Intermex saw profitable growth last year, driven by its omnichannel approach to remittances and growing share in core markets. We spoke to CEO Bob Lisy about how the company will capitalise on new opportunities, particularly its La Nacional acquisition, in 2023.

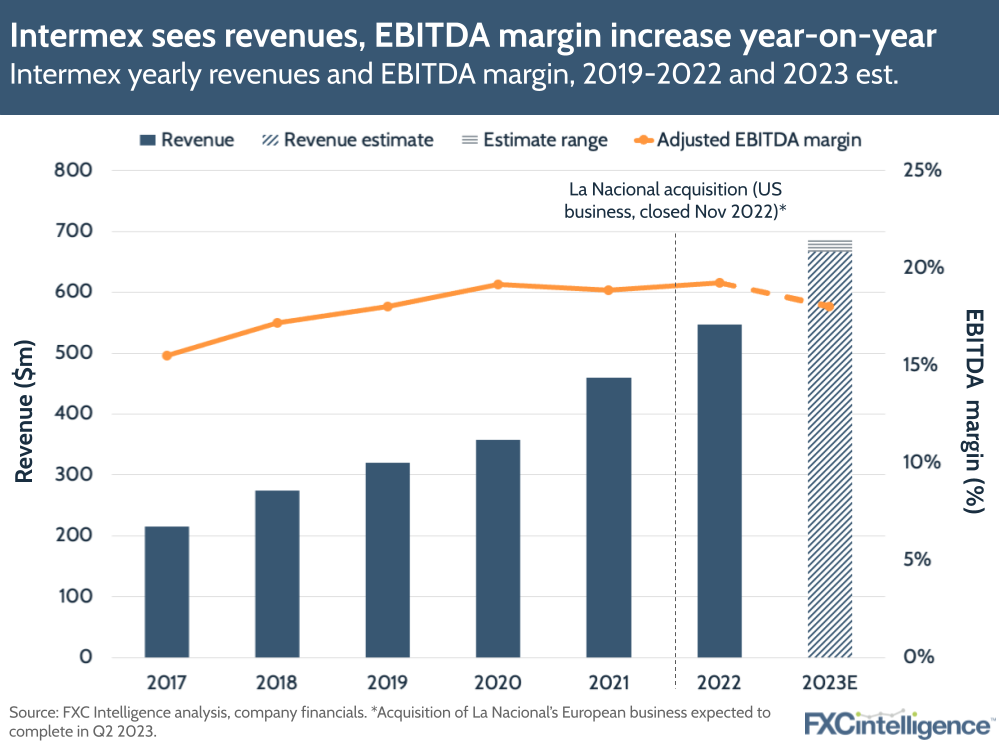

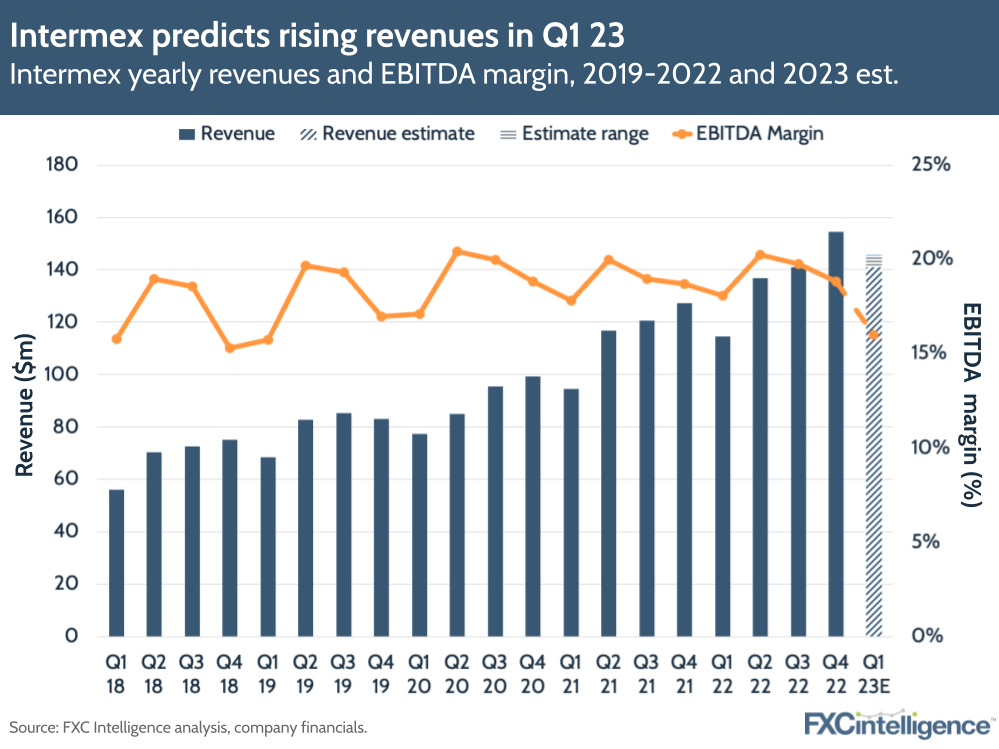

LATAM-focused remittances giant Intermex saw Q4 revenues rise 21.4% YoY to $154.4m, while FY 22 revenues rose 19.1% to $546.8m – in line with projections. Profits continue to rise faster than other players in the remittance space, with full-year adjusted EBITDA rising 21.4% to $105.2m, giving an EBITDA margin of 19.2%. Across 2022, principal amount sent increased 21.2% to $21bn, with the overall number of money transfers growing 19.2%.

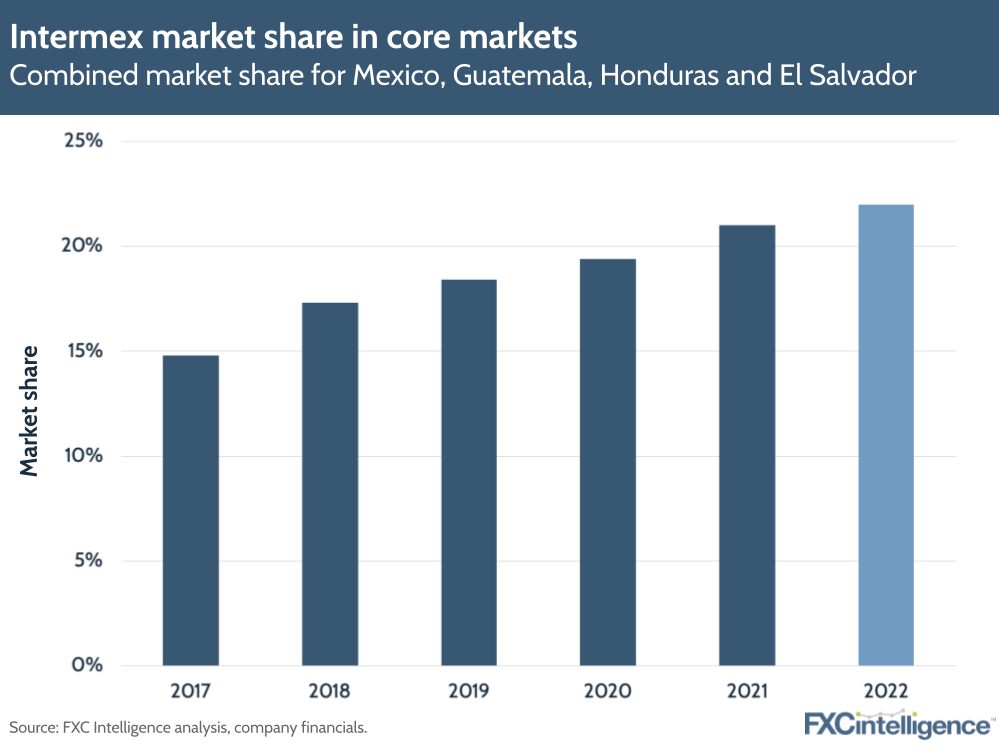

Last quarter, Intermex enabled 13.7 million money transfers, up 23% YoY, which was driven by a 31.4% increase in unique active customers to 3.7 million. Q4 growth was spurred by the company acquiring the US portion of La Nacional (another remittances company) near the end of last year. The company now has a 21% share in five markets that represent 87% of dollars sent from the US being sent to the LATAM region – namely: Mexico, the Dominican Republic, Guatemala, El Salvador and Honduras.

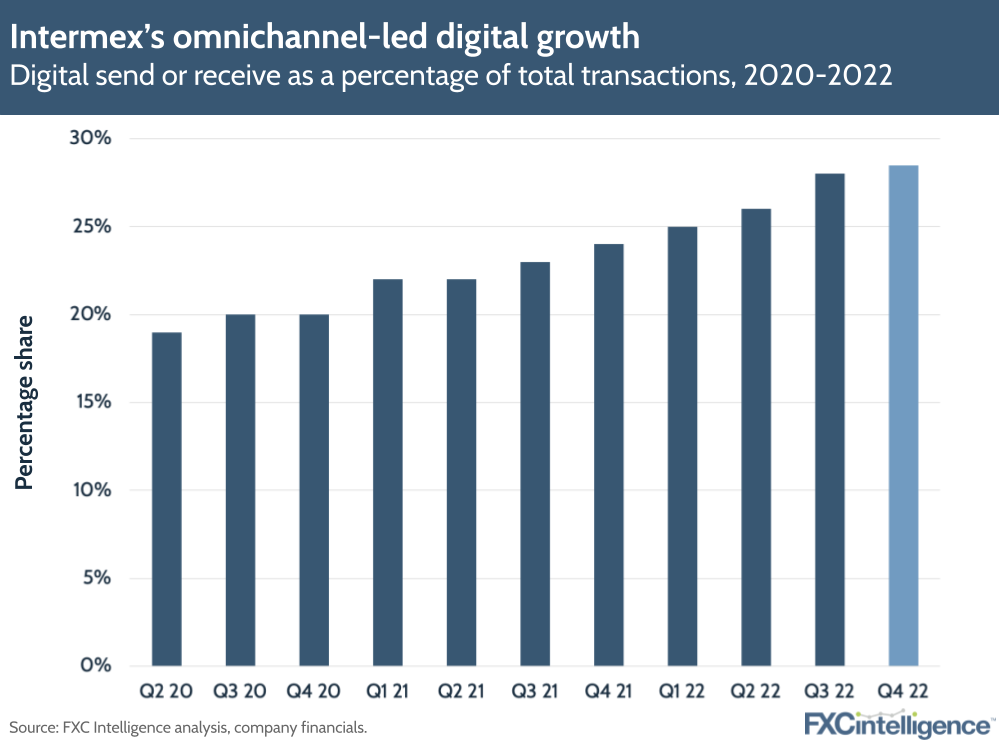

Intermex expects the European portion of its La Nacional acquisition to close in Q2 2023 and provide a further boost to digital transactions, which increased by 100% in 2022. However, the company remains bullish about retail, particularly in the US where it serves many LATAM-born immigrants, and is strategically increasing its agent numbers in areas where these immigrants are based.

For 2023, Intermex forecasts a 22-26% jump in revenue to $667m-688.5m, and expects adjusted EBITDA to rise 14-18% to $120m-124m. While its growth strategy appears to be working, the company needs to strategise well to optimise growth and fend off challengers in 2023, as CEO Bob Lisy discusses in the conversation below.

Intermex revenue growth drivers in 2022

Daniel Webber:

What’s been driving revenue growth in 2022?

Bob Lisy:

We had a strong year. We had some more challenging comps as the year went on and the markets began to slow and competitive factors also rose up, so as the year was ending our year-over-year growth slowed a bit. You couldn’t really see it a lot from our numbers, with that EBITDA performance well into the 20s still.

Our Mexico and Guatemala business are really the cores because they’re the two largest markets in Latin America from the US and by far the two most profitable because of FX – that exchange rate profit – that we gained from them. They remain really strong. We’re also seeing some emerging markets that have come up in terms of growth, including Nicaragua and Ecuador and a little bit in Colombia. Those markets are growing very fast and so we’re seeing a more diverse marketplace for our business.

When we look at Mexico, Guatemala, El Salvador, Honduras and the Dominican Republic, which are about 87% of the business, we’re at about 21% market share. All the other countries in Spanish-speaking Latin America are at 13% and we have reasonable market shares in Nicaragua, Colombia and Ecuador. We’re continuing to grow and will soon grow past a 20% share to the region. That puts us in the neighbourhood of the Western Union business overall, meaning Western Union Vigo and Orlandi Valuta together.

It was a good, solid year in terms of transactions. We’ve had some good growth from the perspective of our digital business; it’s still on a relatively smaller number, but good year-over-year growth there as well.

Growing Intermex’s digital and retail business

Daniel Webber:

You reported that 28% of your transactions are sent or received digitally, but you still take an omnichannel approach. Has anything changed there?

Bob Lisy:

We don’t do anything to change the trajectory of a customer. We’re not trying to move customers from our highly profitable retail business toward digital. We’re not sure that most of those customers are great candidates for that anyway. We believe that the large share of our customers get paid in cash or cheques that they cash at a lot of our retailers, so they’re not even banked; they can’t be banked in many cases, because they’re not documented immigrants.

The retail business is going to continue to grow faster than digital, not in terms of bigger year-over-year percentages but in terms of an absolute number of dollars. It’s going to be some time before digital really starts to approach it. If you’re talking about markets like India and China or the Philippines, which are not markets we service today, that’s a different story, but in our markets we think that there’s still a lot of life left in retail.

We still see really high customer acquisition costs, but we also see those customer acquisition costs are really high in the industry as a whole, which has driven lower profitabilities from some of the folks that are single-channel and digital only, not omnichannel.

Our app has gone from a rating of 2.6 to a 4.6, so people are enjoying using it. Marcelo and Chris have done a great job with that and the business is growing and improving, but we’re not going to go out and spend $30-50m to acquire customers and degrade our EBITDA right now when we don’t see that as an extremely profitable business.

We’re going to let it end naturally, organically; we’ll do some things that are a little bit more strategic related to growing our digital business, one of which is selling wires as a service for a third party. We’ll continue to grow that with our API for other folks, which will enable us to make money on every click on every wire, but we’re not spending all that money on that customer acquisition cost.

Selling wire processing as a service

Daniel Webber:

You mentioned selling wires as a service. Do you have any customers there that you can talk about yet?

Bob Lisy:

We have three that we work with today: Amigo Paisano, which is in Guatemala, and then a company in Vietnam and in the Philippines. We have another one signed that we haven’t announced, but it does send to a different region of the world and we’re pretty excited about it. We should hopefully be ready to announce and talk more about that in the next couple of months.

Daniel Webber:

Aside from wire processing, are you offering any white labelling or access to your retail network to other players?

Bob Lisy:

We are not. We have our own payment retail network on the other side of the border, and that’s a possibility to look at down the road. We’ve not made any decisions related to that. We pay a lot of our own wires through our own retail network, meaning it’s not a particular chain; it’s one-by-one, assembled like our network north of the border. We call it Pago Express in Mexico and Guatemala, and we’ll evaluate over time whether we sell that to a third party.

It’s got its pluses and minuses. You can be enabling competitors that are heavy discounters with differentiation that today they don’t have. At the same time, you get an opportunity to get a click off everyone with those wires. So, we have to evaluate the value of what we’re giving up versus what we get in terms of revenue.

Digital remittance trends in LATAM

Daniel Webber:

There’s been talk about Mexico digitising more on the receive side – are you seeing this?

Bob Lisy:

Depending on how you consider digital, a receive is usually considered digital if it’s deposited in a bank account, and we’re seeing an increase in that. Most of the big banks – whether that’s Elektra or BanCoppel – pass a better rate onto the consumer if they deposit into an account because it’s easier; they don’t handle cash and they like to have the deposits.

So, we are seeing more of the cross-border money going directly to bank accounts versus being paid over the counter. There are still a lot of folks that want to be paid over the counter, with some of those migrating away from the banks that are putting pressure on them to deposit money into the account because they still want money over the counter.

We also have a mobile wallet in Mexico and we’re seeing some growth in that. It’s very small business, but that also would be considered digital. There’s less obstacles on the other side of the border.

Presumably, everyone on that side of the border is a Mexican citizen who can open a bank account and it’s easy enough for them to do it. On this side of the border, there are the same emotional concerns about opening a bank account that there are south of the border – bank failures, trusted banks, treatment, all of that – but in addition, there is a language barrier in most of the country. In most of the banks here in Miami, the people speak Spanish, but if you’re in Cleveland, Ohio or Nashville, Tennessee, the folks at the bank likely don’t speak Spanish.

Even here in Florida, the people in the bank who speak Spanish are probably not very culturally sensitive to our consumers. They’re typically people from South America who are better educated and they’re not necessarily looking to communicate with labourers from Mexico and Central America.

The banks aren’t necessarily in the neighbourhoods where our folks live. Our consumers don’t necessarily want the fees related to the bank; it’s cheaper for them to cash their cheque and wire their money in one fell swoop than to deposit the money into the bank and wire the money online.

Additionally there’s a great deal of trust in the retailers, as there’s usually somebody that can help them with documents and all these other things. So, there are a lot of deeply entrenched reasons why people use retailers here on the northern side of the border that don’t necessarily exist in the south side of the border.

The GPR card we’re putting out there can give that individual the ability to get his payroll on that card if he’s in a company where they can pay him on the card. That can empower some folks to do digital today, but today we’re still seeing the bulk of people with cash and cheques going into the retailers.

Daniel Webber:

Are there other markets on the receive side where you’re seeing any other interesting digital trends?

Bob Lisy:

Guatemala, but not to the same extent as Mexico. The major banks there are trying the same with less success. Mexico’s probably been the most successful. There are some players in Mexico that have been more successful than others in moving their customers to a depository relationship and not over-the-counter cash, but it’s still slow; it’s still a minority of the wires going.

Competitors’ changing remittance strategies

Daniel Webber:

Some groups with strong brands on the receive side are trying to start their brands going on the send side, such as Elektra with its America Cash Advance in the US. What are your thoughts on that?

Bob Lisy:

Clearly they have the customer following at Elektra or BanCoppel. There are some challenges for them to have banking relationships. Believe it or not, some of the Mexican banks have had difficulty even in corresponding relationships, let alone having a bank that would bank them here in the US.

If they were actually collecting wires and were licensees, they’d have to get licensed; have banking relationships; have the technology; and go out and build a retail network. There are a lot of things they don’t have the expertise in. They have expertise in their own branches, but not in third party locations, and that’s really the way the retail network is built.

I don’t think it’s an impossibility, but I don’t see it as an easy task for them. If they really sat down and figured out what they would actually gain versus what we’re getting, they would really see that it wouldn’t be worthwhile. They’re still going to pay the agent $5, they’re still going to have their costs on the other side and the only thing they’d be taking out is our share. They’d have to have a lot of sales and all the rest to do that.

It’s much smarter for them not to do that. There’s always the possibility, but there’s a big moat around that with banking relationships, licensing and just the fact that they’ve got to be able to build it in. Part of our success is that half our wires are to Mexico. If I’m Elektra, I’m pretty much just known in Mexico. I can have a little presence in some of Central America, but I’m not going to have the same panache. So, you start getting a much more fragmented market than somebody who’s really known for the whole region, which is us for Mexico and Central America.

Intermex’s strategy for 2023

Daniel Webber:

What’s the roadmap and strategy for 2023?

Bob Lisy:

For 100% of the year, we’ll own La Nacional’s US outbound business, which is driven by the East Coast and their stores in terms of profitability. There are a lot of opportunities for us in terms of making that business more profitable. This year, we’ll see a big jump in revenue with La Nacional and not as big a jump in the EBITDA.

We won’t own the European business – which has the biggest long-term growth prospects of all of the La Nacional high transfer business – until April, possibly May. We’re in the final stages of the regulatory process, and that business is really high growth. It still has the opportunity to have even bigger revenue growth next year, but its revenue this year is only going to be there for 8 to 9 months of the year, versus 12 months.

Ultimately, the La Nacional business will probably grow two and a half to threefold in terms of EBITDA. There’s lots of economies of scale and shared services we can build and it’s not been a really efficiently run business.

In our core business, we’re retooling and reinvesting into parts of our retail business. We’re putting more salespeople on the ground, and we’re re-looking at some of our markets where competition has heated up a bit and there’s a lot of discounting going on. We’re looking at a more challenging year in terms of our organic growth and you see that as we plot out the year. We plan on that getting stronger in both revenue and EBITDA as the year goes on, as some of the things that we’re executing from Q1 and Q2 start to take effect in Q2, 3 and 4.

Next year, that La Nacional business and the European business will be much bigger EBITDA contributors. The US business will not grow hugely in revenue (the European business will), and you’ll start to see a bigger EBITDA contribution from that and a bigger jump.

Impact of the Silicon Valley Bank collapse on remittances

Daniel Webber:

Do you have any thoughts about the Silicon Valley Bank collapse and the impact on the remittances sector?

Bob Lisy:

It was hopefully a very unique situation that happened at Silicon Valley Bank, with concentrated deposits of one nature that were fast moving, because the bank wasn’t particularly unhealthy at all. It was a surprise in terms of duration mismatch.

We’ll just continue to monitor it. We have a well diversified banking group and we have a large credit line, so we feel that we’re well positioned. But obviously banks are our key partners and we have many of them, which is a good thing, so we’ll just keep pulse on how they’re doing through this.

As times get a little more challenging, it’s great to be a company that has a really great and strong balance sheet. Even through tough times with Covid-19, we were one of the only companies that made money year-over-year and grew even in Q2 2020.

Clearly we follow all this and we’re looking at it, but we feel good about the way we’ve run our business and the strength of our balance sheet, even during difficult times.

Daniel Webber:

Bob, thank you very much.

Bob Lisy:

Thank you.

The information provided in this report is for informational purposes only, and does not constitute an offer or solicitation to sell shares or securities. None of the information presented is intended to form the basis for any investment decision, and no specific recommendations are intended. Accordingly, this work and its contents do not constitute investment advice or counsel or solicitation for investment in any security. This report and its contents should not form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. FXC Group Inc. and subsidiaries including FXC Intelligence Ltd expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in this report, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting there from. This report and the data included in this report may not be used for any commercial purpose, used for comparisons by any business in the money transfer or payments space or distributed or sold to any other third parties without the expressed written permission or license granted directly by FXC Intelligence Ltd.