The Financial Stability Board (FSB) has unveiled the latest key performance indicators (KPIs) for the G20 Roadmap for Enhancing Cross-Border Payments. After failing to make significant progress last year, are we any closer to the targets for 2027?

Last week, the FSB published its third annual update regarding the global targets for cross-border payments set for 2027. While the inaugural 2023 report set a starting point for tracking progress, the following 2024 update showed that very little headway had been made – including some evidence of regression in certain metrics.

The report includes extensive data directly provided by FXC Intelligence, which supplied the data for the retail section of the G20 Roadmap. The remittances segment is based on the World Bank’s Remittance Prices Worldwide dataset, which FXC Intelligence has also provided since Q2 2021.

Once again, the retail section of the new progress report focuses on person-to-person (P2P) money transfers; business-to-business (B2B) payments for micro, small and medium-sized enterprises (MSMEs); business-to-person (B2P) payments; and person-to-business (P2B) payments. This year, marginal progress has been made in some areas towards the G20’s targets for cross-border payments, although not to the degree that it is likely the goals will be achieved by the 2027 target. In fact, this year, the FSB itself admitted that it is “unlikely that satisfactory improvements at the global level will be achieved in line with the 2027 roadmap timetable”.

In this report, we take a look at the key retail payments metrics behind each of the original G20 targets for 2027, to understand just how far off the industry is from achieving these goals, and to determine which areas need the most focus, particularly for P2P payments.

Has the cost of cross-border retail payments improved?

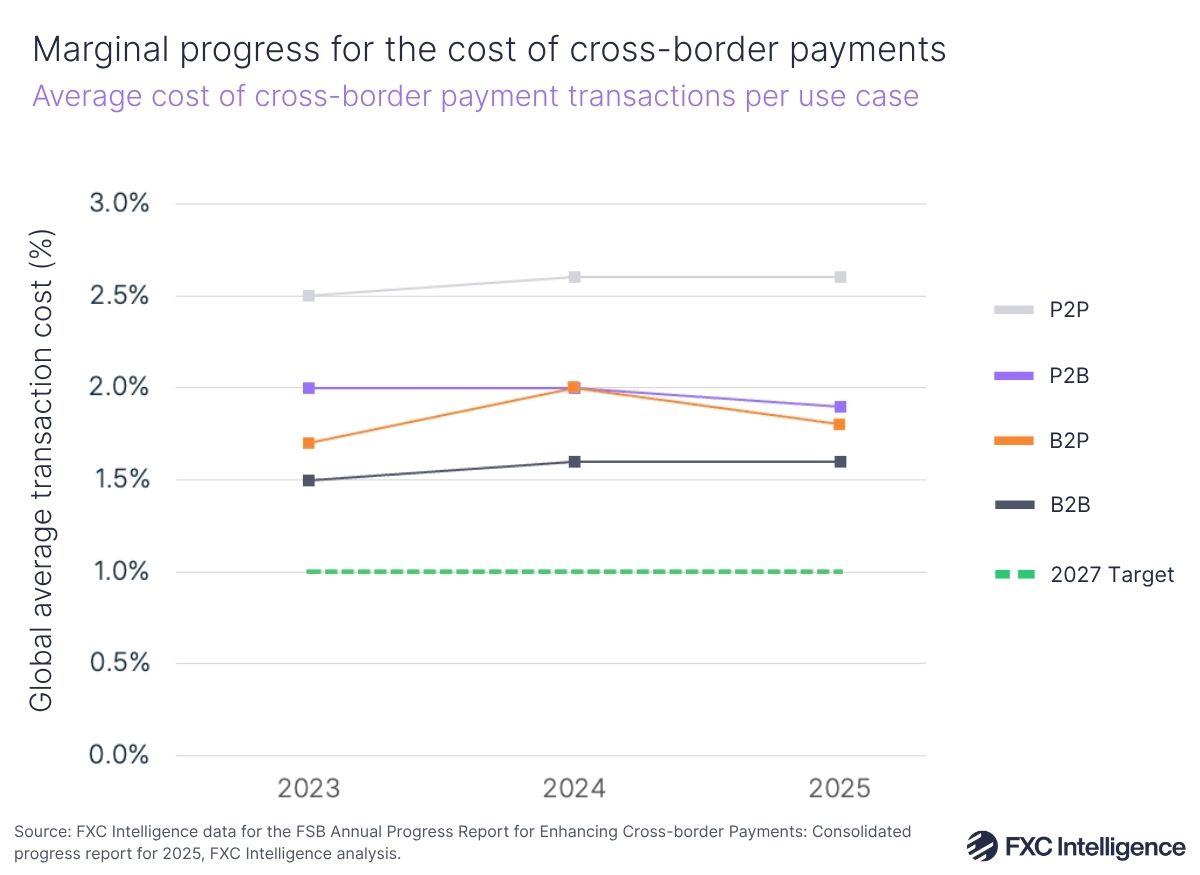

The G20 roadmap outlines plans to ensure that the global average cost of cross-border payments is no more than 1% by the end of 2027. Last year, average costs moved away from this target, with all use cases increasing in costs, barring one – P2B – which simply remained at the same level.

In 2025, there has been some movement back towards the 1% targets, although only one use case has succeeded in getting closer to the target than it was in 2023: the average cost of P2B cross-border payment transactions fell from 2% in 2023 and 2024 to 1.9% in 2025. P2P payments retained its spot as the use case with the highest average cost, with costs sticking around 2.6% to send $1000, and is yet to drop below 2023 levels.

The fact that no use cases continued to move away from the 1% target does indicate a small success in itself. However, like in 2024’s progress report, it is important to note that there was a high turnover of payment service providers (PSPs) and country corridors, which could have impacted some changes in the data, particularly when dealing with margins as small as these.

Looking at the costs to send P2P payments from specific regions, Sub-Saharan Africa emerged as the most expensive place to send money from, with a slightly over 4% weighted average total cost to send money to anywhere in the world. Despite efforts to drive down the cost of cross-border payments, this region actually saw the average cost of sending P2P payments increase by 0.23 percentage points YoY.

On the other end of the spectrum, Europe and Central Asia emerged as the region with the least expensive outbound retail cross-border payments. It also saw the total average cost sending a $1,000 P2P payment drop by 0.04 percentage points to 1.93% in 2025.

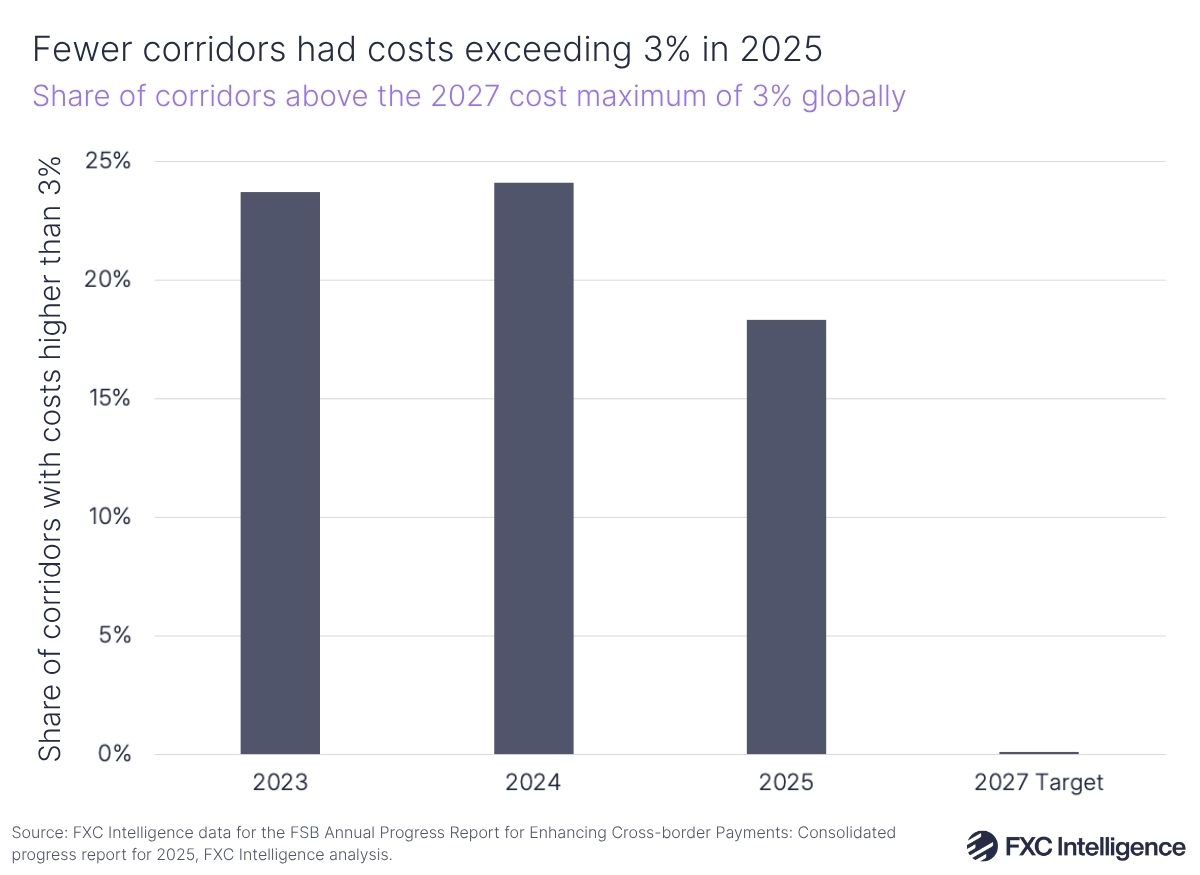

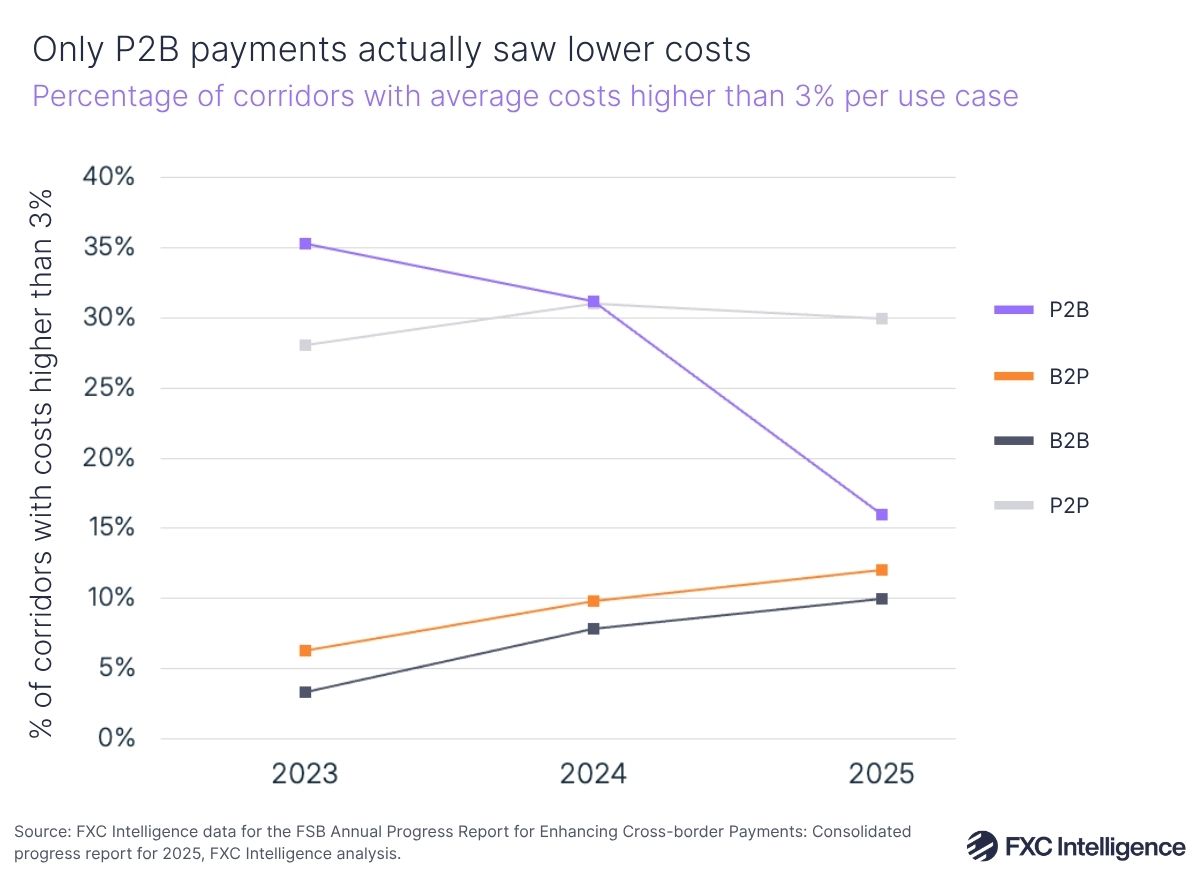

Do fewer corridors charge more than 3% for retail payments?

Further progress was made towards another of the G20’s key targets for cost: ensuring that no corridors globally have average costs higher than 3% for retail payments. Only 18.3% of corridors continue to charge higher than this value on average – an improvement of 5.8 percentage points from the previous year.

This progress was mostly driven by the P2B use case, which has seen the percentage of corridors charging more than 3% drop in both 2024 and 2025. This year, the drop was largely driven by South Asia as a sending region, which saw its number of corridors with average costs exceeding 3% drop by over 36 percentage points. However, B2B and B2P payments saw increases to these in each of the last two years.

The only use case to increase in 2024 and drop in 2025 was P2P – although it remains above the levels seen in 2023. For all sending amounts, twelve regional corridors that had total average weighted costs above 3% in 2024 fell below the target in 2025. However, nine regional corridors below the target in 2024 saw costs increase to above 3% in the 2025 data – meaning this use case only saw a net improvement of three regional corridors YoY. This improvement was largely driven by payments being sent from Latin America and the Caribbean, which accounted for 67% of corridors that dropped below the target.

Did cross-border payment speeds improve globally in 2025?

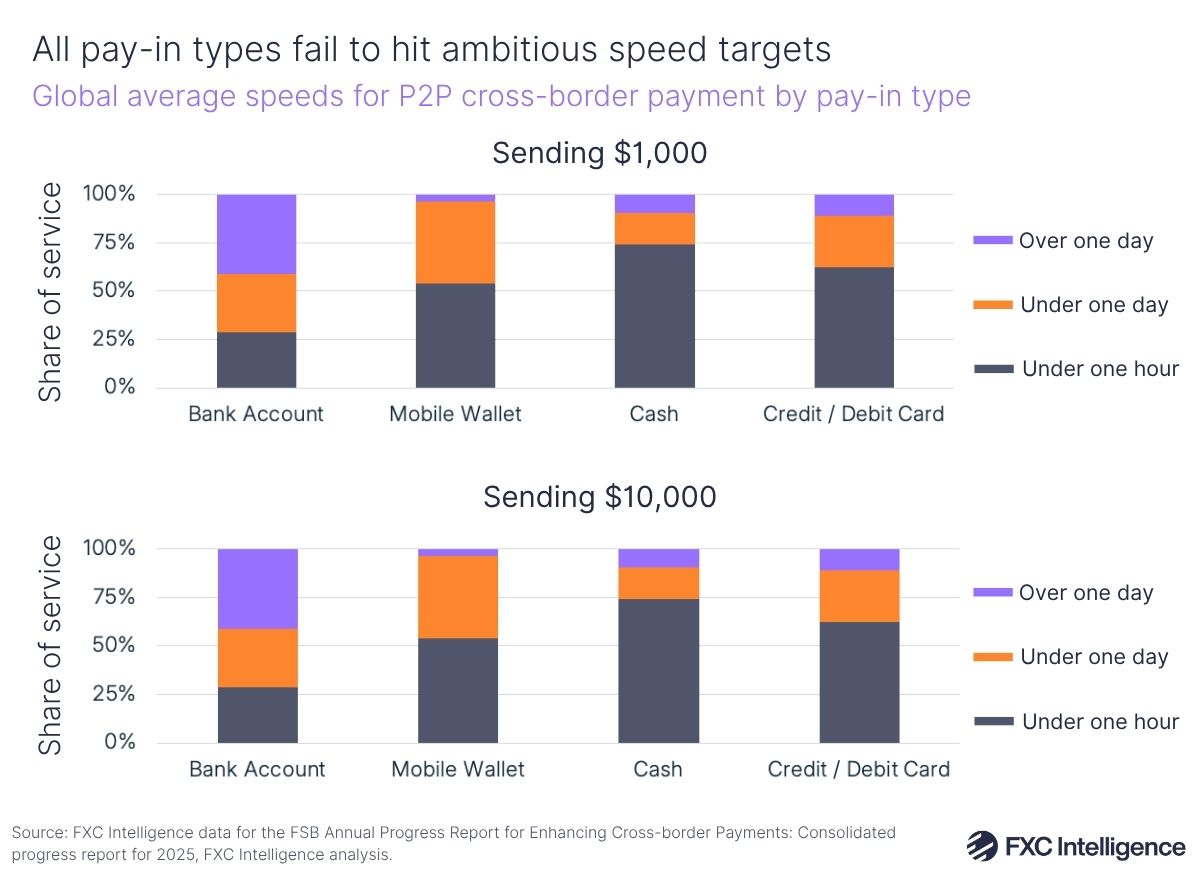

One of the G20’s key targets is related to the speed at which cross-border payments are completed. It is aiming for 75% of all cross-border retail payments globally to provide availability of funds for recipients within one hour from when the payment was initiated. It also wants to see the remaining 25% made available within one business day by the end of 2027.

This year’s data once again gave slightly more promising signs than the previous, with a 1.9 percentage point increase in the share of cross-border retail payments services that credit recipients within one hour of initiation. However, this number currently sits at 35.4% – 39.6 percentage points away from the 75% target, indicating that despite this slight improvement, it is unlikely meet the target by the end of 2027.

Last year, cash emerged as the only pay-in type for P2P cross-border payments to achieve the under one hour target for both $1,000 and $10,000 send amounts at a global level. However, this year, none of the pay-in types were able to achieve the 75% target globally for payments made accessible in under one hour for either payment volume.

Cash emerged as the closest for both amounts, with 74% and 60% of cash pay-ins of $1,000 and $10,000 being made accessible in under one hour, respectively. Similar to 2024, bank accounts remained the furthest away from the speed targets, with a weighted average of 42% of all pay-ins taking longer than a full business day to become available to a recipient.

Although this year’s speed data makes for disappointing reading, the FSB revealed that wholesale cross-border payments speed had improved more significantly, which could lay the groundwork for faster retail payments in the future.

How did accessibility and transparency fare in 2025?

The final G20 target for cross-border payments is to ensure that all end-users (including all individuals, businesses and banks) have access to at least one option for sending or receiving cross-border electronic payments by the end of 2027.

Once again, the data highlights that little progress has been made towards this target, with around 90% of MSMEs having a transaction account. However, the share of individual adults with a transaction account has grown slightly to 78.7% – a 4.9 percentage point rise since 2022.

In an attempt to boost the transparency surrounding cross-border payments, the G20 is also targeting having all PSPs provide total transaction costs (including sending and receiving fees, FX rate and currency conversion charges); expected time to deliver funds; tracking of payment status; and terms of service to all payers and payees by the end of 2027.

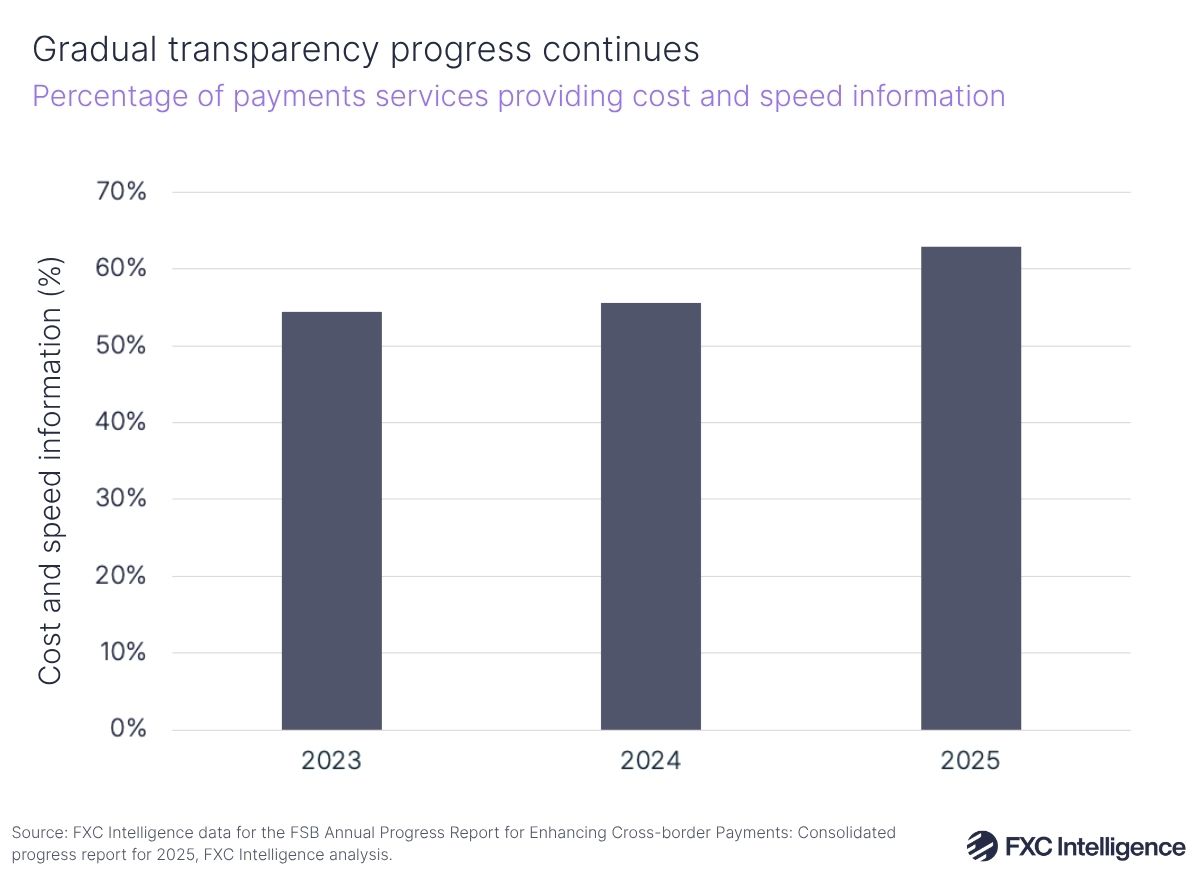

Transparency of payment services jumped 7.3 percentage points since last year, regarding the percentage of payments services providing both cost and speed information. While this figure reached 62.9% in 2025, this means that 37% of payment services do not publicly share either speed or cost information.

The FSB also noted that some payment services that were transparent about only cost in 2024 may have dropped out of the sample, while other payment services that were transparent on both cost and speed could have been added to the most recent sample.

Industry call to action and future plans

The latest progress report undoubtedly shares disappointing news to most industry participants, particularly after a lack of positive movement in 2024. While the majority of the G20 roadmap actions and recommendations have been completed, most end-users across the globe are yet to see them have a positive impact.

According to the latest report, the FSB is attributing a lack of progress to a number of challenges, including long lead times for implementing infrastructure improvements and technological advancements; different rates of adoption across the globe; continuing interoperability challenges; and misaligned anti-money laundering (AML) and countering the financing of terrorism (CFT) compliance controls and privacy rules.

In an attempt to address these challenges, the FSB says greater efforts need to be made at both the regional and jurisdictional levels to translate this international policy work into genuine real-world benefits for users across the globe.

It remains yet to be seen whether the G20 will decide to push back target dates until sometime after 2027 targets to further away, if it will remove the deadline completely, or if it will stay true to the original aims. Regardless, the international body is urging private sector stakeholders to take this opportunity to implement changes that will enable end-users to enjoy cheaper, faster and more transparent payment services. The currency landscape offers a huge opportunity for cross-border payment players to have a direct impact to help international firms align efforts with the G20 targets.