UAE money transfers major Al Ansari Exchange’s parent company Al Ansari Financial Services has announced its IPO. Here are the key takeaways from the IPO document.

Earlier this month, Al Ansari Financial Services, the parent company of UAE-based money transfers player Al Ansari Exchange, announced it was taking the company public in an IPO that values the company at between $2.04bn and $2.1bn. The move will see the company listed on the Dubai Financial Market.

In launching the IPO prospectus, the company has provided the most in-depth look at its financial performance to date, providing insights not only into the company but into the region’s money transfers industry.

As largely private companies, the region’s biggest money transfers players have traditionally been reticent to provide significant details about their businesses, making the UAE one of the harder markets to get a clear picture of. However, Al Ansari’s IPO does provide fresh illumination, which we explore in this short report.

Al Ansari Exchange’s business and market lead

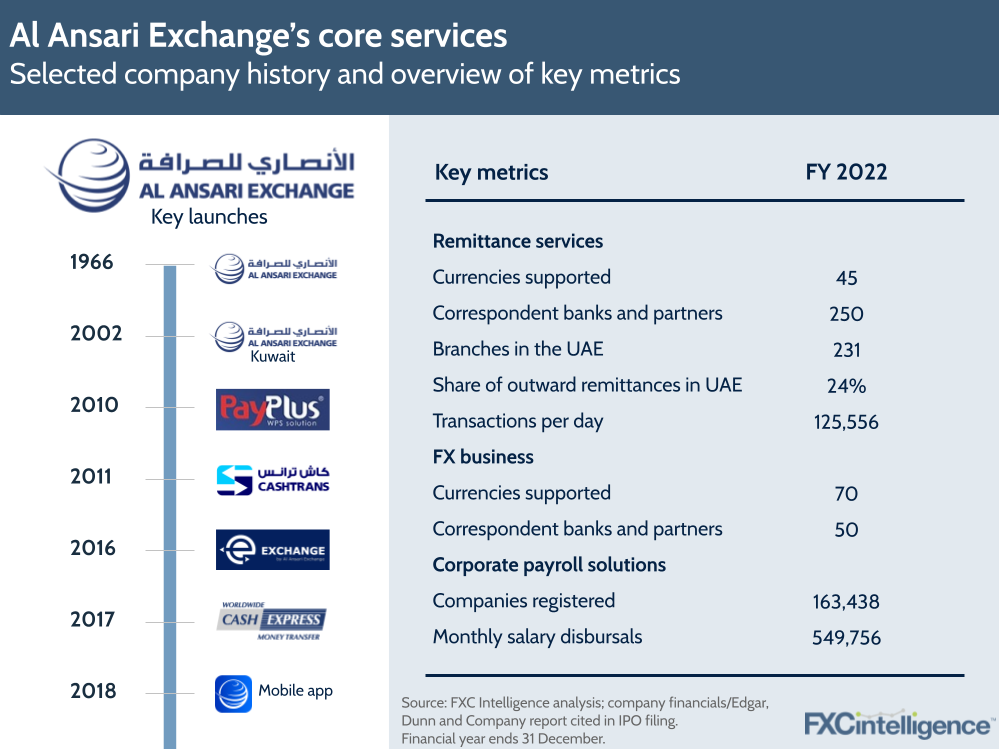

Established in 1966 in Abu Dhabi, Al Ansari Exchange is the leading exchange house in the UAE. Its leading product is consumer remittances, which it offers through its core brand both at retail branches and via digital channels, as well as its subsidiaries Cash Express, Global Fund Transfer and Worldwide Cash Express. It operates a smaller B2B money transfers service through its e-Exchange brand.

In addition, it also provides corporate payroll solutions on behalf of companies in the UAE; retail and wholesale foreign exchange services; pre-paid foreign currency cards; cash management solutions and bill collection.

Share of the UAE market

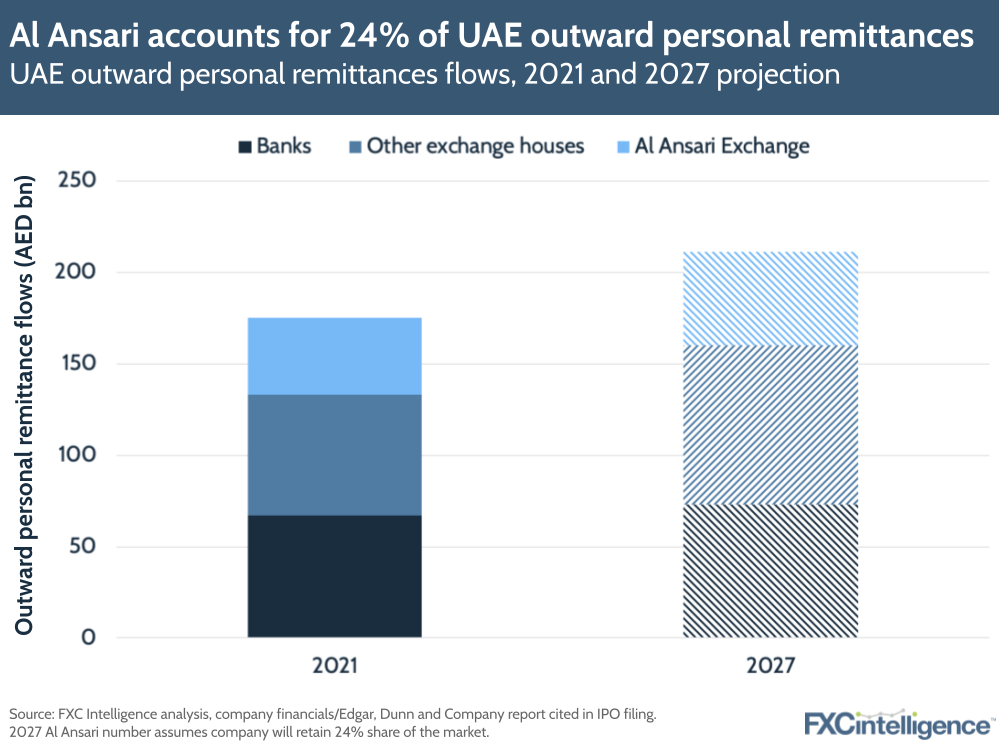

The company reports that it has the largest share of outbound consumer remittances in the UAE, at 24% of the market in 2021. This would make it not only the biggest exchange house in the region, surpassing competitors including Al Fardan Exchange and LuLu Exchange, but the biggest player overall in the UAE by flows.

This represents a significant share of global flows. Our own market sizing data shows the UAE is the second largest sending country in the world for personal remittances, outranked only by Saudi Arabia, and is estimated to have sent flows of $39.8bn in 2022.

Al Ansari reports that it handled around 2.6% of global outward personal remittances in 2021, and handled 45.8 million transactions in 2022.

Financial performance: Key numbers from Al Ansari’s IPO

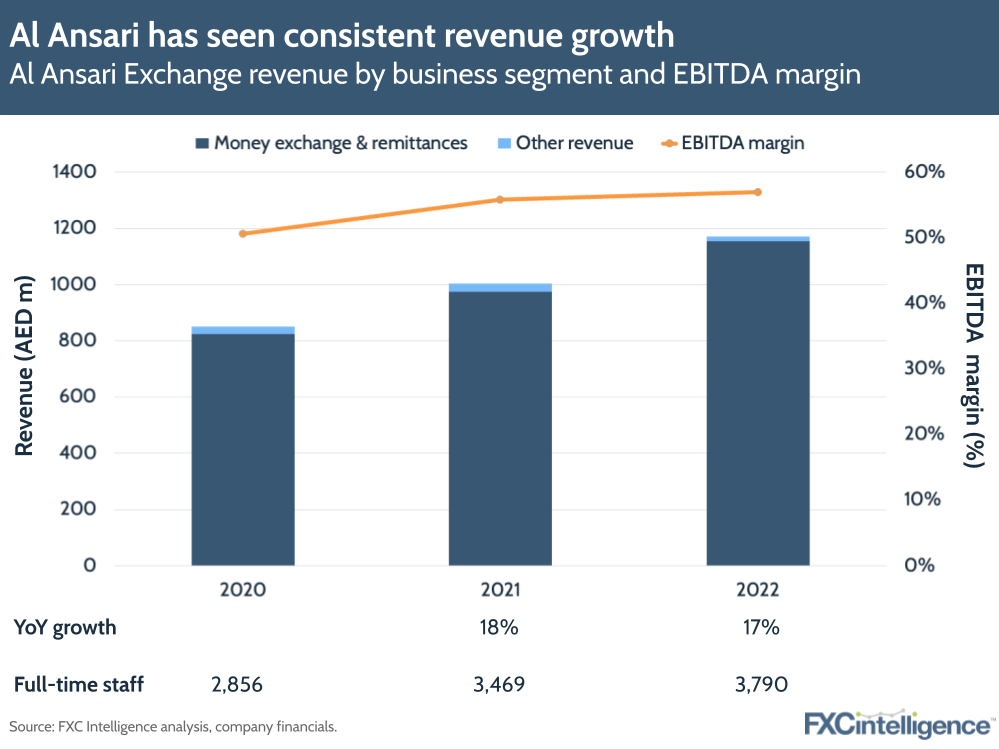

While Al Ansari has only provided full numbers for the company from 2020-2022 inclusive in its IPO document, these indicate consistent growth.

The company reported net profit of AED 595m ($162m) in 2022, up from AED 491m ($134m) in 2021. It also saw 17% revenue growth in 2022 to AED 1.17bn ($319m), and has consistently seen EBITDA margins of above 50%.

The company’s consumer remittances business

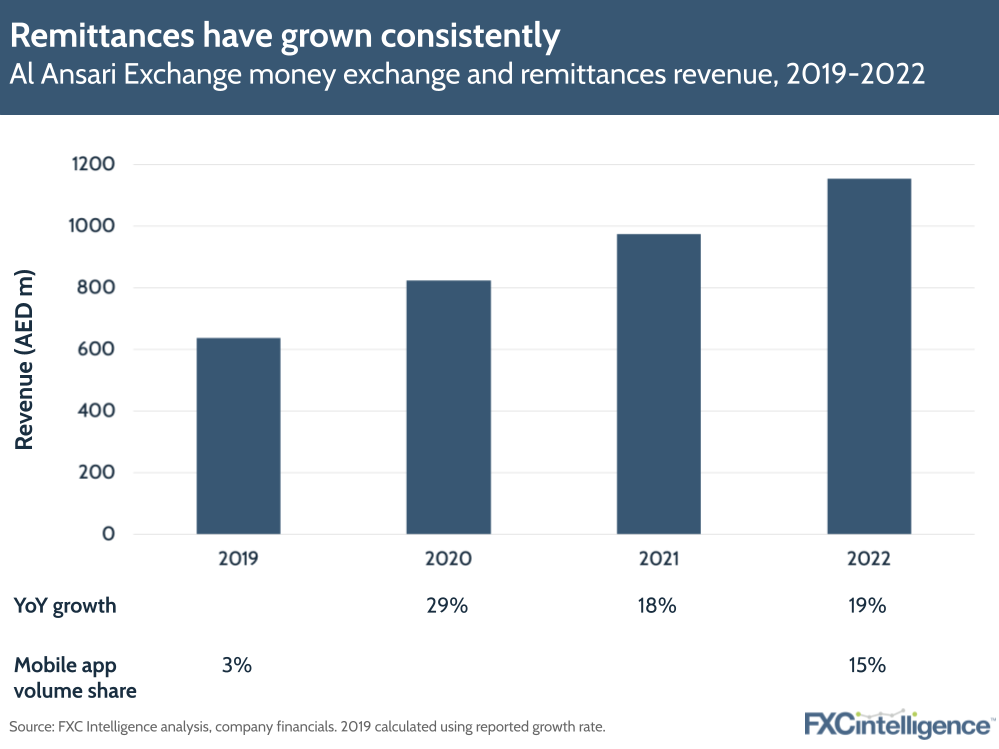

Remittances represents the bulk of the Al Ansari Exchange’s business, with its money exchange and remittances segment growing 19% YoY in 2022. White the company does have a B2B offering, consumer dominates this segment.

The company provides services through both retail and digital channels, and delivers its service through its own network and through providers such as SWIFT and Ripple. It also partners with other money transfer operators, including Western Union.

Sending via retail branches is the dominant means for customers to send money, and is expected to continue to be so for the foreseeable future. This is because much of Al Ansari’s customer base is low-income migrants, who often have limited access to bank accounts and other formal financial services. As a result they have a preference for initiating sends in cash.

Shifting to digital money transfers

Despite the focus on retail-initiated transfers, Al Ansari does have a small but growing digital presence. The company had 1.2 million mobile app customers in 2022, and mobile app remittances accounted for 15% of the company’s send volume in 2022, up from 3% in 2019.

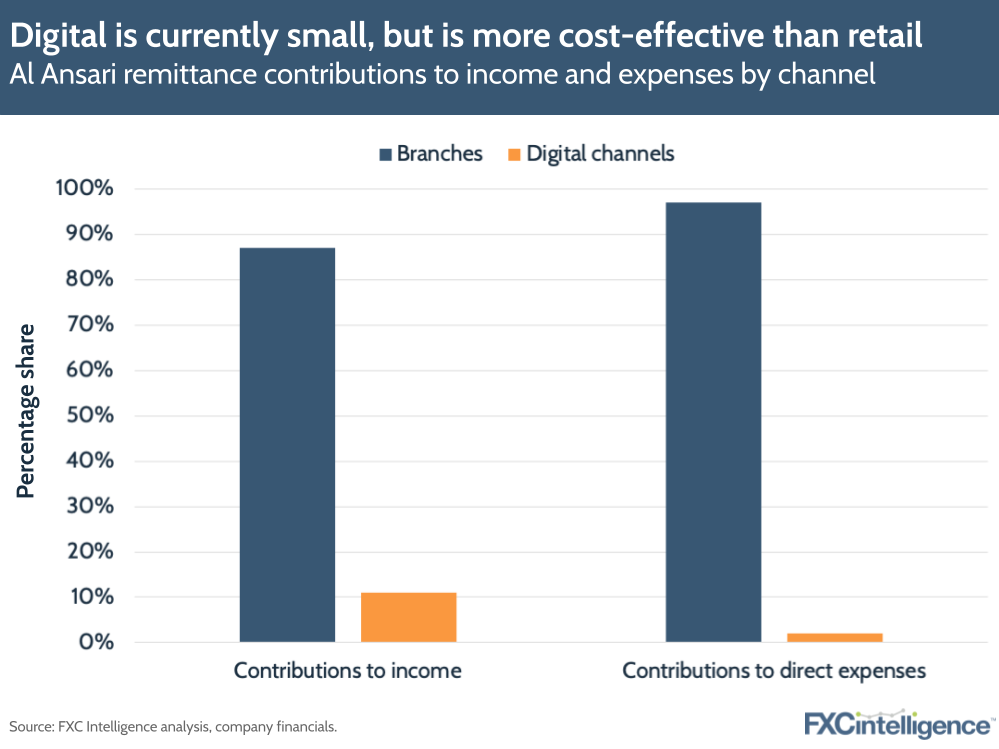

The company also highlights the relatively small cost of serving digital transfers compared to their retail-initiated counterparts. While digital-initiated consumer remittances accounted for 11% of remittances income in 2022, it contributed just 2% of direct expenses.

Over time, customers are expected to increase their use of digital-initiated remittances, making continued digital expansion key to the company’s strategy. An omnichannel approach is key to this, with the branch network functioning as a customer acquisition channel: 32% remittance customers used other services offered by the group in 2022.

As part of this, the company has begun offering “smart counters”, which are digital service points located within branches. It introduced six in 2022 and plans to bring this number to 100 in 2023.

Growing Al Ansari’s B2B arm

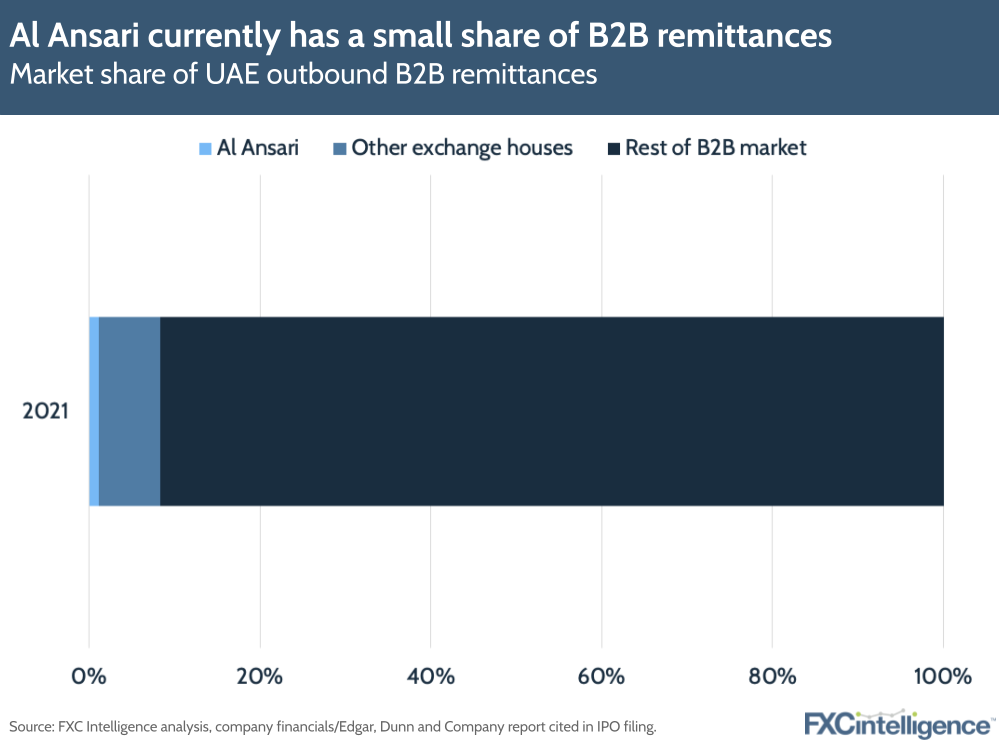

The company has also been expanding its B2B offering, which although currently much smaller than its consumer remittances service has potential to grow. Key to this is cross-selling, with the company looking to increase customer synergies between its payroll management Wage Protection System service; cross-border B2B payments; CashTrans cash management service and bill collections.

At present, the company’s Wage Protection System is its leading B2B service, which has over 136,400 customers. Most of these are small and medium-sized businesses, representing around 40% of the SMBs registered in the UAE.

It plans to increasingly cross-sell this customer base into other areas, including B2B remittances, which represent a significantly larger total addressable market in terms of volume than either its Wage Protection System or the UAE’s consumer remittances sending market.

Future strategy: Geography, digital and beyond

In addition to growing its B2B offering, Al Ansari plans to focus its efforts largely on growing its consumer remittances and related products offering. With cash still dominating the business, expanding its physical branch network is central to this strategy, both in the UAE and the wider region.

Within the UAE, the company plans to expand to new communities and malls as they are developed, as well as relocating existing branches to more prominent locations – a strategy it has successfully employed in the past.

Beyond the UAE, Al Ansari plans to expand to other markets in the Gulf Cooperation Council (GCC) region. It is currently in the process of acquiring Al Ansari Exchange Kuwait, which also owns Oman Exchange Company, which it intends to merge. Once it has completed this acquisition, it intends to expand into GCC countries.

On the digital side, it intends to continue investing in its mobile app, potentially including lowering prices to increase competitiveness.

However, it also plans to expand its digital presence with Al Ansari Digital Pay, a new arm of the business that is in the process of being incorporated to enable the company to hold customer funds. Through this, the company will establish a digital wallet and, in the longer term, a digital marketplace ecosystem.

It also plans to move its Wage Protection System to a digital wallet, to support greater consumer cross-selling to services such as migrant remittances.