Individual investors can bring prestige and expertise to startups, but how are angel investors and others approaching the payments industry?

Individual investors, including angel investors and named venture capital investors, are a vital part of the startup investment ecosystem, despite the recent downturn in venture capital money. Aside from providing cash or other services for a minority stake, they can provide significant benefits to companies, from expertise and connections to media attention and prestige.

The payments industry is one of many to benefit from the attention of investors, particularly as the tech commentary ecosystem in the US, which can help inform the areas of focus for some investors, has increasingly highlighted payments as an area of interest over the past few years.

A recent high-profile example is former Google CEO Eric Schmidt’s investment in cross-border payments platform Keeta at the start of June, while in February Singapore fintech Tazapay announced that its Series A round included angel investor Gokul Rajaram.

But what kind of individual investors are attracted to the payments space, and how much do they focus on investments in payments versus other industries? In this report, we explore the trends behind angel investors in the space.

This report, using data from Crunchbase, brings together the investment practices of all individual investors who have made at least 30 investments overall, with at least one in payments.

How much of a focus is payments for angel investors?

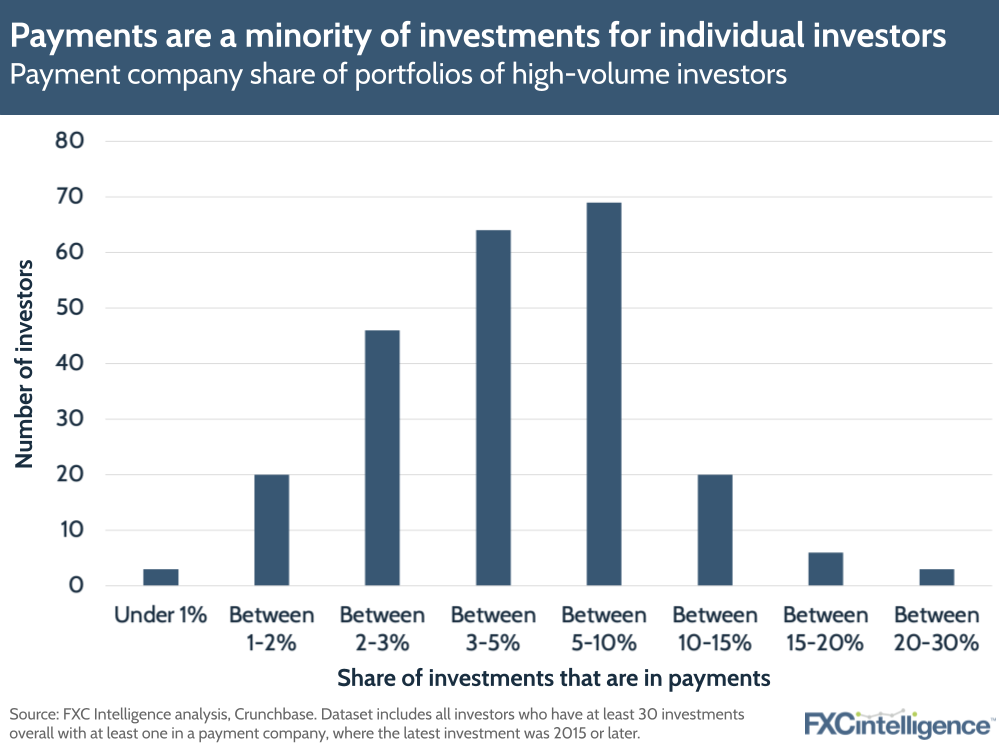

For most individual investors, payments are a small percentage of their investments overall, with most investors making between 5% and 10% of their investments in companies operating in the payments space. However, for a small minority of angel investors this is higher.

Six of the 231 investors overall made 15-20% of their investments in the space, while three made 20-30% of their investments in payments. No angel investor or other individual investor that we reviewed made more than 30% of their investments in the industry.

Furthermore, not all investors have taken a stake in a payments-related company recently. While 90% had made at least one investment in 2021 or later, only 46% had invested in a payments company within the same period.

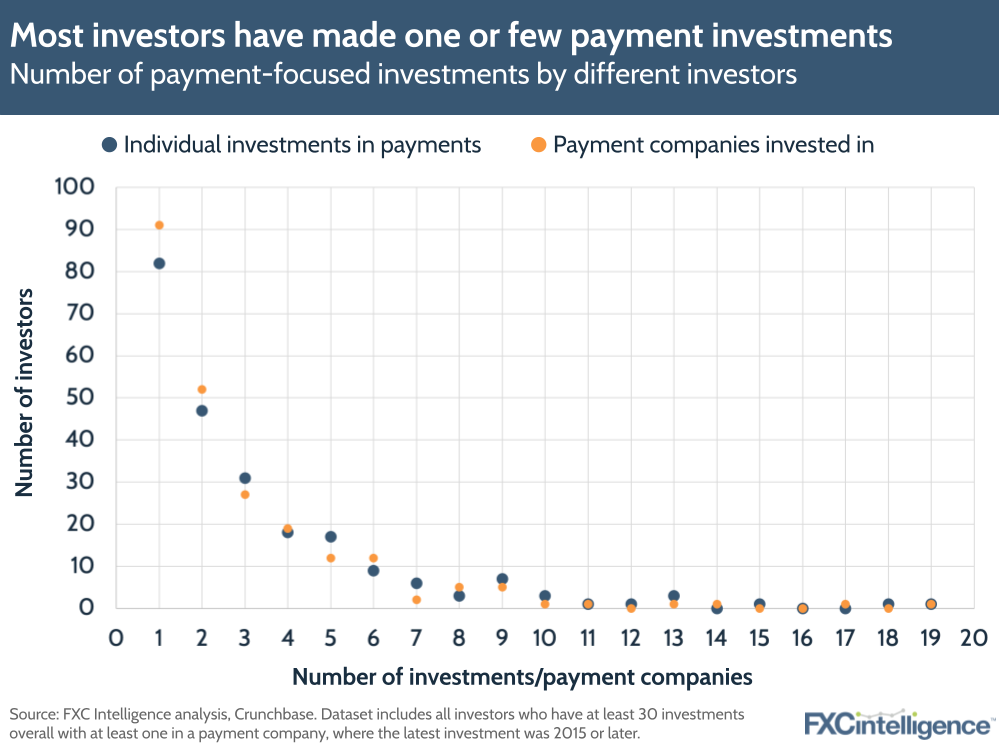

Regardless of when the investment was made, most of the 231 individual investors have only made a small number of investments in payments-related companies.

35% have made only one investment in a company in the industry, and 84% have made five or less investments in payments. Only 5% of investors have made ten or more investments in the industry, with just three (1%) making 15 or more.

Who are payments’ angel investors?

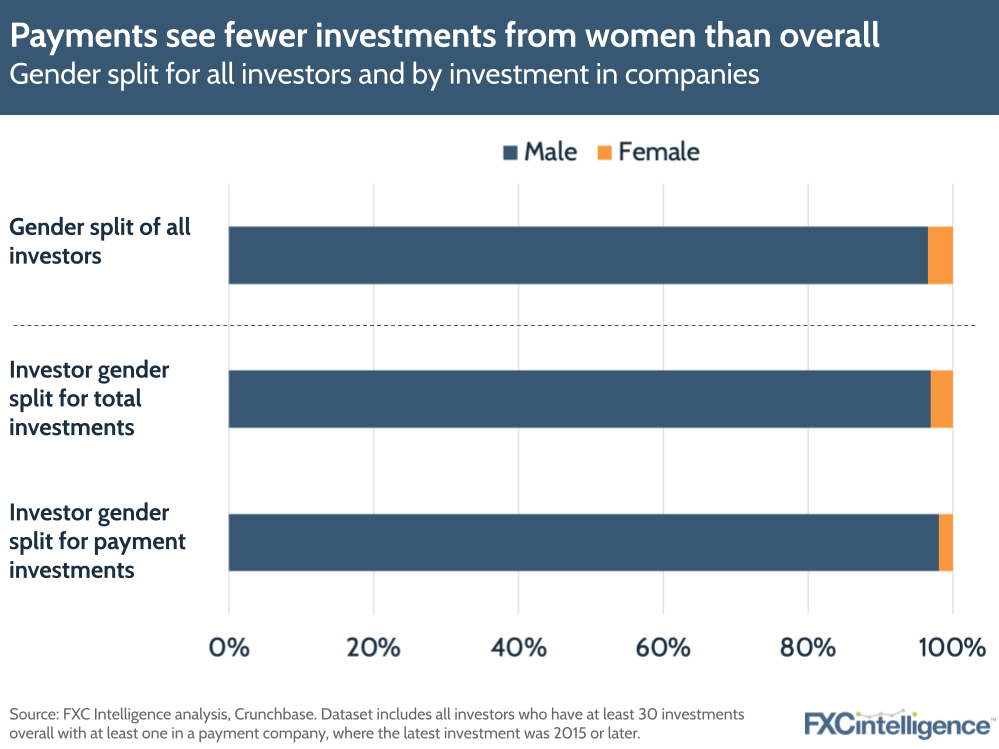

Perhaps unsurprisingly, the vast majority of angel and other individual investors are male, with 96.5% of the 231 reviewed being men.

Interestingly, male investors also made slightly more investments than their female counterparts, at 96.7% of all investments made by the group. However, for investments in payments-related companies this rose to 98%, suggesting female individual investors are less likely to invest in the industry. This reflects a wider lack of diversity in payments. Analysis of the CEOs of the companies on our 2023 Cross-Border Payments 100 found that just 5% were female.

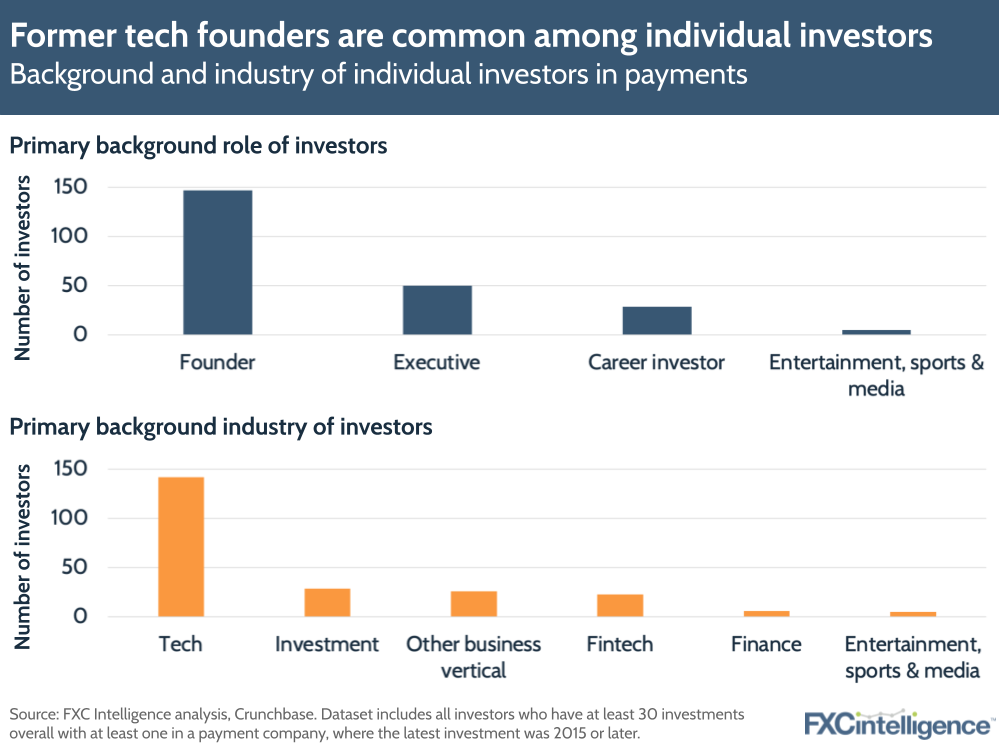

While a minority of angel and other individual investors have been investors for their entire careers, most have begun investing after making their money in another area.

Founders of one or more companies are the most common type, with tech companies being most common, although there are also some founders of fintech companies. In these cases, individuals have typically sold their companies and used the money to invest in startups, although some are still in senior leadership positions at the companies they started.

Former executives are also common, with many being either early employees in highly successful tech startups or former executives of multinational companies. There are also a small number of people from entertainment and sport, including the actor Ashton Kutcher and former NBA player Baron Davis.

Where are most individual investors based?

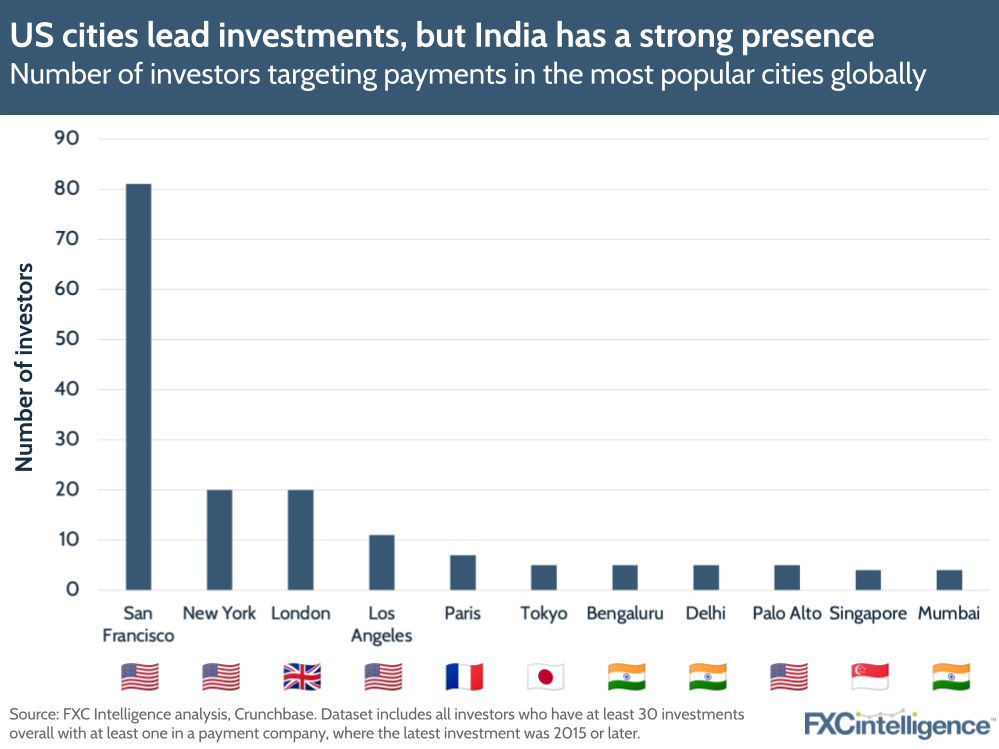

Looking geographically, individual investors are predominantly located in the US, although there are also key presences in India, Australia and Europe. Notably, there are differences in where these investors are focusing their investments.

While the locations of the payment companies that have been invested in are similar to that of the investors, there is a greater presence in Latin America, Africa and Southeast Asia – all emerging markets that are currently seen as key prospects within the payments industry more broadly.

Looking at the cities that investors are based in, while the US, and in particular California, are predictably over-represented, other hotspots are also notable. India is emerging as a key second location for individual investors, many of whom predominantly invest in companies in India and key emerging markets.

Payments’ most prolific individual investors

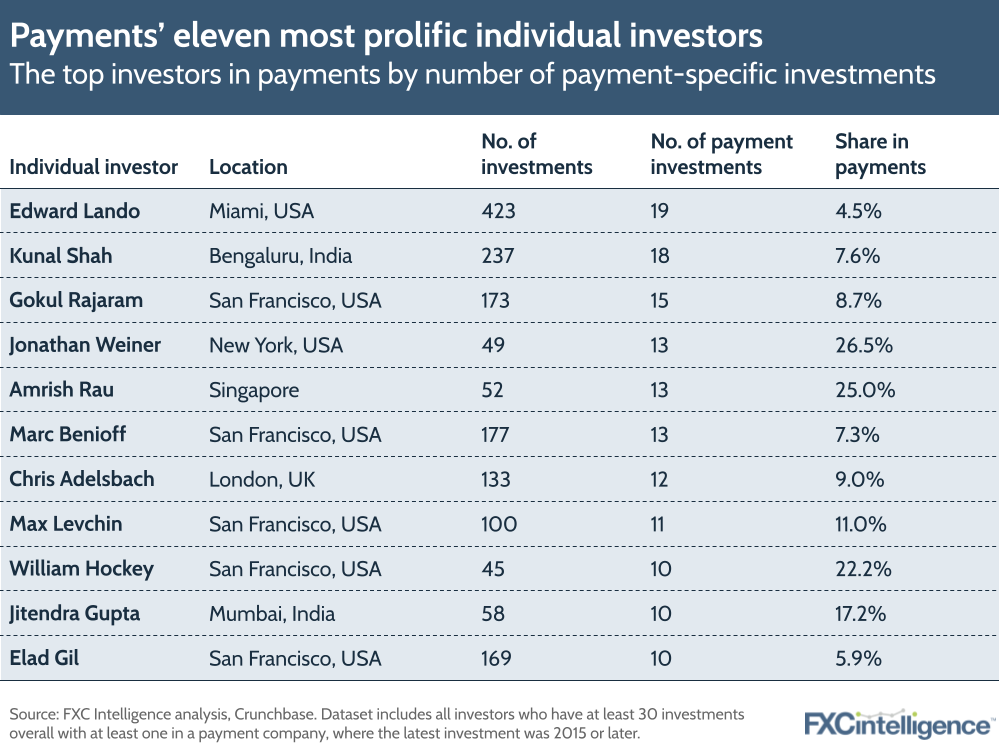

Out of the 231 individual investors listed on Crunchbase, the most prolific in payments is also the most prolific overall: angel investor Edward Lando. Based in Miami, Florida, the US, Lando has invested in 423 companies overall, 19 of which (4.5%) are in payments, and has been active since 2014.

The second most prolific, meanwhile, is Bengaluru, India-based founder-turned investor Kunal Shah. Former Facebook and Square executive Gokul Rajaram; Salesforce co-founder and CEO Marc Benioff; and multiple Singaporean fintech founder Amrish Rau complete the top five.

Which areas of payments are individual investors focusing on?

Within payments investments made by individual investors, there is an interesting trend towards certain types of companies. Payment processors and related companies are the most popular, receiving 25% of the 682 investments made by individual investors and accounting for 25% of the 351 companies receiving investments.

B2B payments and related services was the second most popular area, at 16% of investments across 11% of companies. However, this rises to the most popular when including the related areas of payment infrastructure solutions and B2B financial services, totalling 31% of both investments and companies.

By contrast, P2P payments and related areas including money transfers and remittances accounted for 10% of investments and 8% of companies, rising to 22% of investments and 19% of companies. This reflects the increased growth potential of B2B compared to consumer payments, as well as the relative fragmentation of the market.

While current macroeconomic conditions have created a challenging landscape for startups looking to gain investment, there are individual investors that are still putting significant amounts of money into the sector. Companies wishing to attract investment will need to be able to demonstrate a strong business case to potential investors, but attracting the right angel investor or other independent player could provide key to a startup’s long-term prospects.