India’s Unified Payments Interface (UPI) has already transformed the digital payments landscape in India – now, the instant payments platform is expanding into new markets, most recently France, Sri Lanka and Mauritius. In this article, we explore what UPI is, what’s driven growth for the platform and how it is transforming cross-border payments.

Indian citizens visiting the Eiffel Tower no longer have to pay FX charges when they buy a ticket at the front desk; instead, they can use an app that supports Unified Payments Interface (UPI) to pay with their own currency, instantly and securely, as if they were paying for a bus fare back home.

This is possible because UPI – India’s instant payments platform – launched amongst retail vendors in France at the start of February. Just this week it launched in Sri Lanka and Mauritius, having already been adopted by merchants across a number of countries, including Bhutan, the UAE, Malaysia, Singapore, Nepal, Oman, Qatar and Russia. Now, reports online suggest that UPI could serve as a model for a new real-time payments link between India and the US. Meanwhile, Indian travellers can send remittances, including in the UK and US, back home to India using UPI-enabled mobile apps.

The Eiffel Tower launch reflects the ambitions of UPI’s owner, the National Payments Corporation of India (NPCI), which is expanding the system worldwide after it has already helped steer millions of people in India towards digital payments.

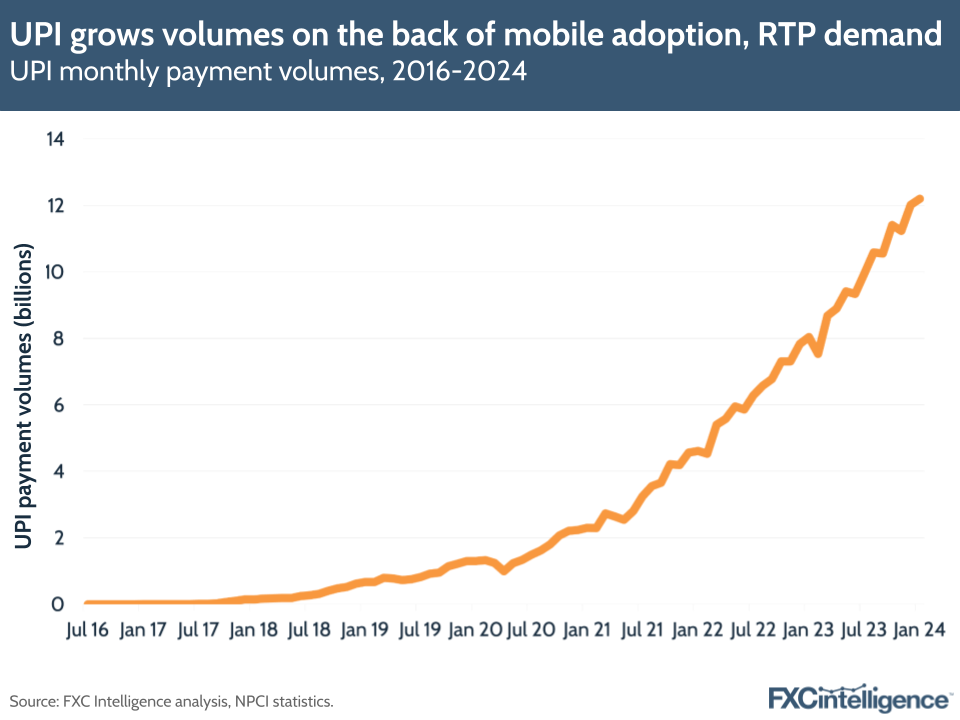

In January 2024, the NPCI saw more than 12 billion transactions across the UPI platform, with a total value of INR 18tn. The platform accounted for over 86% of the total financial transaction volumes sent across payment products built by the NPCI in the same month. The network has driven P2P payments through both the NPCI’s own remittances app and other popular money transfer apps in India such as PhonePe and Google Pay.

Now, UPI is expanding to other countries through cross-border interoperability projects and partnerships. This piece will explore how UPI has transformed the payments landscape in India, as well as the impact that it is now set to have on the cross-border space.

What is UPI?

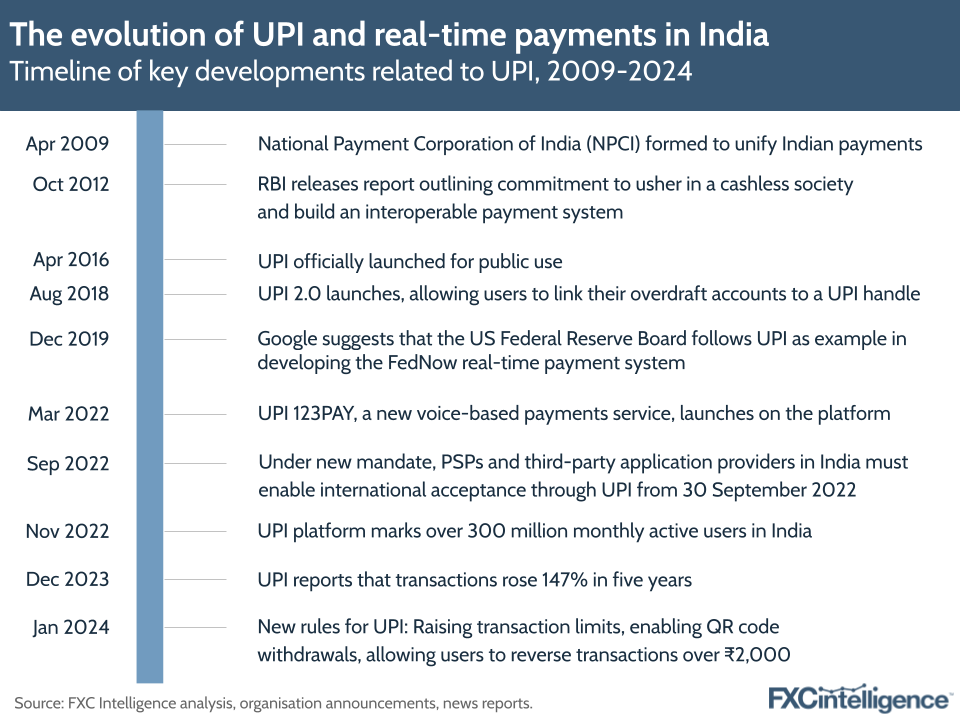

UPI is a real-time payment system that enables instant money transfers from one bank account to another. Though it was launched and is owned by the NPCI, the platform itself is regulated by the Reserve Bank of India (RBI).

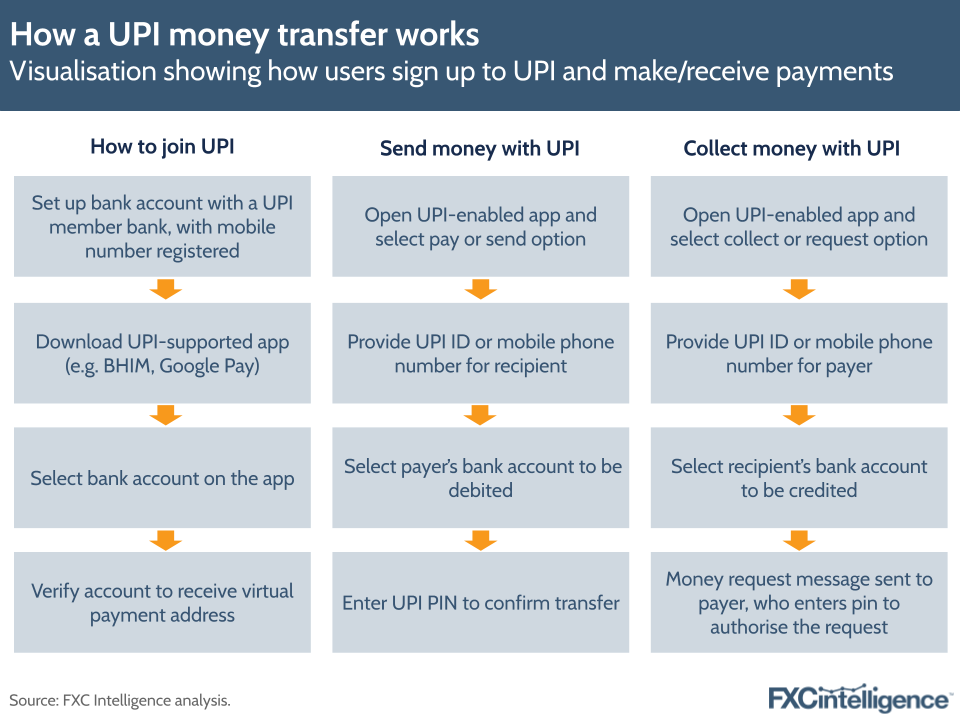

To use UPI, Indians with a bank account create a virtual payment address and UPI ID, which they set up alongside a pin code. They can then send and receive money to other UPI users by inputting their UPI ID or their mobile number into the UPI app, or a third party app connected to the system, and entering their pin to confirm the transfer. UPI can also be used to make payments at merchants in-store by scanning QR codes, or to make purchases or pay bills online.

Rather than being a brand new network, UPI is essentially an application programming interface built using infrastructure created for the Immediate Payment Service (IMPS), a real-time inter-bank transfer system that India launched in 2010. It is also separate from National Electronic Funds Transfer (NEFT), India’s payment system that processes payments in batches, and Real-Time Gross Settlement (RTGS), which is used primarily for high-value transactions.

India’s different payment systems have different features and use cases (see below). However, the key for UPI is its applicability to low-value payments, as well as its capacity to enable instant payments, which separates it from previous, slower methods of batch settlements.

IMPS was already delivering instant payments in India years before the introduction of UPI, and indeed continues to share similarities with UPI; both enable instant transactions with no or minimal fees (depending on the participating bank and the transaction type) and both are available 24/7, all year round.

Though it is built on IMPS infrastructure, UPI differentiates itself by being a mobile-based payment system that allows payments through a virtual payment address. It also allows different bank accounts to be accessed via a single application, making it a more convenient, accessible way for Indians to send and receive money.

The origins of the UPI instant payments system

UPI came about as a result of a desire in India to unify payments in one central space, help spur financial inclusion and make payments more accessible to all. It was also introduced to help shift India away from cash transactions, which the Indian government sees as being important for reducing corruption in the country.

India has traditionally been a cash-heavy economy and prior to the advent of UPI and other payment systems, digital payments in the country were fragmented. Back in 2011, RBI surveys found that the average Indian would make just six non-cash transactions annually.

Even today, millions of people across India do not have a bank account. According to the World Bank’s 2021 Global Findex report (its latest in-depth financial inclusion report), more than 230 million unbanked people – 17% of the total unbanked population globally – were living in India in 2021, while 540 million Indian adults had an account but made no digital payments. The report cited various reasons for account inactivity in India, such as the distance to bank branches, a lack of trust or a lack of need for a bank account.

While the pandemic may have spurred the growth of UPI adoption, cash has also continued to see growth in recent years. In 2020-2021, the amount of currency in circulation grew by 16.6%, which the RBI put down to a number of factors, such as rising uncertainty, the decline in opportunity costs for holding currency (e.g. interest rates) and government initiatives that promoted both cash and digital payments.

UPI key growth drivers

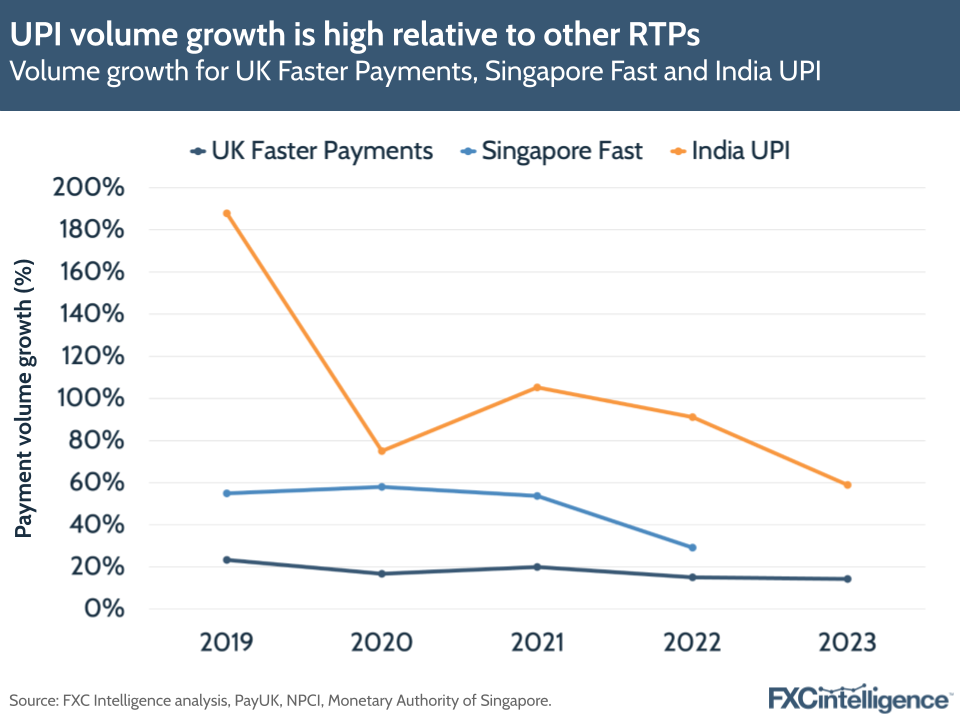

After an initial struggle to gain widespread adoption, UPI’s payments volumes rose significantly from late 2016, growing by 900% in 2017 compared to the previous year. Growth has continued ever since and in 2023, UPI processed 117.6 billion transactions, with a total value of INR 182tn.

The number of banks/financial institutions that have adopted UPI has also grown substantially. As of the latest figures this week, there were 550 Indian banks and payment partners that had adopted the UPI platform, up from 382 a year ago.

According to the NPCI, UPI is now supported by more than 20 third-party payments apps, with some of the most prominent including Amazon Pay, Google Pay and PhonePe. Merchants have also massively adopted the platform, with the Times of India reporting that 500 million merchants were using UPI to accept money for their businesses in July 2023.

UPI adoption is being driven amongst customers and merchants for a number of reasons. Firstly, low transaction fees compared to other payment methods make it more attractive than other payment methods, as in most cases UPI payments continue to be free of charge for the end consumer.

UPI has also seen particular success in rural areas. Fintech company PayNearby found in a study that UPI transactions at retail stores in rural and semi-urban India rose by 118% in 2023 compared to the previous year, while transactions were up 106% in value. The success of UPI in areas outside of urban centres could also see a boost from other UPI capabilities launched in 2022. These include UPI 123Pay – which brings UPI to non-smartphone users – and UPI Lite, a simplified digital account for low-value transactions.

There have been concerted moves from the government of India to drive its population away from cash, though these have often been controversial. In 2016, for example, Indian Prime Minister Modi announced that the country would ban INR 500 and INR 1,000 notes altogether, effectively wiping out around 86% of the currency in circulation, in a bid to tackle corruption.

The Indian government has also promoted incentives for the use of UPI in the country and reportedly plans to boost its investment in such incentives to INR 50bn in fiscal year 2023-2024 (up from INR 26bn during the previous period).

Why merchants are increasingly adopting UPI for payments

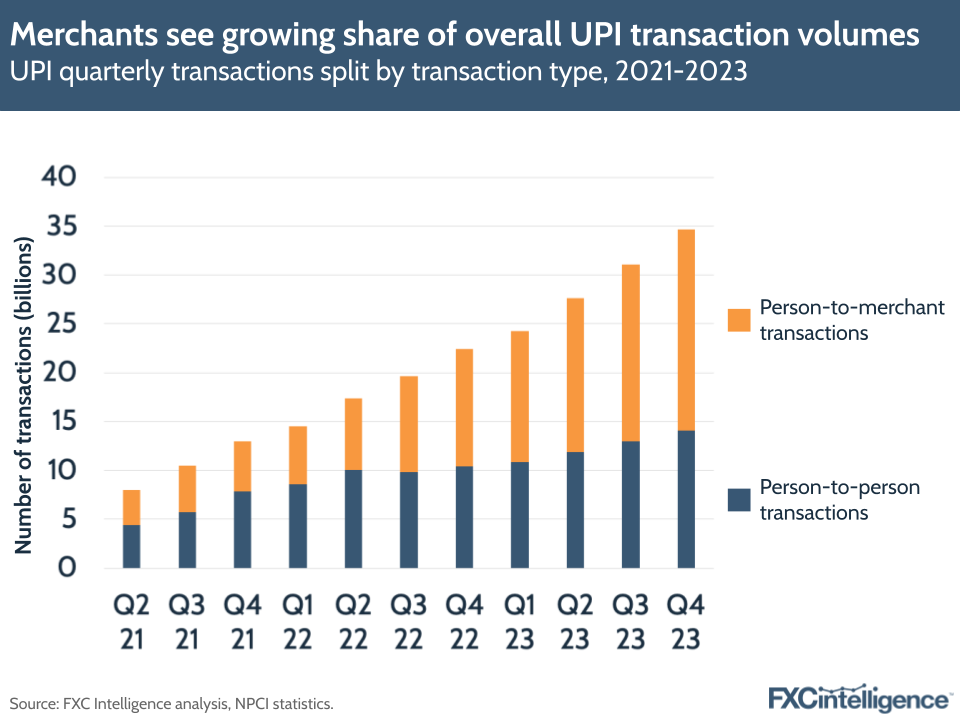

When looking at the share of transactions on UPI, it appears that the share of person-to-merchant (P2M) transactions is growing at a significantly faster rate than peer-to-peer (P2P). Back in April 2021, P2P transactions accounted for 55% of UPI’s overall transactions, with P2M accounting for 45%. However, this balance has slowly shifted, with P2P payments accounting for just 39% of transactions in January 2024, against 61% for P2M.

Based on NPCI data, Worldline projected last year that P2M transactions would make up 75% of all UPI transactions by 2025. The company attributed this movement to be as a result of increasing merchant adoption during the pandemic, with UPI offering zero transaction fees and faster payments, but also its security and popularity amongst consumers as a spending device.

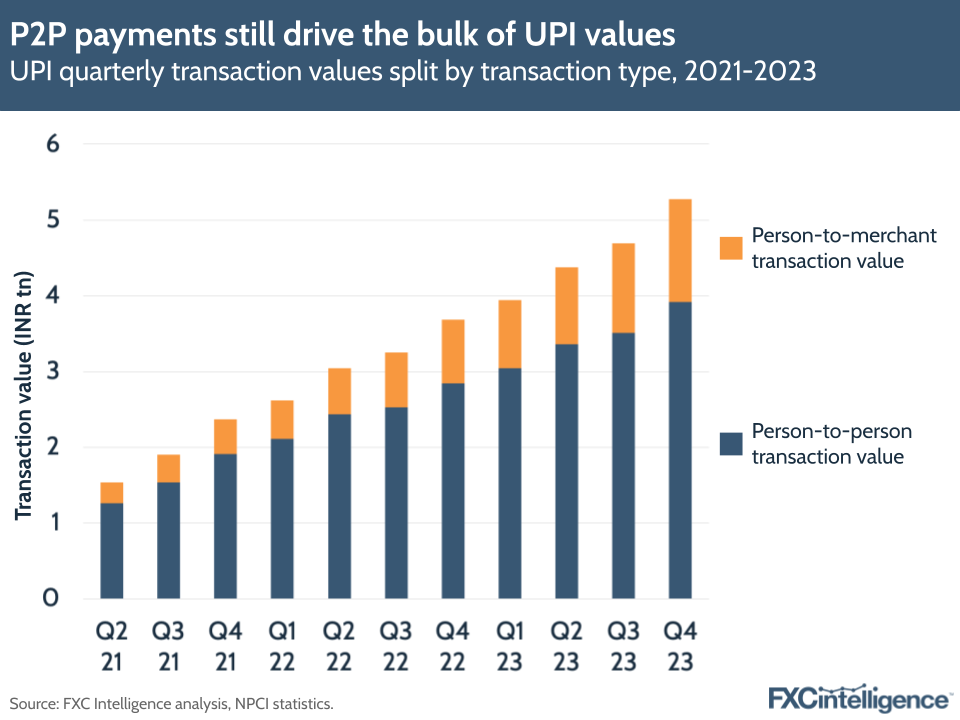

Looking at the values of transactions, this has also been shifting towards P2M over the years. Though P2P transactions still accounted for 73% of total transaction value across the UPI platform in January 2024, this was down from 83% in April 2021.

How third-party apps are driving UPI transactions

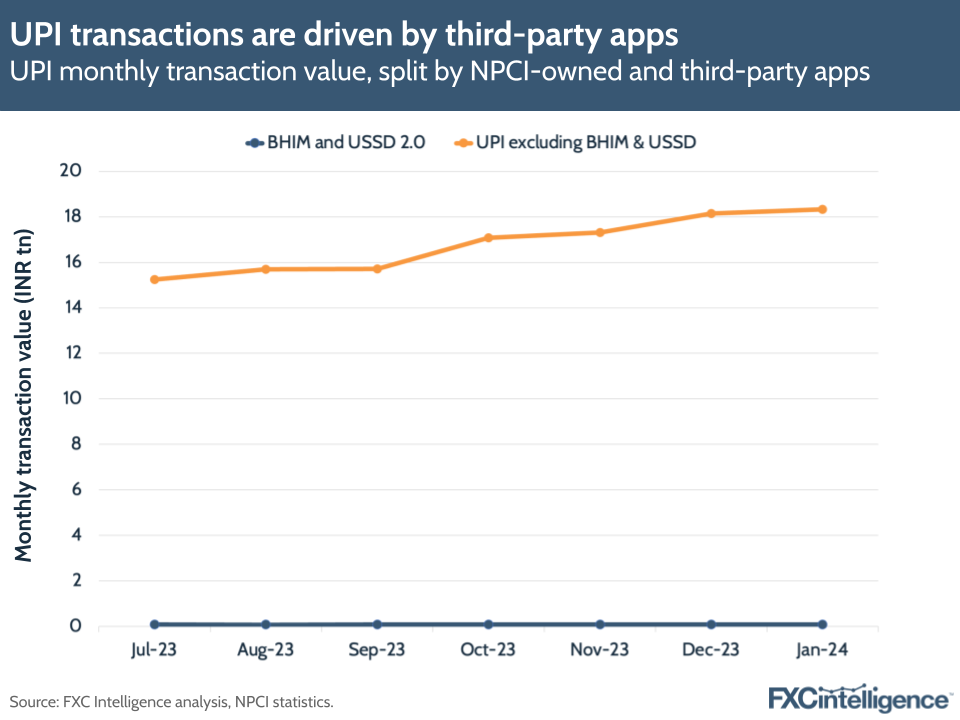

Another point of interest from the NPCI’s retail payment statistics is how UPI values and volumes are being almost exclusively driven by sources beyond the NPCI’s own applications for making UPI payments, which include BHIM, a mobile payments app, and USSD 2.0, which enables payments via a phone call (i.e. without requiring access to the internet).

Out of the INR 18tn that passed through the platform in January 2024, around INR 88bn (just 0.5%) was through BHIM (the graphic above shows this in more stark detail). In terms of transaction volume, BHIM accounted for just 0.2% of overall transactions in the same month.

A report this week from an Indian parliamentary panel found that UPI is currently being dominated by third-party players, with PhonePe commanding 46.91% of UPI’s market share by total volume of transactions processed in the period from October to November 2023, while Google Pay held a market share of 36.39%.

The NPCI has made steps to try to prevent a duopoly in the payments space. In 2020, it proposed a cap on major payments players in India, under which no single player would be allowed to process more than 30% of UPI transactions in a month. The deadline for compliance with this cap was originally January 2021, but has since been extended several times, most recently until the end of 2024. However, there has unsurprisingly been criticism of the market cap from PhonePe, which said that the only way for it to reduce its market share in UPI would be to deny UPI services through its app to tens of millions of Indians.

The ongoing Paytm crisis has brought the UPI 30% cap back into focus, as NPCI data shows that Paytm accounts for 13% of UPI volumes, making it the other big player in India. Essentially, the RBI restricted Paytm Payments Bank from accepting new deposits from 29 February after the bank failed to comply with KYC guidelines. Hundreds of thousands of bank accounts were found to be created without proper identification, according to a recent Reuters report. The news around PayTM has already driven up downloads for PhonePe and Google Pay.

Paytm had previously integrated UPI services and offered virtual payment addresses through Paytm Payments Bank but the Economic Times reported this month that One 97 Communications, which owns and runs Paytm, has been in talks with the NPCI about transitioning the service to becoming a third-party app for accessing UPI payments.

By making Paytm a separate third-party app – similar to PhonePe or Google Pay – and collaborating with other UPI-enabled banks, One 97 would be able to keep the business from UPI, without leaving millions of customers unable to continue using the app.

The potential of UPI for cross-border payments

A key part of NPCI’s strategy has been helping Indians to pay for more goods abroad, with a number of countries worldwide already accepting UPI payments. During the recent launch in France, India’s Prime Minister Narendra Modi said on X (formerly Twitter) that it marked “a significant step towards taking UPI global”.

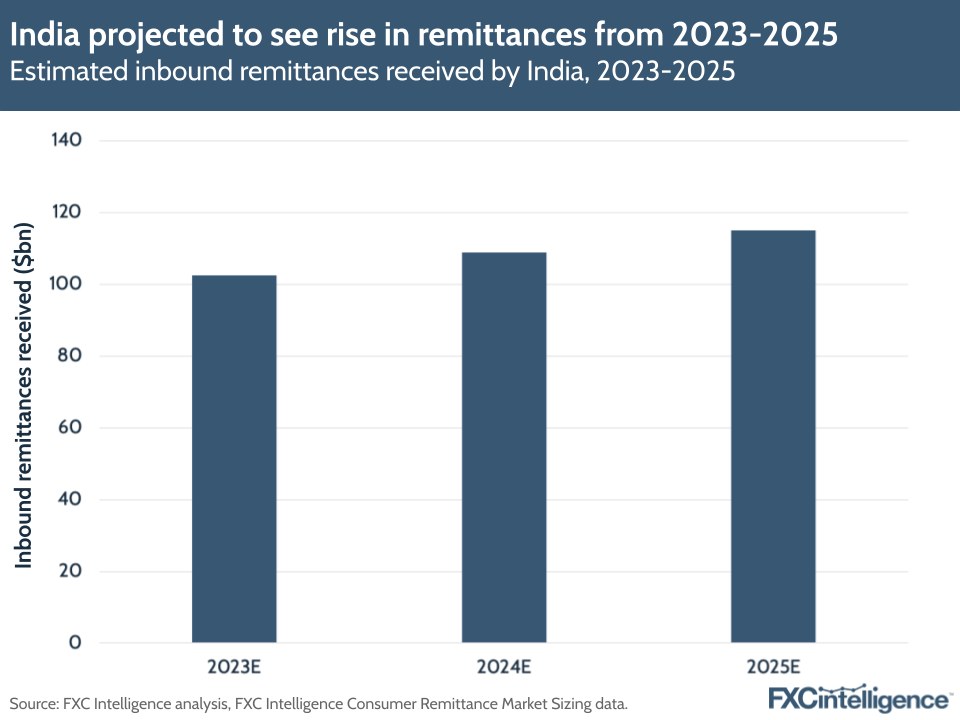

However, the NPCI has also stated its goal of establishing an international remittances network on the back of UPI, with the aim to serve a consistently growing Indian diaspora worldwide. For several years, India has been by far the highest receiver of personal remittances. FXC’s market sizing data estimates that annual inbound remittances to India will rise by around 12% from 2023 to 2025, when remittances are projected to be over $115bn.

Large numbers of Indian people live abroad and send money back home. According to the Indian Ministry of External Affairs, there are currently more than 32 million Indians overseas, consisting of more than 18 million persons of Indian origin and more than 13 million non-resident Indians.

Just like other diaspora, Indian migrants face challenges when sending money across borders, including high exchange rates, differences in time zones, delays and compliance checks as money is sent across large numbers of countries.

Migrants are using specialist money transfer providers to send money back to their home country. The potential of a 24/7 instant payment system in this area has been clear to India, which is why the NPCI has been building partnerships with the aim of capitalising on this business for UPI across a number of key markets. The benefits of UPI for remittances would include lower transaction times and reduced costs.

In 2020, the NPCI even set up its owns subsidiary – NPCI International – to help promote UPI outside of India. In particular, it wants to help travellers outside of India to make payments with UPI, enable remittances through the platform and (eventually) establish similar digital payments systems in other countries.

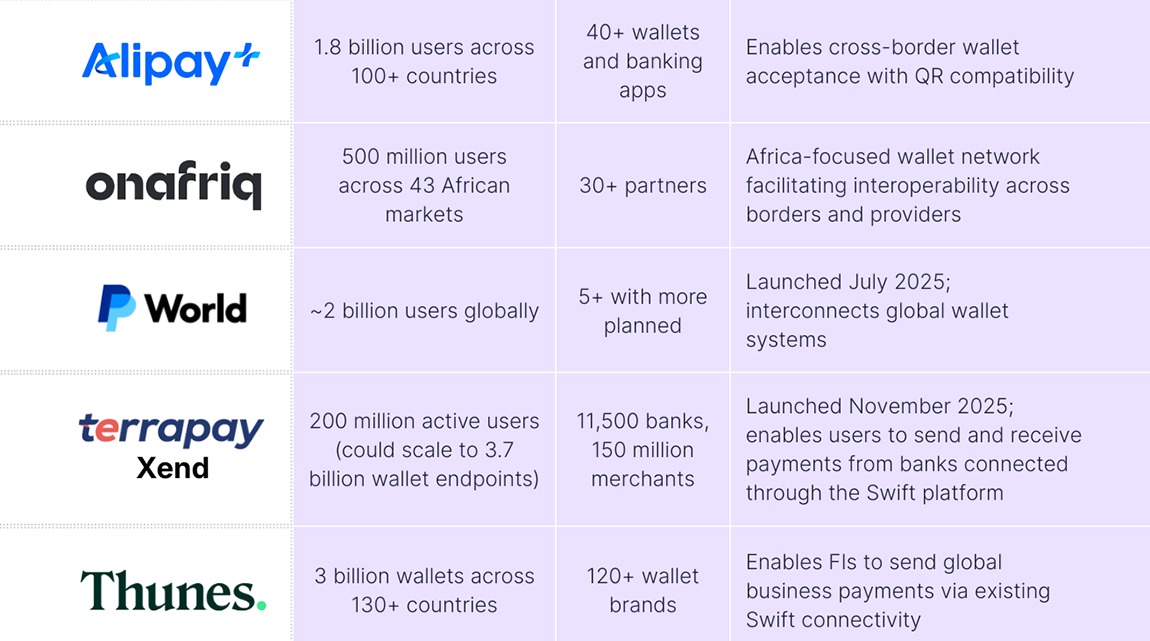

A number of partnerships have formed to enable merchant adoption of UPI in other countries worldwide. Notably, a number of partnerships are with countries that also see high numbers of remittances to India, such as the UAE, which according to the World Bank accounted for 18% of remittances to India in 2023 and is the second highest source country after the US. A large focus of the partnerships on the graphic shown above has been on person-to-merchant transactions, which reflects the growing importance of these transactions to UPI’s overall value in India.

However, there have also been some major collaborations to enable faster remittances using UPI. Last February, a collaboration between Singapore’s PayNow and UPI launched to enable fast, low-cost transfers between the two countries, with transfers from India to Singapore simply requiring a mobile number, while transfers from Singapore to India need a virtual payment address.

In addition to partnering with other countries’ central banks, UPI has also seen expansion through collaborations. The NPCI recently partnered with Google Pay to help it expand the use of UPI for payments outside of India. This agreement will aim to make it easier for travellers abroad to access the system and enable easier cross-border payments for merchants.

How does UPI compare to other real-time payment systems?

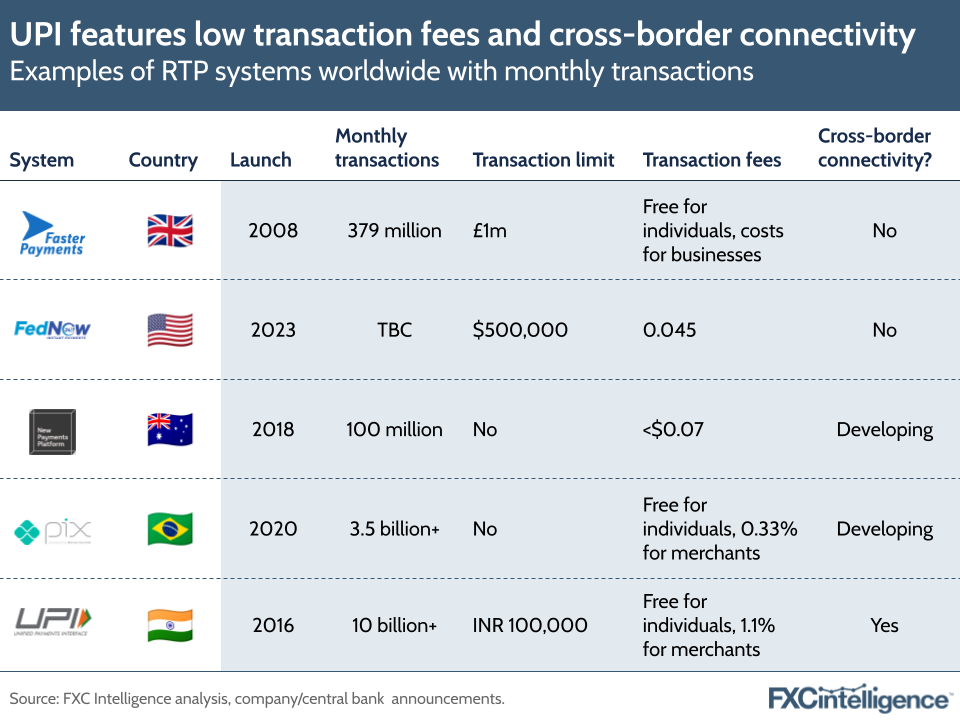

Compared to some other real-time payment systems worldwide, UPI is growing on the back of the government subsidising its use, which in turn reduces fees that merchants and end-consumers pay to use it.

Low fees, alongside the growth of mobile adoption and acceptance of QR code-based payments in Asia, have helped grow UPI’s volumes faster than some other real-time payment systems. Having said this, it is notable that the system is primarily focused on lower-value sends, with a lower daily transaction limit than other systems.

With adoption now enabled across many countries, UPI is leading the charge when it comes to taking its system global, and could be presenting an example for other countries to follow. Indeed, a number of real-time payment systems worldwide have been or are set to be expanded across borders. For example, Thailand and Singapore have connected their PromptPay and PayNow services to enable low-cost instant mobile transfers for travellers from either country.

Within the Eurozone, the SEPA instant payment system enables instant euro payments between countries. On a wider basis, the Bank for International Settlements has been developing Project Nexus – a scheme that aims to connect the payment systems of the Eurozone, Malaysia and Singapore.

According to an Economic Times report this week citing sources familiar with the matter, the NPCI is in discussions with Indian and US banks about the potential of creating a real-time payments link between the two countries. In particular, the report mentions the NPCI is “engaging with” the US’s FedNow instant payments system, which was launched last year but had upwards of 300 financial institutions join as of December 2023. It also said that the initial payments link could focus on smaller consumer transactions, due to the lack of a nationwide instant payment system in the US akin to UPI in India.

What’s next for UPI in 2024?

As we’ve seen elsewhere in the industry, the demand for faster, seamless and more secure payments continues. UPI remains an example of this and has demonstrated the impact of delivering this demand. So what’s next for the instant payments system?

At the start of the year, the RBI and the NPCI released new rules and regulations that came into effect from 1 January. These including increasing transaction limits on payments to education and hospital institutions, and also allowing users to reverse transactions on first payments to new recipients of INR 2,000 or more – a direct response to growing concerns in the industry around payments fraud.

Interestingly, one of the new changes is NPCI rolling out UPI ATMs, which will allow users to withdraw money using UPI, without having to carry a debit card. The move seems to be a reflection of the continuing importance of cash to the Indian economy. The NPCI is also looking to increase the average transaction size on UPI by encouraging more credit card transactions at merchants.

Though digital payments have proliferated, the demand for cash has not waned, and according to a paper from the RBI may have even increased during the Covid-19 pandemic. Refinements to make UPI more accessible and expand its usefulness to Indians could help drive the system to raise transactions, but cash is likely to remain important in India for some time.

By extending its adoption to other countries, NPCI could increase the appeal of UPI to Indians not just living abroad but also travelling, which will in turn increase the appeal of using the app for transactions at home. However, while UPI usage continues to grow and partnerships with third-party apps raise the scope of the system across borders, the NPCI is likely to come under more scrutiny this year around how it will support further home-grown fintech players.