Visa partnered with mobile wallet GCash earlier this week, adding another development to a growing list of collaborations, product launches and initiatives that are boosting cross-border payments in Southeast Asia this year.

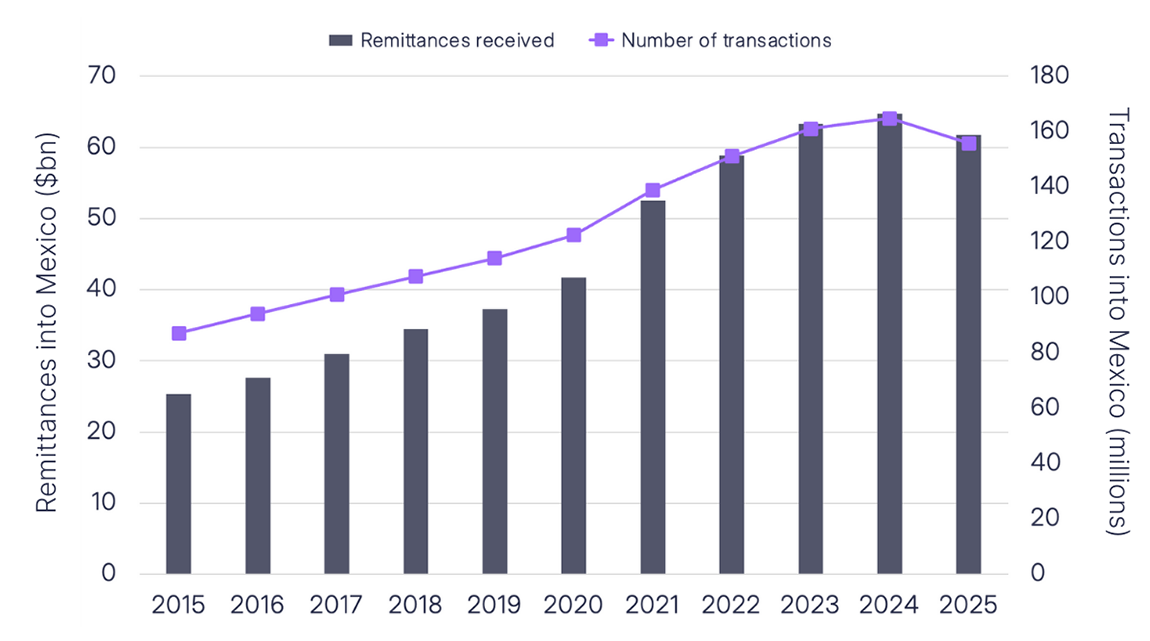

Many recent developments in this region have surrounded remittances, with a mix of homegrown and larger Western players attempting to tap into flows worth billions across the region. This was particularly true in the Philippines – GCash’s home and the fourth biggest recipient country for remittances in 2022 – with $38bn worth of inflows according to the World Bank (behind China ($51bn), Mexico ($61bn) and India ($111bn)).

B2B payments are also represented, with UK-based provider Rapyd extending services to help SMEs accept more payment methods and transact to more countries. A recent study by Rapyd found that many businesses in Singapore – whose central bank recently pledged $150m to support new fintech projects – still favour legacy banks for transfers, despite long delays. Having said this, cross-border trade platform WorldFirst recently reported a 50%+ increase in transactions, driven by a surge in new SME customers from Singapore and Malaysia, showcasing the continuing opportunity for B2B payments in this space.

The need to improve speed, as well as reduce costs, is driving real-time payments and interoperability in Southeast Asia. In August, Vietnam’s central bank joined its counterparts from Indonesia, Malaysia, the Philippines, Singapore and Thailand as a member of the Regional Payment Connectivity initiative, which aims to connect the fast payment system of its members and allow travellers between the countries to make instant payments in their local currency using QR codes. Such linkages have already been launched between Singapore and Malaysia, as well as between Indonesia and Thailand.

According to the Bank of Indonesia, QR code payments could lead to transaction cost savings of up to 30% compared to regular transfers, as by using local currencies they avoid the need to exchange into a commonly held FX currency (i.e., the US dollar) to make payments. If QR code payments do rise rapidly as some analysts suggest, they could prove to be a model for cross-border payments collaboration that other countries (particularly G20 members) may learn from in the future.