In the latest in our Post-Earnings Call Series, Flywire CEO Mike Massaro discusses the company’s success in Q4 and FY 2021, as well as his future plans for the company.

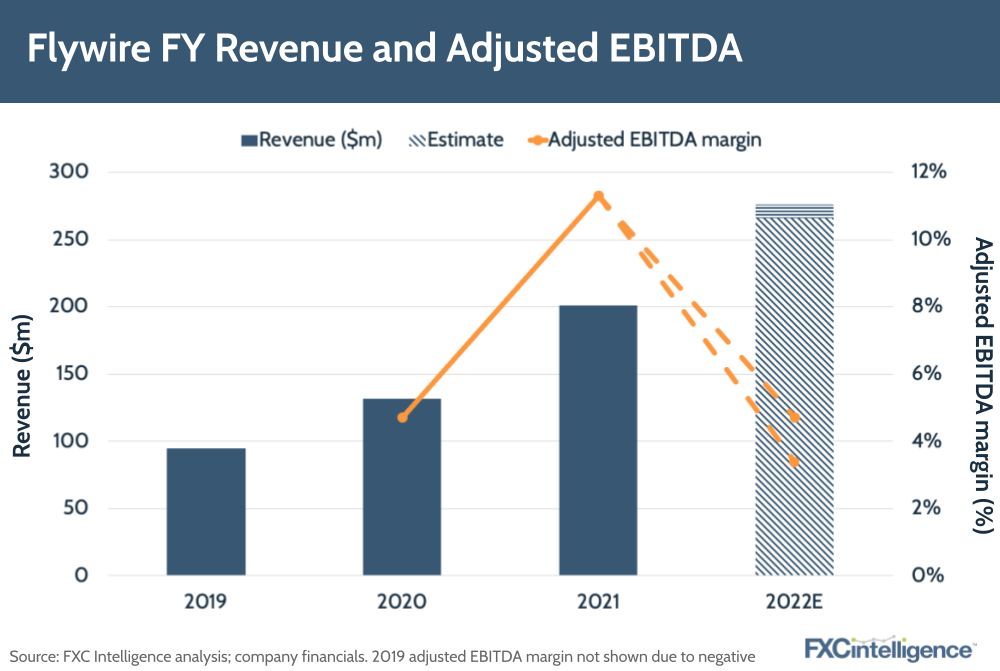

Global payments tech provider Flywire is expecting to fly high again this year after seeing a 53% year-on-year increase in revenues to $201m in 2021.

The company rounded out its first public year with a Q4 revenue increase of 55% to $33.2m – an achievement it puts down to the rapid growth of its international education business and a surge of post-pandemic travel.

Healthcare, education and travel have a combined TAM of $1.7tn, giving Flywire plenty of room to manoeuvre – but it is also looking to capitalise on new B2B growth opportunities this year. The company has cited four central themes that will span its technology investment in 2022, including expanding receivable payment flows, supporting new use cases within existing industries, deepening technical integrations and improving user experience.

Daniel Webber sat down with Flywire CEO Mike Massaro to explore the secret to the company’s success and how it plans to evolve in 2022.

Flywire’s key growth drivers

Daniel Webber: Let’s go through the high-level growth drivers. What’s been driving Flywire’s flow and revenue growth over the last quarter? What are the tailwinds pushing you through?

Mike Massaro:

Obviously it’s our third quarter as a public company and the first full year we reported out. In the earnings call it was the growth of the transactional revenue streams. We have two revenue streams, transactional and platform and usage.

We’ve seen outperformance due to the great growth and the transactional revenue streams of our business. Another tailwind is this belief that we’ve had in this rolling recovery aspect of the pandemic that was really going to happen over 2021 and into 2022. And I think that’s what we’ve seen.

Now there hasn’t been a full recovery yet, but the world continues to find ways to live with things. We saw our international education business do quite well in 2021. Also, the travel sector that we’re in is another area driving growth and outperformance. So, it was a great year. It was a challenging year with a lot of uncertainty, and we’re glad to have our first year as a public company behind us.

Daniel Webber: All of your tailwinds are positive. Is that right? Or is there anywhere you have actually seen a decline because the pandemic has receded?

Mike Massaro:

You’re exactly right. I would say it is important to note that within regions or within the sub sectors. There’s still more to come in some areas as you have boarding schools or language programmes or shorter-term educational experiences. That’s a good example of something that hasn’t fully come back yet.

Australia, New Zealand and in the Asia-Pacific region – they were the last to really open for international students. They are still not fully there and getting back to pre-pandemic levels. So there are regions and sub sectors. For example, we had great growth in travel last year, but at the same time crossing borders still wasn’t easy last year, even in Q4. So you would expect that to really start to come back in 2022 and maybe slightly into 2023.

Figure 1

Expanding in the B2B space

Daniel Webber: The B2B space, you say, has a $10tn TAM. Where are you finding that you’re really having the right tracks in this area, and where do you want to develop?

Mike Massaro:

Obviously we’re focused on the accounts-receivable side of B2B, just like we are elsewhere in our other sectors. We’re not focused on accounts-payable, we’re focused on the receivable.

We look to segments like tech and manufacturing. Those are really great sub-sectors for us, where there’s poor digitisation – at worst, it’s paper and at best it’s electronic PDFs. Then there’s often a lot of bank wires still flying around; a lot of reconciliation problems. So it’s really within those sectors.

The other part that’s probably unique for Flywire is we don’t go into these situations looking to have to own all the receivables. We’re perfectly happy digitising a sector, a subdivision of a business, a certain country or geographic region. We’re happy to start there and often expand our footprint within a given customer as we drive ROI and business results.

Easing payments with software

Daniel Webber: You’re talking a lot about the balance between the software and the transactional piece, but by definition, transactional is just transactional. What’s the hook that tends to bring you in? Is it the software side?

Mike Massaro:

It’s definitely the software side, but there’s also the connectivity into the ERP or CRM system in some instances. So whether it’s a platform like NetSuite or Zuora, or even – as some people do – invoicing out of Salesforce. So it’s really about how you fit into an existing software deployment as a business customer and streamline the receivables with that integration. That’s really where the value of the software comes in.

I’d also say that even if you’re in the space, payments are complicated, as much as we all think we’re here streamlining it, and we understand what’s required for interchange and exchange and all these other aspects of the fee structures. For a business’s finance department, to understand those nuances and to almost have to run a global payment business inside their company, whether they’re doing import export or selling SAS-based software – whatever it is, it’s just unrealistic.

Businesses often have to negotiate complex business arrangements. Maybe they want to accept cards and it’s one acquirer. Maybe they have to have a second acquirer involved as a backup. They get banks who are offering them all different structures. They have to incorporate in different countries and markets and then manage FX risk in those sectors. So that puts a ton of administrative and operational burden on the finance department.

So as much as I say that it’s the software that makes it sticky and that solves the problem, it’s also the fact that with Flywire, we’re taking away that management of all that complexity as well. You don’t have to have your own acquirer. You don’t have to have ten more bank accounts around the world to get paid in. With one relationship with Flywire, you can accept payments in all types of different currencies and you can settle them wherever you need to for your business.

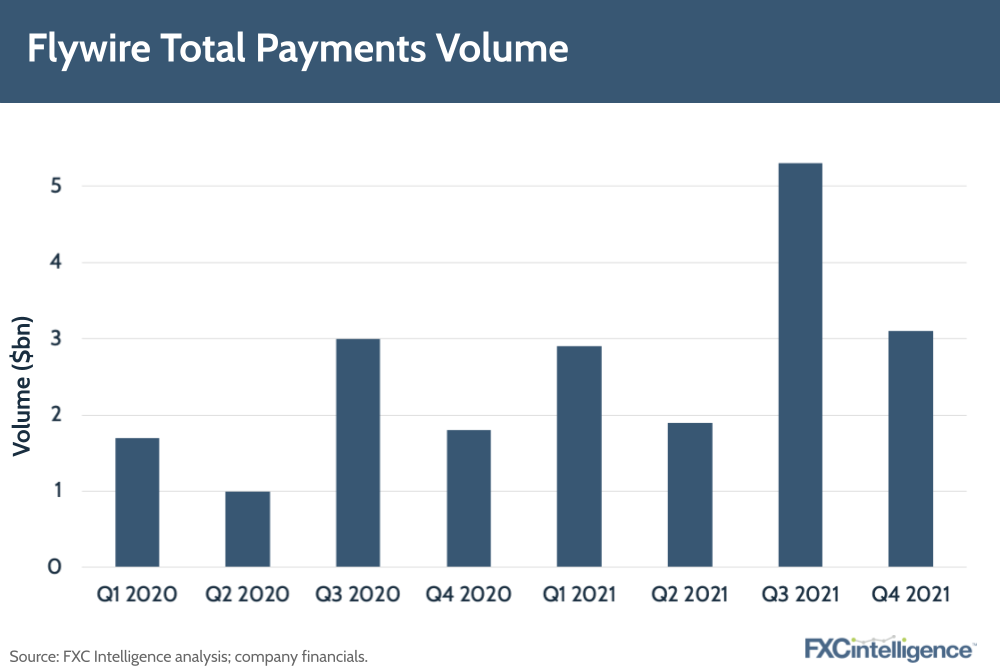

Figure 2

The value of brand recognition in education

Daniel Webber: We were doing some research on the education sector recently and most of the time Flywire’s name comes up. When we were looking at other people trying to get into space, it looks like if you don’t become the ‘branded’ option promoted by the college or university, you are mostly on the outside and you’re going to take a very small share of the wallet. Is that right?

Mike Massaro:

Part of it comes down to how deeply embedded we are in the workflow, and part of it comes down to the cross-border nature of it. If we go in and we’re processing domestic payments, you may still see the Flywire brand, but you’re going to see it more subtly. Mostly, because the trust factor that you have to overcome with that transaction is lower.

The challenge when you get international is that often, to make that transaction go smoothly, we’re leveraging a bank account in the local country, which is often in Flywire’s name. So if you don’t really educate them on your brand, in some ways they’re being asked to send a large sum of money to a bank account in someone else’s name.

There’s also just the support function. One of the things we do for our clients, especially the ones that have lots of cross-border payers, whether it’s travel, healthcare or education, you have consumers who want to talk to someone in their time zone, in their language and our clients don’t have that.

A major medical hospital isn’t going to be available at 2am with a Mandarin speaker to speak to someone who has to wire a payment from China. Same with the universities, same with the travel companies. So you’ll often see our brand being a little more prominent in those instances where most of the flow or a large part of the flow is coming overseas from consumers. Because that’s where we add additional value to our clients. In addition to the software, we’re actually supporting the payer, if they have questions about their transaction.

Evolving the go-to-market strategy

Daniel Webber: Talk a little about how you are going to market and any kind of differences or nuances there. You’ve got some great credits, but it’s got to evolve because you’re getting bigger.

Mike Massaro:

That is true. No one knows that better than me. If you look at the B2B sector, it is massive. We focused everybody on a $10tn number total addressable market. That’s even downsized from that $24-25tn that people often talk about when they talk about B2B, so we’re trying to be very focused.

We’re also into sub-segments – I mentioned tech and manufacturing – and this will be our fourth industry that really we’ve gotten from zero to an emerging sizable part of our business. We did it with education. We did it with healthcare. Even travel graduated last year from this emerging business category into a meaningful part of our business.

We look to investors to look at our track record of doing that three times. Most companies struggle to go into multiple industries and do it globally. With us, with clients in over 30-plus countries, plus having really built three industry verticals from the ground up, we feel really well-positioned in B2B. I think you’re going to see people go after it from the AP side, you’re going to see people come after it from certain sub-sectors of business.

Somebody like Bill.com is going to go after that SMB sector. And again that’s not a sector you’re going to see a company like Flywire go after. So you’re going to have a small business and then you’re going to have mid-market and you’re going to have enterprise. And I think you’re going to see different players in mid-market and enterprise.

For us, we look at clients that have global businesses. We look at sub sectors that have been poorly digitised. We’re going to be the experts in how to connect those existing backend systems to our payment infrastructure and how to modernise those payment flows. That puts us in a really good spot to compete. It’s also just a massive market opportunity. So it is not a winner-takes-all situation.

Evaluating the competition

Daniel Webber: Western Union Business Solutions has now been sold and is officially Convera. It was always historically one of your competitors. Any thoughts on how that may be different now?

Mike Massaro:

It’s going to be interesting. I know they did the first divestiture and it sounds like they get a second one that has to happen for regulatory stuff. Obviously they’re bringing in a senior team. Everybody knew that business struggled inside this consumer world of Western Union, so it’s something they have been trying to bring out for a long, long time and they finally have it out.

It’s a massive market. It’s a massive opportunity. We historically competed with them in the education business and felt we competed quite well.

Competition doesn’t scare me. It gets the blood flowing and I think it’s a good thing. It’s a huge market opportunity, so I’m sure they’re going to go aggressive. I’m sure they have their own strategy for growth, but we’re very much focused on ours and competent in the hand we’re dealt.

Daniel Webber: You make a much higher take rate from your flow than Convera overall. They earned about $420m from $170bn in 2021 whereas Flywire earned $200m from around $13bn, so these are two very different businesses.

Mike Massaro:

I think it goes to the crux of software driving value in payments. If you look at just the consolidation of FX broker firms – which again, of course they have a legacy from two major FX brokerage firms – we’re really coming at it from much more of an enterprise software perspective. That’s the fascinating dynamic in all these industries.

If you think of where things are going, you have banks, card schemes, acquirers, none of which FX brokerage firms have the software infrastructure to salvage the problems of. Then you look at the other side and you have all the software vendors, and everybody’s saying: which one’s going to go? Obviously, our thesis is that the middle section is so valuable. If you can prove you can do that middle section right, you’re in a pretty unique and awesome spot.

I don’t think the back office enterprise software vendors are going to make the leap into payments and really drive the value around payables or receivables, frankly. And I don’t think the transactional players have enough stomach to go all the way into the inner workings of complex software at an enterprise level. If you can stay in that spot, which we intend to do, it’s a pretty valuable spot to be in.

Evolving cryptocurrency demand

Daniel Webber: What are you guys thinking about the crypto and digital currency space?

Mike Massaro:

I’m a big proponent of and holder of all types of different cryptocurrencies. I think it’s ultimately inevitable that digitisation of currency and crypto will take over a lot of the money movement flows or a lot of the currency flows. At the same time, I see it taking quite longer than people think.

There’s a trust question that exists that is generational in nature. My mother’s ability to use crypto or desire to use crypto to make a payment or some type of transaction is extremely low. You and I are probably on the generational high-end of potential users. So there’s going to just take some time for it to truly go mainstream.

Also you have this shift. Seven or eight years ago,people thought crypto was going to be the payment vehicle in the new rail, and it really has shifted over the last three or four years into much more of a trading asset. I think it’s switching back or deciding if they’re more of an asset class or whether they’re more intended for transactional processing. I’s just going to take a while for that to adapt.

As a consumer, where I struggle is having all types of different crypto and moving it even into my own wallet. The other day, I was charged $15 to move it into my own wallet. So you’re almost going back to those crazy brokerage fees, when you used to have to pay $19.99 for a stock trade in a brokerage account in the 1990s. Those things don’t make a ton of sense.

And I think as much as everybody says, “hey, this is going to change the economics”, the industry’s created this whole fee structure but they don’t get given a hard time for it yet, because I don’t think it’s hit the mainstream.

For us, it’s just another node of the network. Whether we choose to accept Bitcoin or Ethereum or whatever, think of it as another node, just like we’re accepting a method like Venmo or PayPal or Alipay or a currency like the Euro or the Pound.

Our ability to add it as a node to the network, either directly with some partner or exchange or through these crypto acquirer types that have started to pop up, we can do it through either of those paths, but is someone going to pay a $70,000 bill? It’s less likely with the fluctuations that exist. At the same time, I’d expect this to be on the front end of that.

There’s no inherent risk to us because a university doesn’t want to have to go and accept crypto themselves and deal with all the operational and logistical and anti-money laundering checks and all the things they have to do to accept that as a payment vehicle. They’d much rather have someone like Flywire added as a method, and we’re already integrated to their software system, we’re already integrated to their ERP, their bank account infrastructure.

We have our own sanction screening and all the other controls we have in place on our platform, so it makes a lot more logical sense to have it added as a payment method than it does for someone with a crypto solution to try and bypass us at the hospital or the university or the business or the travel company. They’re not going to build the software like we already have in place.

Daniel Webber: Is there anything else you wanted to cover?

Mike Massaro:

There’s a lot of talk around, people, talent. That’s the other thing that really came up in our earnings call. We feel really good. We hired 240 new FlyMates last year.

Last year, a lot of companies struggled with the talent war and we’re competing really well and obviously the company’s doing well. But in addition to that, the globalisation of the workforce plays in our favour. We’ve always been a very global, flexible, able-to-work-cross-border kind of company. More FlyMates exist outside the US than inside the US.

We feel really good competing in the talent war too, which we think is going to be a big differentiator in 2022.

Daniel Webber: Thank you very much Mike.

Mike Massaro:

Thank you.

The information provided in this report is for informational purposes only, and does not constitute an offer or solicitation to sell shares or securities. None of the information presented is intended to form the basis for any investment decision, and no specific recommendations are intended. Accordingly, this work and its contents do not constitute investment advice or counsel or solicitation for investment in any security. This report and its contents should not form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. FXC Group Inc. and subsidiaries including FXC Intelligence expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in this report, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting there from. This report and the data included in this report may not be used for any commercial purpose, used for comparisons by any business in the money transfer or payments space or distributed or sold to any other third parties without the expressed written permission or license granted directly by FXC Intelligence Ltd.