European B2B payments major iBanFirst has announced that it is acquiring UK cross-border payments player Cornhill. We speak to Pierre-Antoine Dusoulier, CEO of iBanFirst, and Vivek Savani, Executive Director of iBanFirst and formerly Cornhill, to find out more.

The B2B payments space is seeing considerable consolidation at present, and the latest company to make such a move in the space is iBanFirst, with the acquisition of UK-based Cornhill.

Acquired for an undisclosed amount, Cornhill brings a strong UK customer base to the France-founded and Belgium-headquartered iBanFirst. Specialising in foreign exchange and risk management, the company’s clients are 80% corporates, with the remaining 20% being private clients, such as high-net-worth individuals.

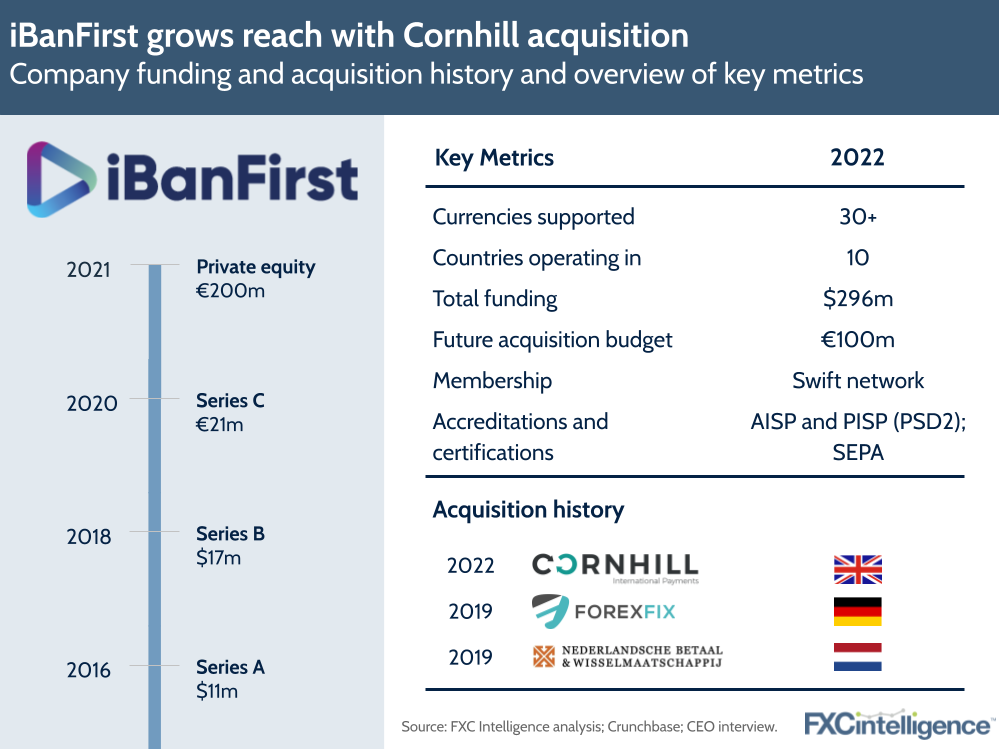

According to Pierre-Antoine Dusoulier, CEO of iBanFirst, the acquisition represents the desired combination of “licence, clients and a good team”, and begins a plan to spend a further €100m on acquisitions designed to grow the business.

“It was the perfect match for our strategy,” he says.

iBanFirst’s Cornhill acquisition: Adding strength in the UK

The acquisition follows an intense period of development for iBanFirst. Between 2020 and 2022, the company has grown its presence from three countries to ten, and in the process has spent “a lot of resources” developing its technology platform, according to Dusoulier.

“The platform is traveling well,” he says. “Across Europe – we have clients in Italy, Netherlands, Germany, France – and they are all very happy with what we offer.”

However, while iBanFirst had a small number of UK clients, it also had a problem: if it wanted to continue serving those clients in the future, it would need to get a UK-specific licence due to Brexit.

“We started thinking, if we want to become bigger in the UK we need three things: a license, a team and if we can start the business with small clients it will be nice,” he explains.

Cornhill was seen as an ideal candidate because not only did it fulfill the requirements, but it also lacked the technological sophistication of iBanFirst – meaning the acquisition could bring immediate improvements to the company’s clients.

“Over the last probably five to seven years, technology has really become a key focus for clients both on the private side and the corporate side,” says Vivek Savani, Executive Director of iBanFirst and formerly Cornhill.

This was a particular challenge during the pandemic, with Savani explaining that he had to work highly unorthodox hours during the pandemic to keep up with the needs of clients, as well as struggling to provide the collateral terms required during periods of currency volatility.

“Partnering with iBan, obviously the technology is brilliant and the ability for us now to service our clients in a much more effective way is incredibly exciting for us,” says Savani.

Improving economies, enhancing revenue

The acquisition of Cornhill has long-term potential for iBanFirst, but in the short term the company will be able to provide immediate pricing improvements.

“iBan has 20 times the volume [of Cornhill],” says Dusoulier. “We have way better pricing, so immediately from day one, once everything has been launched, we’ll allow Cornhill to have really better pricing just by being with us.

“We’re getting about €400-500k of economy per year just by signing the contract.”

Beyond initial cost savings, there are also longer term gains, with Cornhill bringing UK market knowledge not previously known by iBanFirst, and which is particularly valuable given the size of the UK B2B cross-border payments market. However, with the enhanced technology iBanFirst provides, Dusoulier also sees the potential to increase revenue from existing clients.

“Moving Cornhill clients to our platform will be an upgrade for the client, and probably we can do some upselling, cross-selling, making more revenue from the existing client portfolio of Cornhill,” he says.

Growing iBanFirst: Opportunities in B2B payments

Looking forward, the company now plans to “accelerate the UK market”, through increased investment in a common team and a dedicated marketing budget.

However, Dusoulier also sees particular opportunities in the white label space. Here he says the company has “full white label capabilities” that have so far been under-utilised as white labelling is “not very popular in continental Europe”.

“Our white label product is probably going to add a lot of success in the market,” he says.

Looking beyond the UK, while the company is eyeing expansion into Scandinavia and even to North America, he stresses that there is also a need to sure up the company’s existing markets.

“We have grown a lot, very fast. Probably one of the things that we need to do at the moment is just to consolidate some of the markets we have open,” he says.

“We just opened Italy, so it needs investment in order to have a good product offering. We are really in a place to investment everywhere.”

However, Cornhill is set be the first in a number of acquisitions by iBanFirst in the near future. The company has earmarked a further €100m for additional acquisitions, with Dusoulier saying that the company is exploring other additions that provide a route to new markets.

A place for digital currencies?

With the company’s expansion plans in place, does iBanFirst see any potential to adding digital currencies into its mix of offerings?

For Savani, while cryptocurrencies have been a source of intellectual curiosity for his clients, he has not seen any express any serious interest in their use for B2B payments.

“I just don’t see that at the moment being something that will supersede good old fashioned international payment,” he says.

“Maybe years down the line, but in terms of my client basis, I don’t really see it coming up any time soon.”

Dusoulier echoes this, although highlights that the underlying technology does have the potential to simplify money transfers in more fraught corridors.

“If we were to reinvent international cross-border payments today, it would be done with the blockchain instead of using a lot of intermediaries,” he says.

However, he argues that as it stands, transitioning would be incredibly difficult as it would require every bank and payment company in the world to transition to a new system at the same time.

“It’s very tough when everything has to route through different intermediaries,” agrees Savani.

“It needs to be simpler and cryptocurrency does offer that simplicity to a certain degree. Maybe in the next 10 years or so.”