Payoneer has reported FY 2023 earnings at the top of its previous projections, as it continues to focus on ideal customer-focused growth. In our latest post-earnings discussion, CEO John Caplan discusses the company’s SMB focus and plans for 2024 and beyond.

Payoneer has not always been well-understood, making its public entry via SPAC and finding itself benchmarked to large, incumbent and domestic-focused payment processors, due to a lack of other emerging markets-focused cross-border payments players. Market reaction to its latest Q4 and FY 2023 earnings suggest that there is still room for development when it comes to investor understanding.

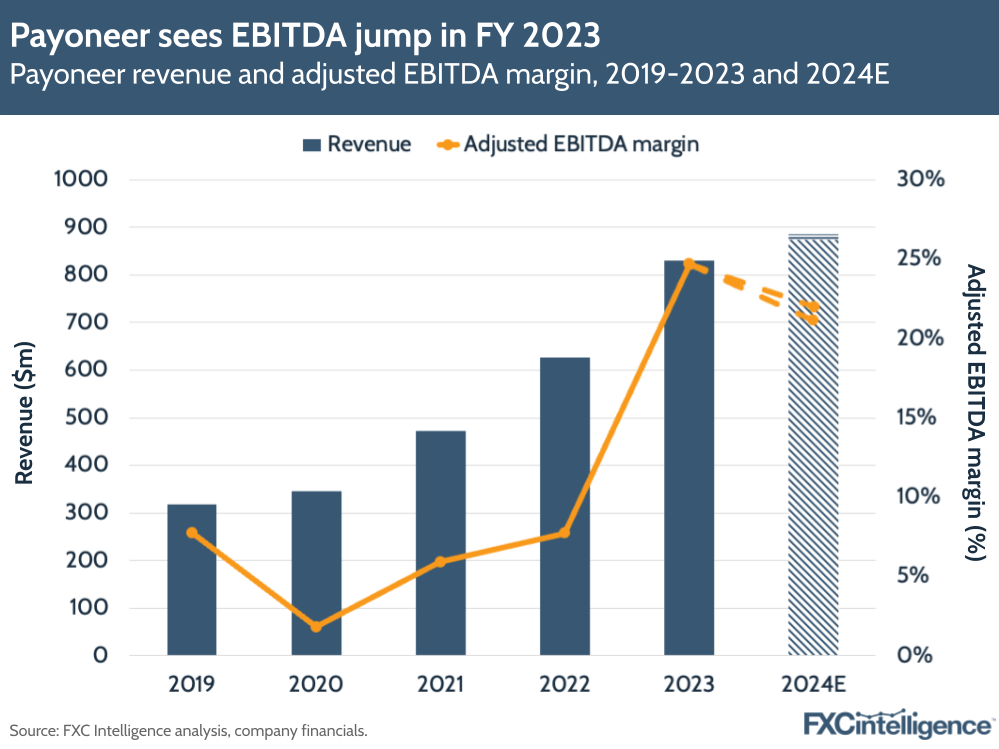

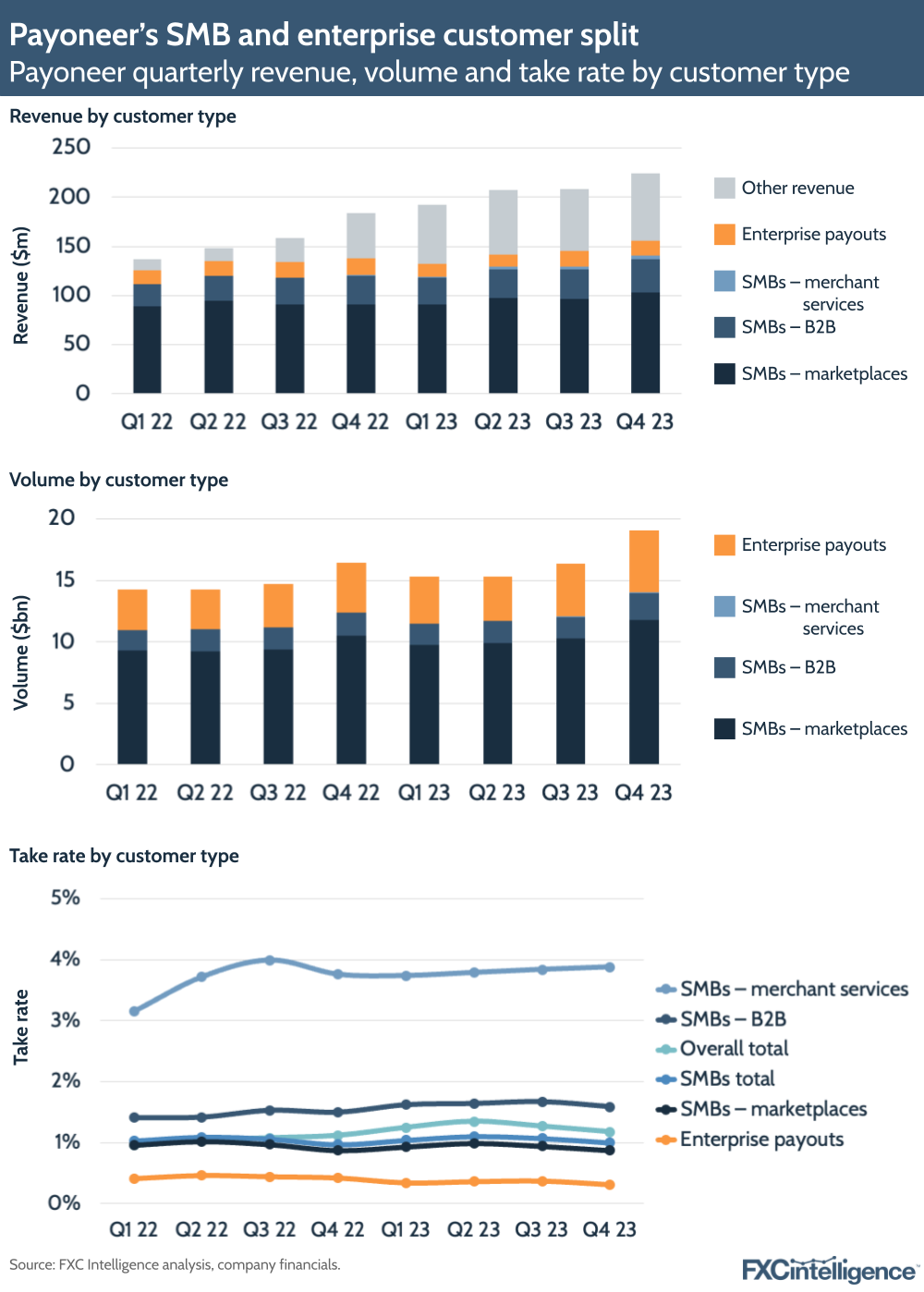

The company saw revenue growing 22% YoY for Q4 and 32% YoY for FY to reach $224m and $831m respectively – at the top end of its previous projections. Adjusted EBITDA followed a similar trend, growing 323% for the FY to reach $205m, providing the company’s highest ever adjusted EBITDA margin of 24.7%. Volume, meanwhile, increased 11% YoY to reach $66bn in FY 2023.

However, Payoneer for the first time also released a detailed breakout of its revenue in terms of customer segments, showing that while many think of it as enterprise led, enterprise payouts accounted for just 7% of revenue in Q4 2023. Meanwhile, SMB business across marketplaces, B2B and merchant services accounted for 62%.

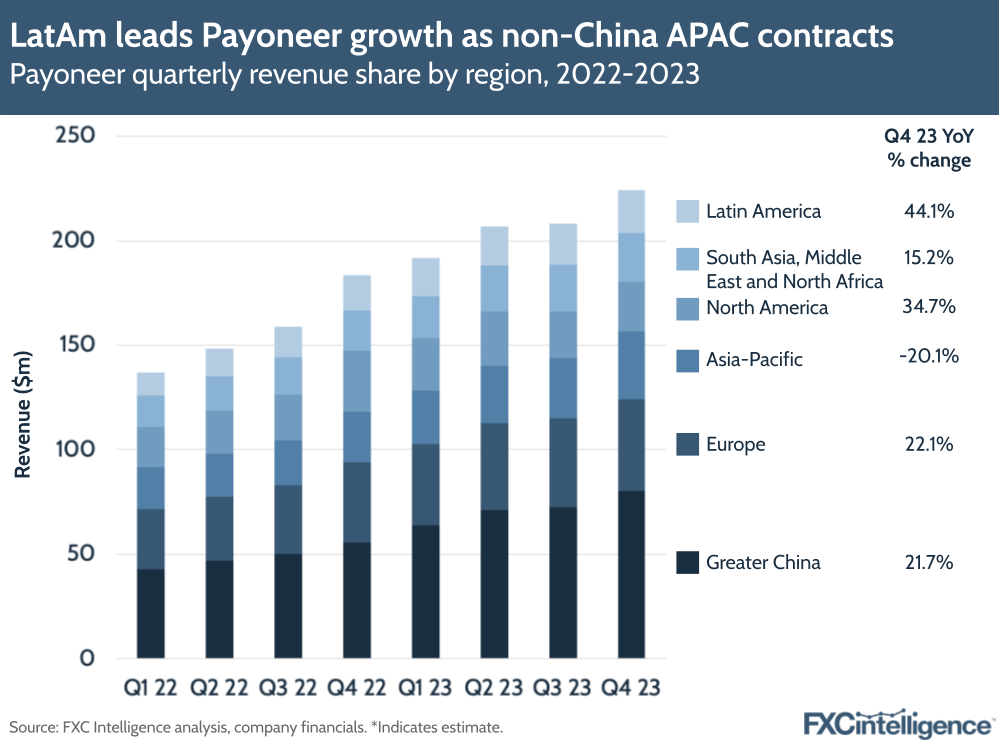

While Payoneer continues to see a significant portion of its revenue from Greater China and the US, it is continuing to see outsized growth in other regions, particularly emerging market regions of Latin America and South Asia, Middle East and North Africa. Here, along with APAC, B2B volume increased significantly above overall levels, at 27% for Q4 2023.

However, investors responded negatively to what some perceived to be soft 2024 projections, with the company forecasting 5-6% revenue growth for the coming year and a decline in adjusted EBITDA of between 5% and 10%.

With this in mind, how does Payoneer plan to grow over the next 12 months and beyond, and how will its SMB play drive its strategy? I caught up with CEO John Caplan to find out.

Payoneer as an SMB-first company

Daniel Webber:

You’ve released a lot of new numbers this time, focusing on the split between SMB and enterprise. Talk us through those two sides of the business.

John Caplan:

Payoneer operates two separate businesses. One is our SMB customer business and one is our enterprise business.

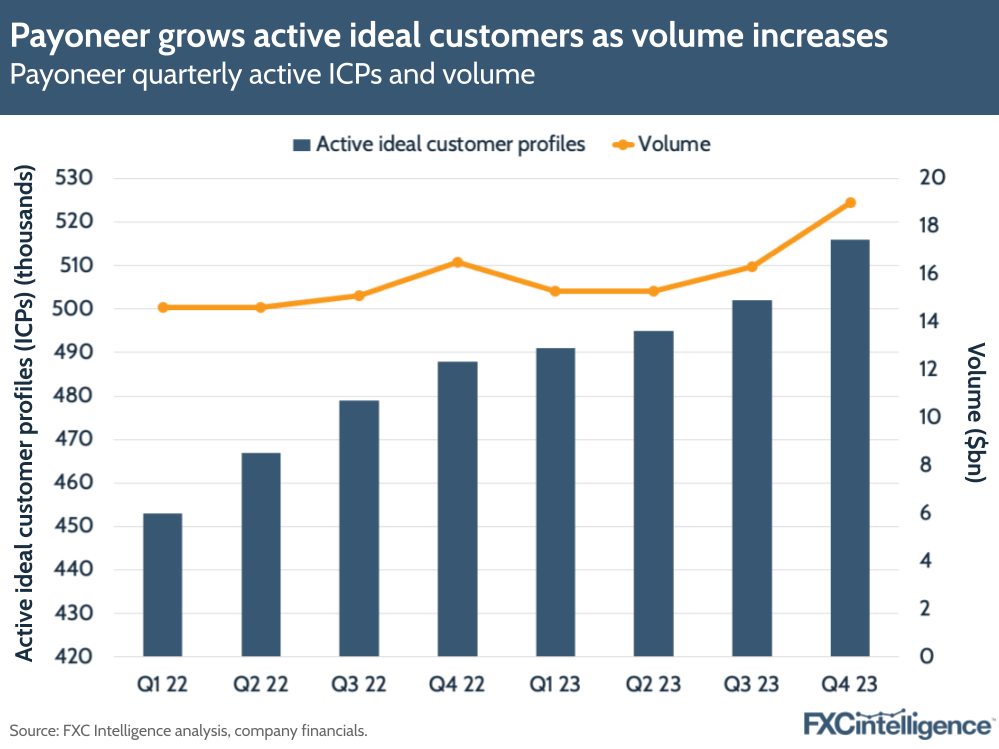

Our SMB customer business is driven by the acquisition, retention and growth of ideal customers; we communicated that over the last year. In 2023, we grew ICPs [ideal customer profiles] in aggregate 6%. But most importantly, we grew ICPs that have greater than $10,000 a month of AR into their Payoneer account 15% year over year.

The SMB customer receives their revenue, their AR, into their Payoneer account from three sources: marketplaces they sell their goods or services on; direct sales between themselves and other businesses, we call that B2B; and our merchant services business where we help them sell direct to consumer.

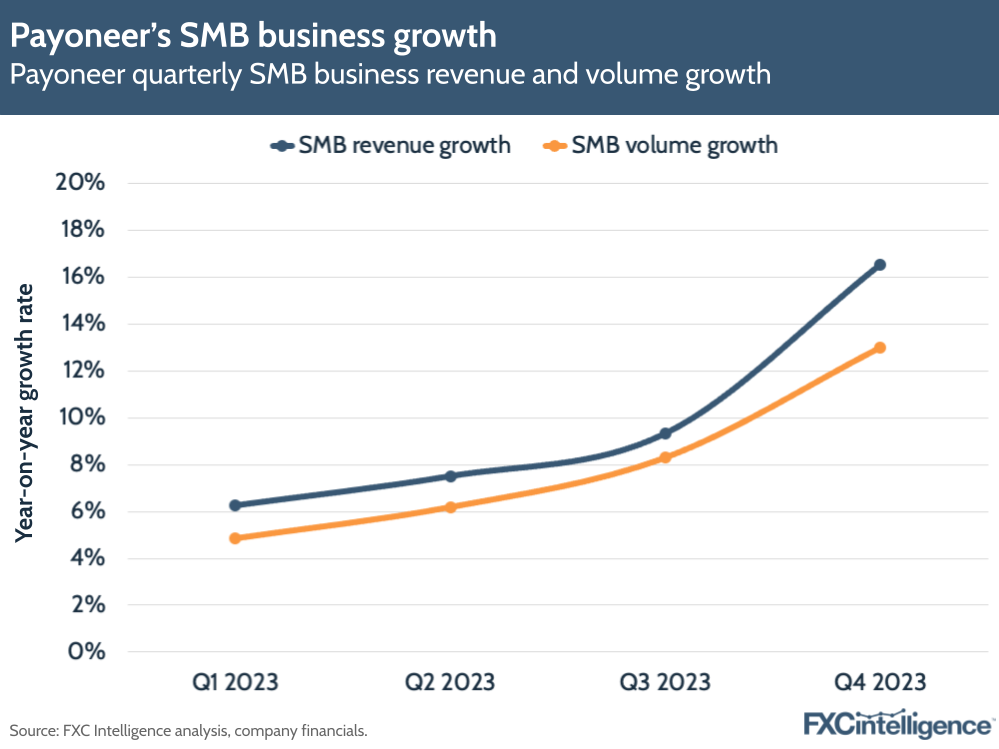

Our ICPs receive funds into their Payoneer account; those funds grew 13% year over year in Q4 and they grew 16% quarter over quarter, Q4 over Q3. What’s important about the growth of that SMB business is – and I think most people will be surprised to hear – take rate in our SMB business grew in 2023 over 2022.

The reason it grew is because our customers value the Payoneer account and all the AP tools that we offer our customers. Our revenue from SMBs grew 16% year over year.

We’ve articulated a very direct strategy: we’re going to help SMBs all over the globe that do business cross-border receive their international AR and manage their international AP from a multicurrency Payoneer account.

We are the only firm on the planet that’s doing this at scale in all the markets around the globe that we do it in. We have a market lead there and if you unpack the numbers, the growth engines of that SMB business, you can see 19% growth year-over-year in revenue on our SMB B2B line.

That is really important because that is a business that we have first-mover advantage in, we have a very strong brand in, and there are 80 million SMBs around the globe that need that service. We have a lead, great growth and a lot of market opportunity.

The other side of our business is the enterprise payout client. Many people still think of Payoneer as an enterprise payouts company.

If you look at our enterprise pay, it’s a big business that has grown 24% year-over-year. The reason why it’s grown is because we provide a really valuable service for enterprises that want to reach hard-to-reach parts of the globe with their payouts.

But you can also see we’ve seen some pricing progression in that business, an 11 basis points decline in our take rate and an 8% decline in our revenue. Volume in that business will grow to begin to offset the take rate decline.

If you look at Payoneer today, why am I excited about where we are is that our SMB strategy is working – as proven by these numbers. Our ICP acquisition is working – as proven by slide 24’s numbers. Our enterprise business is big and valuable, but if we didn’t disaggregate the business, I think people would be concerned about our effective take rate. What you can see is Payoneer’s take rate is flat year over year in our SMB business.

At a high level, ours is a dynamic global business. The way to think of it is we’re SMB first, providing an exceptional solution for two million SMBs around the globe and 515,000 ICPs and 55,000 of the highest value.

We have a great group of people acquiring more and retaining them and building and buying products to make that service even stronger. If you think about the competitive landscape, who could you name today, that has two million small business customers receiving $19bn a quarter of volume into their account and a 1% take rate? There isn’t another firm.

With the market lead we have, we’re hoping that just by consistent steady execution, shareholders, customers and the payments ecosystem will continue to embrace Payoneer as an SMB-first company, with a dynamic business serving them and a very strong enterprise business that exists because we built the SMB business.

Driving efficiencies in the SMB market

Daniel Webber:

Traditional banks often struggle to serve SMB cross-border customers in a cost-effective way. How are you driving efficiencies in this market?

John Caplan:

We have opportunities to leverage more technology to make our own operations more efficient and we are doing the hard work required to run Payoneer more efficiently. We ended 2023 with 8% or 9% fewer people on staff than we started the year.

In 2022, we were spending roughly $25m a year serving our non-ICPs – the roughly 1.5 million customers that don’t meet our ICP threshold. We’ve reduced that by about 30% in 2023.

We’ve also decreased the cost-per-customer support ticket by over 40% as of the fourth quarter.

Emerging markets-driven growth

Daniel Webber:

A lot of your growth is coming from these more challenging emerging market regions. How are you approaching your business geographically?

John Caplan:

We had a 13% growth in ICPs in APAC, LatAm and SAMEA [South Asia, Middle East and North Africa]. You can see here 18% in APAC, 9% in SAMEA and 12% in LatAm.

The 11% decline in Europe is war and Russia-related. There’s not some endemic thing going on there, it’s something out of our control.

You can see our revenue by region, 23% growth in LatAm, 20% growth in SAMEA, 43% in China, 34% in APAC. This is where the growth in our business is coming from.

Driving enterprise volume

Daniel Webber:

You still drive a tremendous amount of volume in the enterprise space. How are you approaching that?

John Caplan:

We love the enterprise business because we have great relationships with many, many customers who use the Payoneer platform to solve a problem that they otherwise couldn’t solve, which is to make reliable, trusted payments, delivered quickly and efficiently to the far reaches of the globe.

We do that at a high service level, at a fair price. As you can see at 24% growth, as travel continues to rebound and people see the world and go further afield, that puts wind at our back in our enterprise business.

Evolving Payoneer’s ICP strategy

Daniel Webber:

Your ICP strategy is now fully in place. Where does it develop now?

John Caplan:

There’s two things we’ll see. We’ll continue to see steady growth of ICPs. There are 80 million businesses we’ve identified that could fit into that profile and you can see two million total customers and 516,000 total ICPs.

We’re on a long march to add them all, so we will see steady growth of ICPs. The other thing is it’s driving our product roadmap as we add more product and functionality for those larger ICP customers, that space between us and the rest of the market grows.

We get more of a lead because our product is more and more designed for that cross-border SMB, who’s selling in multiple markets, who’s receiving multiple currencies and has expenses around the globe, entities around the globe.

This is a hard problem for the SMB to solve and we’re purpose-built to address them. I actually think that our branded relationship with these customers really builds the moat around Payoneer.

Daniel Webber:

John, thank you.

John Caplan:

Thank you.

The information provided in this report is for informational purposes only, and does not constitute an offer or solicitation to sell shares or securities. None of the information presented is intended to form the basis for any investment decision, and no specific recommendations are intended. Accordingly, this work and its contents do not constitute investment advice or counsel or solicitation for investment in any security. This report and its contents should not form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. FXC Group Inc. and subsidiaries including FXC Intelligence Ltd expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in this report, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting there from. This report and the data included in this report may not be used for any commercial purpose, used for comparisons by any business in the money transfer or payments space or distributed or sold to any other third parties without the expressed written permission or license granted directly by FXC Intelligence Ltd.