Corpay saw its first $1bn quarter in Q3, primarily driven by revenue growth in the company’s global B2B payments segment, Corporate Payments. As the company starts to see benefits from its recent acquisitions, we cover key drivers for the quarter and what’s next for the future with Corpay Cross-Border Solutions Group President Mark Frey.

Corpay (formerly Fleetcor) surpassed $1bn in revenue for the first time in Q3 2024, with a 6% rise in revenues to $1.03bn compared to Q3 2023. EBITDA was $557.7m, driving a margin of 54.2%.

Once again, the biggest driver for these gains was Corporate Payments – Corpay’s global B2B payments segment that was originally called ‘Corpay’ before this name was used to rebrand the wider company earlier this year.

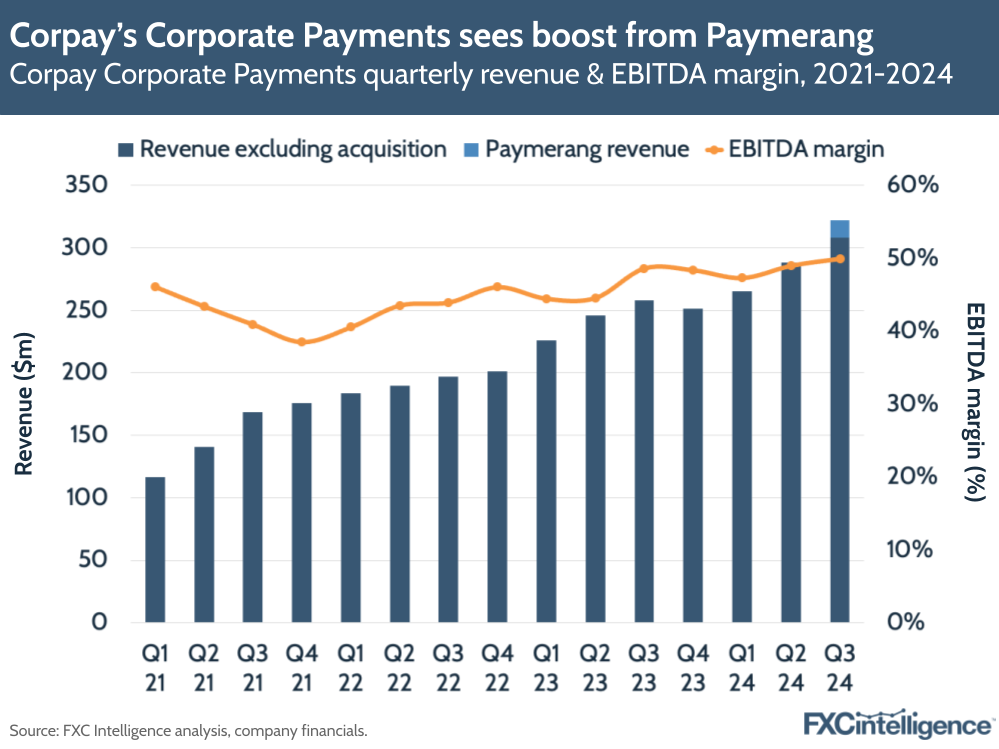

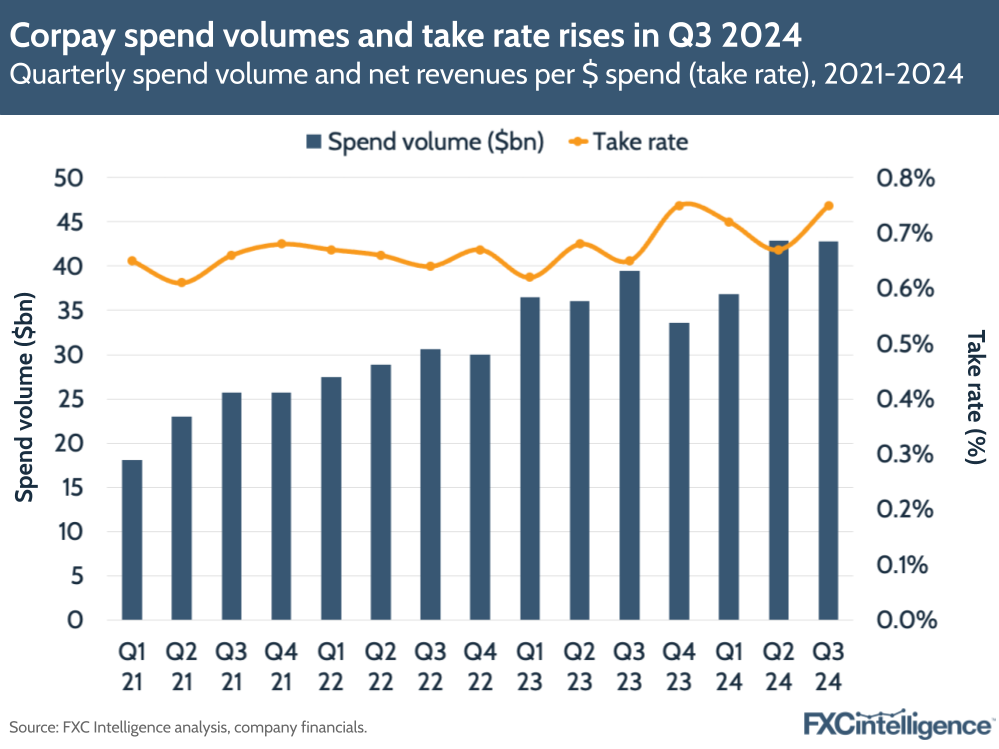

This segment grew 25% to $321.9m, or 18% on an organic basis (i.e. removing macro environment factors and acquisitions), while its EBITDA grew 28% to $161m, giving an EBITDA margin of 50%. Revenue growth was driven primarily by spend volumes rising 9% (or 7% organically) to $42.8bn, as well as stable card penetration rates and higher spending across all regions as the company continues to scale globally.

Corpay continues to make progress on its most recent acquisitions, including payment automation brand Paymerang, as well as US-based B2B cross-border business GPS Capital Markets, with the former closing in July and contributing $14m in revenue, while the latter is expected to close in early 2025.

As the company continues to scale its B2B payments segment through M&A and growing partnerships across its corporate payments business, we once again spoke to Group President Mark Frey about the company’s key drivers in Q3 and its strategy going forward, as well as potential market changes after the recent US election.

Corpay’s Q3 revenue drivers for Corporate Payments

Daniel Webber:

Let’s take it from the top. Looking at your Corporate Payments business, what drove Q3 for you?

Mark Frey:

In terms of the cross-border business specifically, it was a very strong quarter. We were up double-digit growth year on year versus Q3 in 2023, in each individual jurisdiction and/or geography in which we operate.

Each of our lines of business was up more than double digits. We’ve had exceptional growth in certain geographic markets. Our APAC business is up almost 60% year on year. It will be a north of $100m business this year now, performing very well from a new business perspective.

We have just launched in New Zealand, and that is performing better than we originally expected. Our Singaporean business is growing fantastically and has now become a material contributor to the overall top line. Our Australia business, which is really the stalwart in that APAC group for us, has done very, very well. New business trends and core have all performed above expectations in that jurisdiction, so very positive growth overall.

Europe, the Middle East and Africa continues to be very solid, both in terms of payments and our hedging business. We see really big potential with our multicurrency account product, in Europe and North America especially, with the launch that we’ve begun to hit the gas pedal on at the beginning of Q4 here. That’s given us a bit of momentum as we’ve gone through Q3, and some really good solid sales performance and base revenue growth out of our European and UK business.

North America has perhaps been a big surprise in the overperformance we’ve seen from that unit. We’ve had solid double digit growth in Canada, which is a very mature business for us, and our US business has grown very nicely, both in terms of the risk management solutions but also the integrated payments in our financial institutions’ indirect partner business. It’s been a really good growth story for us.

Part of our story in 2024 for cross-border is the geographic diversity – the relatively even performance between payments and risk has done very, very well. Some of the new things that we’re doing in the new geographies have really begun to take hold and have performed better than we originally expected, and that’s led to the overperformance.

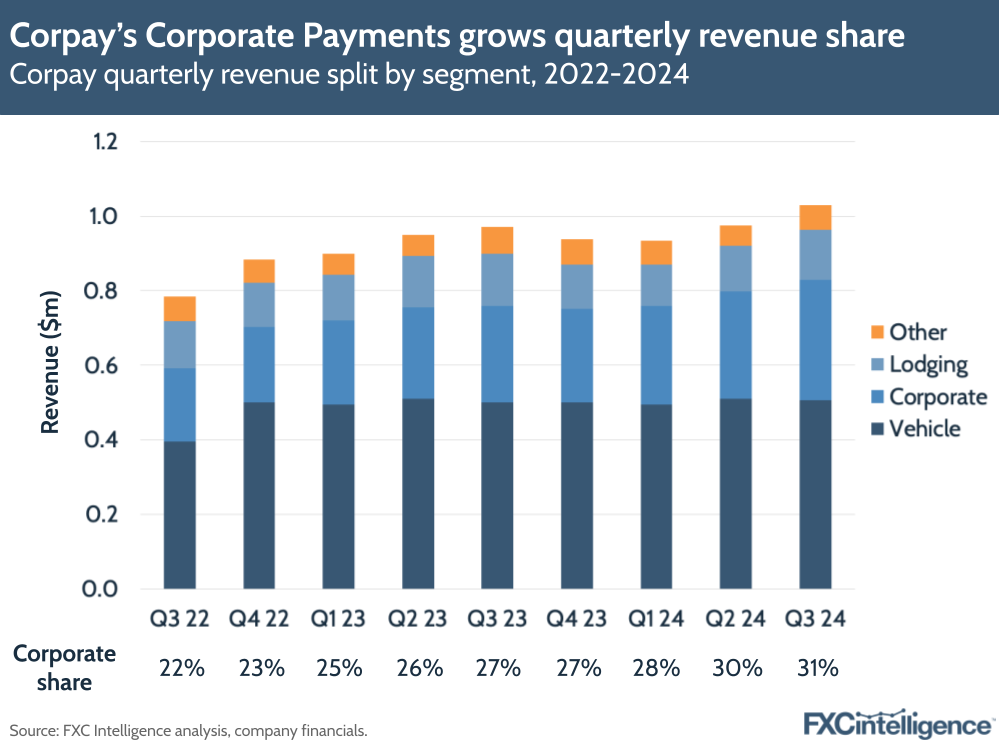

Corporate Payments continues to grow revenue share

Corpay’s revenues are broken down across three primary segments: Vehicle Payments, which spans how commercial drivers pay for vehicle expenses: Corporate Payments, which covers B2B payments, including cross-border payments and AP automation; and Lodging payments, which covers how businesses book accommodation for workforces.

On a non-organic basis, Corporate Payments has continued to outperforrm all other segments this quarter, with 25% growth to $322m versus the next best performing segment Vehicle Payments, which grew by 1%. Corporate Payments sales were up 28%, with the company’s business in Brazil seeing mid to high-teens growth.

Though Vehicle Payments still accounted for 49% of revenues in Q3 and was the largest segment, Corporate Payments grew its share once again, to 31% of revenues, and this is expected to continue to rise going into Q4 as the company hopes for sales growth of 20%.

Corpay’s growth in APAC

Daniel Webber:

As you say, you’ve seen high growth in APAC, which is very different to your other two big regions. What’s underpinning your growth there?

Mark Frey:

Similar to our continental European business, we’ve got some incremental geography plays that are really helping us there. The core Australia business is performing very well because we’ve opened up a few new segments. We’re doing well in the institutional vertical, in the payments integration and financial institutions in Australia.

In terms of new geographies, Singapore has really become a material driver of overall business performance there. It’s grown from being a $2m business in 2021 to being a pretty significant driver of growth in that region. Our New Zealand business is going to go from zero to $1m in the first six months with just a modest investment in terms of standing up that business and getting it started, which makes us very bullish on the near-term future of what we think that geography can be.

We’ve seen a very similar result as we’ve expanded into net new incremental geographies in Europe as well. We’ve launched businesses in Malta, Luxembourg and Lithuania. All of those things are taking off and performing above expectation, in addition to our core markets of the UK, Spain, Italy and Ireland, which are all continuing to chug along nicely. Ultimately, it’s [due to] overperformance from the core base business, as well as the incremental geographies and the net new customer segments all performing a little bit above trend.

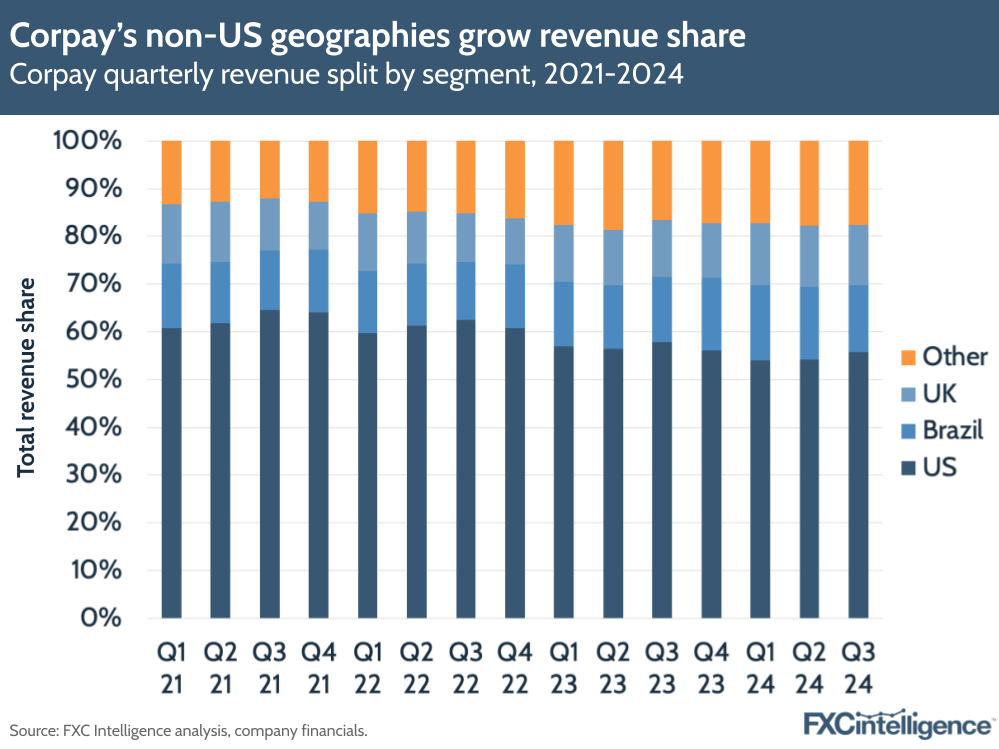

Corpay’s non-US geographies grow revenue share

Corpay provides services to customers in more than 150 countries worldwide, with more than 80% of its revenues in the US, Brazil and the UK. However, as a result of the company’s expansion into new regions, Corpay’s non-US geographies continued to grow revenue share in Q3 2024.

US revenues accounted for approximately 56% of Corpay’s overall revenues (spanning all segments), while Brazil accounted for 14% of revenues and the UK for 13%, with other countries making up the remaining 17% of revenues. However, this mix has shifted over time, with the US share declining from 58% in Q3 2023, 62% in Q3 2022 and 65% in Q3 2021.

Note that this includes segments outside of Corporate Payments (which doesn’t have the same geographic breakdown) as well as the company’s recent Brazil-focused Vehicle Payments acquisition Zapay, and as Mark reports, North America more widely continues to see strong “overperformance”.

How Corpay’s infrastructure helps it expand rapidly in new markets

Daniel Webber:

What is the underlying platform or infrastructure that is allowing you to launch businesses in new geographies?

Mark Frey:

There’s a core platform and capability that we can take to a net new geography and hit the ground with a fully complemented product offering and service offering right from the get-go. So, when we’re competing with smaller organisations in the fintech world or even smaller regional banks, we can offer a much more comprehensive overall product offering in terms of risk management capability and payment capability globally.

That allows us to hit the ground running and attract much larger corporate customers and/or indirect partners than what you would typically see if you were a small business entering a new market. We can really begin to scale much more effectively, much more quickly.

We can put the entirety of our capability from the broader organisation to bear in each of these individual markets. So, while we might only start a team with five or six individuals, they come fully armed with all the capabilities of the broader global organisation, so that means the breadth and quality of customer that they can appeal to is quite attractive right out of the gate.

Daniel Webber:

Does this also mean that these markets can become highly profitable quite quickly?

Mark Frey:

Yes. 10 years ago when we thought of going into a new geography, we thought of it as being a bit of a slog; a two to three-year investment thesis to really begin to break even before it becomes a contributor to earnings.

Now, we’re finding that within six months these businesses are already profitable and funding their own growth on a go-forward basis. That makes it really easy to continue to scale when you’re not pulling resources away from the mothership to fund these little projects everywhere, but they can self-fund themselves, and that becomes very attractive from an investment thesis standpoint.

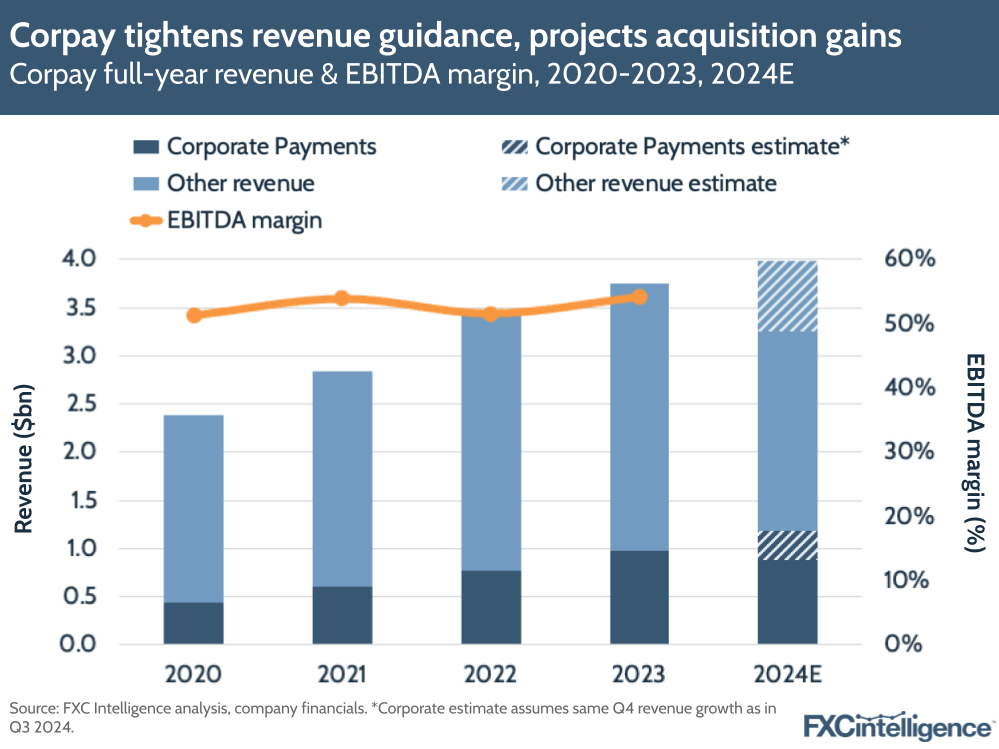

Corpay tightens revenue guidance

Overall, Corpay’s revenues rose 6% to $1.03bn versus Q3 2023, when it had included $13m from selling its business in Russia. On an organic basis (i.e. excluding the impact of macro effects and acquisitions), revenue rose by 6% across the companies businesses, which includes Vehicle Payments and Lodging Payments in addition to Corporate Payments.

In Q4, Corpay is projecting 13% revenue growth overall, and the company has once again tightened its revenue guidance for FY 2024, lowering the midpoint of guidance to $3.995m due to unfavourable fuel prices and FX rates. It is expecting total revenues between $3.98m and $4.01m, with net income of $1.061m-$1.081m.

In the earnings call, Corpay executives said they expected new sales to grow to be in the low to mid-20s in Q4. In terms of actual revenue growth (not organic), if Corporate Payments once again grows by 25% in Q4 2024 (as it did in both Q4 2023 and Q3 2024), it will account for nearly $1.2bn in 2024 overall, making this the segment’s first $1bn year.

Lessons from Corpay’s multicurrency account product

Daniel Webber:

Let’s talk about your multicurrency account product, which is starting to get pick-up in the market. What’s resonated about that product as it’s starting to scale up usage?

Mark Frey:

Our customers are really excited about the accessibility of accounts on our platform so that they can go to far corners of the world and get a local account with local in-country connectivity to the local in-country rail. They can send and receive payments in their own name, which makes it easier in terms of dealing with their beneficiaries and payees, as well as reconciling transactions. And they can also move away from it taking weeks or months to get accounts open with a different financial institution.

There’s also the efficiency with which they can then support their growth and expand into net new geographies, and/or provide better localised payment capability for their customers and vendors in that local market. We’ve been pleasantly surprised with how excited our customers have been by that value proposition.

For us, it’s really just a flick of a switch. If you’re already a corporate customer, we can enable a new account in a new geography in a new currency, and it’s stood up on our platform instantaneously because we’ve already KYC’d that customer.

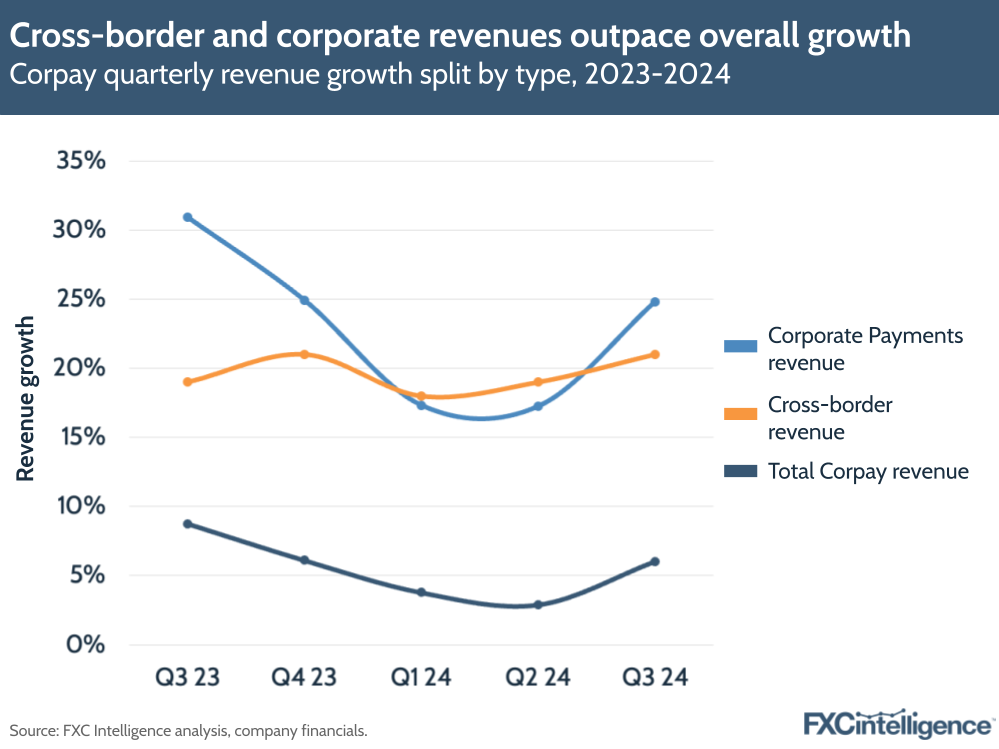

Cross-border revenue growth outpaces wider growth

Corpay’s cross-border revenues grew 21%, led by 40% in sales, and this revenue growth continues to outpace growth across the wider company at 6%.

The company offers an online trading platform, Corpay Cross-Border, which enables trades across more than 200 correspondent banks and counterparties globally. However, it also offers multiple services linked to cross-border transactions, in particular FX risk management and payment automation.

How Corpay is attracting Tier 1 bank customers

Daniel Webber:

Talk us through your proposition for Tier 1 institutions and the big groups that are looking to extend their currency capabilities.

Mark Frey:

Going back over the last three or four years, this has been a big part of our growth story and our financial institutions business. We are enabling access to the Southern Hemisphere in the emerging market world, if you will, for Tier 1 money centre banks. They come to us looking for both FX liquidity and payment execution, both for one-off large ticket FX transactions, as well as mass payment applications, whether it be gig economy or payroll, or small ticket AP transactions for large corporates. We can send local payments throughout Africa, Latin America and much of developing Asia, meaning we can extend that reach so that it’s no different for our customers who are trying to make a payment in the Eurozone.

So, it’s that level of liquidity and that level of localised payment – as opposed to a very correspondent banking-heavy solution with lifting fees extracted along the way – and the speed of execution that we can offer. There’s also our payments GPS, which is a payments tracking product that is available to all of our customers so that they can see exactly where their payment is at any juncture between processing versus when it credits the end beneficiary.

It’s been a big part of our success. Of course, we leverage that capability to send to our own corporate customers as well, but it’s a big part of the rationale as to why the Tier 1 banks are coming to Corpay: to help them expand their global reach, as correspondent banking networks of many of these organisations have begun to shrink over the last five to 10 years.

Daniel Webber:

You’ve built up direct connections and direct partners to underpin a lot of this, correct?

Mark Frey:

Correct. I’d love to say that it’s an overnight success, but we’ve been working very diligently at this for more than 13 years, and the fact that it is now beginning to pay significant dividends of that proprietary network that we have built is a long-term investment thesis that is now giving us significant commercial scale.

Corpay’s acquisition-led strategy

Corpay announced it was set to acquire Paymerang in May in order to expand Corpay’s presence across four attractive vertical markets including education, healthcare, hospitality and manufacturing. With the deal closing in July, the company – which provides accounts payable automation solutions – has contributed $14m in revenue to Corpay so far.

Paymerang is expected to further grow Corporate Payments revenue share alongside the company’s recent acquisition of cross-border payments and treasury solutions provider GPS Capital Markets. Back in June, we spoke to Corpay about this latest acquisition, which in addition to driving further gains for the business has also exposed Corpay to some of GPS’ advanced solutions around netting – a growing area of interest in the sector.

In our conversation, the company discussed expectations for GPS and Paymerang to contribute around $200m in incremental revenue in 2025, as well as grow the Corporate Payments business by approximately 15%. Overall, the segment will help Corpay grow close to $2bn revenue by 2026, at which time Corporate Payments could account for 40% of overall revenue.

Risk and hedging after the US election

Daniel Webber:

Risk and hedging is a big part of your business. Can you talk about this business last quarter and whether this could change due to recent developments in the US?

Mark Frey:

One of the things that we’re mindful of is that there’s a lot of risk in the payments business from a currency risk perspective. Even if we’re processing a lot of payments and foreign currency for our customers, it’s one thing to get the payments there cost-effectively and efficiently and on time. The other thing is to make sure that we smooth out the fluctuations of those currency impacts over time.

We try to cross-sell our FX hedging capability to all of those payments customers that we’re doing payments for around the world, and that is the value proposition that we use in terms of selling combined business.

One of the things that has been really intriguing, and has probably been a bit of a headwind for that risk business over the last two years, is that currency markets have been very stable in a historical context, and very low volatility. There hasn’t been the trending one-way movements in currencies that really bring pain to either an exporter or an importer, and we’ve been operating within a very narrow currency range for many key corridors.

Obviously, the Trump trade will begin to have an impact, and maybe that will not yet be felt for a number of months and be fleeting to a certain extent. The more important thing is we’re now seeing significant divergence of interest rate policy in major economies, and that will begin to drive long-term change in exchange rates. That will be much more impactful and long-lasting than the Trump trade will be.

As interest rate policies continue to diverge, you will see more volatility in FX markets and you will also see more trending volatility. If the market chops up or down within a range for a period of time, that’s not that painful, and you can begin to mitigate that through other budgetary means. But when markets begin to trend 10%, 15% or 20% over extended periods of time, that also exposes organisations that don’t have robust risk management policies to manage the FX exposure in their AR or their AP.

So that’s where we really begin to shine as a counterparty that can help organisations employ best practices to manage those risks. We see that as a bit of a tail end going into the next couple of years, that this period of extremely low historic volatility is likely coming to an abrupt end and that we’re going to see more normalised market environments that would see some more market chop, some more volatility and some big one-way trends as interest rate policy diverges.

Corpay’s spend volumes and take rates rise in Q3 2024

Spend volume across Corpay’s business rose by 9% to $42.8bn (or 7% on an organic basis), driving strength across segments, including Corporate Payments, while the company’s revenues net per spend (i.e. take rate) rose 10 bps YoY to reach 0.75% – the highest it has been since Q4 2023.

The addition of GPS will add blue-chip clients that could contribute significantly to Corpay’s cross-border volumes. During the earnings call, Corpay Chairman, President and CEO Ronald Clarke said that the company’s M&A pipeline has focused on building bigger volumes faster across Corporate Payments and transactions.

Growing Corpay’s share of the B2B global payments market

Daniel Webber:

Anything else you would like to cover?

Mark Frey:

For our business, we’re trying to continue to expand into net new geographies. We want to continue to introduce new products to the market that can add value to our existing customers and help attract new customers.

At the end of the day, while we might be a significant player in terms of our market segment, as a non-bank payments provider in the global arena, we still have a very tiny share of the overall market.

Daniel Webber:

You have a tiny share of an extremely large market that continues to grow, and we forecast it to grow significantly up to 2032.

Mark Frey:

This market is going to grow circa 9% year-on-year. Even if we can do double that and grow at 18-27% year-on-year, the support of overall market growth and the fact that we have a tiny market share, and an immense amount of runway in front of us, with the ability to both build and roll out new products and expand into net new geographies that we’ve never sold in before, this is an attractive growth story.

So, we’re very bullish on the future. We like the positioning of where we sit in between the large banks and the smaller fintechs with less capability. We believe we can be customer-centric and innovate, just like a fintech, but we have the strength and financial backing of a much larger enterprise, much like a regional bank.

We really like the setup, we like the long-term macro view that we have on the marketplace, and we are very focused on ensuring that we continue to be competitively positioned within that marketplace. Then it’s about going out and hustling and executing and doing the job.

Daniel Webber:

Absolutely. Mark, it’s been a pleasure. Thank you.

Mark Frey

Thank you.

The information provided in this report is for informational purposes only, and does not constitute an offer or solicitation to sell shares or securities. None of the information presented is intended to form the basis for any investment decision, and no specific recommendations are intended. Accordingly, this work and its contents do not constitute investment advice or counsel or solicitation for investment in any security. This report and its contents should not form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. FXC Group Inc. and subsidiaries including FXC Intelligence Ltd expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in this report, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting there from. This report and the data included in this report may not be used for any commercial purpose, used for comparisons by any business in the money transfer or payments space or distributed or sold to any other third parties without the expressed written permission or license granted directly by FXC Intelligence Ltd.