Last week, the European Central Bank (ECB) revealed it is exploring interlinking its TARGET Instant Payment Settlement (TIPS) system with the Swiss Interbank Clearing Instant Payments (SIC IP) system as part of efforts to improve cross-border payments within the EU and beyond. As cross-border instant payments continue to grow in adoption and demand, we explore how Europe is responding.

Recent interlinking efforts follow the November 2017 rollout of the European Payments Council’s SEPA Instant Credit Transfer (SCT Inst) scheme, which enables real-time euro payments across Europe. Using this scheme, payment service providers in 36 European countries enable customers to transfer up to €100,000 to accounts in banks that also participate in the payment scheme within 10 seconds.

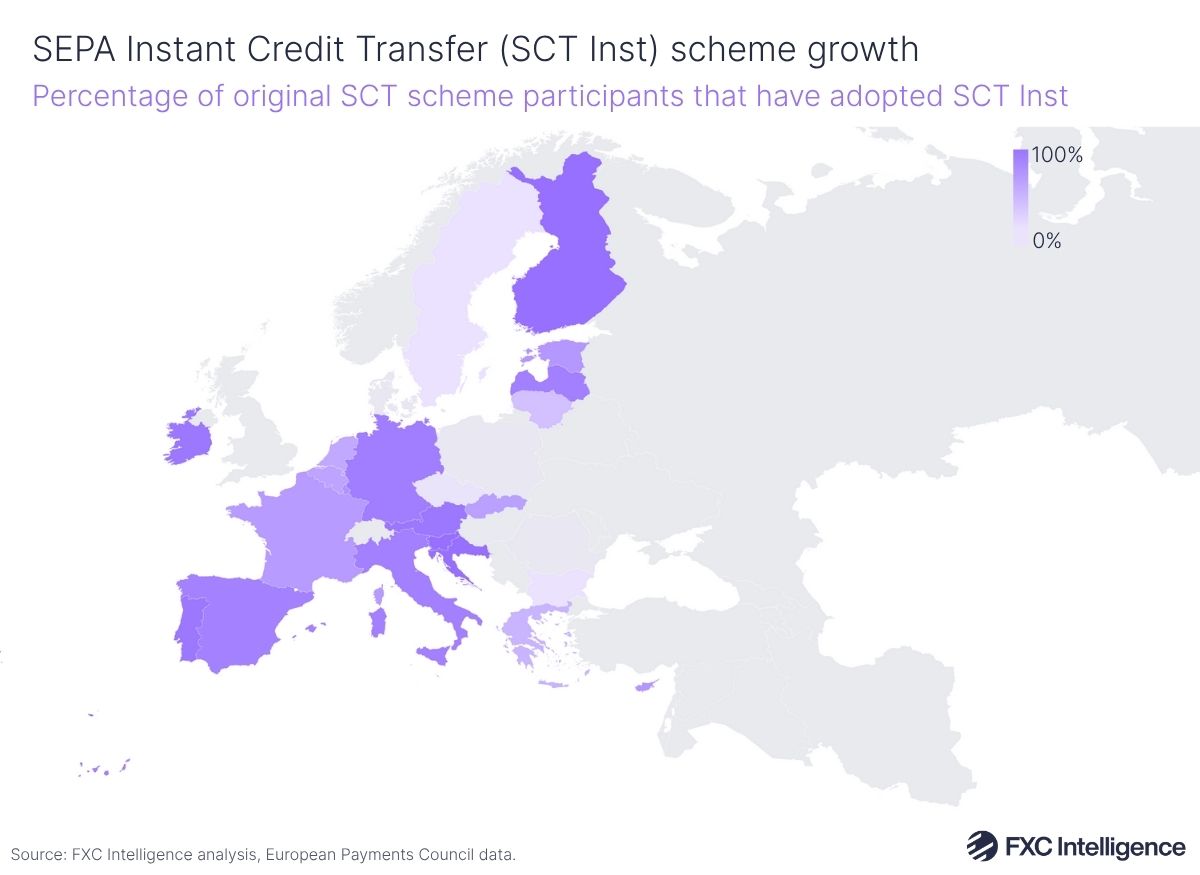

Since its launch, SCT Inst adoption has surged – around 91% of euro-using participants of the original SCT scheme have already adopted the instant payment scheme. Unsurprisingly, the same level of uptake is not seen in EU countries that do not primarily use the euro, highlighting the need for these types of interlinking initiatives.

According to the latest announcement, the Swiss National Bank will work alongside the ECB throughout 2026, assessing whether the plans to link the instant payment systems should and will go ahead. The news comes as Europe’s central bank continues to explore linking with other fast payments systems globally as part of a larger effort to enable faster, cheaper and more transparent access to cross-border payments.

At last week’s Sibos conference, Piero Cipollone, Member of the Executive Board of the ECB, stressed the importance of quickly providing solutions that meet the needs of customers and markets in Europe by ensuring progress for cross-currency settlement. Although efforts such as Project Agorá, which has brought seven central banks together to explore tokenisation to facilitate cross-border payments, are underway, Cipollone noted that these will take significant time to implement, meaning interlinking more payment systems is a must. Simultaneously, the Bank for International Settlements is leading Project Nexus, which looks to standardise how domestic instant payment systems connect to one another by enabling each one to simply connect to the Nexus platform and gain access to all of the other systems already connected.

While these efforts ultimately look to improve access to cheaper, faster, more transparent, interoperable and inclusive cross-border payments in line with the G20 roadmap, political, governance and standardisation challenges remain. As more instant payment systems connect across borders, will Europe move closer to complete market integration or could regional projects with different goals increase fragmentation and make it harder to achieve global standardisation?

How can I compare pricing on payments into and out of Europe?