FXC Intelligence’s Daniel Webber spoke to MoneyGram CEO Alex Holmes about the company’s Q1 2021 earnings results and future plans.

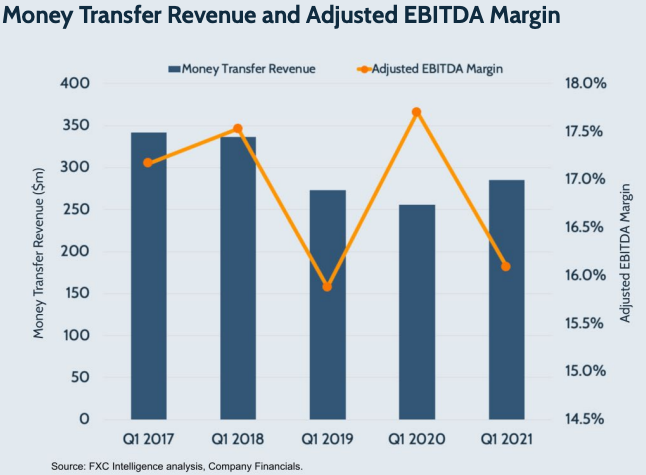

MoneyGram produced a strong set of Q1 2021 results with an 11.5% year-on-year increase in overall revenue and an 86% increase in cross-border digital transactions. This followed on from a well-received set of 2020 numbers, again driven by digital growth.

MoneyGram also announced an agreement had been reached to close out its Deferred Prosecution Agreement (DPA) with the US government related to previous compliance issues. This will provide the business with more flexibility going forward, including potentially renegotiating its debt and capital structure.

For MoneyGram, the pandemic’s impact on remittances has been more positive than expected, and the growth of digital has been particularly strong. But what lies ahead? Who are these new digital customers the company has attracted? And how will its MoneyGram as a Service contribute to the company’s plans in the rest of 2021 and beyond?

FXC Intelligence CEO Daniel Webber had a detailed discussion with MoneyGram CEO Alex Holmes to find out more.

Topics covered:

- Drivers of cross-border principal growth

- Digitisation and the market beyond the pandemic

- Balancing cash and digital on the receive side

- Positioning MoneyGram as a service

Drivers of cross-border principal growth

Daniel Webber: Let’s start with the top-line principal: you reported a 26% increase. That’s a very strong increase. What is really driving that?

Alex Holmes:

I think it’s on the back of very strong principal growth in the fourth quarter, which we talked about. I don’t think we talked about the third quarter last year, but it was up as well.

There’s a variety of factors influencing it. From a MoneyGram perspective, definitely our increase in transaction volume is helping in a big way. Finally getting back to growth, and particularly as the digital business continues to surge, we’re seeing some big increases there.

We’re also doing quite well in corridors where you see typically larger principals sent anyway – when you’re sending into account in places like Southeast Asia or Indian subcontinent, or Pakistan, as an example, you’re seeing a little bit of higher face per transaction on a lot of that, which is good. But across the board in almost every market we’re seeing an average $30, $40, $50 per cent higher than you would normally see on most transactions. Not all, but on most transactions.

A lot of that’s being driven by a couple of factors. One is a continued belief from a lot of senders that the receivers are in much more time of need at the moment than they have been before. Certainly sends out of the US have been helped by the depreciating US dollar, because a lot of senders do time their sends – they’re looking to maximise that return back home.

Then on top of that, the influence of not being able to travel, I think, is helping all of us in the industry get more money through the rails. Typically, there’s your general hawala system or travel. People will go home to their home countries at least once or twice a year, and when they go, they’ll buy all the things, they bring gifts, they bring cash.

For most people, that cross-border travel has just been massively restricted. So a lot of that is turning into additional transactions and a little bit of additional send. So it’s really a nice mix across the board. I take a lot of solace just in that increase in principal and a little bit of an increase in frequency of transaction.

But our huge surge in transaction growth is 14% across the board and that’s with the US domestic product being down. If you just isolate for the variable around that and look at just cross-border as well, the numbers are obviously significantly higher. So I think the fact that we’re getting more customers coming in and more transactions is making a big difference.

Our international piece, so basically non-US outbound, is now in the 60% range. I believe it’s around 65% with US outbound being about 35%. So we’re obviously seeing a lot of increase in our network in terms of sends from the non-US piece of the business, which is a huge transition for us because when I started here, domestic was something like 35% of the business. And the US, combined with US domestic and outbound, was close to 70% of what we did. So to see the international piece come through, it’s where most of the people are in the world. Plus, the domestic piece drop-off has been super beneficial to us.

Figure 1

Daniel Webber: The domestic piece is just a lower margin, more competitive segment. I know there’s a lot of P2P US domestic products out there. How is domestic playing out for you?

Alex Holmes:

It’s been an evolution. Traditionally it was the single fastest way to get cash into people’s hands. There’s a few things happening domestically. There are domestic migrant workers; people travel for performing and seasonal type work. There’s obviously a lot of labor in oil and gas, mining industries and stuff. So people do move around for work in the US and then send money back home. So there is that domestic side. But traditionally, you go back 10, 15, 20 years, people were paid in cash, and the fastest way to get that money back was domestic.

The other piece of it too, is that in domestic we could take out that migratory work factor: most of the sends were actually within a metroplex. So Dallas-to-Dallas type transfers, LA-to-LA, New York, general metroplex.

When we interviewed people, I remember this about 10 years ago, we talked to them and they’d all say, “Hey, I’m not working right now. I needed a bus ticket”, or “I have a flat tire. My mom sent me money for a flat tire”. A lot of that has just really turned into P2P now, and with low prices and Venmos and Zelles, it’s become a lot more standardised that way.

So there is still a subset that use it, there is a lot of emergency need in there as well and it is still one of the fastest ways to get cash. But it’s just not what it used to be, for sure.

Digitisation and the market beyond the pandemic

Daniel Webber: What market trends do you still see as transitory from the pandemic and what is here to stay?

Alex Holmes:

My belief is that if there was a day, and there won’t be because it’ll be a transition, but if there was a day when suddenly everyone was vaccinated or whatever, and all the markets reopened, I think there is going to be a pent up demand for travel and I think a lot of the extra money flowing through our systems will fall back out as people go back to their old behaviours, and this is in a perfect scenario. But then I think what we’ll see is the return of migrant workers, the return of cross-border movement. We’ll see a huge upswing in hospitality, travel, cruise ships, hotels, restaurants.

Then I think that that’ll bring back a lot of that summer migration and winter patterns and movement in the Middle East and other places for mining and for oil exploration, etc. So I think it’ll blend itself back out, honestly. And I think that we’ll go back to a period of sustained growth as the world kicks back into gear again.

That would be a perfect scenario. I don’t think that’s going to quite happen: I think that we’re going to see a little bit of a blend. You’ll see some markets reopen again for travel and people be comfortable but other places are going to stay muted for a while.

It’ll slowly transition and blend back together. Assuming coronavirus can be controlled – and that’s a big if, because it seems like it can, and then every time they say it can, it slips a little bit. There’s obviously huge issues and crises in a number of countries right now. So time will tell a little bit, but what I think we’re seeing is that there is going to be an increasing demand, and that that’s going to be sustainable for some future period of time. Probably a couple of years, at least.

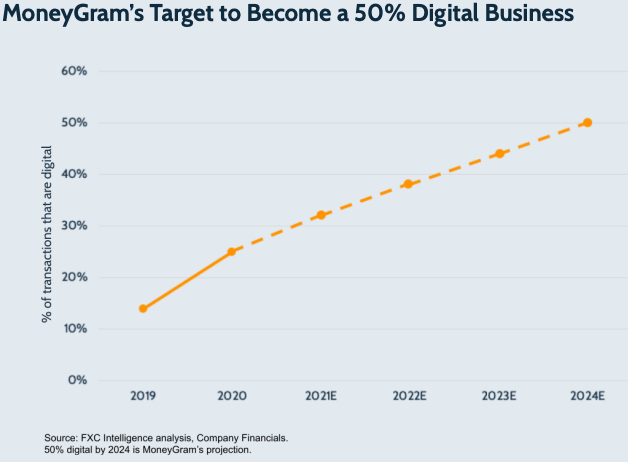

The transitional piece that I think is going to be more permanent is really on the digital side. When you look at our numbers and some of the stats that we share, two thirds of our customers on the app right now are millennials and Gen Z.

Which says that the age demographic for that app and the demand in the mobile space is transitioning younger, which intuitively makes a lot of sense. They’re growing up with electronics, they’re growing up with digital banking and digital banking alternatives, and they’re looking at that as a permanent shift.

Also once people start sending to bank account, it’s a little stickier and we see that in our data. The customer lifetime value in the app is about three times as high. The number of transactions they do is about three times as many.

Daniel Webber: That’s not 30%, that’s 300% higher. That’s a big difference, because that’s a fundamentally different type of customer that’s worth three times the amount of a traditional retail customer.

Alex Holmes:

Absolutely. I think that’s the beauty of stickiness in the customer experience.

Many people are now paid into bank accounts that used to be paid paychecks. So many markets have been pushing so hard, particularly in the Middle East and in Europe, and even in the US, although we don’t talk about it as much.

They’d go cash their paychecks, and then they’d send money. Now a lot of that’s just being pushed directly into your bank account. So we saw this transitional period back in the mid-teens where consumers would go to the bank and pull the cash out of the ATM and put it across the counter. But I think as time has gone on, younger generations have come through, people are getting used to doing more and more on phones and on apps.

I think that that transitional mental thought isn’t there anymore. Now it’s just more natural. You’re paid digitally; people aren’t used to seeing cash. You’re seeing signs in places, at least in the US, where no one wants to take cash anymore. Small merchants don’t want to walk to the bank and make deposits.

There’s a big push for a cash-neutral world and a digitised world. I think that that bleeds right into what we’ve been pushing. Once you get that stickiness, once your bank account is linked, once you have your senders listed and the pricing is good, why are you going to change?

The three times higher lifetime value is really driven by the repeat transactions. It’s not this significantly higher margin, because the pricing is quite tight, and you’re very honest about pricing. It is driven by the stickiness, the repeatability, because the margin on retail is good but it just doesn’t stick as well.

Figure 2

Daniel Webber: The three times higher lifetime value is really driven by the repeat transactions. It’s not this significantly higher margin, because the pricing is quite tight, and you’re very honest about pricing. It is driven by the stickiness, the repeatability, because the margin on retail is good but it just doesn’t stick as well.

Alex Holmes:

That’s right. And at the end of the day, when you walk into a location, particularly the non-exclusive space, there’s a lot of agent/teller influence on that. If somebody’s got a better rate for the agent today, because agents are working on commission, they will push a product.

Oftentimes one of our frustrations is they’ll even go as far as to say, “Oh, MoneyGram is not working today. Use this service today.” So there’s a lot of switching happening at sale.

It’s amazing, we continue to see an increase in new customers every month, yet 85% of all of our new transactions are really coming from repeat customers. So that does show you the frequency of the customers once they stick.

Then the beautiful thing about the online world is the authentication costs are all on the first transaction. That can be pretty expensive: customer acquisition costs or marketing, they’re not super high, but that’s expensive. You’ve got to authenticate them, which involves quite a bit more upfront costs on that first transaction. But once you’ve got the customer, the repeatability is pretty straightforward and the incremental margin on that is a lot higher. So it’s definitely a super value add piece there.

Daniel Webber: I know people ask you on the earnings calls what level of your retail business is being cannibalised. I think it’s a red herring, because it’s a completely different customer set: one is a Gen Z younger person and the other is the traditional person. Do you see it as two different customer sets?

Alex Holmes:

Yes, absolutely. On any given month, the number of customers that are transacting, there’s a very, very small overlap. 80% are repeat customers. When you get into how many of those customers are brand new, how many are repeat, and then how many are in that toggler space, the toggler space is actually relatively small, the number of customers that we’ve actually seen in the walk-in that have transitioned is also quite small.

You’re seeing, not a massive difference, but you do see an age demographic difference as well in the walk-in customers versus the online ones again. So you have higher Gen X populations, higher boomers, etc., in the walk-in space than you do in the digital, which makes perfect sense.

Balancing cash and digital on the receive side

Daniel Webber: Let’s talk about the receive side of digital transactions. The vast portion is still going to cash, and that’s important because that’s the MoneyGram network. But you’ve had this additional trend in digital, which is now seeing great growth, on paying out to a bank account or mobile. But one of them is leveraging your existing retail infrastructure and one of them is leveraging your expanding digital payout infrastructure. Talk us through some of those trends on the receive side – are they going against one another?

Alex Holmes:

It’s dynamic, which is probably the only way I can phrase it. Sending to account is really not for everybody. There’s a lot of underlying trends on that, and it’s important to think through them.

When you’re sending to another person, the beautiful thing about all of our networks at the end of the day is that most of them were built on cash-to-cash, and ubiquity was king. Now we’ve changed a lot of that with our data collection requirements and compliance standards and other things. But there was nothing easier than just simply sending money from Alex to Daniel and go pick it up and who cares.

The cash network is pretty important: putting cash in your hands, there’s nothing more liquid than that, particularly when you’re in developing markets around the world. You start thinking about a lot of Asia, you start thinking about Africa, South America, Latin America. In the old days, 80% of that money was typically spent within 24 to 48 hours on food, shelter, education, basic needs.

That says a lot about what the business is and what it does. I always go back to Bangladesh when people are living on a dollar a day on average, and then you’re sending a remittance of $300. That’s life changing for somebody.

There’s a desire to have that in your hands and physically see and feel it and be able to utilize it instantly, because in Bangladesh there’s not a lot of alternative in the market. Everything is traded in cash. You go to Africa, it’s the same thing. You guys have seen it a million times.

So it is still today a super important part of a lot of the remittance mix. It’s a very important part of a set of the demographic of the world and for people that are in need of money, and cash is still relatively king in most markets. It’s the most liquid tradable form of payment that you can have, particularly in countries where you don’t necessarily trust the governments. There might be a lot of inflationary factors or deflationary factors, or just all sorts of challenges with governments and trust in banks and that type of thing.

But with the rise of fintech, with the rise of payments, with the changes in those areas, people have, I think, gotten a lot of solace with their mobile devices and the access to see that money sitting there. There’s a lot of comfort, I think, that’s been gained through that. So this migration back to bank accounts, into wallets, bank accounts, and then the success we’ve had with the Visa Direct, is a super interesting inflection point in the mindset of a lot of consumers.

The other thing that you get with account transfers, which is quite different from a traditional business, is that it’s really a great forum and a good medium to send to yourself. It’s a great way to send money and keep it within your control. You can set up a bank account in India and then you have access to the app. You’re sending to federal bank, access bank, whatever it might be in India. That money’s there.

You might live in the US or in the UK, but you can actually access that money and then distribute it, make your payments as you need to, because that has been mobilised as well. So it’s actually creating a lot of freedom and a lot of opportunity for people that are trying to time money being sent back home, that are trying to create more flexibility and value with the rupee, for example, once it’s back home.

So it’s not always about trying to get it into a second party’s hands. Sometimes it’s about keeping it for yourself, or managing it for yourself as well. That’s created a lot of opportunity. But then when Covid hit, then it all just compounds on itself. Now you’ve got this massive desire potentially for cash, but yet how do I get out into a market and get it? And do I want to go out to the market and get it? Am I allowed to go out in the market and get it? In our case that’s actually changed the mental shift.

Look at India: go back probably two years, and India was maybe 30% bank account, and for us it was 10%. Now at the end of April 48% of our business to India was bank account driven, which is just a massive change.

That’s coming not only from online sends going into bank account, but also from people walking in with cash at the counter and sending it into a bank account in the foreign market. So huge shifts there, and we’re seeing that in Pakistan, India, Bangladesh, Indonesia, Philippines. Even Mexico to some extent is actually moving quickly that direction as well. It just creates a vast opportunity.

Then when you add wallets, which are very, very different, that’s more of a send to someone else. That’s more digital liquidity and access. That’s very successful in Africa.

Then of course, you’ve got Visa Direct, which is a super interesting product because you’re used to answering a merchant’s request for your debit card to make a payment. This is basically saying, “Daniel wants some money from Alex, give me your debit card and I’ll push it right onto my card.” Which is remarkable to me because it’s counterintuitive to actually how my mind works, but you’re actually willing to give me that information to get the money pushed to your card. Which is amazing to me in a world where people don’t have a lot of trust around online risk and theft.

The success of that product is pretty overwhelming. Consumers are migrating to it pretty quickly, because if you think about the difference between that from an ease-of-use versus a bank account transfer, where you need the routing number and the bank account number, which not everybody has, sending to a Visa card is pretty simple.

Positioning MoneyGram as a Service

Daniel Webber: You’re now offering MoneyGram as a Service to what I would call less direct competitors. Players who are other money transfer operators, but not your primary competitors. How are you thinking about MoneyGram as a service now?

Note, following this discussion, MoneyGram announced a deal with Coinme to allow its customers to buy and sell bitcoin with cash.

Alex Holmes:

There’s a variety of different ways to look at it. We gave you the pillars – there’s cash-in and cash-out of wallets, there’s cash-in and cash-out of crypto assets. And there’s a whole variety of places you can take it.

On pure money transfer pieces, every time we’re out in the retail markets, you’re not talking about the Walmarts and the Kroger’s and these bigger shops. You’re talking about the mom and pop bodegas in LA and Texas and other places. We’re out there competing every day with our salesforce on the ground. You’re competing with Intermex and 90 other brands. You’re competing with Ria and Western Union; Western Union owns Vigo.

It’s a very high competitive area. You’ve got these smaller niche competitors, like Sigue who’s a Latin America specialist that just is never going to get on a plane and start expanding their business into India and Pakistans. But yet where they operate, they have those consumers in the market. So I think for forever, our attitude, Western Union’s, everyone’s attitude is you need to own the customer, you need to own the product. I’ll go into a bodega and I’ll compete with 10 other brands.

At some point it’s a little counterproductive because there’s a variety of factors influencing consumer behaviors. So there are Sigues, they have a nice network in the United States, and there’s a vast majority of them don’t have MoneyGram inside of them. But they might have a Vigo. They might have an Intermex, they might have these other competitors. And so us partnering with Sigue actually gives us an opportunity to do something that we otherwise wouldn’t be able to do.

It wasn’t Sigue, but I talked to another potential partner and he said, “Oh yeah, we dominate Caribbean and Latin America.” But he added, “I don’t have enough money to get on a plane and fly to India and start putting money in India and start investing in that.” But he said, “I have Indian customers that walk down the street, come in from time to time. If I could send to India through your rails, that would be great. It helps me and helps you. And I’m never going to go start an India business.”

So maybe he’s lying. Maybe someday he will if he sees the success of it. But in the interim period, I’ve got a network in India. I’ve got capacity and bandwidth to push those transactions through. So to me, it’s a little bit of an extension of a non-exclusivity. But I don’t think it really makes or inhibits our ability to be competitive in any way at all.

I think it’s pretty exciting. Western Union spent a ton of money buying Vigo. They operate as a niche provider. So to me, it’s like, what’s the difference? It’s like, “Okay, if Sigue can be your Vigo without the investment, that’s awesome.”

Daniel Webber: Great Alex, thank you for your time

Alex Holmes:

Thanks.

The information provided in this report is for informational purposes only, and does not constitute an offer or solicitation to sell shares or securities. None of the information presented is intended to form the basis for any investment decision, and no specific recommendations are intended. Accordingly, this work and its contents do not constitute investment advice or counsel or solicitation for investment in any security. This report and its contents should not form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. FXC Group Inc. and subsidiaries including FXC Intelligence Ltd expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in this report, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting there from. This report and the data included in this report may not be used for any commercial purpose, used for comparisons by any business in the money transfer or payments space or distributed or sold to any other third parties without the expressed written permission or license granted directly by FXC Intelligence Ltd.