Stripe Payments International Holdings, the payments giant’s EMEA and APAC subsidiary, has posted strong results, including rare pre-tax profits. How could this impact its potential to IPO?

Stripe International has published its full-year 2024 results, providing the most in-depth picture of its parent company’s financials available to-date, with both strong revenue growth and rare pre-tax profit suggesting the company is shifting its focus to sustainable growth.

While the company has not yet entered the public markets, and so does not publish financials for its overall group, its Ireland-headquartered subsidiary Stripe Payments International Holdings – which covers its activities across Asia-Pacific (APAC) and Europe, the Middle East and Africa (EMEA) – is required to publish annual accounts.

Stripe has not shared what percentage of its overall revenue comes from its international arm, however the subsidiary is believed to have accounted for around 26% of the group’s employees in 2024. As a result, Stripe International’s financials are a key insight into the wider company’s performance, particularly as speculation builds about when it may finally have its IPO.

Stripe International grows revenue and pre-tax profit

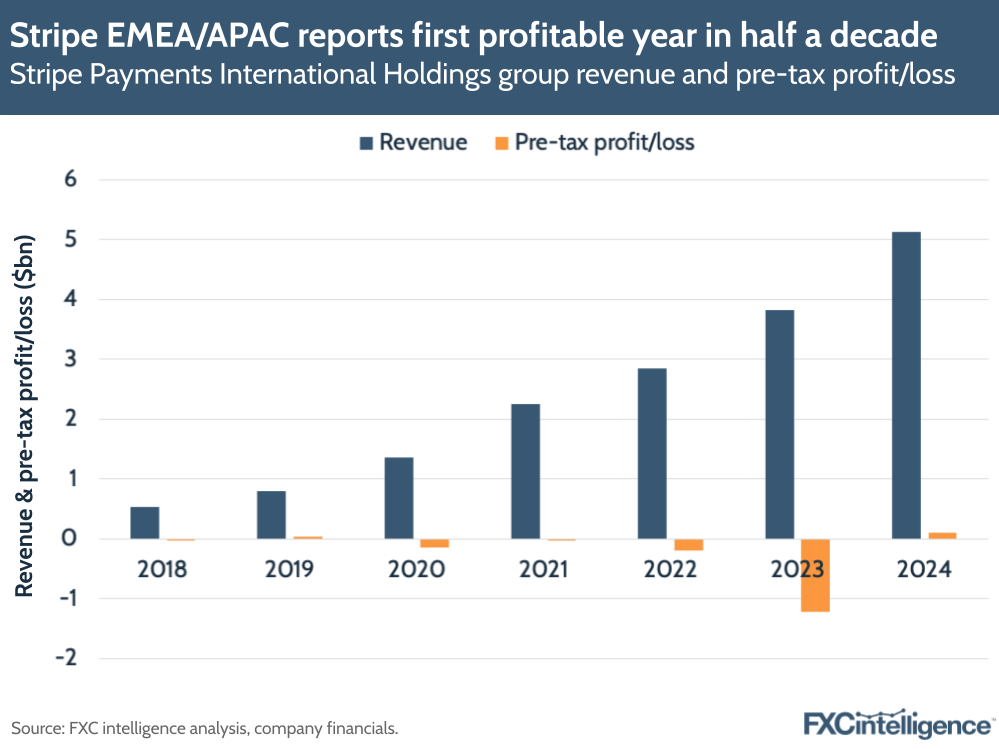

At the top level, the signs are very positive. In FY 2024, Stripe International saw revenue climb by 34% YoY, matching its growth for 2023, to reach $5.1bn – its highest revenue to-date and roughly equivalent to its 2021 and 2022 revenue combined.

Crucially, this has also come with the company’s first pre-tax profit since 2019, and its first profit in the triple-digit millions, with the international subsidiary reporting profit of $102m. This represents a dramatic improvement on 2023’s losses of $1.2bn – although crucially that year was hit by significant one-off employee share payment costs that partially contributed, alongside a surge in its cost of sales – as well as 2022’s $190m losses.

This shift to profit was also echoed in Stripe’s March-published annual letter, which provided a narrative update on the overall group as well as very limited specific metrics. There, the company reported shifting to being fully profitable for the first time in some years, which it expects to continue into 2025.

It also reported an overall 38% increase in total payment volume to $1.4tn for the overall company. And while this is a metric not reported for Stripe International specifically, it shows a rate of growth only slightly ahead of the subsidiary’s revenue increase, suggesting that unit is broadly in line with the company overall.

Stripe International delivers cost efficiencies in FY 2024

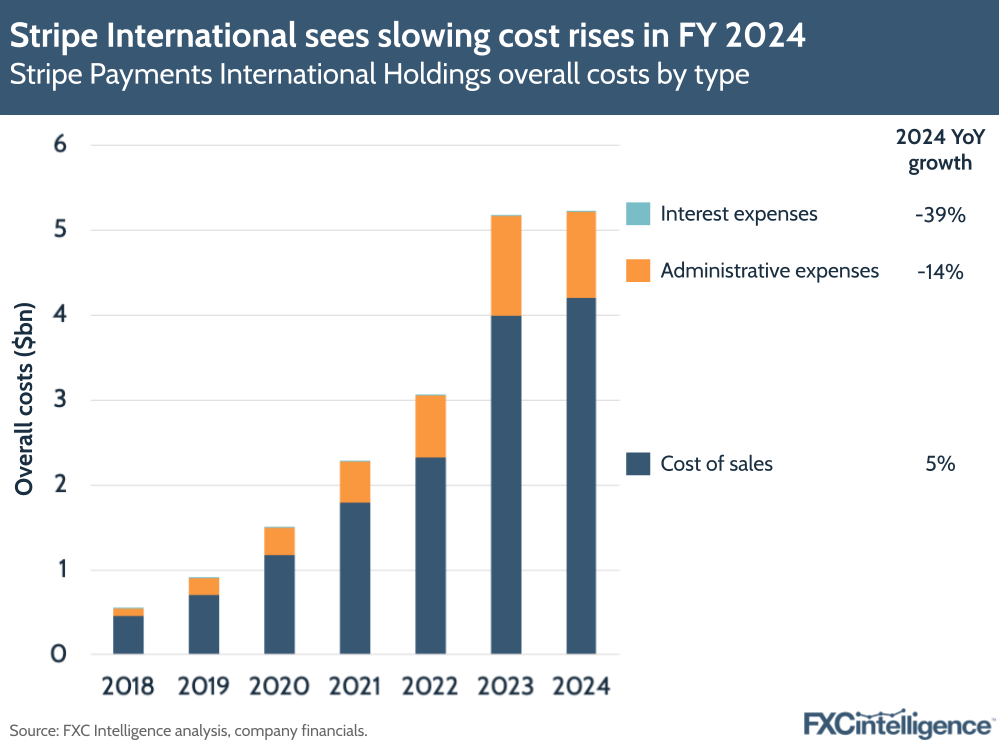

A key driver of this shift to profitability was a significant reduction in cost rises compared to full-year 2023. While total costs climbed by 69% in FY 2023, in 2024 they increased by just 1% to $5.2bn.

The most obvious drop was in Administrative Expenses, which had surged the previous year as a result of share-based payments and this year shrank by 14%, however the largest source of costs, cost of sales, also saw signs of significant efficiency improvements.

Having climbed by 71% in 2023, a significantly faster rate than revenue, cost of sales saw just a 5% increase in FY 2024 to $4.2bn. Stripe never gives much insight into the drivers behind this metric, again citing research and development as a key source of the growth, but the much slower growth reflects a wider fiscal tightening across the industry that is likely to be key to Stripe’s plan to shift itself to a greater level of financial maturity before it makes its public market debut.

Stripe sees improved EMEA and APAC employee costs

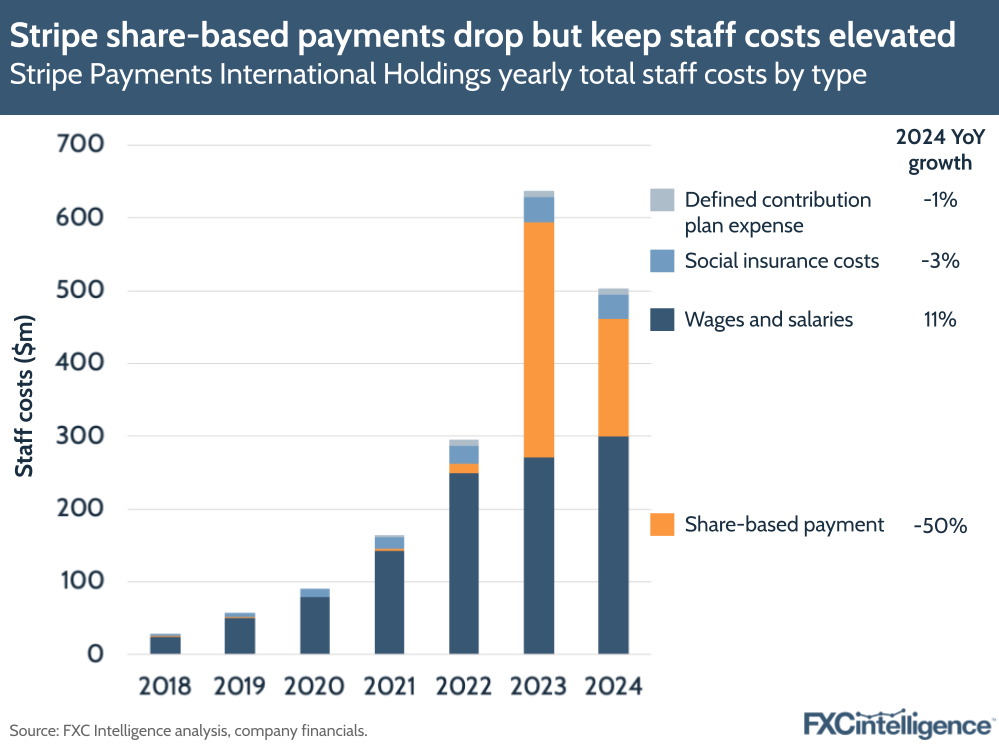

One area we do have more insights into is the subsidiary’s employees and how their wages contribute to its administrative expenses. While wages and salaries increased by 11% and share-based payments reduced by 50%, Stripe International saw other costs associated with its EMEA and APAC employees, namely social insurance and defined contribution plan expenses, reduce by 3% and 1% respectively.

The result is a 21% reduction, although without share-based payments, staff costs for the subsidiary increased by 9%.

On a per-employee basis, the drops were more pronounced. In FY 2024, average total staff costs per employee were around $228,000, compared to $361,000 in FY 2023 – a reduction of 37%. Notably, this was also the case when excluding share-based payments, as per-employee costs reduced across all areas. Minus share-based costs, FY 2024 saw Stripe International’s costs per employee reduce by 13% to around $155,000.

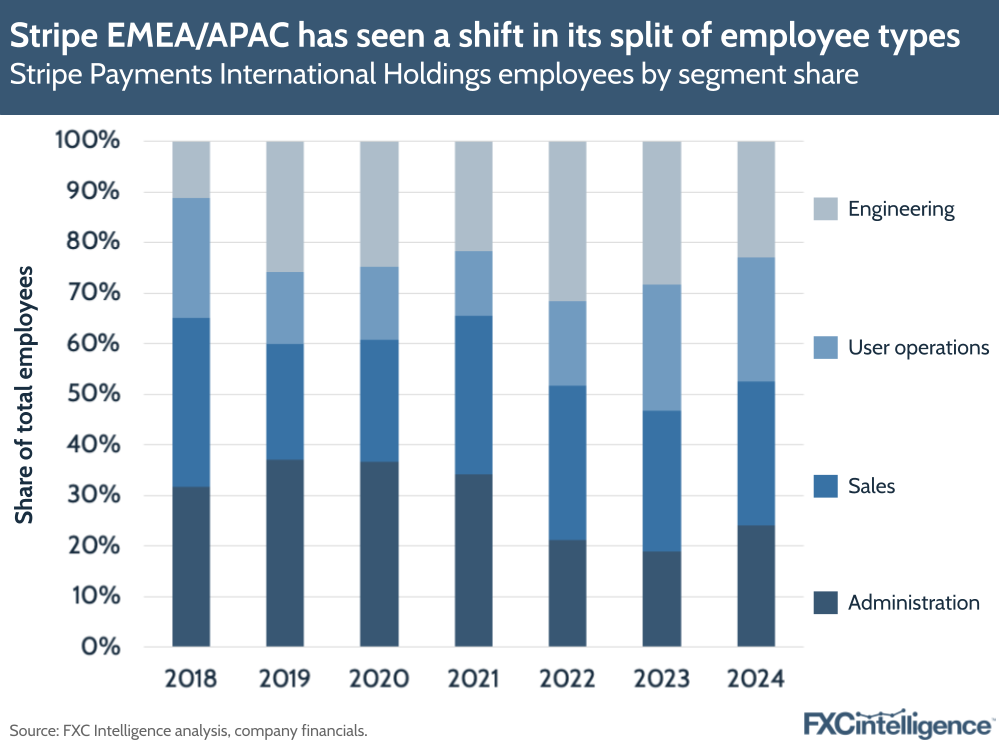

This drop in per-employee costs is likely to be the result of a change in employee mix. Having made cuts to almost every department in FY 2023 except for user operations, 2024 saw all areas increase their number of employees, however there were very stark differences between departments.

While total employees saw a 25% YoY increase to 2,208, Administration saw the biggest increase, growing its headcount by 60%. Sales came in second, with a slightly above-average increase of 27%, while User Operations increased by 22%. By contrast, Engineering, typically the source of the highest per-employee costs, saw just a 2% increase in headcount.

As a result, Stripe International’s employee mix has changed significantly over the past few years. Having accounted for almost a third of employees in 2022, Engineering is now just 23%, while Administration, Sales and User Operations now have an almost equal split, despite Sales having had almost twice the headcount of User Operations in 2022.

This shift may reflect an increased use of AI in the organisation, with the company referencing its own use of AI in its annual letter, but Glassdoor reviews for the company’s Dublin-based office, the headquarters of Stripe Payments International Holdings, also speak to very high workloads across multiple departments.

What do these financials tell us about Stripe’s IPO prospects?

Stripe’s potential IPO is one of the most hotly anticipated in the sector, with recent market analysis speculating that it could be one of the largest on record. However, it should be noted that the company has said little to indicate that an IPO is imminent.

In February this year, the company announced a renewed $91.5bn valuation as part of a share sale to employees that brings it far closer to its previous 2021 peak of $95bn. This is a threshold it is likely to want to pass before or during its IPO in order to deliver a return for its investors, however the fact it was conducting a share sale suggests its leadership did not believe an IPO was on the cards imminently.

However, since then, market conditions have changed significantly, with Circle among those to achieve a blockbuster IPO, and Stripe’s strong position in the stablecoin space, aided by its acquisition of Bridge, is likely to have helped its valuation further.

The signs of profitability and greater fiscal efficiency at both the subsidiary and overall level speak to a company that is readying itself for the public markets more seriously, although when it will finally make the move remains in question. If all continues to go well, 2026 may be the year the company finally makes its debut, particularly if it can do so with a two-year run of profitability behind it.