Cross-border payments companies of all sizes have seen considerable investment, but who is behind the industry’s leading companies? We identify the companies who have backed the Top 100.

The cross-border payments space has long been a focus for investment activity. From early stage funding to buying stakes in late-stage players or even post-IPO investment, this is a sector that many players are keen to invest in, and have done so in large numbers over the past few decades.

However, when it comes to the active investors in the space, much of the focus has in the past been on startup funding, including our own prior coverage in this area. This tells us where investors see the industry going, but it doesn’t show who has prioritised the players that are ultimately defining the shape of the industry.

To this end, this report sees us focus on the companies who have made investments in the biggest players in cross-border payments, in the form of the 2025 Cross-Border Payments 100. Using data from Crunchbase, we have identified every company that has invested in these players since their inception – whether that is a current investment or one that they have since divested – to identify which players have invested the most in these industry-leading companies.

The result is a rare picture of the investors behind the industry’s most impactful companies, providing a sense of who has driven the industry’s key players – and therefore whose future moves may be especially worth watching in the future.

The most prolific investors in the Cross-Border Payments 100

Out of the 100 leading cross-border payments companies, 60 have at least one investor listed on Crunchbase, with more than half having 10 or more different investors.

These investments have taken place over years, in some cases over a decade ago, although there are also those that are far more recent, with Deel and Airwallex among those who have seen investments in H1 2025.

There are more than 750 different companies behind these investments, however the vast majority – 83% – have only made an investment in one company within the Top 100, while a further 10% have invested in just two and an additional 3% have invested in three.

However, there are a small number of companies – 27, or 3.5% – who have invested in four or more companies within the Top 100, and it is these players we have focused on in our analysis.

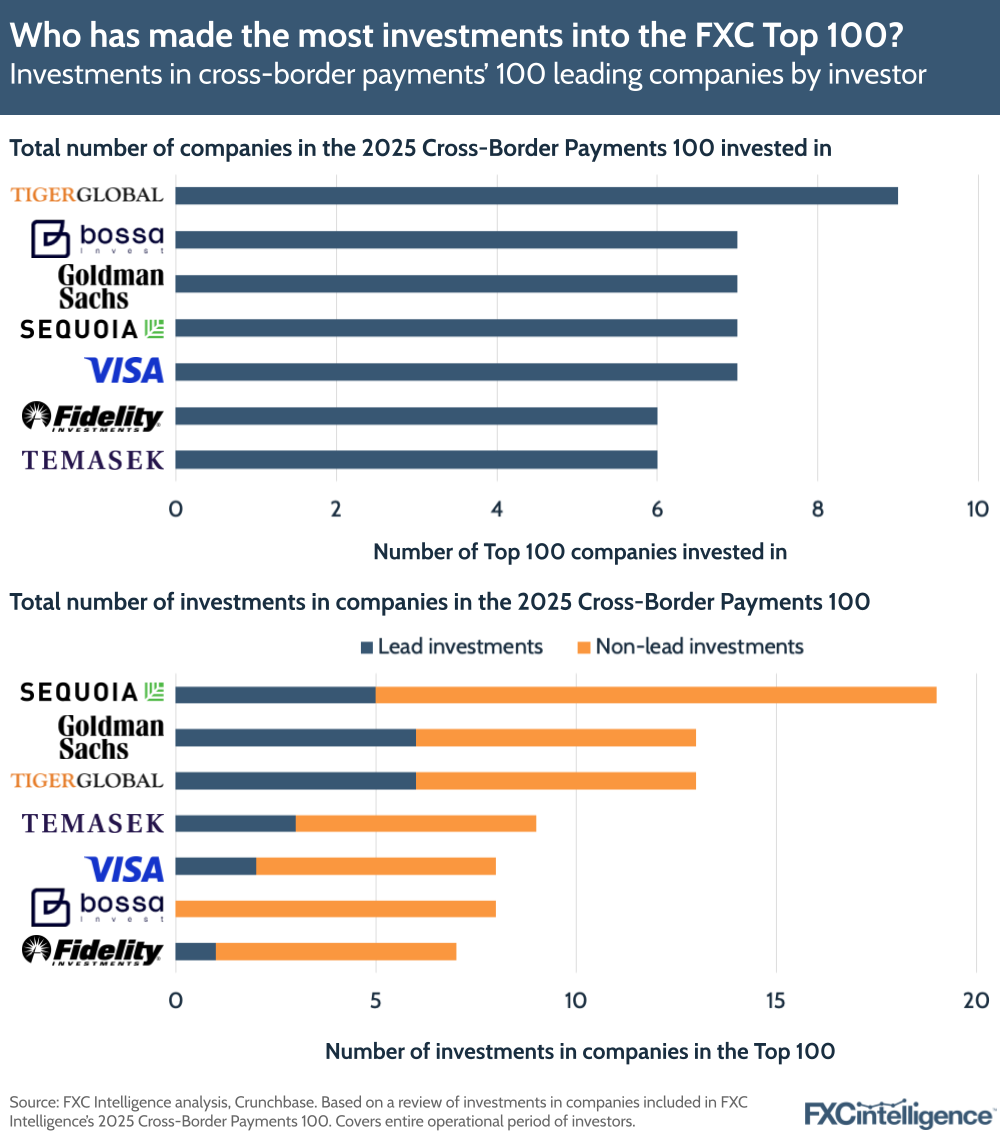

In terms of the number of companies in the Top 100 invested in, Tiger Global Management leads the way, having made investments in nine different companies within the Top 100. A prolific investor that has been active since 2003, Tiger Global has invested in more than 780 companies since its inception, with software, fintech and ecommerce being its biggest focus areas.

Within the Top 100, the company has invested in BVNK, dLocal, Rapyd, Revolut, Flutterwave, Mercado Libre, Checkout.com, Stripe and Papaya Global between 2019 and 2024, with its most recent investment being BVNK’s December 2024-announced Series B round. Across this time, the company has made 13 different investments in companies within the Top 100, six of which saw it act as lead investor.

However, while Tiger Global leads in terms of the number of individual companies it has invested in within the Top 100, when it comes to the number of overall investments, Sequoia Capital is slightly ahead of it. The company has made 19 investments, including five where it was a lead investor, in seven different companies within the Top 100. Almost all of these were made between 1999 and 2021, although the company did also make an investment in Apple in 1978. Fireblocks was Sequoia’s most recent investee from those in the Top 100, with the investor participating in its December 2021-announced Series E round.

The remaining five companies are Stripe, Google, PayPal, Ant Group and and Airwallex, although Sequoia has made far more investments in Stripe than any of the others, having made 11 separate investments in the company, including two where it was a lead investor.

Goldman Sachs and Visa, meanwhile, are the only companies to have several investments in the Top 100 while also being on it. Visa has invested in seven companies in the space in eight different investments between 2015 and 2023, with its most recent being its July 2023-announced participation in Thunes’ Series C round. Goldman Sachs, meanwhile, also invested in seven companies in the Top 100, with 13 investments between 2000 and 2022.

Bossa Invest is the final company to invest in seven of the Top 100, having made eight investments between 2018 and 2023, while Fidelity and Temasek have both invested in six of the Top 100 – between 2020 and 2022 and 2000 and 2023 respectively.

The companies with the highest share of investments in the sector

However, while these largely big name investors lead in terms of the number of investments in the Top 100, looking at these as a share of companies’ overall investments provides a slightly different story. Only 1.1% of Tiger Global’s investments are in companies within the Top 100, for example, while for Sequoia the share is 0.9% and for Bossa Invest it is just 0.5%.

There are others for whom the share is higher. Marshall Wace, a 1997-founded, UK-based global asset manager has made five investments in four of the Top 100: Tipalti, Thunes, Circle and Flywire. However, due to its comparatively small number of overall investments, its investments in these companies are a greater share of its overall investments than for any other company who had at least four investments in leading cross-border payments companies. 7.8% of Marshall Wace’s investments were in companies within the Top 100, with the four companies on the list accounting for 7.3% of the companies that Crunchbase records it having invested in during the time it has been operating.

While Marshall Wace has the fewest number of investees of the group recorded on Crunchbase, at 55, many of the other investors with fewer companies invested in also saw a higher share in the Top 100. All of those that have invested in fewer than 150 companies – a group that sees Marshall Wace joined by Visa, Greenoaks, Hedosophia, D1 Capital Partners and Dragoneer Investment Group – were among the top 10 investors in terms of the share of their investments made in the Top 100.

Here Visa was second, with 6.3% of its investments in the Top 100 and 6.1% of its investees, while Greenoaks, Hedosophia and D1 Capital were also key presences, with the Top 100 accounting for 3.3%, 5.2% and 3.4% of their investments respectively.

Meanwhile, those with larger portfolios that see the Top 100 disproportionately represented typically have a focus that makes them more likely to invest in the sector. UK Government-backed British International Investment, for example, made 1.5% of its 400 investments in the Top 100, which is likely a reflection of the outsized presence the finance industry has in the UK and that the UK has among leading cross-border payments companies.

By contrast, blockchain technology-focused Digital Currency Group’s outsized presence is a reflection of its investment in stablecoin-focused players, many of whom are building a strong presence in the market.

Which companies have seen the most investment?

Across the 60 companies within the Top 100 that Crunchbase records as having at least one investor, the vast majority have multiple investors, with a third having 20 or more different investors and five having 50 or more.

Revolut leads the way, with 64 different companies having made at least one investment in the organisation, closely followed by Stripe with 60 and Flutterwave with 59. Deel and Circle complete the five, with 54 and 51, respectively.

However, among the seven most prolific investors in the Top 100 – i.e. those who have invested in six or more companies – Stripe is the clear leader among investees, with five of the seven having invested in it at least once. Flutterwave and PayPal, meanwhile, have both seen investment from three of the seven investors, while 10 further companies have seen investment from two of the seven.

While the macroeconomic environment means investment is more challenging to attract than it has been at some times in the past, it’s clear that there are many companies who are consistently seeing the sector as an opportunity for success. The number who have invested in the Top 100, many of whom will have since seen a return on their investment, suggests this is an industry that continues to deliver for investors – particularly given that many leading companies continue to attract new investment today.