QR codes are seeing a growing role in cross-border payments in Southeast Asian countries. This report explores what is driving the use of QR codes in these regions and whether the industry could see more QR cross-border payment linkages worldwide.

Whether they are used to buy groceries or send money to friends and family, quick response (QR) code payments are not a new phenomenon. However, there has been a growing conversation about the role of QR codes in cross-border payments – particularly when it comes to cross-border linkages in Southeast Asian countries.

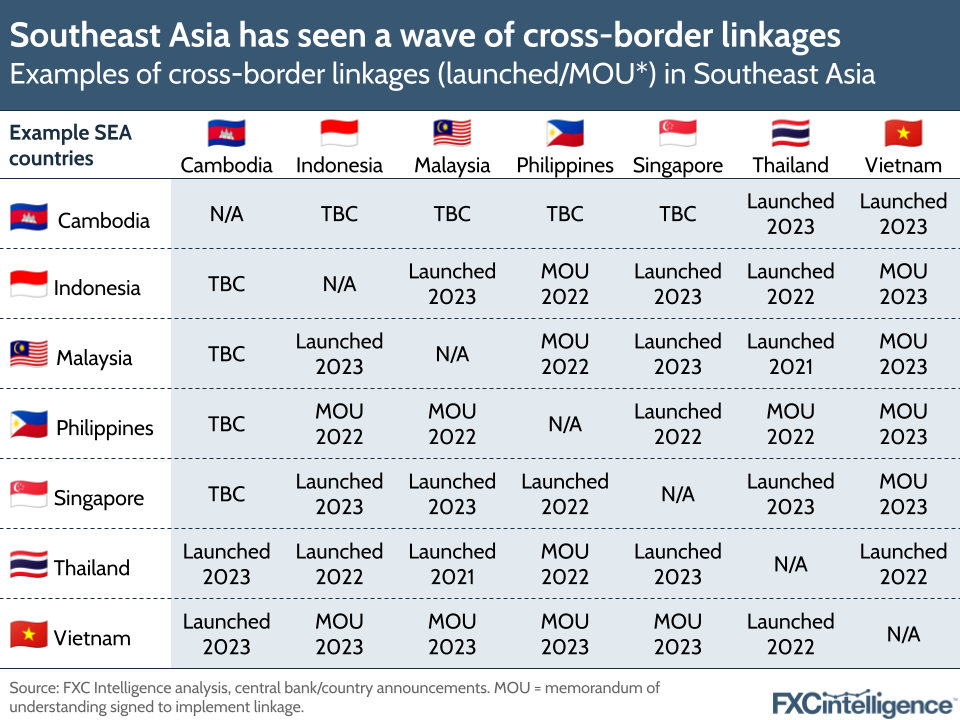

The majority of countries in this region – including Singapore, Cambodia, Indonesia, Malaysia, the Philippines, Thailand and Vietnam – now have at least one cross-border payments link, whereby a domestic instant payments system in one country (for example Singapore’s PayNow) has been linked to a counterpart in another. This enables easy, fast and convenient payments when travellers visit the linked country and, in many of these cases, travellers scan a QR code that allows them to directly make payments from their chosen local payment method.

As we’ve seen in previous FXC Intelligence reports, cross-border payments interoperability is becoming a major topic not just in Asia but around the world, as countries look to enable more cost-effective and faster cross-border transactions. QR code payments have become more significant in some markets than others as the adoption and prominence of near-field communication (NFC) technologies in many Western markets, enabling digital wallets such as Apple Pay, has reduced the need or desire for alternatives such as QR payments.

This report explores what has driven the use of QR codes as part of cross-border payment linkages in Asia and asks a number of questions about QR code payments. In particular, what are the challenges involved with creating QR cross-border payment linkages? Do QR payments add an additional layer to payments? And could we see their use increasing worldwide?

How do QR code payments work?

Invented in 1994, QR codes are scannable 2D barcodes that can be read with a camera to provide more information or complete an action. Since being launched, the codes have been used for multiple different purposes, such as loyalty schemes, marketing, business cards, customer surveys and contactless payments.

QR codes didn’t see widespread use in payments initially, but the introduction of smartphones with cameras that are able to scan codes has helped spur their revival in certain markets. This is particularly the case in China, where WeChat Pay and Alipay have become two of the most popular payment methods in the country.

When it comes to person-to-merchant (P2M) transactions, QR code payments can be made in two ways. Firstly, they can be merchant-presented, which is when shops display a QR code at checkout that can then be scanned by the consumer, enabling them to make a payment through their chosen banking app or e-wallet.

Alternatively, they can be consumer-presented, which is when consumers themselves have a QR code on their banking or e-wallet app that is then scanned by the merchant, allowing money to be taken directly from the account.

For peer-to-peer (P2P) payments, users can send money to one another by sharing a link to a QR code with the recipient or showing it on their phone for the recipient to scan directly. This feature, used by apps such as Monzo and easypaisa, enables faster payments without having to input bank details.

How much do QR code payments cost?

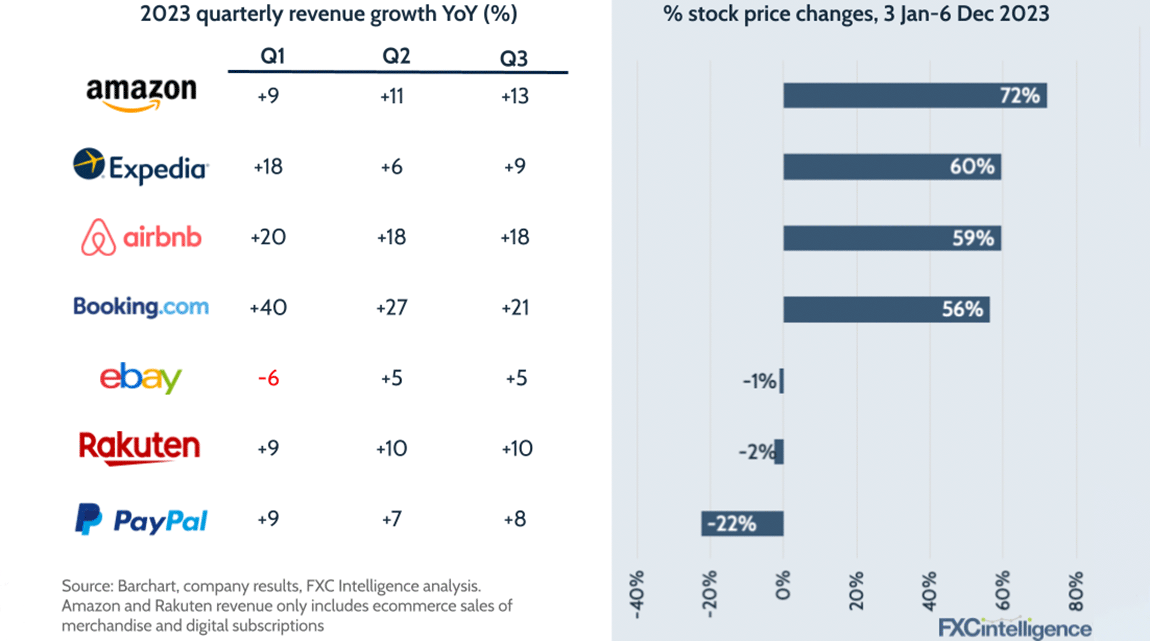

Looking at some of the major payment service providers that offer QR code payments worldwide, many of these focus on merchant rather than customer-presented payments. In terms of whether there is an impact on fees, it appears that there is often no additional fee (or at least a specified) fee for merchants that specifically relates to QR code payments.

While providers tend to specify how much merchant fees will cost (in addition to fees for using foreign payment methods), fees for QR payment in particular aren’t always mentioned. This supports the idea that QR codes are often more of an overlay that enables access to payment methods, and that it is these methods that are often the determinant of transaction fees.

There are exceptions to this, such as PayPal, which on both domestic and international QR transactions charges merchants a percentage of the transaction plus a fixed fee, which depends on the currency used and the transaction amount.

For payments in the UK for example, the charge for receiving a domestic payment via a QR code would be 1.5% plus a currency-dependent fixed fee on transactions above GBP 10.01, and 2% plus a fixed fee on transactions below GBP 10.01. This is higher than the charge on non-QR alternative payment methods, such as Apple Pay or Google Pay, which is 1.2% plus a fixed fee.

For the merchant, the costs to bear on QR would often come from the PoS systems needed to implement dynamic QR code payments. These systems can come at a one-off cost, or can be included as part of monthly subscription or per transaction pricing models. For example, Square – which provides PoS systems to support contactless, mobile and chip and PIN payments – will charge 1.75% per transaction for businesses with below GBP 200,000 in annual card sales, and a bespoke amount for businesses with more than GBP 200,000 in annual card sales.

FXC Intelligence provides detailed data on cross-border ecommerce fees

The impact of different QR code types on payments

Aside from P2M and P2P payments, another key difference in QR codes is between static and dynamic QR codes. Static codes contain fixed data that cannot be altered, while dynamic QR codes can be changed or updated. This is because the dynamic code doesn’t itself contain the data, but rather links to a location online where data is stored.

From a payments perspective, this usually means that if the consumer is scanning a static QR code at a merchant (for example, in a shop), they themselves would need to input the amount to be paid to the merchant via their banking app. However, in the case of a dynamic QR code, the amount can be changed by the merchant before being shown via a digital medium (usually a point-of-sale (PoS) system).

Both methods have pros and cons for merchants and customers. While static codes are much easier for merchants to implement as they just require being printed and displayed, they are less convenient for the consumer, as they need to input the amount to be paid each time.

There is also the additional security element with static codes, which is that merchants and consumers may be more susceptible to fraud (i.e. with bad actors swapping out QR codes for another code).

Dynamic QR codes, meanwhile, can require a PoS system to implement, which can lead to additional costs to the merchant, and also need access to internet connectivity.

What is driving the use of QR code payments?

QR code payments have a number of key drivers. Firstly, a static QR code can provide a cost-effective digital payment option for merchants, as they don’t have to implement expensive PoS solutions through an external provider.

Secondly, from a financial inclusion perspective, using mobile payment solutions can often be easier in countries where there is a higher unbanked population and with more people living in rural areas – while many of these people may not have access to the formalised financial system, they may well have a mobile phone. This could make payments through QR codes more attractive, as they are able to make cash-free payments through a mobile wallet without having to sign up for a bank account.

The Covid-19 pandemic is also believed to have driven QR code payments in a number of markets around the world as part of a drive towards touch-free payment methods. Another benefit is that QR code payments (alongside other contactless payment methods) may offer lower transaction fees for merchants than credit card payments.

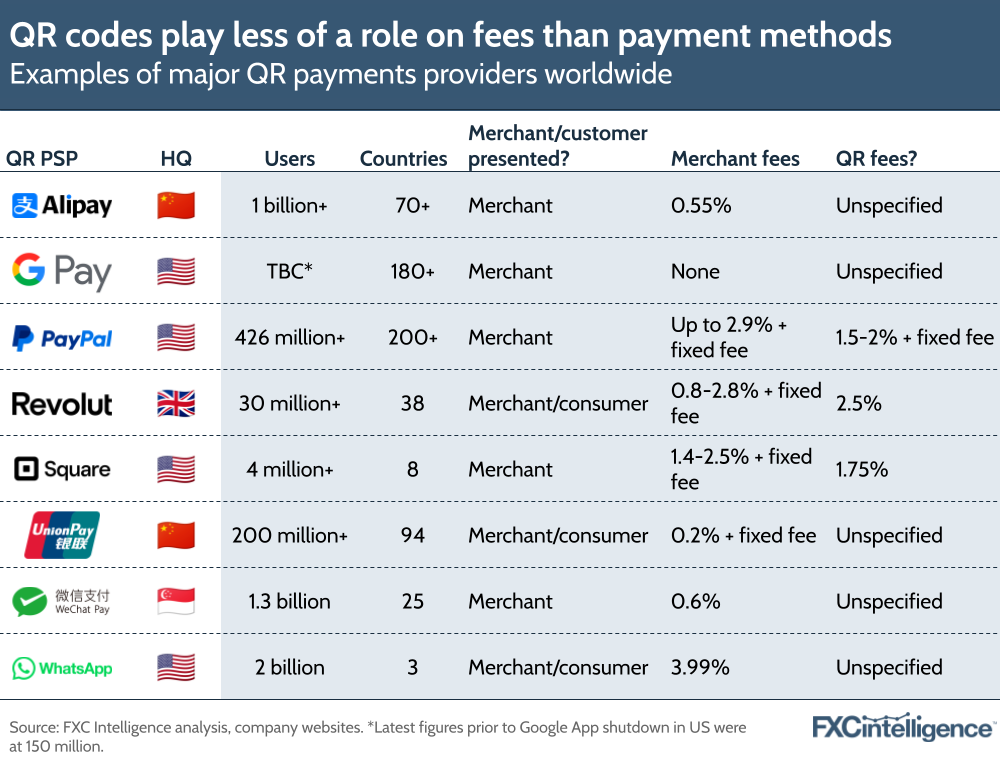

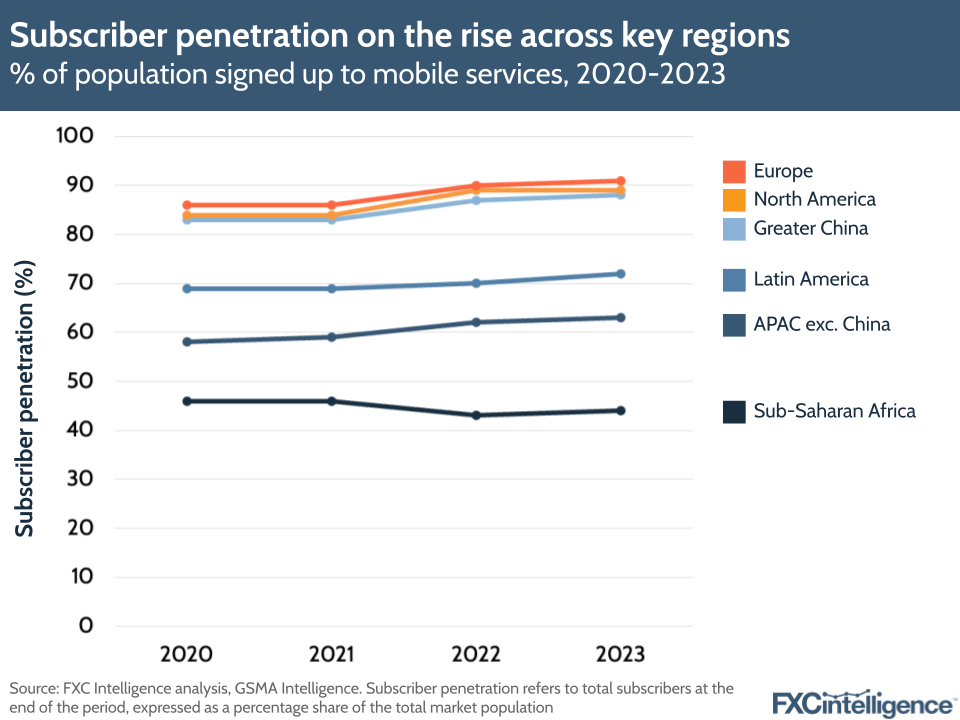

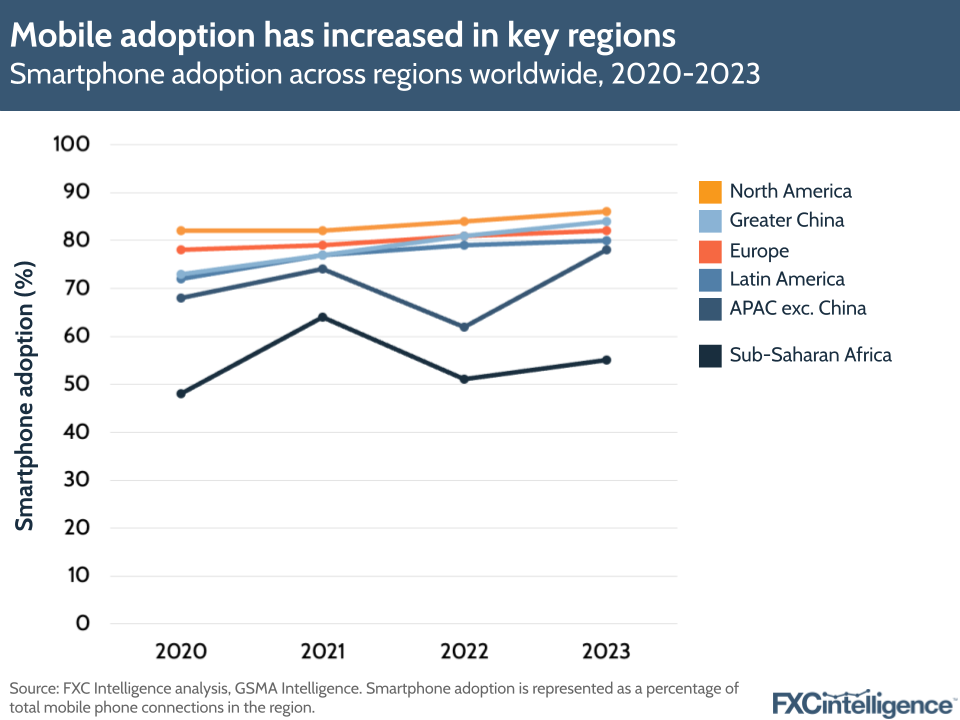

Smartphone adoption has continued to grow worldwide, as data from network operator industry group GSMA shows. When examining subscriber penetration (i.e. the percentage of populations that have subscribed to mobile phone services across a number of regions worldwide), Europe appears to have the highest number, with 91% of the population subscribed in 2023.

North America and Greater China also see high levels of subscriber penetration, at 89% and 88% respectively in 2023. Meanwhile, Latin America saw 72% penetration, Asia-Pacific (which here excludes Greater China) saw 63% and Sub-Saharan Africa had 44%. Notably, the last of these regions saw a decline compared to 2020-2021.

In addition to mere subscriptions, however, QR code payments also rely on smartphones that are capable of scanning codes. Examining smartphone adoption across the same regions, North America is the leader here, with 86% of total mobile phone connections in the region, followed by 84% in Greater China, 82% in Europe, 80% in Latin America, 78% in APAC and 55% in Sub-Saharan Africa.

The GSMA also measures mobile phone adoption data for other regions including the Middle East and North Africa (MENA) region, the Commonwealth of Independent States and more recently Eurasia, though for clarity reasons these were excluded from the graphics above. In 2023, MENA saw 65% subscriber penetration and 81% smartphone adoption, while in Eurasia (which includes countries such as Armenia, Belarus and Russia) penetration was 78% and smartphone adoption was at 83%.

Overall, subscriptions to mobile phone services are on the rise and already have a firm hold in several regions, but many regions where QR codes appear to be a focus are still growing their levels of adoption. The figures in particular show the difference in adoption of QR-scanning devices in China compared to much of the rest of APAC, which alongside the early prominence of WeChat and Alipay explains why this is seen as a haven for QR code payments.

Within APAC, (according to a region-specific 2022 report from GSMA) there is much variation in smartphone adoption, with India having 77% adoption in 2022 while Singapore had 90%. Both countries have their own QR standards and are supporting it as a method.

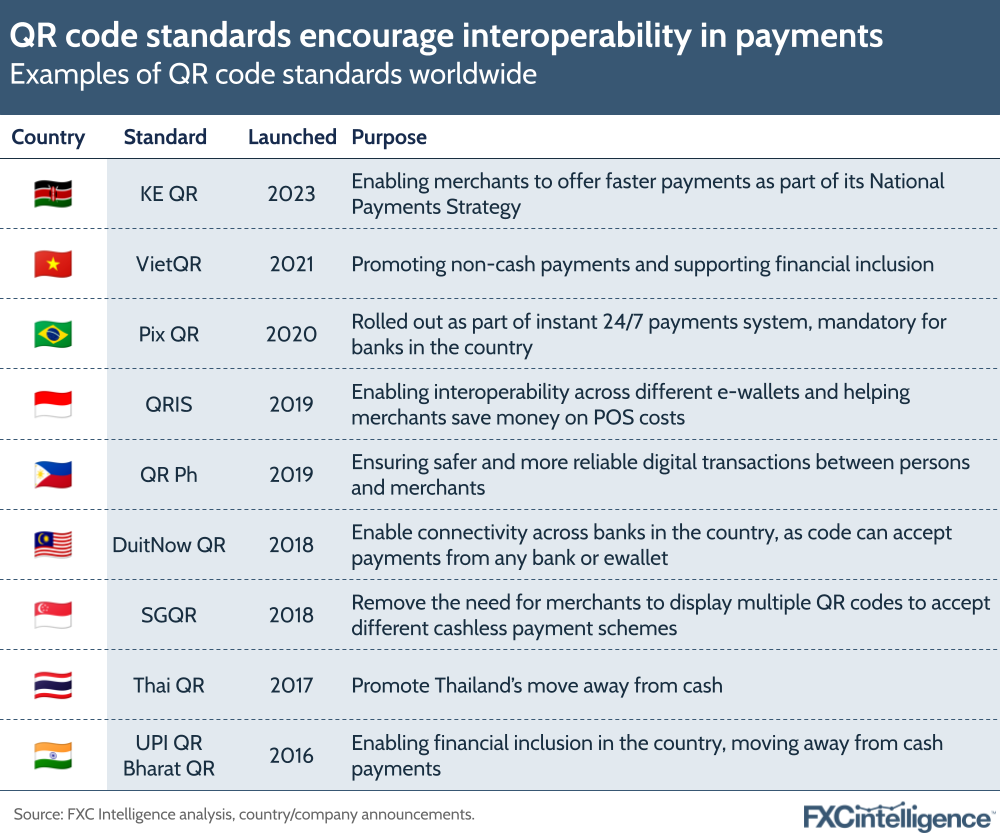

The rapid growth of QR payment adoption in APAC, alongside a drive to replicate the success of Alipay and WeChat, has led to a number of countries introducing QR interoperability standards to help promote the acceptability of QR code payments and prevent merchants from having to use separate QR codes to accept scans from different wallets.

Which countries have high QR code payments adoption?

QR code payments have been introduced in many markets around the world, but there has been a particular focus on their use in the APAC region. Countries such as Vietnam, South Korea, India, China, Indonesia, Singapore, Malaysia and Thailand have a culture of QR codes being used to make payments.

It’s believed that the adoption of Ant Financial’s mobile payment platform AliPay and Tencent’s WeChat Pay has supported this. Both of these apps were early adopters of the QR code payment model. According to a 2022 report from the Payment & Clearing Association of China, QR code scanning is now the most frequently used payment method for 95.7% of Chinese mobile payment users.

In January meanwhile, the State Bank of Vietnam reported that average annual growth in the number of transactions via QR code since its 2018 introduction to the country had reached 471.13%. In Singapore – a hub for fintechs – the Singapore Quick Response Code Scheme had been adopted across more than 239,000 merchants in the country as of September 2023, according to a report from the Monetary Authority of Singapore.

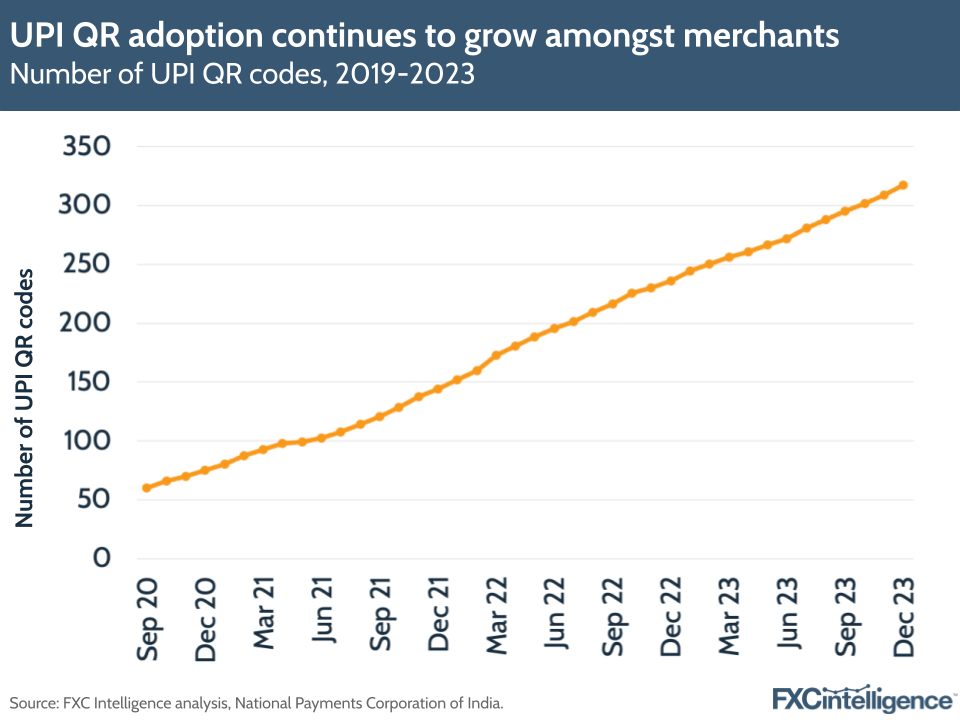

Elsewhere, India has two primary QR code standards in service: the Bharat QR and BHIM UPI. According to NPCI statistics, the number of UPI QR codes that are currently in use has grown by 41% in 2023 compared to 2022, and 145% since 2021. This highlights how the country’s commitment to QR code payments has continued to grow in the wake of the Covid-19 pandemic, during which there was an acceleration of contactless payment methods as merchants looked for ways to limit physical interaction with customers.

Outside of APAC, another market to see high adoption of QR-based payments is Brazil, through its Pix instant payments system. Despite only being launched in late 2020, Pix has since amassed over 160 million users and in 2023 alone it enabled 42 billion transactions.

Europe has also seen the use of QR code payments, but available sources suggest this hasn’t been at the same pace and that it is still seen as a new payment method. Having said this, QR code payments have still been introduced in some markets – for example, via a collaboration between Alipay and six European digital wallets in 2019.

In 2022, the European Payments Council launched a new consultation regarding the standardisation of QR code payments – this resulted in the launch of a set of guidelines for the use of a QR code in the Single Euro Payments Area.

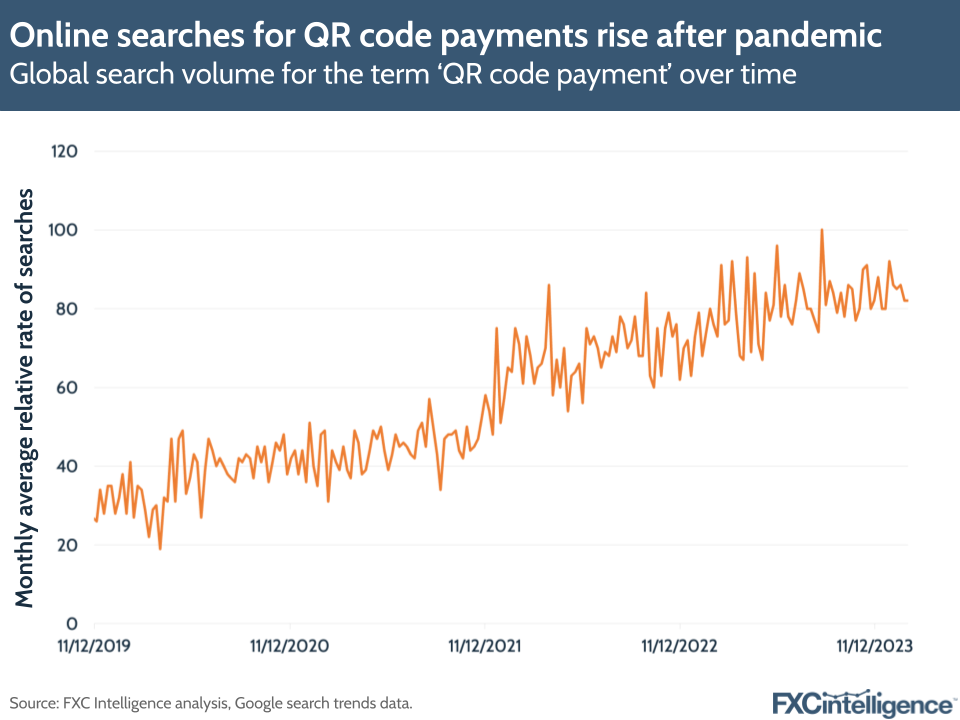

Meanwhile, Google search trend data also highlights a growing interest in the search term ‘QR code payment’ after the Covid-19 pandemic. The graphic above shows the level of search interest on Google across searches globally for the specific term ‘QR code payment’ relative to the highest point on the chart, with a value of 100 being the term’s peak popularity in terms of its total searches.

Google calculates search interest for a given time period by analysing a sample of web searches for that term over the time period. With this in mind, relative search interest popularity increased by 257% between 11 Feb 2019 and 11 February 2024, which shows the number of searches for this term have increased.

This graphic shows that the popularity of the search term ‘QR code payment’ has grown relative to its peak popularity globally, however this does not necessarily mean that this term is being used more than other search terms, nor indeed that the searches are all coming from one place.

Google also breaks down locations where search terms were the most popular during a specified time frame. It calculates values on a scale of 0-100, with 100 belonging to the location with most popularity as a fraction of the total searched for that location, while a value of 0 indicates there was not enough data available for the term.

When examining the countries where the term ‘QR code payment’ has seen the highest popularity over the past five years, the top countries are Singapore (at 100 in terms of relative search interest), Nepal (46), India (40), Malaysia (40) and Hong Kong (36). Notably, these are all countries where QR interoperability has been a major topic in recent years. By comparison, search interest is lower in the UK (6) and the US (3).

While Google search interest does not necessarily indicate increased global adoption worldwide, it does show a growing interest in the role of QR code payments and the regions where it has been important enough for people to search for it online.

Where are the current QR cross-border payments linkages?

QR codes have increasingly been integrated into fast payment systems and interoperability links, particularly in Southeast Asia. One of the first of these linkages was between Malaysia and Thailand to enable instant cross-border QR code payments between the two countries. The first phase of this linkage – which allowed users in Thailand to scan DuitNow QR codes to make payments to merchants in Malaysia – launched in June 2021.

To give another example, last year the Monetary Authority of Singapore and Bank Negara Malaysia launched a cross-border QR code payment linkage between the two countries, based on the NETS QR and DuitNow QR code systems. Travellers from Malaysia that use participating financial institutions can now scan merchant QR codes through their existing mobile banking apps to make payments in Singapore.

As shown in the graphic above, a large number of countries in Southeast Asia already have cross-border linkages, or are in the process of securing them. An important point of note however is that not all vendors and banks are signed up to established bilateral schemes in the countries (such as in the Singapore-Malaysia linkage).

ASEAN countries have further committed to establishing a region-wide cross-border payments network. There have been several bilateral exchanges, but having one multilateral system is still a work in progress, one that could come in the form of Project Nexus. This project, spearheaded by the Bank of International Settlements (BIS), essentially aims to standardise the way that instant payment systems connect to each other.

Rather than a country seeking to sync up with each country’s instant payment system individually, the Nexus project proposes that there should be one central platform that these systems can connect to in order to enable instant cross-border payments. Last year, the BIS Innovation Hub announced that it had successfully launched a system connecting three instant payment systems: the Eurosystem’s TARGET Instant Payment Settlement System (TIPS), Malaysia’s Real-time Retail Payments Platform (RPP) and Singapore’s Fast and Secure Transfers (FAST).

A key driver for cross-border payments interoperability via QR codes – beyond convenience – has been moving towards the use of local currencies across the region and reducing the power of the dollar in cross-border transactions. In September 2023, the Bank of Indonesia launched a National Task Force with the aim of expanding the use of local currencies in Indonesia’s cross-border payments with other countries.

In addition to linking payment systems, the Bank of Indonesia, the Bank Negara Malaysia and the Bank of Thailand have signed three bilateral memorandums of understanding to enable the settlement of transactions in local currencies across borders. This would reduce FX transaction fees that otherwise stem from converting to the US dollar.

What are the current barriers to interoperability and cross-border payments?

In order to achieve interoperability, a big goal for countries in Southeast Asia recently has been to standardise the QR codes used for payments. At present, the need for merchants to support multiple QR codes can become confusing or mean that consumers need to manually check whether their preferred payment method is accepted.

Standardisation across countries takes a long time and can be difficult, as there are so many different players, regulators and aspects of the system to consider. For example, there could be issues around cybersecurity, in which regulators express concern about QR codes being used by scammers.

At a recent roundtable on ‘Enabling & scaling instant cross-border payments’, hosted by the BIS Innovation Hub and the Monetary Authority of Singapore, several barriers to interoperability were mentioned.

This includes a lack of uniformity in standards and regulatory frameworks, which makes it harder for countries to integrate payment systems for several reasons – different rules around compliance, for example. This makes it harder to integrate a cross-border payments system that is operating across lots of different jurisdictions.

Will QR feature in more cross-border initiatives worldwide?

QR code payments are the norm in some APAC markets, but in a number of Western markets they are seen as less prevalent when it comes to making payments. This is partly driven by the prominence of mobile wallets and consumer behaviour shifting towards other contactless payment methods, such as NFC technologies that enable fast access to Apple Pay and Google Pay.

“Because there is very high bank account ownership [in some Western markets], people are less excited or interested in alternatives, and if they do have them they are on top of the banking infrastructure and not outside of it,” says Arinola Lawal, Research Analyst at FXC Intelligence.

During the Covid-19 pandemic, QR code payments saw a particular boost in industries such as hospitality, where restaurants would implement QR code solutions to help patrons scan and pay for their orders with less staff interaction. However, the aspect of boosted convenience isn’t felt as much in PoS-terminal based transactions – particularly with the advent of SoftPoS systems, which allow users to download PoS software directly onto their mobile devices.

Going forward, QR codes will continue to play a role in bilateral connections between countries – particularly as instant payment systems such as India’s UPI and Brazil’s Pix seek to spread internationally into new markets. However, differences in consumer behaviour will likely mean the draw of cross-border payments in some markets is likely to be more related to a desire for faster and more convenient payments, rather than the demand for QR as a payment method.