In our latest Post-Earnings Call Series report, Intermex CEO, president and chairman Bob Lisy shares his views on key drivers for the money transfer provider’s strong Q2 results, and why the company would be resilient in an anticipated economic downturn.

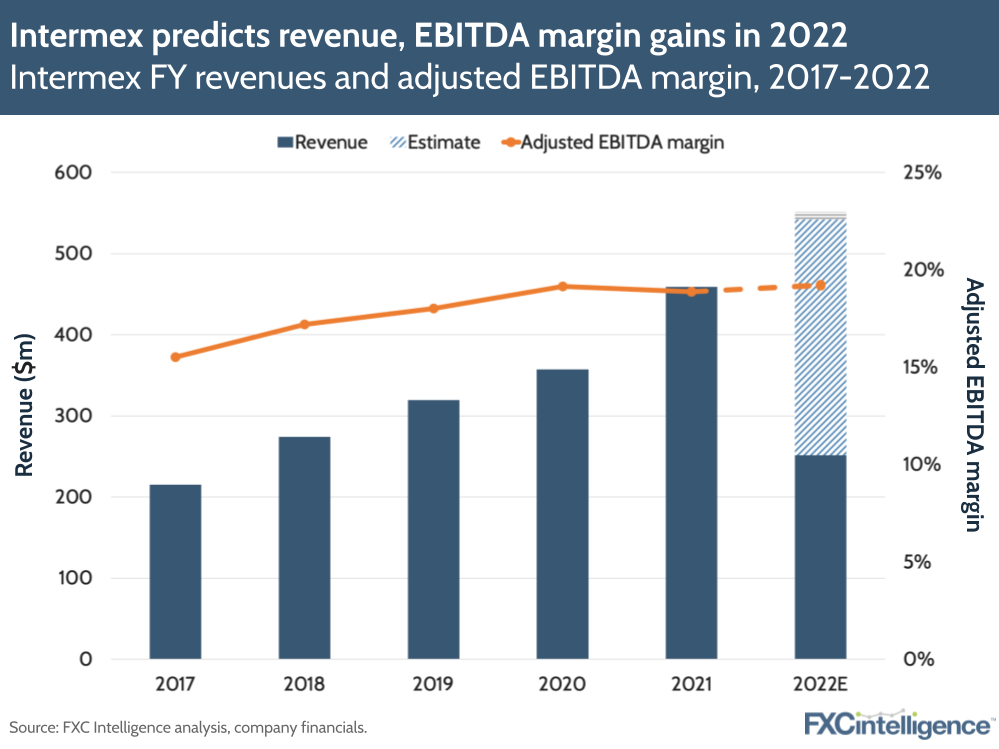

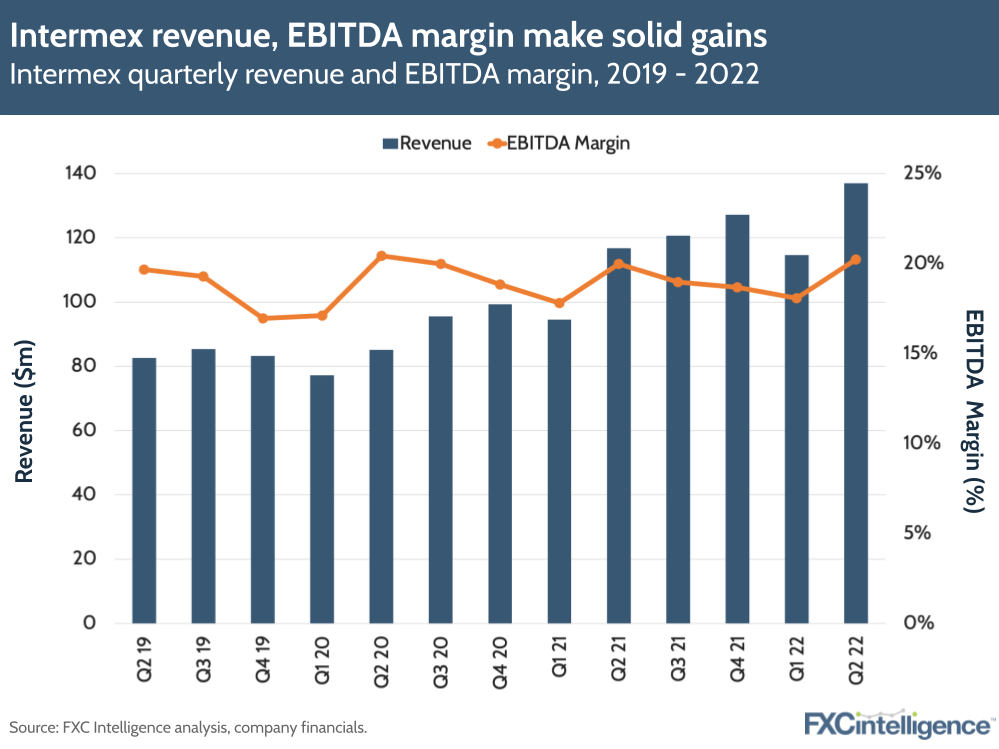

LatAm-focused money provider Intermex has had another successful Q2, having seen revenues increase 17.3% to $136.9m, while EBITDA has increased by 19.3% to $27.7m in Q2. The company’s EBITDA margin for the period was 20.23%.

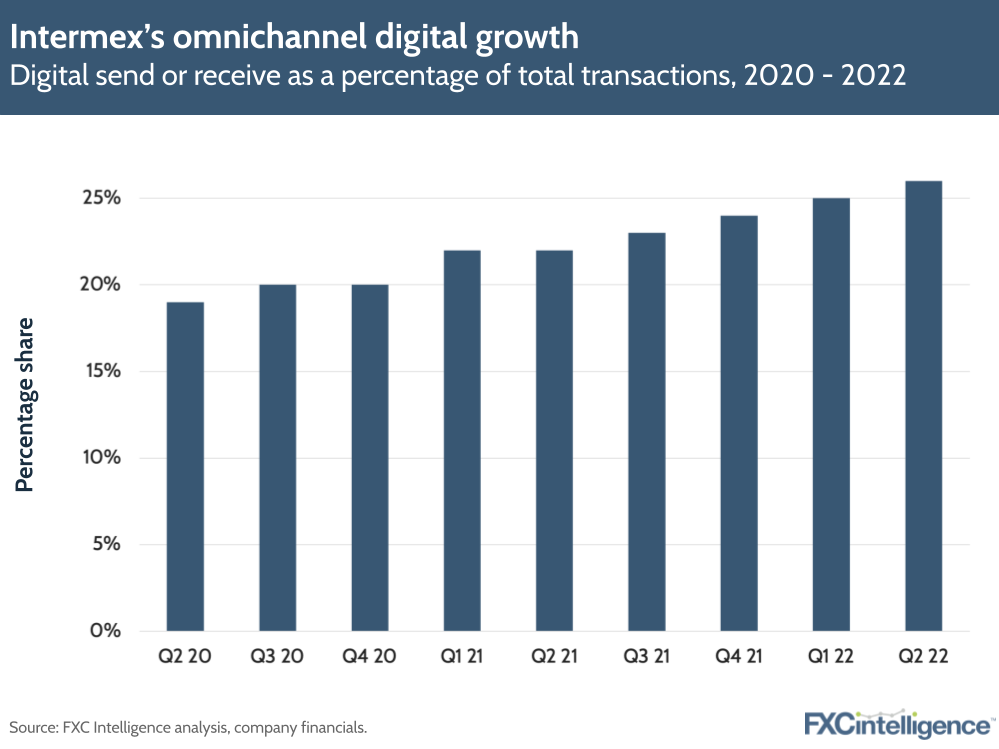

Key drivers for growth, the company said, were its expanding network of independent retail agents (up 10.8%), 14.7% increase in unique active customers and 106.6% growth in digital transactions.

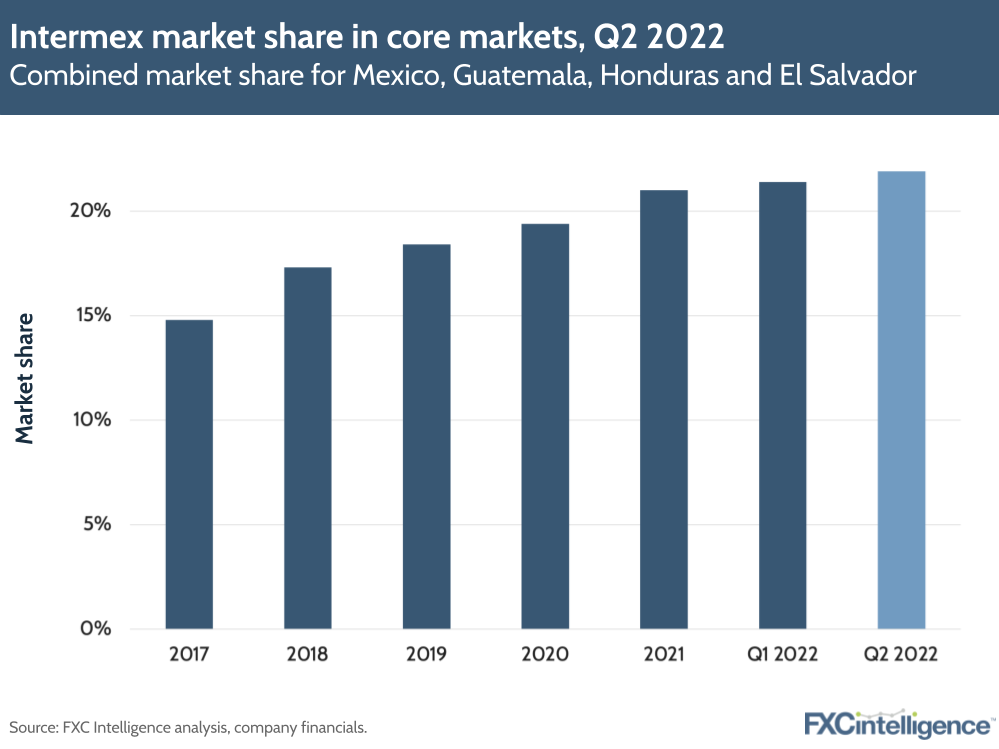

Intermex continues to consolidate its position in its core market of Latin America, increasing its combined market share across Mexico, Guatemala, El Salvador and Honduras to 21.9% (up from 21% in Q1). Following its acquisition of hispanic remittances player La Nacional (expected to close in September), Intermex expects to become a market leader in the Dominican Republic, as well as open up new markets in Europe.

With some major competitors losing share in some regions, Intermex’s bullish focus on retail continues to deliver results. Daniel Webber spoke to Intermex CEO Bob Lisy to find out why and ask how the company will react to an economic downturn.

Intermex’s key growth drivers in Q2 2022

Daniel Webber: Well done on another successful quarter. You’ve seen great revenue and EBITDA growth. What’s driving this?

Bob Lisy:

We continue to take share from some of the weaker small players, and wires at big box or chain stores basically vacating. The Krogers and the Publix and the Ralphs of the world are taking a less important share of the overall business, which has been coming back into the neighborhoods, and we get a disproportionate share of that.

Western Union had a 13% decline in transactions, so they’re losing share, as well as MoneyGram. Smaller guys are also losing share, and with some of those, it’s service related. We’re certainly not getting that business from them from a competition on price. We’re always at the top end of the market for cost to the consumer, but also in terms of quality of service.

For example, we saw Remitly indicate on their website it would be an up-to-20-minute wait on Mother’s Day to speak to customer service. In Intermex’s case, it was typically a five-second wait. Those are the kind of things that we compete with the smaller guys on too.

We continue to have great growth throughout the East as well as the West. We have a high level of market share in the East, and we continue to grow well into the double digits there. About 12% to 13% of that growth comes from same-store sales, but about 6% or 7% of that comes from new agents (with us for less than a year).

We had one of our best quarters ever in terms of adding new retailers, and while that makes an impact in that quarter, it will make a bigger impact nine, 12 and 18 months later as those retailers ramp up. So growing the same store, as well as bringing in new retailers, is driving wires quite a bit.

Figure 1

Daniel Webber: Speaking of big box retailers, you mentioned Walmart in your comments. How do you compete with them?

Bob Lisy:

I don’t think we really need to compete with Walmart as it’s not a driving force in our industry. When it comes to remittances, there’s no compelling reason for one of our consumers sitting in Queens, New York to get on his bicycle and pedal past 25 retailers that handle remittances to get to Walmart.

Even if Walmart was a dollar cheaper, it’s just not worth it. They don’t have enough locations to be convenient for the consumer. And then when you go there, it’s really not their business. You might stand in line behind a lady returning a toaster. It’s not a great quality of service and it’s not necessarily conveniently located.

Now, why will Walmart do some business? It’s a convenience thing when you’re in the store. Nobody says, “I’m going to go to Walmart to send the money”, because it’s not really convenient for them relative to where our retailers exist.

Driving profitability for investors

Daniel Webber: What do you think is driving the positive view from the investment community?

Bob Lisy:

We started to get momentum when we did the shareholder meeting in New York back in March, and then had some really good momentum leading into the announcement of the La Nacional deal. The marketplace liked to see us put capital at work and open ourselves up to more markets.

As the market has started to turn, people have gotten a better impression of the companies that were in our sector that were thought of as driving great growth. For some of them that went public, when the facts were peeled back, those models didn’t quite work in a specific market perspective.

In the broader market, investors are moving away from highly leveraged companies that might have great growth, but do not have a clear path to profitability and don’t have great balance sheets; we’re the opposite of that. We’re very profitable, we’re continually growing EBITDA, we have a great balance sheet and we’re leveraged very modestly (less than one times).

So, when tough times came around, people really started to see our company for the value it has, the stability it offers, its profitability and its free cash flow. They recognise that if we have a downturn, this is a great place to have an investment because it’s a really stable, solid performing company.

Figure 2

Resilience against an economic downturn

Daniel Webber: How is a business like yours positioned in a downturn? Particularly when it comes to cash-focused remittances?

Bob Lisy:

After the stock market had its crash in 2008, from 2009 to 2015 the remittance market didn’t really grow at all. In that period, we tripled our business because we continued to take market share away from others.

We’ve always been at the very top-end of performance during difficult times. During Covid-19, we were the only one of the four public [remittance] companies that never saw a quarter being smaller than the quarter the previous year. Even in Q2 2020, we grew our EBITDA and our revenue while Western Union, MoneyGram, and Ria (part of Euronet) all had severe downturns.

There’s a lot of reasons for that. One is that a lot of our workers that send money with us are in the agricultural field, and that really is not affected by any downturn. Secondly, another part of our consumers are people that work in housing, and right now housing is still relatively strong.

The third component is service, but it’s a smaller component for us. Some companies that have more business focused in the city have more service-related employees, where there are more restaurants and hotels. Our customers would lean more towards being agricultural, which is a very stable component.

There is a nimble group of consumers whose real purpose for being in the US is to make money and send it home. Even if there’s a bit of an obstacle, they’ll move very quickly around it.

From our perspective, we’ve done better during downturns because of the strength of our customer base. Secondly, it’s because our customers are nimble and will continue to make money. Lastly, it’s because of the way we respond to that, because we’re metrically based, and because we’re already looking at places where we have the biggest opportunities to pick up wires.

We’d rather see good times, but we also know that we’ve done really well in the weaker times. During those periods, the weaker companies are weaker because they are barely making money, and so it gives us an opportunity to actually take a bigger share away from them.

Figure 3

Impacts of the DolEx-Barri merger

Daniel Webber: Money transfer providers DolEx and Barri have just announced a merger, subject to regulatory approval. How might this affect Intermex?

Bob Lisy:

Whenever two companies merge, the companies that didn’t merge from a standpoint of absolute opportunity will benefit. Things slip out. There are going to be retailers that might have both of them and may choose to throw one of them out, in which case we have an opportunity to come into that retailer.

Both of them are good companies. We know DolEx better, having worked with the senior management team of DolEx at the Vigo business, and have a lot of respect and admiration for them.

We also looked at the Barri business when it was for sale, but we felt like that it was too much of a double down for us with Mexico. We didn’t like the loan product and we were uncomfortable with some of the interest rates for short-term loans that were being charged, particularly in Texas, where there’s not a necessarily usurious law related to the top end. So with your ultimate APR, that could be relatively high and that’s what caused us to back away from Barri.

But they’re both good companies and it’s probably a smart move for both of them. I’m guessing they’ll be the number one company out there in terms of company-owned stores. But ultimately, I see it as positive because some business will trickle away from them.

The La Nacional acquisition

Daniel Webber: Is there any more colour you can add on the La Nacional acquisition?

Bob Lisy:

We’re expecting it to close in the middle of September, and we’re still very bullish on the business. For La Nacional their number one country is the Dominican Republic, so there will now be a fifth country that we’re going to be a leader in. By the way, we’ve got more than a 15% share in Ecuador and Nicaragua now, so we’re continuing to add more and more top countries. But what La Nacional brings us is one of the top five markets out of the US that will now be a number one player with more than a 20% share, heavily concentrated.

We really like the concentration, because it doesn’t have a lot of overlap with us. They’re really strong in the Northeast, and they have about 80 brick-and-mortar stores that we’re going to take on. Stores do really well where there’s a heavy concentration to your customers because you make a lot more per wire, but you just have a higher fixed cost. In those 80 stores, we can ultimately make much more money than La Nacional makes today.

We’ll take on about 500 of their retailers along the east coast, but we probably won’t keep a lot of their retailers in the western states, just because they’re just not profitable.

One of the biggest additions is Europe. We were careful to ensure that they aren’t losing money in Europe, and they actually make a little bit of money there today, but they aren’t deeply penetrated. They only do about a hundred thousand transactions a month in Europe, which is not a huge amount and we think that we can grow that through the Intermex method at retail.

The second thing that’s really valuable there is that you have an opportunity for digital. Europe’s business is more ripe for digital business than remittances from the US to Latin America, and there are a lot of reasons for that. There’s not the same distrust of banks in other countries that are recipients of wires from Europe, as is so much the case in Latin America. Secondly, less people are likely to be there undocumented, meaning it will be easier for people to get a bank account and send money.

It will be great for our business at retail, but actually a little bit more of a bump than the US business for us relative to the digital side. We’re expecting it will be more than a 10% increase in our revenue. At the beginning, it’ll be less than that in EBITDA, but [eventually] we think it can be a significant EBITDA contributor as well.

Figure 4

Increasing digital and retail transfers

Daniel Webber: Since we last spoke, has there been any other change in the dynamics regarding the digital side of your US business?

Bob Lisy:

We saw a lot of pricing pressure in May, and we discounted a little more than we needed to, so it affected our margins. We’re never going to be the cheapest and we’re always going to be at the more expensive end. We have to stay within shouting distance of the discounters, but as we continue to grow it gets tougher.

Right now we’re probably adding six or 700,000 wires per month, year over year. If we went back to when we first went public, this would be 35% growth. Now it’s 17% growth. We’re still growing the number of wires per month, but it’s hard to grow because of the law of big numbers. So we’ll continue to look at new ways to put a charge into that.

We’re adding more people at retail. Our regional sales executives are working within a broader geography, looking at vacant or underperforming zip codes. We’ve been putting more of those people on the street, and the EBITDA that we achieved was representative of that greater investment. In terms of revenue, this investment isn’t typically felt as strongly until we get past nine, 12, 18 months because those agents have to ramp up.

Overall, we’re investing a little more to pursue opportunities in the marketplace a little more aggressively.

Daniel Webber: Bob, thank you.

Bob Lisy:

Thanks, good to talk to you.

The information provided in this report is for informational purposes only, and does not constitute an offer or solicitation to sell shares or securities. None of the information presented is intended to form the basis for any investment decision, and no specific recommendations are intended. Accordingly, this work and its contents do not constitute investment advice or counsel or solicitation for investment in any security. This report and its contents should not form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. FXC Group Inc. and subsidiaries including FXC Intelligence Ltd expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in this report, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting there from. This report and the data included in this report may not be used for any commercial purpose, used for comparisons by any business in the money transfer or payments space or distributed or sold to any other third parties without the expressed written permission or license granted directly by FXC Intelligence Ltd.