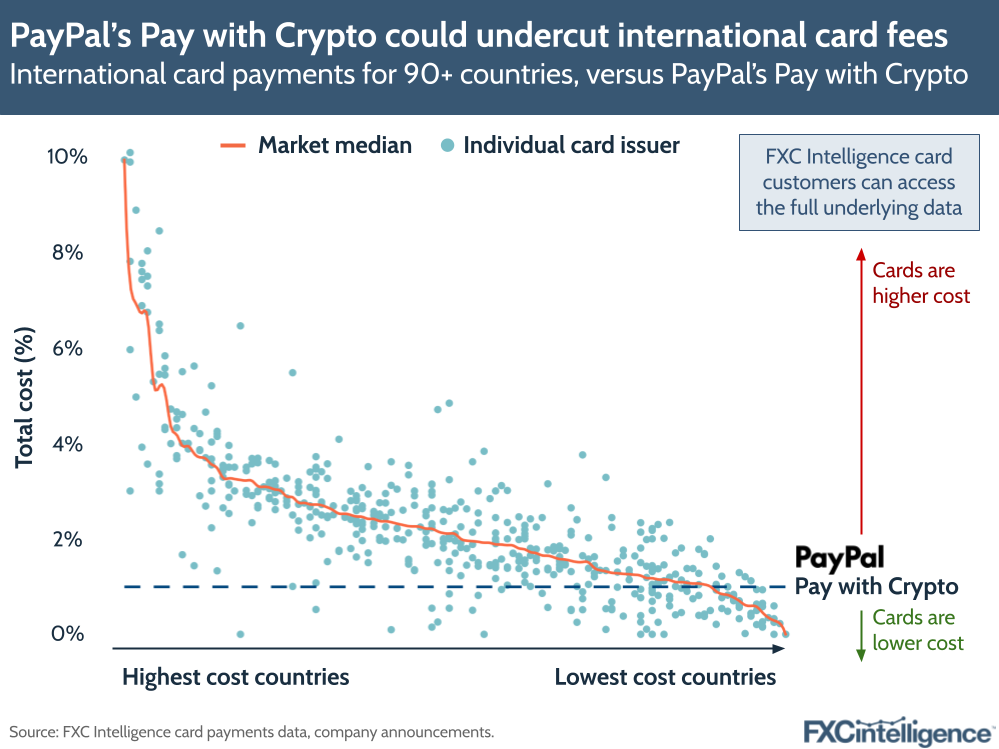

At the end of July, PayPal announced Pay with Crypto, a cross-border payments acceptance solution that is intended to significantly reduce the cost of transactions versus those involving a credit card. And while PayPal’s claim of an up to 90% cost reduction may seem bold, comparisons with our card pricing dataset show it has strong potential to challenge in the space.

Initially only available to merchants in the US, PayPal’s Pay with Crypto solution enables customers to fund purchases using over 100 different cryptocurrencies, including volatile crypto such as bitcoin and ethereum or stablecoins such as USDC, via an option at checkout. This crypto also does not have to be held with PayPal itself, with leading wallets including those of Coinbase, Binance and Kraken also supported.

The service, which features near-instant settlement, also allows merchants to be paid out in either stablecoin or fiat currency.

Set for launch within the month, the service comes with a 0.99% transaction rate that will remain fixed until 31 July 2026, which PayPal says “decreases the cost of transactions by up to 90% when compared to international credit card processing”.

Our data shows that while it is possible in many countries to access cards with lower fees, this 0.99% transaction fee is significantly lower than the average fee for cards issued in almost 90% of the countries in the dataset, while even fewer had no card issuers where the average fee was higher than PayPal’s Pay with Crypto. Across all markets, around 80% of issuers were consistently higher than the 0.99% fee.

PayPal’s claim of a reduction of up to 90% is also reflected in our dataset, with Pay with Crypto being 90% cheaper than the highest single fee in the dataset, although the average numbers were a little more muted. Across all datapoints, regardless of market, the crypto-based solution represented an average cost reduction of around 8%, while it had an average cost reduction of 53% versus the most expensive provider in each market.

With growing concerns around the cost of interchange fees and other card transaction costs, stablecoins are increasingly being presented as an alternative for such payments, particularly in the US. PayPal has therefore launched a solution with strong potential for the space, and we are likely to see others follow suit.

How can I access granular card data for my priority markets?