Revolut’s FY 2024 results speak to a maturing company that is increasingly growing its reach. But how close is it to reaching its 100 million customer target and where is it seeing growth?

Revolut has released its annual report for FY 2024, providing renewed insight into the neobanking major, which is not yet publicly traded.

The results see consistent gains across a variety of sectors, continuing from 2023’s success as the company gears up for the long-awaited launch of its formal bank in its home market of the UK in 2025. There are also signs of maturity in parts of its business, as well as a continued diversification of its revenue streams.

However, with the ambitious goal of 100 million daily active customers in 100 countries, how close is it to achieving these targets and where is it seeing the most growth?

Drivers of Revolut’s top-line growth in FY 2024

Revolut reported FY 2024 revenue growth of 72% YoY, bringing its revenue for the year to £3.1bn. This is slightly slower growth than 2023’s 95% but still represents a very strong rate of growth for the company.

It also reported a significant improvement in profitability, with operating profit increasing by 149% to £1.1bn, while net profit reached £790m with a margin of 26% – a record for the company.

This is also the first time Revolut has reported positive operating profit two years in a row – and the fourth year in a row that it has been net profitable.

Gains in profit have been aided by the fact that while Revolut has grown its headcount, it has done so at a slower rate than its revenue. By the end of 2024, the company’s total employees had reached 10,133, up from 8,152 at the end of 2023, with much of the additional headcount in its customer operations division.

However, at a 24% YoY increase, this is a considerably lower rate than its 72% revenue increase, allowing it to increase revenue per employee from around £220,500 in 2023 to almost £305,000 in 2024.

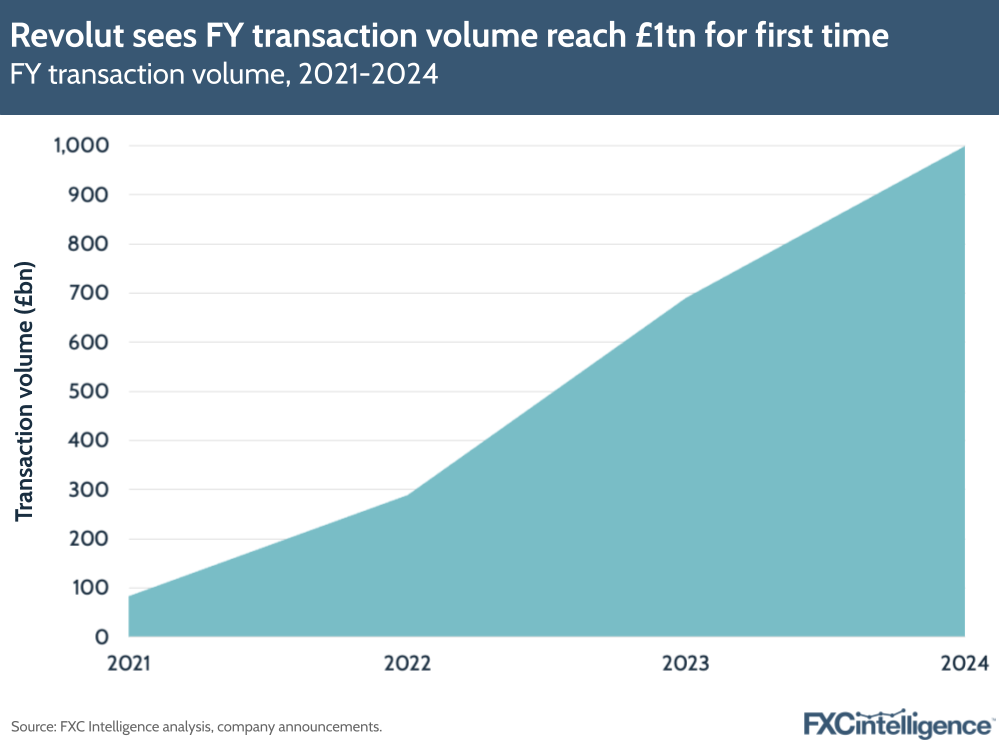

Meanwhile, Revolut also reported its first £1tn year for transaction volumes, which grew 52% YoY. CEO and Co-Founder Nik Storonsky attributed the boost to an increased number of customers choosing Revolut “as their preferred spending account”, with total customer balances growing to £30bn – a 66% increase on 2023.

Cross-segment growth and the role of foreign exchange

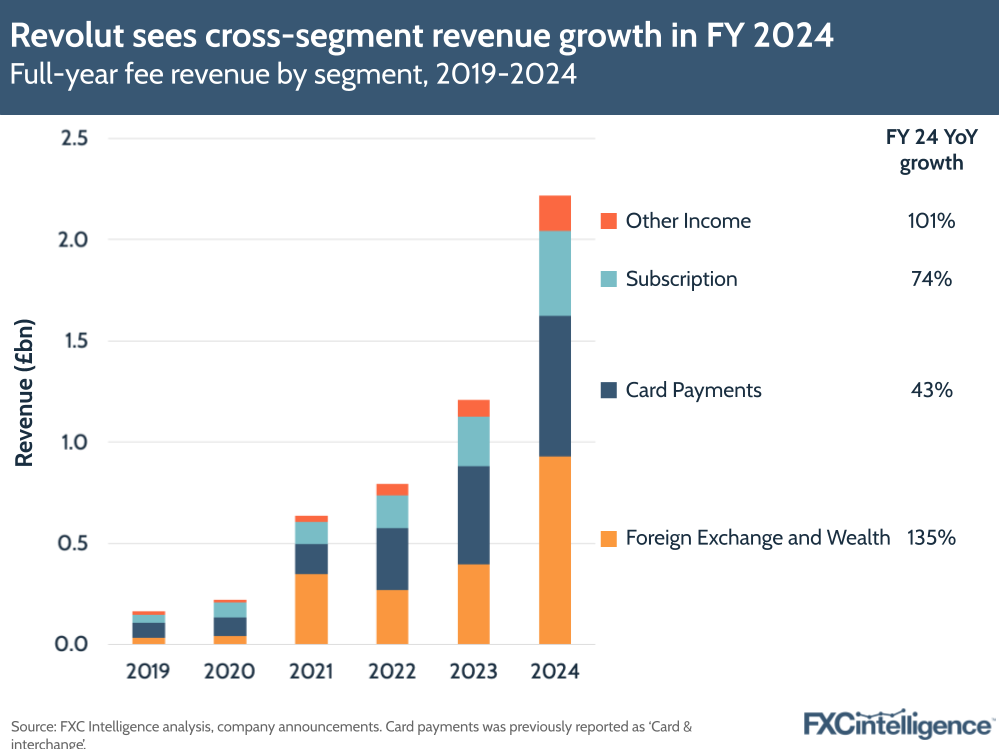

Revolut’s revenue is largely made up of fee income – revenue from charges associated with its various products and services – which in 2024 accounted for 72% of its top-line revenue, up from 67% in 2023. Second to this is interest income (26%), with the remaining 3% attributable to other income.

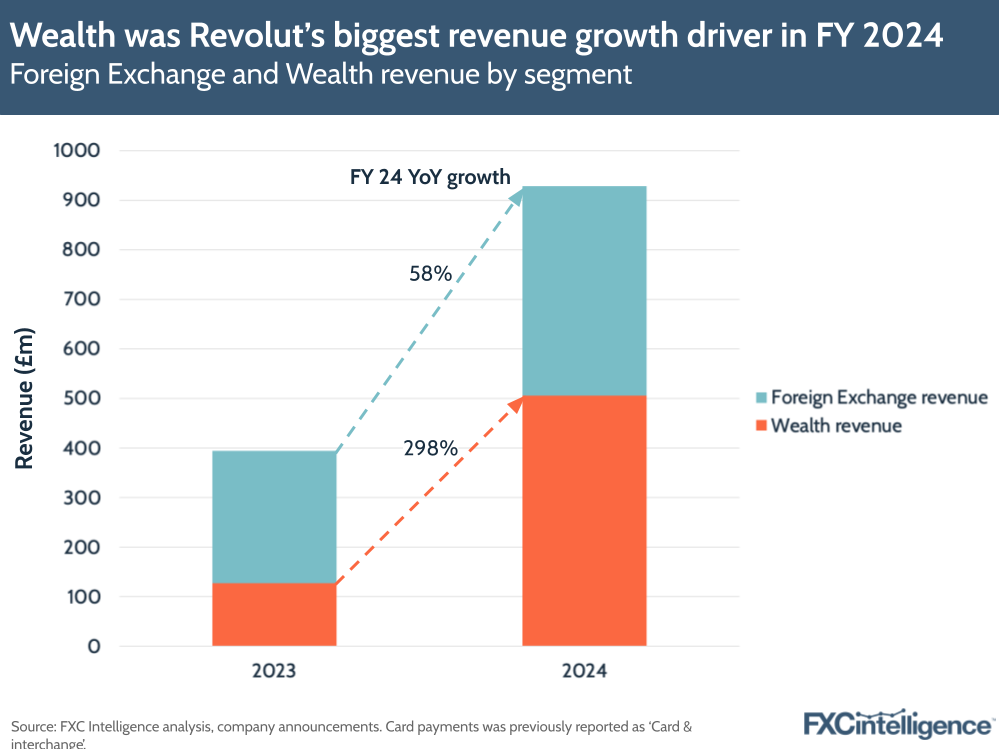

Within fee income, Foreign Exchange and Wealth as a combined unit has outpaced Card Payments for the first time, climbing 135% YoY compared to the latter’s 43%. However, Revolut has now opted to break the former into two distinct reporting segments, making Card Payments the largest on its own.

Covering fees earned from card payments, ATM and card top-up transactions, while Card Payments has had strong growth this year, it has been significantly outpaced by Subscriptions’ 74% growth. Covering monthly and annual fees charged to both consumer and business customers who have signed up for services such as Revolut Premium, Subscriptions saw an increased range of benefits offered through the plans, which the company says drove a 45% increase in sign-ups to paid plans.

Other, meanwhile, includes revenue from card deliveries, remittances where the customer has requested payment from another consumer and commission on the sale of additional products such as insurance or lounge passes. This segment grew by 101% in FY 2024.

However, reported on its own, Wealth was the biggest growth driver, climbing 298% YoY to £506m. Covering areas including the sale of cryptocurrencies and equities, this segment was particularly boosted by increased crypto trading activity, aided by the launch of the Revolut X crypto exchange.

Foreign exchange, meanwhile, grew by 58% to £422m, which Revolut attributed to “market-leading currency exchange rates compared to specialised competitors and high-street banks”.

Interest income as a revenue driver

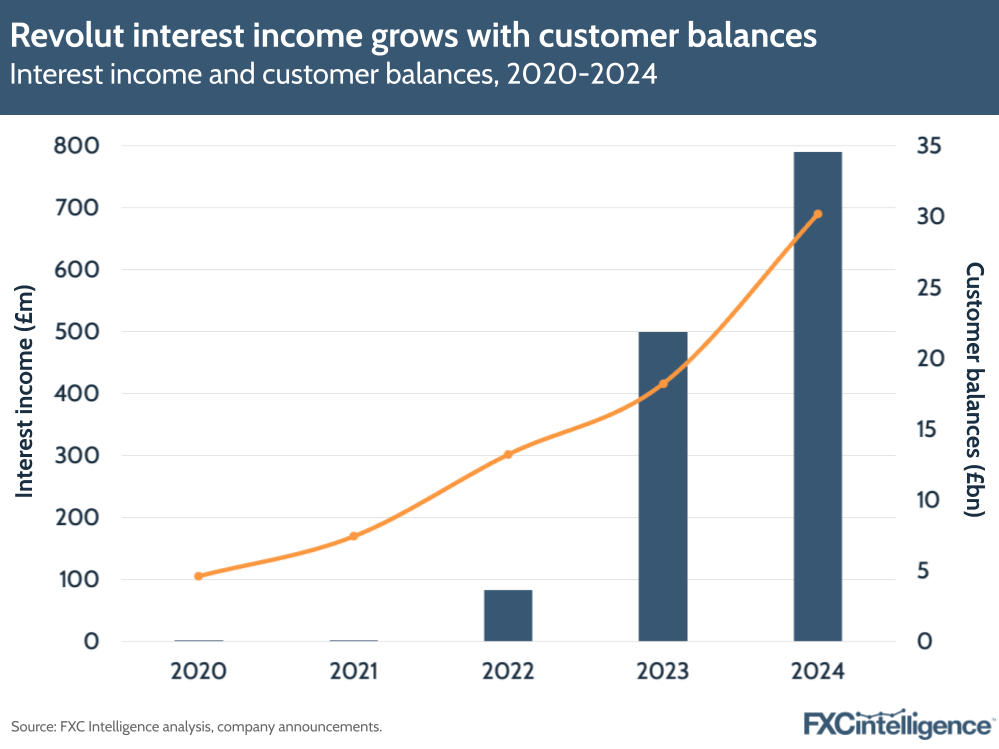

Interest income, meanwhile, continues to be a driver for the company, growing 58% YoY despite a less favourable interest rate environment compared to 2023.

Covering interest earned on customer balances, Revolut saw its interest income skyrocket in 2023 but in 2024 it became more stably tied to growth in customer balances, which themselves grew by 66% YoY to £30.2bn.

Its contribution to overall revenue also dropped slightly, from 28% to 26%, which is not necessarily a bad sign. While any revenue growth is beneficial, becoming over-reliant on interest income makes a business highly exposed to changes in interest rates, which is a particular concern at present given the wider macroeconomic environment.

Revolut Business performance

The company also shared greater insights into its SME-focused product-set Revolut Business than it has done previously, including providing limited revenue information for the first time. In full-year 2024 Revolut Business revenue totalled £463m, around 15% of the business’ revenue as a whole.

According to Revolut, this makes the company “one of the largest B2B digital banking players in Europe”.

The company also saw monthly active Business customers increase by 56% YoY, although did not provide an overall total.

How close is Revolut to 100 million customers in 100 countries?

In its annual report, the company also highlighted its ultimate goal of reaching “100 million daily active customers in 100 countries”, which Storonsky stressed Revolut was “still early” on its journey to reaching.

Revolut’s customer reach is growing

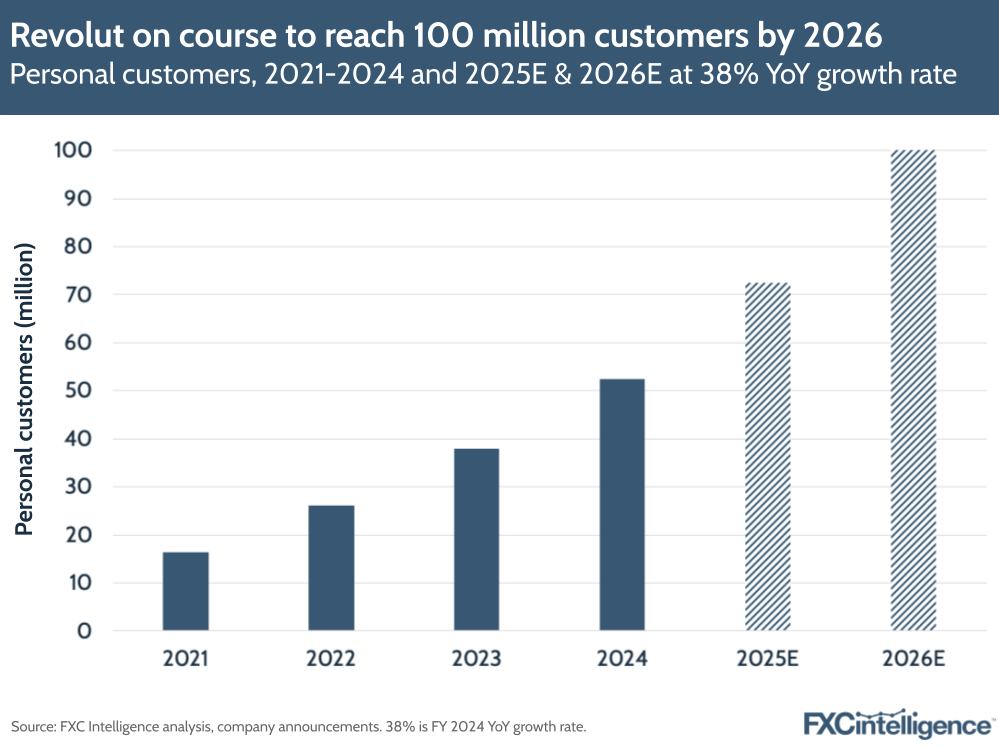

For the target of 100 million customers alone, Revolut is making significant progress. The company’s personal customers grew 38% YoY in 2024 to reach 52.5 million, above its projections for the year, which in its 2023 report it set at 50 million.

If the company were to continue growing at a rate of 38% YoY over the next few years, it would reach 100 million customers in FY 2026. However, it is not clear how frequently these customers use the service, with Revolut not providing a daily active customer number. As a result, it is likely to be further away from this goal.

Country coverage remains sluggish

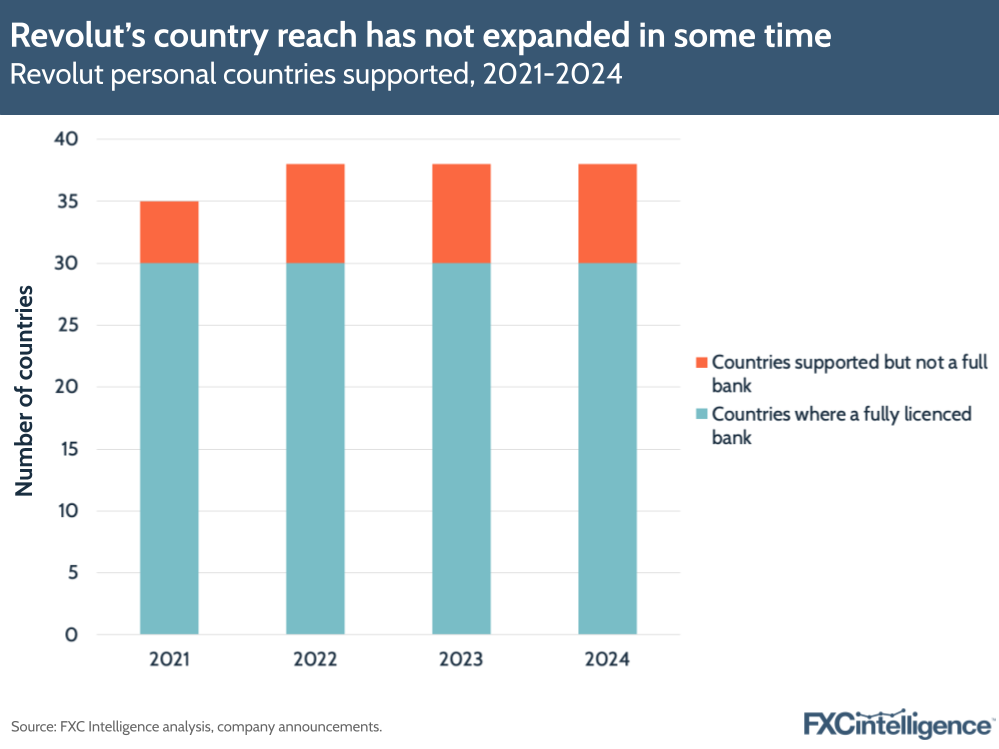

On the country side, however, it is much further away. At the top level, the company has not made any measurable change over the past few years, with 38 countries listed as supported for personal customers and 30 countries where it currently operates as a full bank.

However, this masks progress across a number of different products and services within the country total. Among its additions in 2024, Revolut made local account details available in 11 European countries, added its instant-access savings product in seven additional countries and expanded access to its Flexible Cash Funds product to more than 30 countries.

Revolut has also expanded its Business product to Singapore this year, as well as rolling out its under-18s product in New Zealand.

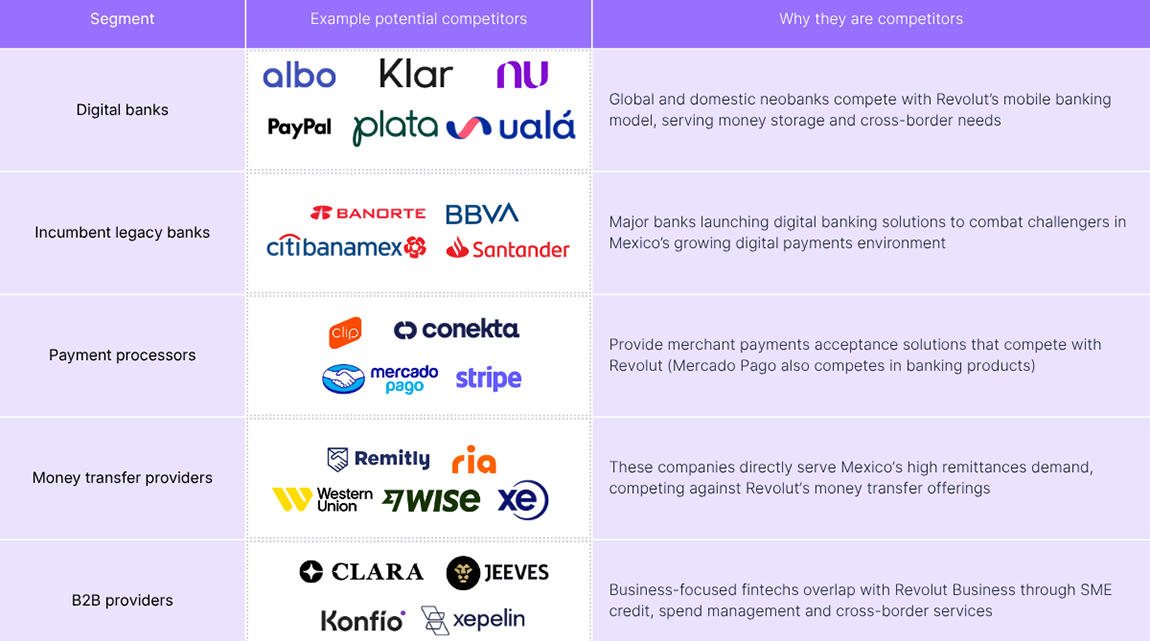

It is also currently going through the process of launching its full bank in the UK, which is set to go live in the coming year, as well as launching a bank in Mexico, where it recently gained a banking licence. Revolut is also preparing launches in India and Brazil.

Although it is building out its presence beyond the UK and Europe, this region remains highly dominant in terms of its revenue, with the UK accounting for 26% of fee income and Europe accounting for 71% in 2024. This has seen Europe in particular grow at a faster rate than any other region, climbing 91% YoY to reach £1.6bn in revenue.

By contrast, the UK grew 66% to £583m and the rest of the world increased 76% to £55m.

Revolut’s prospects for 2025

While it has not provided direct revenue projections for 2025, the company is centering its bank launches in the UK and Mexico as key to the year’s growth. Its UK launch is set to be particularly key, following a years-long process to gain its banking licence in the country, although how much of an impact it will have remains to be seen.

The stalling of the banking licence in the UK saw Revolut shift focus to Europe as its primary growth driver over the past few years, where the broader range of products it can offer has enabled it to generate increased fee income. This is something that it is only building on, with mortgages among the the products in its pipeline.

However, the UK bank launch will open the doors for it to step up its presence in the country as it continues to cement its place in the UK finance landscape, including with its recently opened offices in London’s Canary Wharf financial hub. As the year progresses we are likely to see this focus intensify, with next year’s results providing a first key sense of how much of an impact this licence will have on the company’s UK business.

Beyond its banking launch Revolut plans to continue developing its market and product presence, with some of the biggest efforts in areas such as the Americas and Asia-Pacific. With so much of its revenue still concentrated in Europe, Revolut has strong potential in these newer markets – but also has work ahead to build trust with consumers in these regions.