It’s often suggested that the value of companies with significant involvement in the crypto space is more determined by the value of crypto than by other stock market moves. But is this really the case? We looked at crypto exchange Coinbase and bitcoin-focused Block, owner of Square, to find out.

Looking at the normalised daily close prices of Coinbase and Block versus bitcoin to USD, the most dominant measure of crypto value, there is a notable correlation. While there are times when one moves in a different direction from the other, or the gap between them widens significantly, for the most part they follow the same overall shape.

However, this is also true of the Nasdaq 100, suggesting that it may not be the bitcoin price, but the overall shifts in the stock market that are creating this effect. To explore this more, we needed to review how close Block and Coinbase are to bitcoin’s normalised close compared to that of the Nasdaq 100.

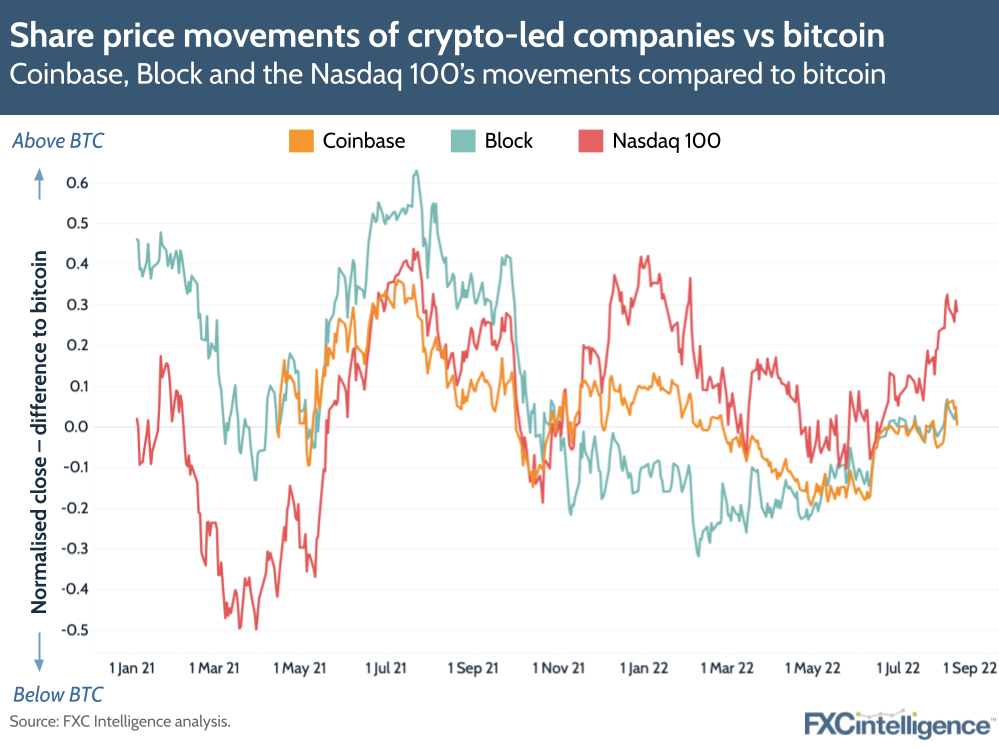

On the chart above, the values represent how close Coinbase, Block and the Nasdaq 100 are to the normalised close of bitcoin to USD. A value of 0 would be the same as bitcoin, while a positive number is a higher close and a negative value is a lower close.

Here you can see that there is some difference between the Nasdaq 100 and Block and Coinbase, but to see how much more the two stocks are to bitcoin than the wider stock market, we need to shift to a different view.

Here we can more easily visualise how much of the time Coinbase and Block are closer in value to bitcoin to USD – represented by the thin lines – and how much they are closer to the Nasdaq 100 – represented by the thick lines.

In both cases, it’s clear that the stocks of both companies are not exclusively impacted by the price of bitcoin: the market also plays a role. However, the extent of the impact is quite different between the two.

Crypto exchange Coinbase has more closely followed bitcoin since its IPO in April 2021 – unsurprising given that the price of crypto directly impacts the frequency of trades and therefore its perceived value.

Meanwhile, while Block has had periods where it more closely follows bitcoin, it is mainly led by the market. This makes sense. While bitcoin has become a key source of revenue for Block, accounting for 57% of revenue in 2021, it has many revenue streams other than crypto, including its Square payments brand. For those looking for Block to diversify away from crypto, it’s a positive sign that it hasn’t been as strong a definer of share price as is often thought.