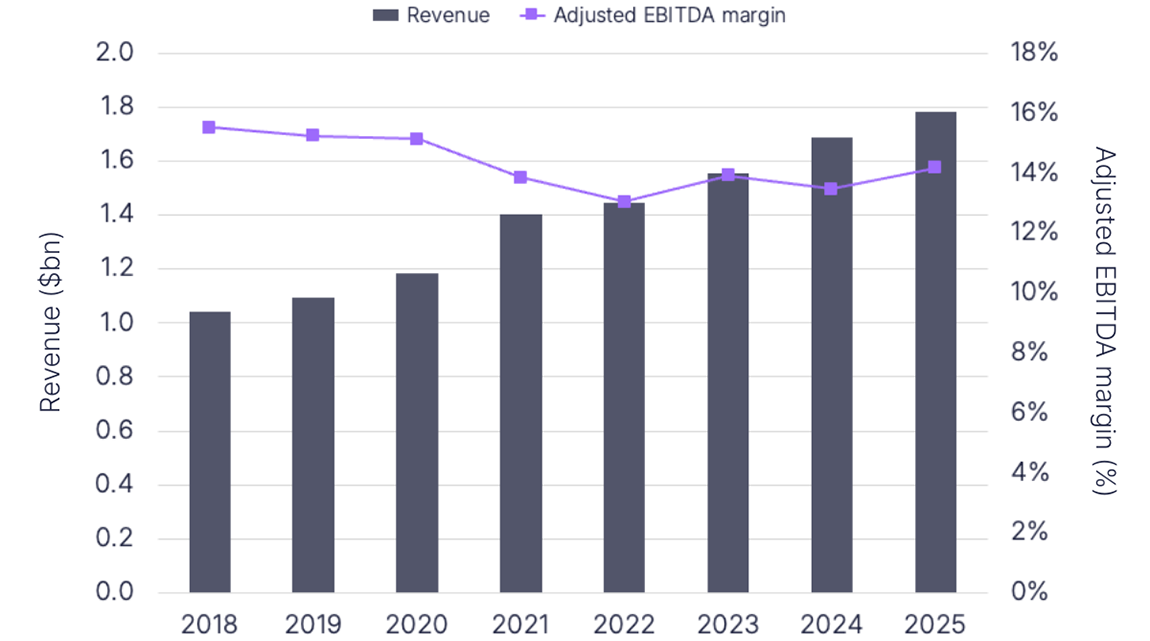

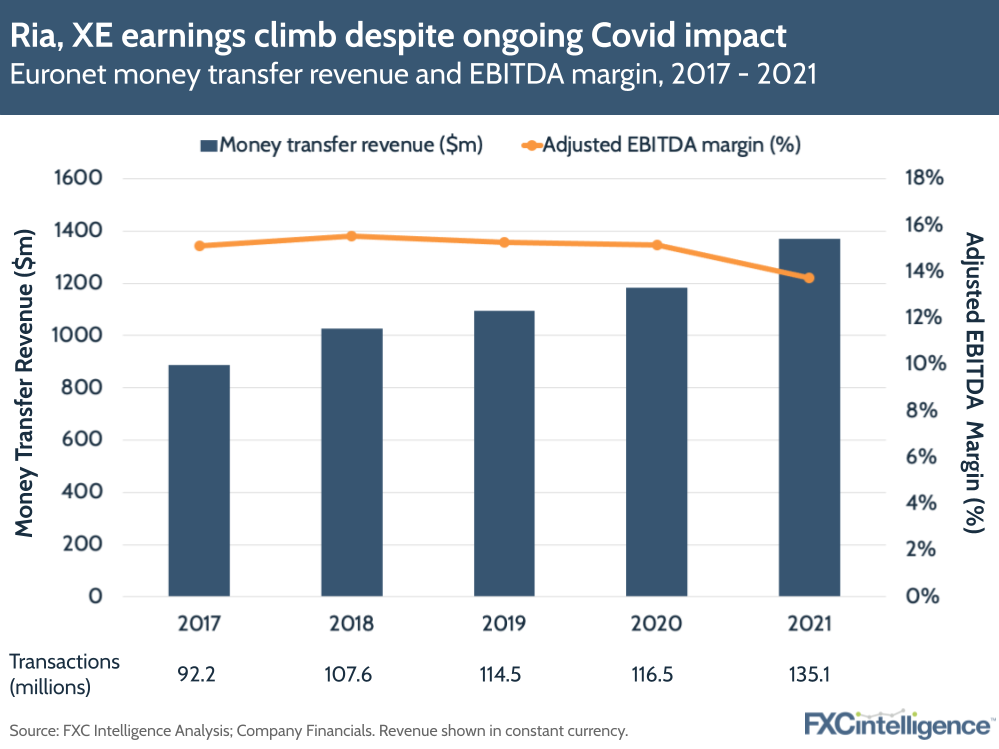

Euronet’s Q4 2021 earnings saw the company miss estimates, although with full-year revenue growth of 21% the company avoided a share price drop on the news. Its money transfer segment, which includes Ria and XE, saw 18% revenue growth to $1.4bn (16% in constant currency), with ongoing Covid-19-related disruptions continuing to mute the results.

Key takeaways from Ria and XE’s Q4 2021 results

Key takeaways from Euronet’s money transfer segment:

- While Euronet’s money transfer segment saw double-digit growth, this was in part buoyed by particularly strong growth in its XE brand, which saw combined corporate and consumer payment transactions grow by 29% and volumes increase to $14.5bn in 2021 ($12.7bn in 2020).

- For Ria, digital transactions have continued to climb, with its app and website together seeing 72% growth for 2021 and 55% for Q4.

- While Ria has expanded its physical locations to 510,000 across 164 countries, a 16% increase on 2020, it has also boosted its digital capabilities. This includes the launch of its mobile app in two more countries, the addition of two countries to Euronet’s bank deposit network and the expansion of its mobile wallet presence to 20 wallets in 11 countries. Account deposits have also become an increasingly important part of Ria’s payout mix.

- Looking globally, both US and international outbound money transfer transactions grew in double digits, although those in the Middle East and Asia were impacted by ongoing lockdowns, which hit both domestic and cross-border money transfers from the region. 70% of Ria’s business is from North America and Europe.

- Ongoing travel uncertainty was a significant headwind for Euronet this year, both in its money transfer business and beyond, particularly with the emergence of the Omicron variant. However, it anticipates a strong rebound in travel from Q2 2022.

- Euronet also provided an update on its Dandelion platform, the rails that underpin Ria and XE and which it also provides on an as-a-service basis to third parties. Here the company has expanded its network and increased usage of the platform. Transactions on Dandelion grew 51% in 2021, with current growth as “exceptionally strong double-digit” rates. The platform now accounts for 9% of revenues in its money transfer segment.