Fees associated with cross-border remittances vary significantly by provider and corridor, but FXC Intelligence data shows that across the board, customers still pay more for money transfers with cash pay-outs.

Over the past decade, the usage of cash has seen a sharp decline in many parts of the world. Between 2011 and 2021, account ownership at a bank or other regulated financial institution has climbed from 51% of adults to 76% overall, with the rate at 71% in developing economies, according to the World Bank.

Remittance players, meanwhile, have significantly expanded their digital services. Traditionally cash-led players such as Western Union and MoneyGram have seen the share of their business that comes from digital climb significantly, with WU’s branded digital revenues now accounting for 23% of all revenues, while MoneyGram saw its share of transactions that were digital pass 50% for the first time in 2023.

Meanwhile, players that provide digital-only pay-ins have proliferated and grown, with Remitly becoming one of the highest profile after launching in 2011.

Despite this, there remains a significant need for cash pay-outs for remittances that will take at least a generation to overcome. No matter their pay-in options, all major remittance-focused players continue to provide cash pay-outs as a key part of their services and while the global averages for account ownership have grown, there are many countries where the share of adults with an account remains low.

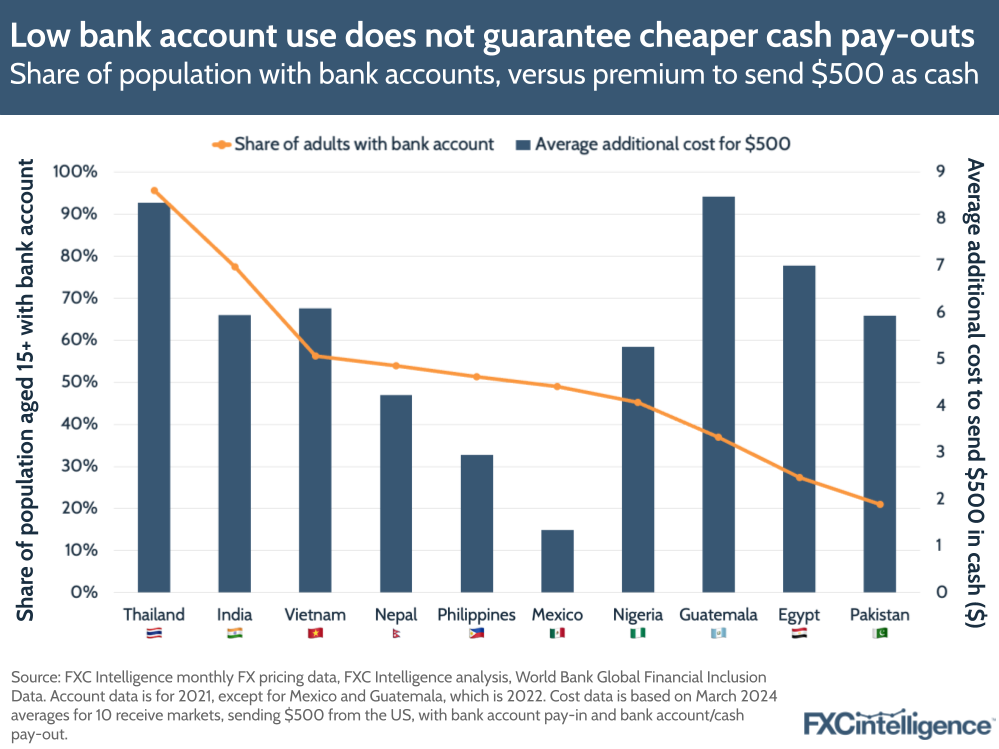

According to the World Bank Findex database, in 30% of countries the share of the population aged 15 or over with an account is at 50% or below, while in 42% of countries the share is less than 60%. There is also a significant crossover with the world’s biggest destinations for cross-border remittances payments.

Cash pay-outs are often the most vital to some of the world’s poorest people, however our data shows that they are consistently more expensive to send to than transfers sent to bank accounts. In this report, we analyse datasets from FXC Intelligence’s FX Pricing Data to determine how much of a premium cash pay-outs require versus bank accounts for remittances.

Remittance pricing: Cash pay-outs consistently cost more than bank account pay-outs

For this research, we used data from FXC Intelligence’s Monthly Median FX Pricing dataset, which itself is a median of its more granular datasets. Focusing on data for March 2024, we collected the standard pricing to send $500 from five major remittances providers across 10 corridors, all originating from the US. We did not include new customer pricing, which FXC Intelligence also collects real-time data on.

The 10 receiving countries were selected as they were broadly spread geographically, but all are major recipients of remittances. They are Egypt, Guatemala, India, Mexico, Nepal, Nigeria, Pakistan, the Philippines, Thailand and Vietnam.

We collected pricing to send bank account-to-bank account and bank account-to-cash, meaning this research does not include pay-outs to debit cards, airtime top-up or mobile wallets, or other forms of pay-ins, all of which are available in the overall dataset.

We then averaged the median FX margin, median fee margin and median total cost of sending $500 on each corridor across the five providers, and calculated the difference between the results for cash pay-outs and for bank account pay-outs.

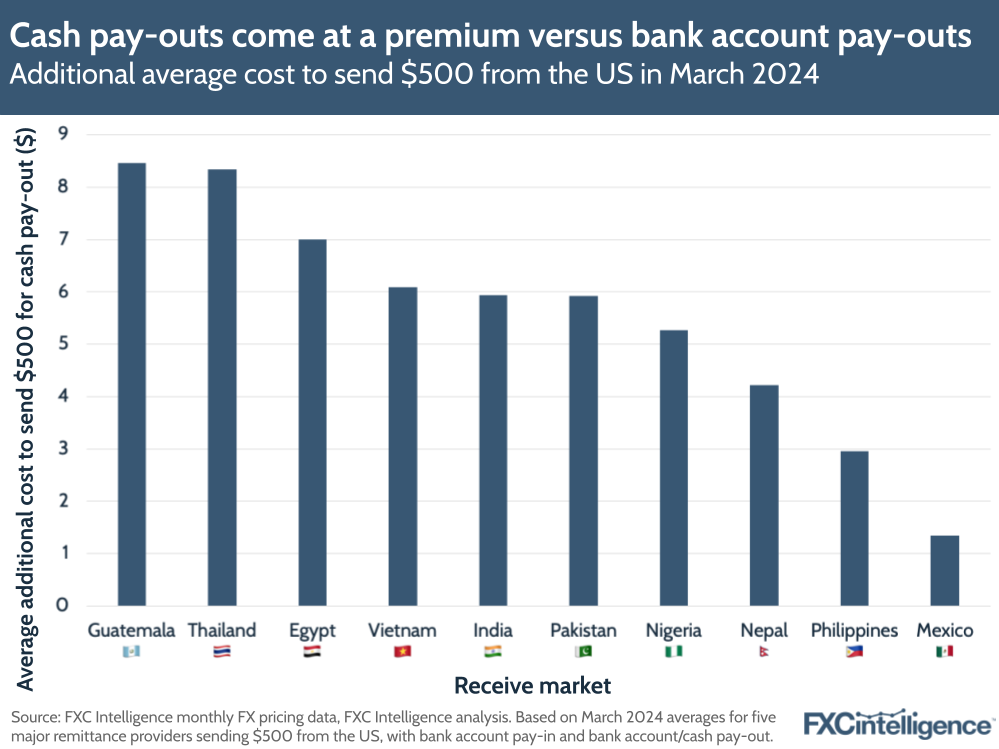

Across every one of the 10 corridors, we found that the average cost of cash pay-outs was higher than those for bank accounts. On average, across all 10 countries in March, sending $500 from the US cost an extra $5.55 to send if paying out in cash instead of paying into the recipient’s bank account.

However, the variation across corridors was significant. US to Mexico had the smallest average difference between bank account and cash pay-outs, costing an extra $1.34 to send $500 for cash pay-out. Meanwhile, US to Guatemala had the biggest difference out of the 10 in the sample, costing an extra $8.47 to send the same amount in cash. US to Thailand, meanwhile, was close behind, at a premium of $8.35 to send in cash.

Find out how the underlying FX pricing data can help your business

Margin analysis: What makes cash pay-outs more expensive?

While all corridors were consistently more expensive to send cash pay-outs, analysis of the makeup of the margin – the amount charged to send a remittance – provides insights into where the additional cost is coming from.

The margin charged to send a remittance is typically made up of two components: the FX margin and the fee margin.

The FX margin is a percentage charged on top of the currency conversion to fund the cost of converting the remittance from the sending currency to the receiving currency. Meanwhile, the fee margin is a percentage fee charged to deliver the remittance to the recipient.

These two percentages are added to provide the overall margin charged, which provides the precise numerical amount a sender pays on top of the amount they are sending the recipient.

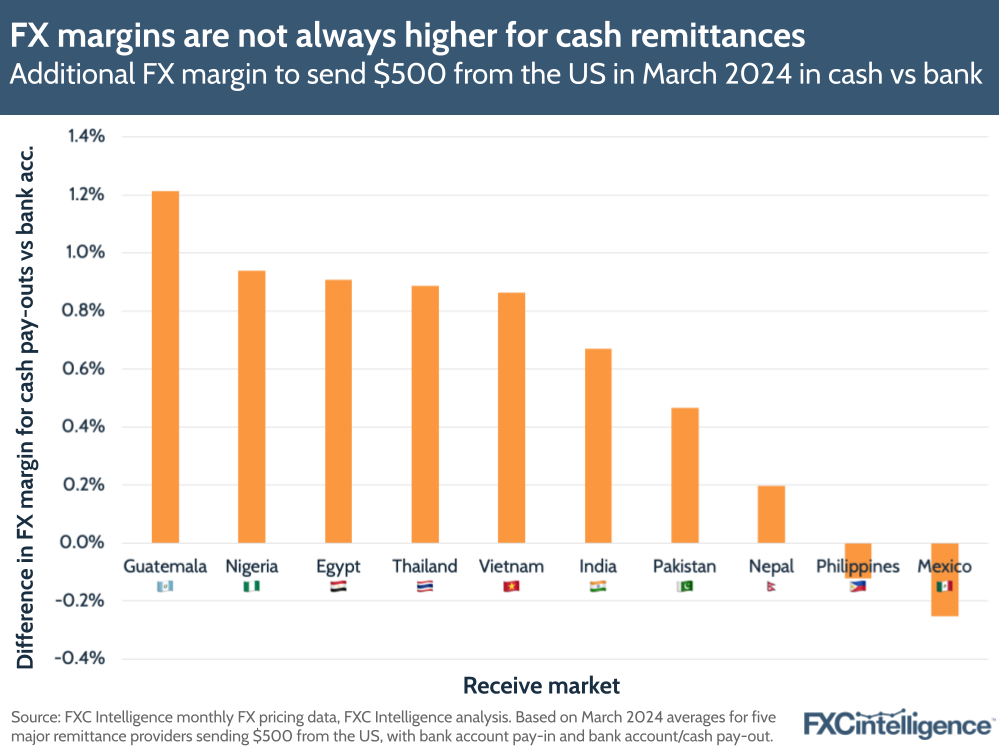

The total additional margin charged for cash pay-outs was, on average, an extra 1.1% on top of the amount charged for bank account pay-outs, however this varied significantly by country.

Within this, the FX margin averaged a lower share of the additional total margin for cash. In some cases however, while sending in cash was more expensive overall, it was cheaper on FX margin alone; remittances sent in cash to Guatemala and Mexico both attracted a lower FX margin on average than for those sent to a bank account.

In other countries, sending in cash added a considerably higher additional FX margin that made up well over half of the additional total margin. Guatemala had the highest additional FX margin for cash, attracting a premium of 1.2% on a $500 send (out of an overall additional 1.7%). Nigeria had the second highest here, with cash seeing an FX margin premium of 0.9% out of an overall additional 1.1%.

This significant variation may be related to challenges in maintaining supplies of the appropriate physical currency in different countries. While providing money in one currency to a bank account versus another does come with some costs, it does not require maintaining a supply of cash in the same manner, which may be more challenging in some regions of the world than in others.

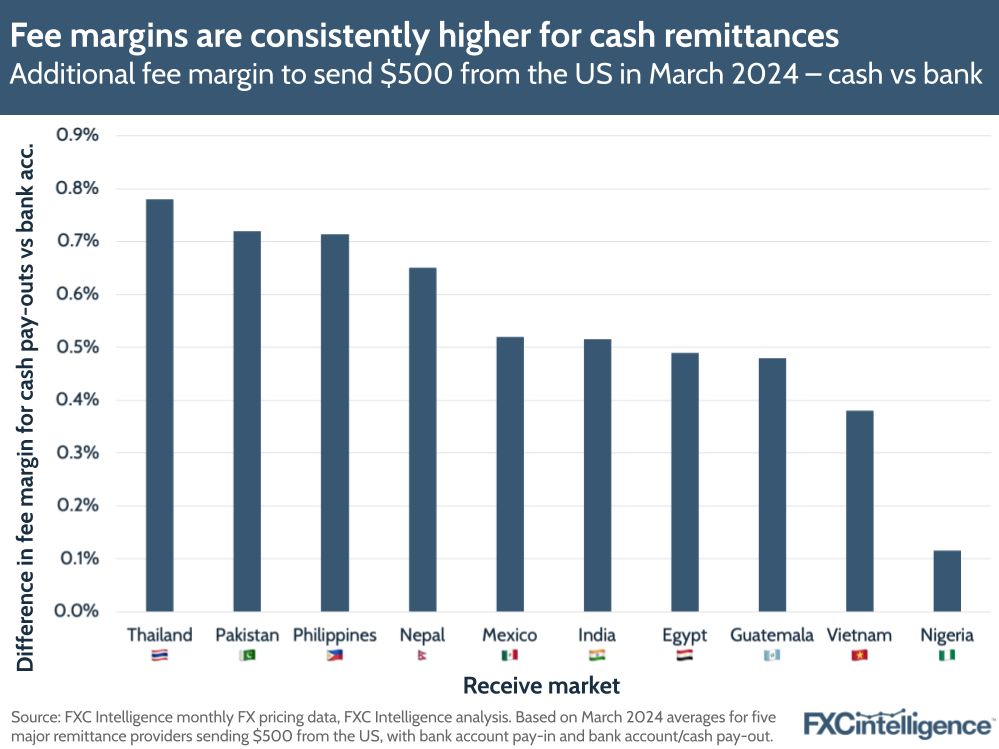

By contrast, fee margins, the other half of total margins, saw a premium for cash pay-outs in every country in the sample, which is likely a reflection of the fact that maintaining retail networks presents costs over bank account pay-out networks in all markets.

However, there were still some variations, with Thailand seeing the highest additional fee margins for cash pay-outs, at an average 0.8% premium, while Nigeria saw the lowest, at a 0.1% premium.

Provider breakdown: Cash premiums vary sharply by company

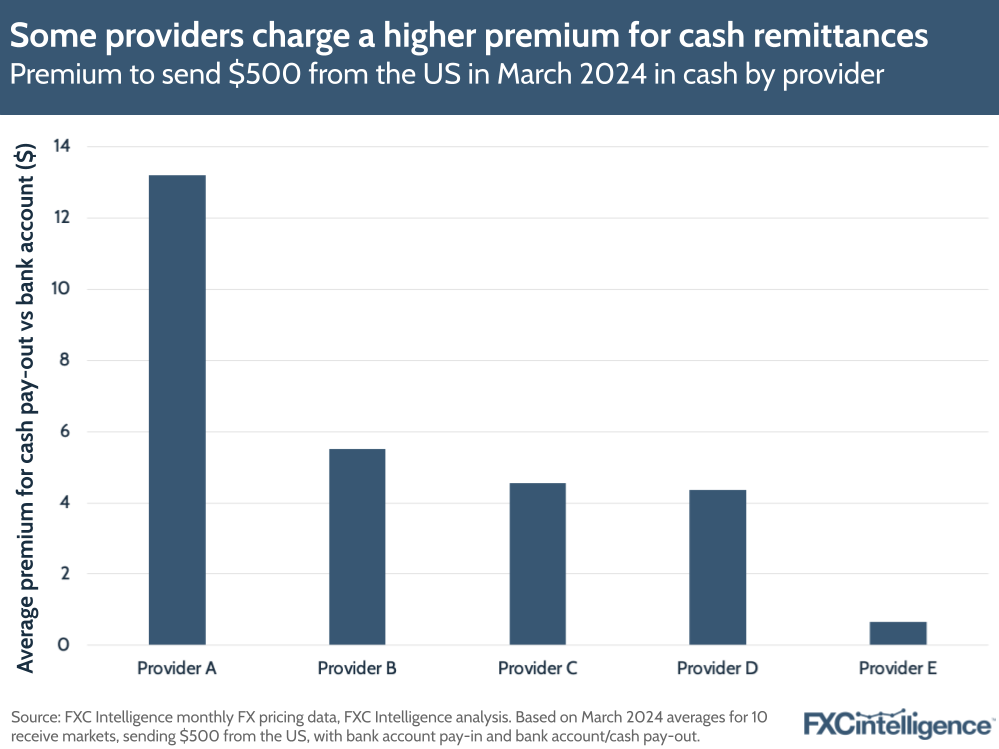

Notably, when looking at the averages for the 10 corridors by each of the five providers, we found that some providers charged a much greater premium for cash versus bank account pay-outs than others did.

While three of the five providers (B, C and D) charged an extra $4-6 on average for cash pay-outs versus bank accounts, one (E) charged only an additional $0.66 on average, while the remaining company (A) charged an extra $13 on average across the 10 countries.

Within this, while the vast majority charged more for cash than bank accounts on all 10 corridors, there were a small number of cases for some players where this was not the case. For provider C, US to Vietnam was slightly cheaper for cash payouts than for bank accounts, while US to Thailand was significantly more expensive by more than $10.

Meanwhile, provider E saw several corridors where there was no difference between cash and bank account pay-outs, which was the case for one corridor for provider B.

Access the full underlying data, including named provider-specific data

Account access: Is there a correlation between countries with lower account use?

The cash pay-out premium is likely to have more of an impact in countries where a smaller percentage of the population has access to a bank account, as it means more transactions where the sender has no option but to pay extra to ensure the payment is received by the recipient.

However, mapping the additional cost to the share of adults with accounts in each country provides some interesting results. While there is not one firm trend line for additional costs for cash when mapped against account share, countries with the lowest share of adults with access to accounts generally saw a greater pay-out premium for cash than those in the middle of the spread on account access, while the premium then again increased for those with very high levels of account access.

Causes and solutions: Why do companies charge more for cash?

It is likely that the primary reason companies charge extra for cash pay-outs in remittances is because of the additional cost to provide this service. Successfully maintaining an effective and well-managed retail network comes with additional costs versus only maintaining a digital pay-out network, and companies are likely to want to pass this premium onto customers in the form of higher margins. Costs to provide cash also typically rise when cash use is in decline.

However, the additional costs are in many cases likely to fall most harshly on more vulnerable customers, underscoring a need to ensure that significant differences are kept to a minimum wherever possible. This is particularly important given the ongoing focus on reducing remittance costs, both from UN Sustainable Development Goal 10.c and the G20 cross-border payments roadmap.

For companies, insights into pricing both internally and externally are vital. The ability to have clear and consistent visibility into organisational pricing strategies and effectively benchmark them are critical to ensuring consumers are being offered fair pricing – and that those who have few options beyond cash are not being overcharged.