In the latest of our post-earnings call series, we speak to CEO Mark Horgan and CFO Velizar Tarashev about the company’s latest results.

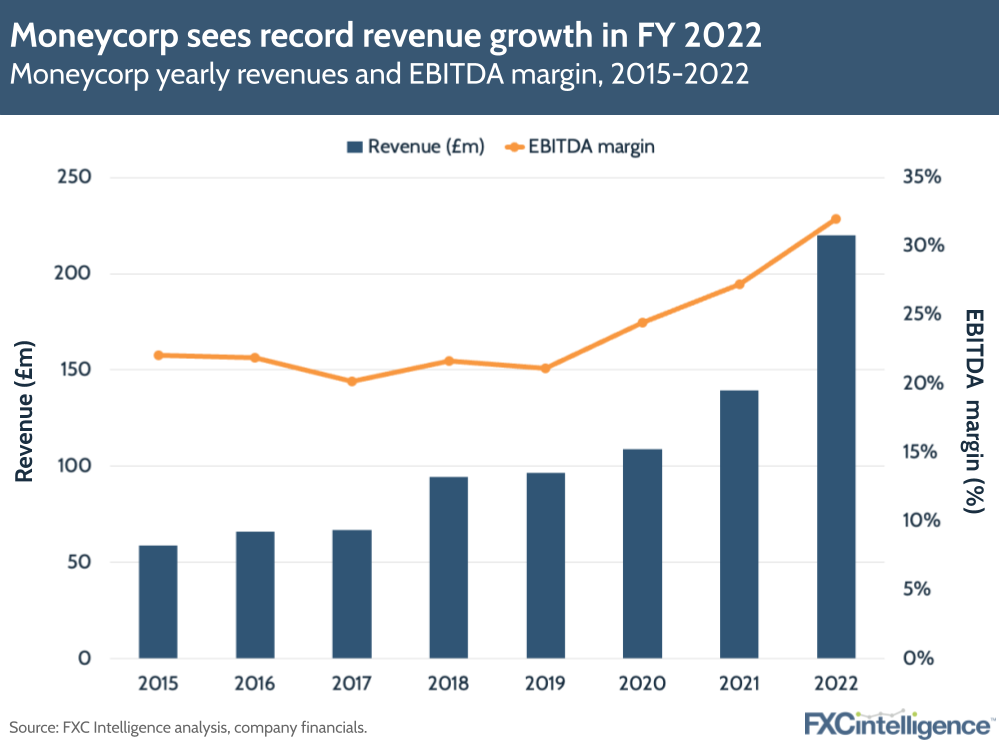

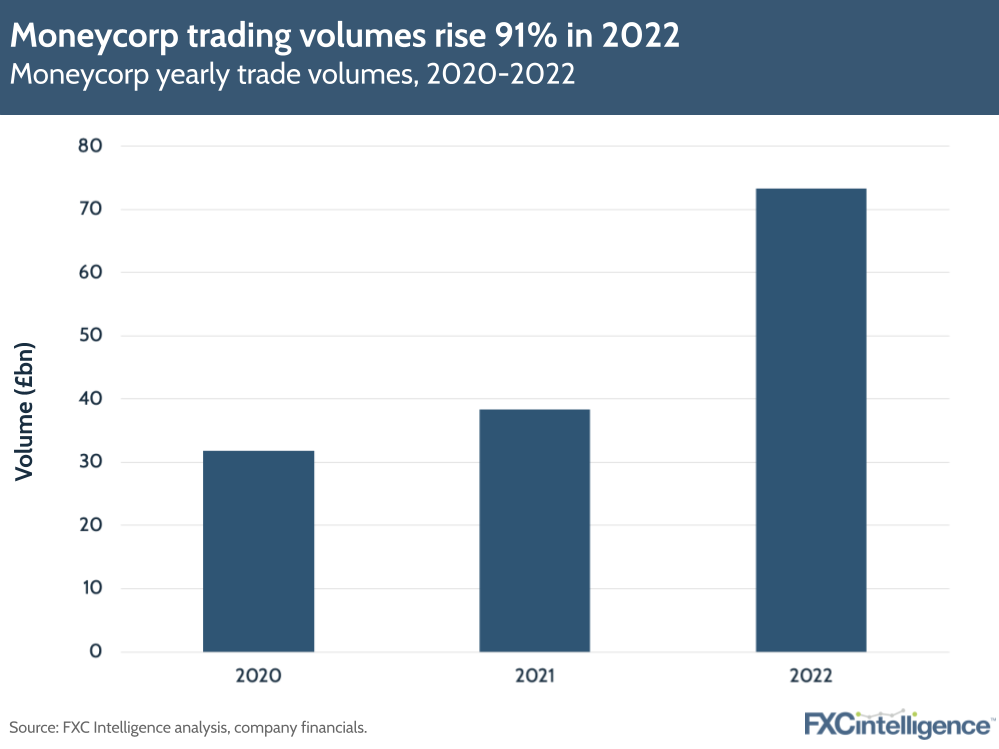

Moneycorp’s revenues rose 58% YoY in 2022, to £220.1m, more than doubling the 28% growth rate for revenue it achieved in 2021. This was driven by 91% growth in trading volume to £73.3bn, as well as strength in the company’s financial institutions segment.

Over the year, EBITDA grew by 85% to £70.4m, leading to an upgraded EBITDA margin of 32%. Moneycorp linked the rise to higher trading revenues; investments in people and more efficient payment platforms; and cost management. It said that 75% of EBITDA was converted into free cash, giving the company significant room to invest in further growth.

Moneycorp also noted the strength of the dollar was a tailwind for performance as over half of the company’s revenue is USD-denominated (see how other payments companies were affected in 2022 here). The company also launched a new real-time monitoring system for transactions in June 2022 and Moneycorp France in September 2022.

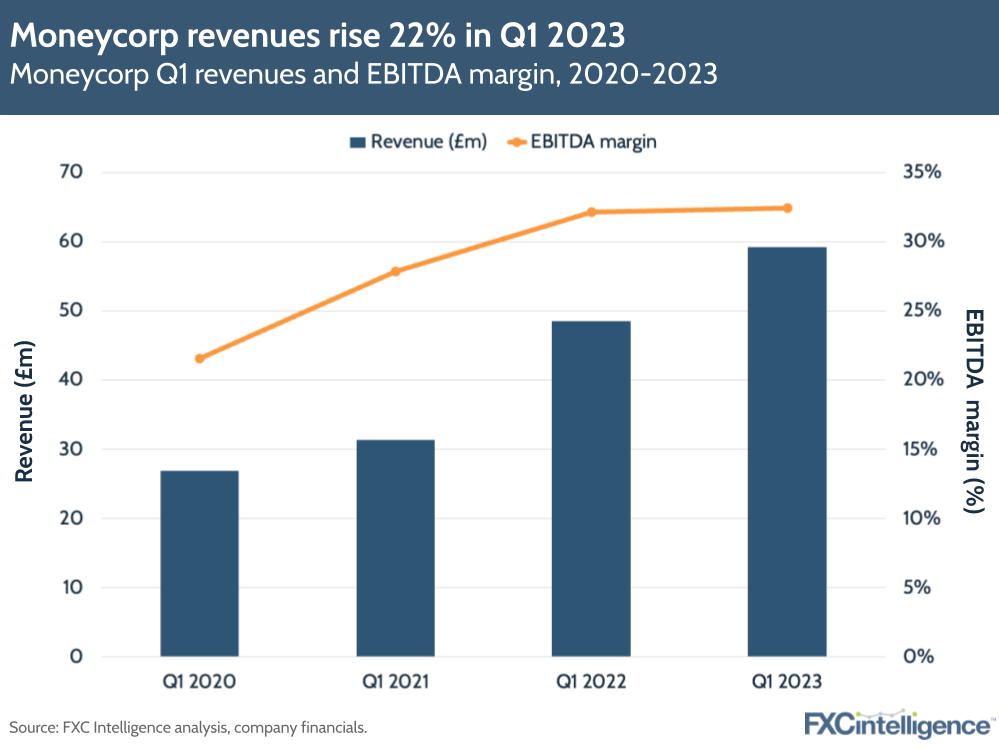

In Q1 2023, Moneycorp’s revenues rose 22% YoY to £59m, with trading volumes up 75% to £20bn and EBITDA up 23% to 19.2m. However, there was no specific revenue outlook figure for 2023, with Moneycorp saying it would continue to expand in core markets amid an uncertain economic backdrop.

We spoke to CEO Mark Horgan and CFO Velizar Tarashev to find out more about Moneycorp’s core revenue drivers for Q1 2023 and full-year 2022.

Moneycorp FY 2022 results: Driving growth

Daniel Webber:

You saw strong growth in 2022. What has been driving that?

Mark Horgan:

2022 was our fastest year of growth in our history, and it was driven right across the board. We had strong growth in private clients, strong growth in corporate SME and strong growth in the financial institution payments group.

It’s all been a testament to our investment in infrastructure, which is licences and geographic coverage, and investment in people, because we’ve got excellent scores on our service operations.

We’ve got great retained volume, we’ve got great new business and we’ve got a strengthened infrastructure. Basically, everything across the board was up. It was a very, very good year.

Daniel Webber:

Do you have any geographic colour to add?

Mark Horgan:

As you would expect given Brexit, the business outside the UK is growing faster than the business inside the UK, which is facing a number of headwinds as a generalised statement.

Velizar Tarashev:

I think that it’s important to recognise that where we’re talking about relatively slower growth, we’re still talking double digits, 20%+ growth. So it’s all relative in the grand scheme of things.

2023 outlook: Insights from Q1

Daniel Webber:

Talk me through Q1 and how you’re seeing 2023 play out.

Velizar Tarashev:

Q1 continues a very strong performance for the organisation – it’s up 23% year-on-year from an EBITDA perspective – and I think that it’s important to know that that’s in the face of challenging market conditions.

They have become even more challenging than last year. And I would highlight the continued risk-off stance from the group. We have not changed our risk appetite, and if anything we’ve actually become a bit more risk-off in the current environment and just a bit more cautious.

Within these numbers, payments, financial institutions, is about 70% growth year-on-year. So that continues to show very strong market share momentum on the back of the FBICS licence that we have. And our corporate on-platform business is about mid-single digit growth.

Overall the business as a whole is doing very well. We are a portfolio business, we have some areas where, given market conditions, we’ve been a bit more relatively lower growth, but overall, very strong.

Specifically, I would highlight areas like Europe and North American corporate payments that have been very strong as well.

Mark Horgan:

What Velizar’s saying there is, as a result of Trussonomics, and seeing the volatility within the marketplace, unlike some of other market players, haven’t extended massive credit terms to drive volume.

We’ve been quite conservative in our counterparty exposure. We have actively foregone some volume to make sure we mitigate risk in an uncertain marketplace. And that’s particularly in the UK, to be candid.

Future developments

Daniel Webber:

Is there anything else either of you would like to add?

Mark Horgan:

The only additional message I would have is we continue to look at strengthening regulatory backbone, and in doing that we’re looking at other geographies for appropriate licences.

Daniel Webber:

Mark, Velizar, thank you.

Mark Horgan and Velizar Tarashev:

Thank you.

The information provided in this report is for informational purposes only, and does not constitute an offer or solicitation to sell shares or securities. None of the information presented is intended to form the basis for any investment decision, and no specific recommendations are intended. Accordingly, this work and its contents do not constitute investment advice or counsel or solicitation for investment in any security. This report and its contents should not form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. FXC Group Inc. and subsidiaries including FXC Intelligence Ltd expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in this report, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting there from. This report and the data included in this report may not be used for any commercial purpose, used for comparisons by any business in the money transfer or payments space or distributed or sold to any other third parties without the expressed written permission or license granted directly by FXC Intelligence Ltd.