Q2 2021 saw Flywire report its first set of results as a public company, providing an insight not only into its path to profitability, which it is set to reach this year, but also its plans for future growth. I speak to CEO Mike Massaro about what’s next.

Q2 2021 saw Flywire report its first set of results as a public company, providing an insight not only into its path to profitability, but also its plans for future growth.

Having reported a 77% year-on-year revenue increase, the company is now approaching breakeven and expects to reach profitability this year.

But how does it plan to capitalise on its four giant addressable markets – education, healthcare, travel and B2B – for future growth, and what strategies does it intend to employ as its key markets evolve?

Daniel Webber spoke to CEO Mike Massaro learn more about Flywire’s prospects and plans as a public company.

Topics covered:

- Flywire’s total addressable markets

- Geographic spread and expanding customer bases

- Differentiating in domestic payments

- Understanding Flywire’s economics

- Approach to sales and customer growth

- Pricing trends

Flywire’s Q2 2021 Results: Key Highlights

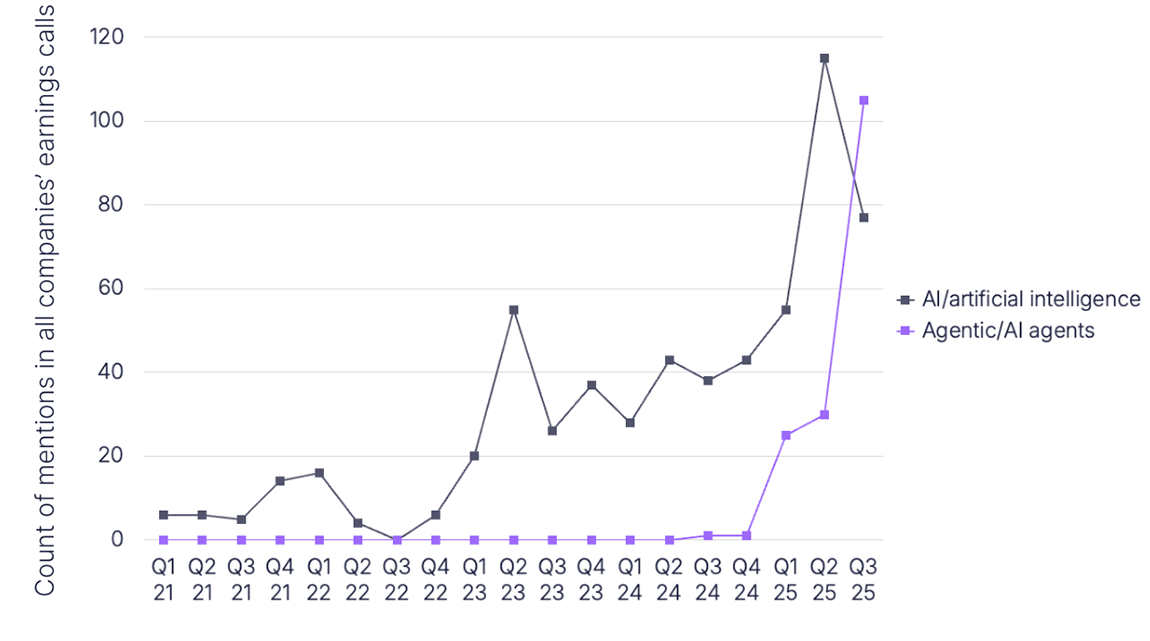

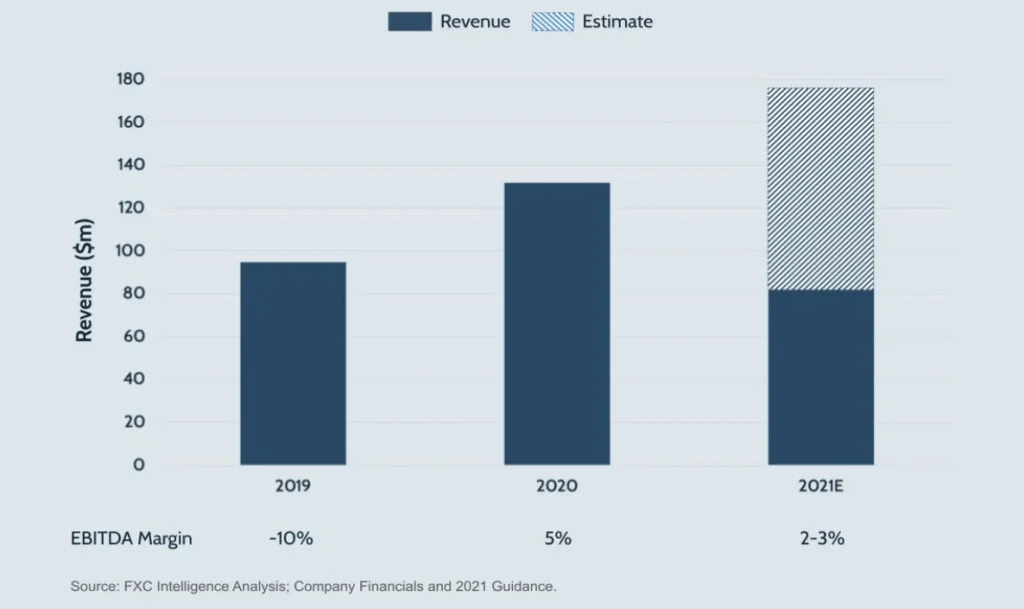

Flywire reported Q2 2021 revenue of $33m, a 77% increase on Q2 2020. It also saw total payments volume increase by 85%, with adjusted EBITDA now approaching breakeven.

In this quarter, 77% of the company’s revenue came from transaction revenue, the majority of which is cross-border, while the remaining 23% came from platform and usage-based fee revenue, most of which is domestic.

Flywire focuses on four key verticals – education, healthcare, B2B and travel, with the first two making up the majority of its business at present. These are both highly seasonal industries, meaning that the company sees revenue spikes in Q1 and Q3 as a result of increased client payment processing in these quarters.

These are segments that the company sees as being ripe for digitisation, creating a combined market opportunity of $12tn. The Covid-19 pandemic has helped accelerate digitisation in healthcare and education, which is increasing the opportunities for Flywire. Travel, meanwhile, has been impacted by the pandemic, although the company sees growing potential of this vertical as more borders open.

Central to its future growth strategy is growing with existing clients, which the company plans to achieve by adding complementary solutions. One example of this is new omnichannel engagement capabilities in healthcare, which has produced an 80% increase in email conversions for customers. A new user experience for the vertical has also proved effective, producing a total payment volume increase for healthcare clients using it of between 5-20%.

In education, meanwhile, the company has looked to expand its offering with existing clients, in particular moving from being solely a cross-border provider to providing all tuition payments. A recent win in this area is with Texas A&M, for whom Flywire is now the sole payment provider.

Beyond existing clients, Flywire has also expanded its total client base, adding more than 200 in H1 2021, including over 100 in Q2. The company also added education solutions in key Latin American markets, including enhancements to its offerings in Colombia, Peru and Chile.

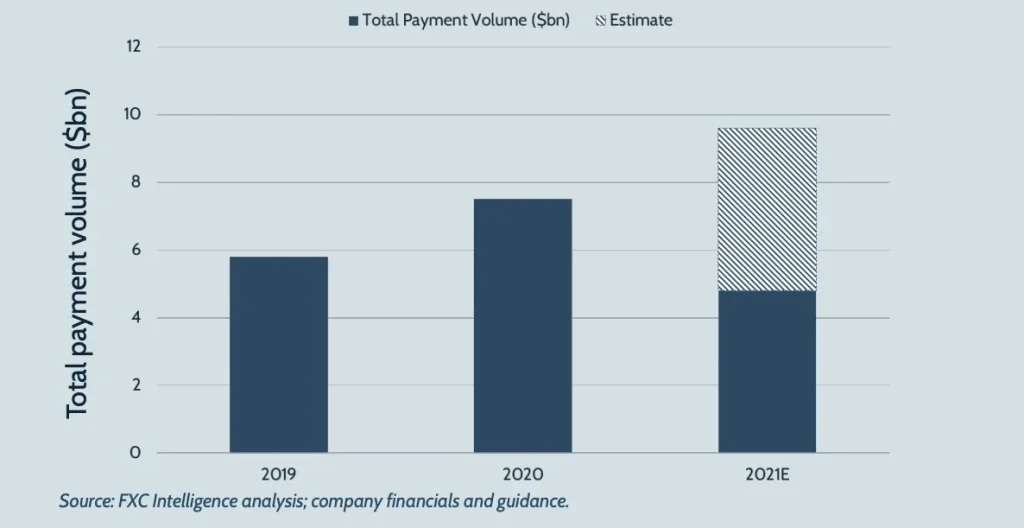

The company sees international expansion as a priority, and is focusing on Canada, Latin America, EMEA and Asia-Pacific.

Building on its strong Q2 2021 results, Flywire now expects to reach profit in FY 2021, with projected EBITA and $4-6m and revenue of between $173-178m.

Flywire’s Total Addressable Markets

Daniel Webber: Let’s start with the big picture. You included a lot of focus on your four total addressable markets (TAMs) in the earnings call: education, travel, healthcare and B2B. How are you thinking about those?

Mike Massaro:

Those four TAMs make up just under $12tn – I think it’s $11.7tn in opportunity. It’s a huge potential.

It started off in education. 10 years ago we were just in the education sector. We just had one product back then, which was the core cross-border tuition product. We’ve since added a whole suite of offerings, including domestic processing and a bunch more software, to really just help digitize payments in general within the education sector.

I’d say that there’s $600bn TAM or so for education, which of course includes the cross-border, but also includes pretty much all the domestic capability now that we have in the suite.

Quite differentiated from a number of folks in the market, right? Either you see people that may have a point solution for cross-border or you see legacy software vendors that just deployed EBPP type billing software and didn’t really solve the payment challenge. So that’s the type of ecosystem that we operate in; really trying to digitize the entire campus.

If you look at the next sector, healthcare, it is around patient out-of-pocket spend, so it’s post insurance being applied. There are some hospitals outside the US we work with, but it’s predominantly the US. Huge out-of-pocket spend challenge here in the US for US hospitals. Cost of insurance and healthcare has gone up. It used to be a couple of percentage points of a hospital’s payments that would come from the consumer, and now it’s significantly higher. It’s typically somewhere between 20 and 30% of their receivables coming through the consumer.

What happened in that industry, about a $500bn TAM, that whole industry didn’t really have infrastructure to deal with payers and to do so in a modern way. That’s really just going through this massive digitization, that whole industry, that whole sector.

As you’d imagine, as we do more domestic payments. A lot of the domestic capabilities, the cross-border capabilities, are consistent at a platform level. That platform and that network that we built and took 10 years to develop, really on top of all of that, is that vertical software.

So those three things is what we try and use to help highlight to people why Flywire is so unique. That core technology, plus the network in our control to move the money and then that expertise to actually deliver the vertical software, that combination is what really differentiates us. That helps us in the healthcare industry as well.

Those two sectors still make up the majority of our revenues.

Daniel Webber: Education and healthcare are two sectors that would never typically invest in payments, they’re never going to build their own infrastructure, whereas there are other industries such as ecommerce where that has happened. Has it been part of your strategy to target industries that have that approach to payments?

Mike Massaro:

I think you’re exactly spot on. If you look at the industries that we focus on, they’re high value, typically high-stakes payments, but it’s almost like they’ve been left behind by what innovation you’ve seen in ecommerce and retail.

When it comes to payments, those two industries have seen such a transformation into how we pay and how they engage the payer. They’re pretty great, right? I mean, if you’re like me, you’re probably spending way too much money on social media selling you different things. And it’s so easy to go into a store and tap and pay and all that.

But if you go into the industries that we serve, I mean, it is almost absurd what the legacy technology looks like. It looks like you’re trying to make a payment on the internet, one or two decades ago. So that’s really where we see the opportunity. We think what you’ve seen as consumers inside retail and ecommerce, is going to be the transformation that happens in so many other parts of the industry, of the global company.

Figure 1

Flywire’s Revenue

Expanding Customer Bases

Daniel Webber: You’ve talked about a lot of geographic expansion. Given the geographical differences in healthcare and to a lesser extent education, where do you see that being focused and what are the similarities and differences?

Mike Massaro:

The beauty of our go-to-market is that shared network and that shared platform. The vertical software really attacks the use case and what’s needed in the industry. But the reality is, as you point out, different regions have different needs.

So you’ll see slight changes, but it’s more configuration changes for us. Maybe it’s a different student information system that exists in the UK, that is more popular than in the United States. Or maybe, of course, there’s always new payment methods in different places that people want to accept.

Those nuances will exist geographically, but the core thesis and the core functionality is consistent. People need to make a payment. Sometimes they need to make a payment upfront. Sometimes they need to make a payment plan, which is another core capability that we’ve added to our platform over the last three or four years. Think of it as all the trends you’re seeing in buy now, pay later.

Our software enables our clients in education and healthcare, in particular, to offer different ways to pay, different timelines to pay that tuition throughout the semester, or to pay that medical bill over time, if you can’t afford to pay it all at once. All that type of nuance that could happen in different parts of regions, is just handled through configuration of the software.

Daniel Webber: Education and healthcare are two necessities, but you have two of the higher value ones. Do you see overlap in your customer base? For example with travel. Are there opportunities to expand from the person who is actually paying, as opposed to the receiver?

Mike Massaro:

Historically, we’ve always been focused on the receiver. Our client is the receiver of money. What is interesting though is, as you grow the business, obviously you interact with the payers. There’s crazy examples of payers who were students, who are now in a finance department of a business reaching out to us and saying, “I remember this is how I paid for my tuition, and now I’m a business with the same problem that the university had of receiving money from overseas.”

People who used us for a travel experience that had also used us to pay for their kids tuition at a major university. So you’ve seen that type of connectivity, but it’s not our focus. Our focus has always been on, how do we help our clients get paid from their customers, anywhere in the world.

Daniel Webber: You talk quite a lot about adding complimentary services. What are those and how do they impact the economics as you build that out? For example, your reach in US education is now really strong, so how do you find more revenue in that segment?

Mike Massaro:

Having gone from just having that one product, in one region, if you fast forward today, you get clients in over 30 countries. So we’ve taken that product and the platform and the network, and gone global.

A lot of companies talk about going global and they may have. They’re launching a new country or they’re looking to get into a new country, but our business has been global for quite some time.

So you’ve got that global distribution, but then you also have what you highlighted, which is, now that we have all these new capabilities, it’s about bringing them into our existing clients and saying, “We can do more for you than just the cross-border payments.” Which, frankly, the clients were often asking us for.

From a client’s perspective, they’d sit there and say, “Why are you helping me just in cross-border payments? Why don’t you just do all my payments?” That’s what actually drove us to add additional products and capabilities over the years.

We talked at length on the earnings call about Texas A&M, which was a great new addition. An existing cross-border client that kind of went with Flywire for all their payment needs. And so doing payment plans, domestic tuition, we even have our e-store module deployed, overdue payments. Again, all these are nuances of how they get paid and our software really connects and digitizes all those business processes.

Differentiating in Domestic Payments

Daniel Webber: How are you approaching domestic payments? In the US it’s a significant pain point, but how are you thinking about it and carving out your differential?

Mike Massaro:

Having that client centricity and our strategy of, ‘how do we help our clients get paid?’ was pretty clear. Our clients need help in other areas. It seemed even unusual, back in the day, where we would deploy this amazing payment experience to engage international payers, but it would be driven from this old, outdated domestic solution that they would have to get over from first.

So when you really start taking it from that perspective, how do you modernize that entire experience? In healthcare, it’s called patient engagement, patient experience, those types of terms. And that’s a similar type of change we’re making across all the products. How do you ensure the payment experience is great, no matter who it is that’s actually paying.

The big reason a lot of companies probably look at cross-border and stay there, is because they sit there and say, “Geez. Well, the old wire system is antiquated, outdated and very costly, and we can undercut that and make good money.” For us, we actually have two revenue streams. We have a transactional revenue stream, and we have a platform and usage-based revenue stream, which we articulated on the call and in the S1.

As you think of monetizing, there’s a lot more volume often on the domestic side, but it’s monetized differently. It can be monetized with platform and usage-based fees. That actually can be really interesting business, especially for a company growing like us. Whereas, I think historically, legacy payment providers have looked at that and looked at it as, “I may process a credit card for 10 or 20 basis points”.

For us, we don’t look at it that way, because we have usage-based revenue, we have software-based revenue and we have transactional revenue. At the end of the day, our software controls the payment vehicle that the money moves over, meaning that’s a pretty powerful position to be in, where the software is actually governing the methods being shown to the payer.

We actually don’t care how you pay. You can pick any of the methods you want, any of the currencies you want. You can pay local if you have a local account. But again, all of those are really beneficial to the customer because it just takes away all the problems on one platform, one consistent entry point to engage their payers.

Obviously our economics across all those methods are quite strong, because of the different revenue streams that we have. Very different than if you just were trying to get the acquiring business alone. If you don’t have the software, you don’t really get to deliver as much of the value that allows you to charge some of the platform usage components.

We’re not alone in the trend. Look at companies like Toast, which is a great example in the restaurant space. They’re digitizing the way in which you pay in restaurants, and engage your customer. It’s another great example of how software is coming in with payments to drive value. So it’s a trend you’re going to see in industries that have almost been left alone or left behind for too long.

Figure 2

Flywire’s total payment volume

Framing Flywire’s Economics

Daniel Webber: One of the things that was really interesting on the call is that you are pushing people very much away from thinking about your business as a take rate business. There’s a lot of revenue based on software usage, which doesn’t equate well against process flow. How should we be thinking about the business’ economics correctly?

Mike Massaro:

We’re at the intersection of software and payments, so people have to think of it that way, as they’re thinking about it.

Companies like Bill.com is a good example. There’s a core software aspect and there’s payment aspect. That’s actually a great diversified business model, and a number of folks kind of have that type of model. But it is very different, as you point out, to how a lot of the cross-border, and specifically remittance companies, look. So people look at us and try to turn us into a remittance company. It doesn’t make sense, and the numbers don’t make any sense either.

It’s really important that people realize that, for us, we don’t actually try and force how anyone pays. We actually don’t even control when someone pays, because our clients have bill due dates. We’re integrated software. Our customer may have a bill due date in September, they may change it next year to the first week in October.

We don’t have to control it. We want to give the configurability through the software, to our customer, to manage it and make it easy, let them change things however they want. Then when users get the choice to pay, Flywire doesn’t care how they pay. We don’t care if you pay in local currency or cross-border. We don’t care if you pay in five installments or you pay it all upfront.

All of those instances, Flywire has good economics for the method picked and good value to our client who’s receiving, and good value to the payer who’s getting a great experience and an easy way to pay. So it’s that combination that has obviously discouraged people to try and apply a take rate.

When you hear it sometimes referred to as monetization, that can vary by transaction size, it can vary by currency pair, it can vary by payment method, it varies by all of those things. It ultimately is by choice of the payer.

Sales Approach

Daniel Webber: You’ve talked a lot about the platform and software. As I understand it, you have a direct sales model and direct relationships with providers, as well as some salespeople. Do you plan to keep the focus on the direct sales model or look to leverage your underlying software and platform for other customer types?

Mike Massaro:

There’s so much out there, as I know you know well and I’m sure your readers also know well. A lot of payables, white label networks out there. Visa bought two of them in the last two years, Earthport and Currencycloud.

What I would highlight there is our network is really set up on the receive side, and it may sound, to someone that doesn’t know payments as closely as probably we all know it, that those should be the same thing, but they’re vastly different.

They have different regulatory frameworks, they have different complexities. And for our business, that’s truly global, you’ve got to be able to help people get paid from quite a number of countries and territories. Whereas, you can build a payables business in a couple of markets and help people send money to many places.

So first, our focus is on the receive side. Eventually over the next decade, I believe you’re going to see send and receive payment companies do more together, where companies and institutions don’t want to have one company that helps them make payments and another company that helps them receive payments. But today, that’s still a pretty big line in the industry.

As you look at our receive network, the industries we focus on, again, they’re unique in that they’re high value, high stakes. Typically big ticket sizes, typically poorly served, as we talked about. And frankly, they’re also low risk. That’s partially by design for Flywire.

We like these industries that are poorly digitized, poorly serviced, but also that aren’t as risky as, frankly, many of the cross-border payments in other sectors like remittance or gaming payments. There’s all types of things that use a lot of the white label networks that we really don’t want within our network, so we keep it private.

There are instances with software partners and such, where we’ll have integrated offerings, where somebody may be using another product and it’s very well integrated to accept payments from Flywire. But the money fundamentally is still going through a client relationship that we have.

Figure 3

Flywire relative payment volume by sending country, FY 2020

Pricing Trends

Daniel Webber: Do you see any particular trends on the pricing side? You set pricing within your business for people, and if they’re sending payments via bank transfer or via card, are you seeing any particular pricing pressures in either direction? Is it stable?

Mike Massaro:

Because of the software value we’re driving, we don’t see a lot of those pressures from the payers, from the receivers. It’s a very low noise friction environment. Again, we’re not forcing anyone to pay in a given method or even in a given currency. So if someone can get a rate somewhere else or find another payment method, they could pay out of one bank account they have, or another. So that’s part of kind of the flexibility that we offer.

I would highlight some of the emerging verticals we’re in, our travel business and our B2B business. I mentioned travel quite extensively on the earnings call. I would definitely say you’re seeing the trend around value.

You’re seeing businesses, institutions, looking to change their business processes, either because of the pandemic or because they’re kind of starting to come out, hopefully, from the pandemic. And they’re saying, “Geez. Why are we doing things too manually, too constantly, and how do we find new solutions that drive more value?” Maybe provide a cost savings to them or to their customer. That is definitely a big trend, so that’s kind of a macro trend.

Daniel Webber: Mike, thank you for the time. This has been great.

Mike Massaro:

Thank you.

The information provided in this report is for informational purposes only, and does not constitute an offer or solicitation to sell shares or securities. None of the information presented is intended to form the basis for any investment decision, and no specific recommendations are intended. Accordingly, this work and its contents do not constitute investment advice or counsel or solicitation for investment in any security. This report and its contents should not form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. FXC Group Inc. and subsidiaries including FXC Intelligence Ltd expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in this report, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting there from. This report and the data included in this report may not be used for any commercial purpose, used for comparisons by any business in the money transfer or payments space or distributed or sold to any other third parties without the expressed written permission or license granted directly by FXC Intelligence Ltd.