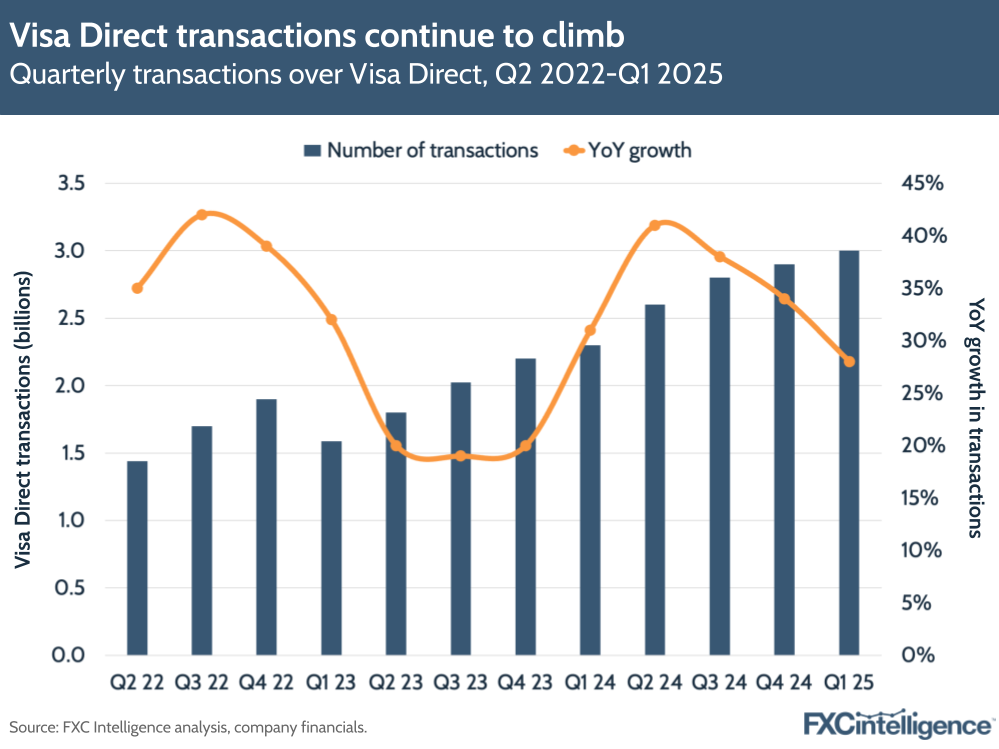

Both companies continued to see cross-border growth in card usage, but also reported key gains in their network platform products Mastercard Move and Visa Direct.

Visa’s Q2 2025 results highlights

Visa reported a 9% YoY increase in net revenue to $9.6bn and an 8% overall increase in payments volumes. This was aided by a 7% increase in Visa credentials (payment instruments issued by Visa) as the company continues to focus on displacing cash in key emerging markets.

Cross-border volume outpaced overall volume growth, with both overall and excluding intra-Europe cross-border volume increasing 13% YoY. Cross-border travel was just below this at 12%, while cross-border ecommerce increased by 14%.

Visa also highlighted ways it is targeting affluent cross-border travel customers, including through continued development of its premium Visa Infinite card product, including the launch of a version with Scotiabank.

Visa Direct, meanwhile, saw a 28% increase in transactions to three billion, and has also seen a number of key recent partnership announcements. These include an expanded agreement with US money movement platform TabaPay and the launch of Visa Direct’s push-to-card solution in the UAE with Checkout.com.

Commercial & Money Movement Solutions, which covers both Visa Commercial Solutions and Visa Direct, also saw a 13% YoY increase in revenue in constant dollar terms. However, the company said that this was partly offset by the lapping of one-time items as well as lower growth in cross-border volume.

Visa also gave an update on its nascent stablecoin initiative, reporting that it had passed $200m in cumulative stablecoin settlement volume, and that BBVA, its first pilot partner, would be launching a stablecoin later in the year.

Acknowledging the “increased levels of economic uncertainty” from the US tariffs, Visa expects Q3 and and Q4 cross-border volume growth to be slightly below that of Q4 2024. It has also seen higher volatility in April but assumes this to be moderate for the rest of the year.

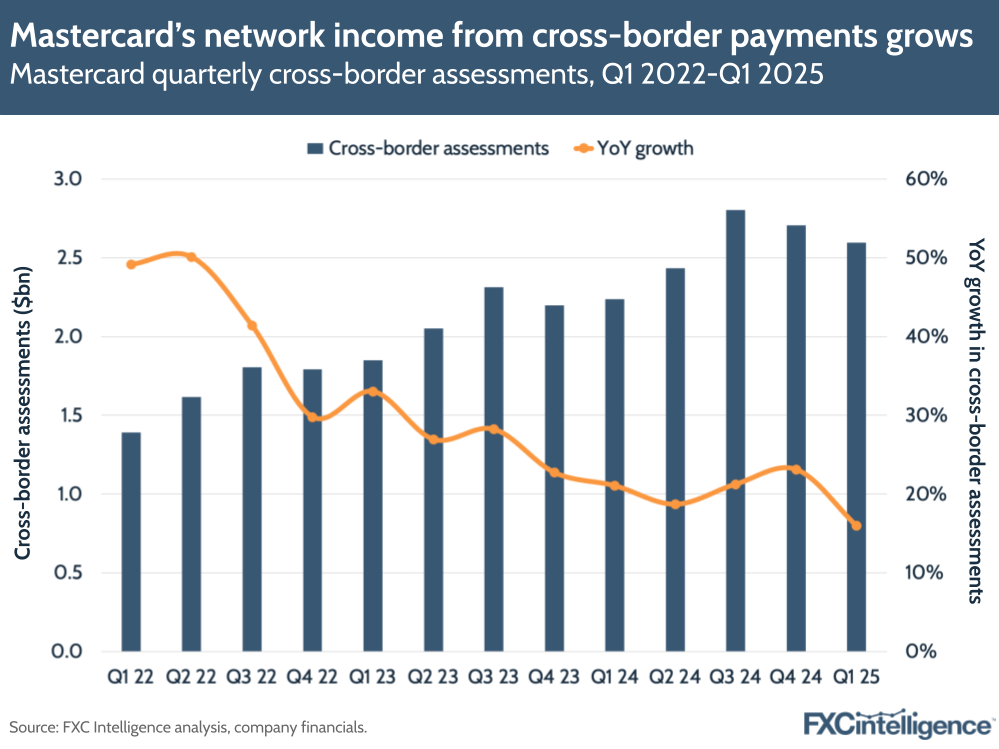

Mastercard’s Q1 2025 results highlights

Mastercard reported a 14% YoY increase in net revenue to $7.3bn, or 17% on a currency-neutral basis, while the company’s payment network net revenue increased by 13%, or 16% on a currency-neutral basis, aided by a 9% increase in volume to $2.4tn.

Cross-border volume was cited as a particular driver for both revenue and overall volume, growing 15% YoY on a local currency basis, while intra-Europe volume and cross-border volume excluding Europe climbed by 15% and 16% respectively. Cross-border travel was at 12%, down from last year’s 17% growth, while cross-border ecommerce saw the highest growth at 19%.

Cross-border assessments, the income Mastercard reports from fees associated with cross-border payments on its network, also grew by 16%, or 18% on a currency-neutral basis. The company said that the increased growth relative to cross-border volumes was the result of international market pricing.

Mastercard Move, meanwhile, saw transactions grow by more than 35% YoY, with the company highlighting several new partnerships, including MoneyGram, InstaPay, Checkout.com and Worldpay. The company also highlighted its investment in Corpay, announced earlier this week, which improves the capabilities offered in Mastercard Move’s corporate payments services, particularly around hedging and risk management.

Mastercard also highlighted its ongoing work to support agentic AI, including Mastercard Agent Pay, which uses agentic tokens to enable AI agents to enact payments. The company is already working with Mastercard and OpenAI in this area.

Acknowledging the current macroeconomic turmoil, Mastercard highlighted the diversified nature of its business, stressing that no cross-border corridor pair represented more than 3% of its business. While the company has seen a drop in inbound cross-border travel to the US, it reports seeing this offset by increases elsewhere, with improved trends in Europe, the Middle East, Africa and Asia-Pacific.

The company now expects consumer spending to remain “healthy” for the rest of the year, although it is estimating minimal impact to revenue from foreign exchange as a result of recent currency fluctuations.